1,050% VMware Price Increase: AT&T's Concerns Over Broadcom's Acquisition

Table of Contents

The Staggering VMware Price Increase and its Implications

The projected 1,050% price increase for specific VMware services isn't just a headline-grabbing statistic; it represents a seismic shift in the virtualization landscape. While the exact details of which services are impacted and the specific pricing changes remain somewhat opaque, reports suggest significant hikes for crucial elements within VMware's portfolio. This compares starkly to previous, more modest price adjustments, indicating a significant post-acquisition strategy shift.

The impact on AT&T's operational costs is potentially massive. A 1,050% increase on even a small portion of their VMware licensing could translate to hundreds of millions of dollars in additional expenditure annually, significantly impacting their budget and potentially affecting their bottom line.

- Specific VMware products experiencing significant price hikes: While not publicly confirmed, speculation points to key virtualization, cloud management, and networking components experiencing the most substantial increases.

- Potential impact on AT&T's network infrastructure and services: The price increase could force AT&T to re-evaluate its infrastructure investments, potentially delaying upgrades or impacting service quality.

- Analysis of the price increase's potential effect on AT&T's profitability: The increased costs could directly affect AT&T's profitability, potentially leading to higher prices for consumers or reduced investment in other areas of the business.

AT&T's Dependence on VMware and its Vulnerability

AT&T's operations heavily rely on VMware solutions. VMware's virtualization technology underpins a considerable portion of AT&T's network infrastructure, enabling efficient management of its vast computing resources. This deep integration makes AT&T particularly vulnerable to significant price increases.

The extent of AT&T's reliance on VMware is a key factor contributing to its concerns. The company has likely invested heavily in VMware infrastructure and expertise over many years, making a swift migration to alternative solutions challenging and expensive.

- Specific VMware technologies used by AT&T: This likely includes vSphere, vSAN, NSX, and possibly other VMware cloud and networking solutions.

- The extent of AT&T’s infrastructure dependent on VMware: A precise percentage is unavailable publicly, but it's safe to assume a significant portion of AT&T's infrastructure relies on VMware for its virtualization needs.

- Potential alternatives to VMware and their feasibility for AT&T: Migrating away from VMware would be a complex, time-consuming, and costly undertaking. Alternatives such as OpenStack, Microsoft Hyper-V, or other virtualization platforms exist, but their integration into AT&T's existing infrastructure would pose significant challenges.

Broadcom's Acquisition and Antitrust Concerns

Broadcom's acquisition of VMware is a significant event in the tech industry, combining a major semiconductor company with a leading virtualization provider. This merger raises considerable antitrust concerns, particularly regarding market dominance and reduced competition. Regulators are scrutinizing the deal to determine its potential impact on the market.

The potential for reduced innovation and slower development of VMware's technology is another area of concern. With less competition, Broadcom might prioritize profit over innovation, potentially harming the wider tech ecosystem.

- Concerns about market dominance and reduced competition: The combined entity could control a significant portion of the virtualization market, potentially stifling competition and limiting customer choices.

- Potential impact on VMware's innovation and future development: Without the pressure of competition, the pace of innovation at VMware could slow down.

- Regulatory bodies involved in the review process: The Federal Trade Commission (FTC) in the US and the European Union's competition authorities are among the key regulatory bodies reviewing the acquisition.

Potential Mitigation Strategies for AT&T

AT&T faces a complex challenge in addressing the VMware price increase. Several mitigation strategies are possible, though each comes with its own set of challenges and limitations.

Negotiating with Broadcom is a crucial first step. AT&T's size and influence might allow for some negotiation leverage, but the success of such negotiations is uncertain given the significant price increase already announced. Alternatively, exploring migration to alternative virtualization solutions, while technically feasible, represents a substantial long-term project.

- Negotiating better pricing terms with Broadcom: AT&T might attempt to negotiate more favorable pricing based on its scale and long-term relationship with VMware.

- Exploring alternative virtualization technologies (e.g., OpenStack, Microsoft Hyper-V): A complete migration would be a complex and expensive undertaking, but could offer long-term cost savings.

- Strategies for cost optimization and budget reallocation: AT&T may need to identify areas where cost savings can be made elsewhere to offset the increased VMware expenses.

Conclusion: Addressing the 1,050% VMware Price Increase – What's Next?

The 1,050% VMware price increase presents a significant challenge for AT&T and highlights the potential ramifications of Broadcom's acquisition. The merger raises serious antitrust concerns and puts pressure on AT&T to find effective mitigation strategies. The company's dependence on VMware, coupled with the substantial price increase, necessitates a careful and strategic response.

The key takeaway is the need for careful consideration of alternative virtualization solutions and the potential for long-term strategic changes within AT&T's infrastructure. Stay tuned for updates on the Broadcom-VMware acquisition and the ongoing implications of this substantial 1,050% VMware price increase. Understanding the impact of this merger is crucial for navigating the future of virtualization in the telecom industry. For more information on antitrust regulations and the Broadcom-VMware merger, refer to the FTC and EU Competition websites.

Featured Posts

-

Combating The Killer Seaweed Strategies For Protecting Australias Coastal Biodiversity

May 30, 2025

Combating The Killer Seaweed Strategies For Protecting Australias Coastal Biodiversity

May 30, 2025 -

Manila Bays Health How Long Can Its Vibrancy Last

May 30, 2025

Manila Bays Health How Long Can Its Vibrancy Last

May 30, 2025 -

Kyriaki 16 Martioy Ti Na Deite Stin Tileorasi

May 30, 2025

Kyriaki 16 Martioy Ti Na Deite Stin Tileorasi

May 30, 2025 -

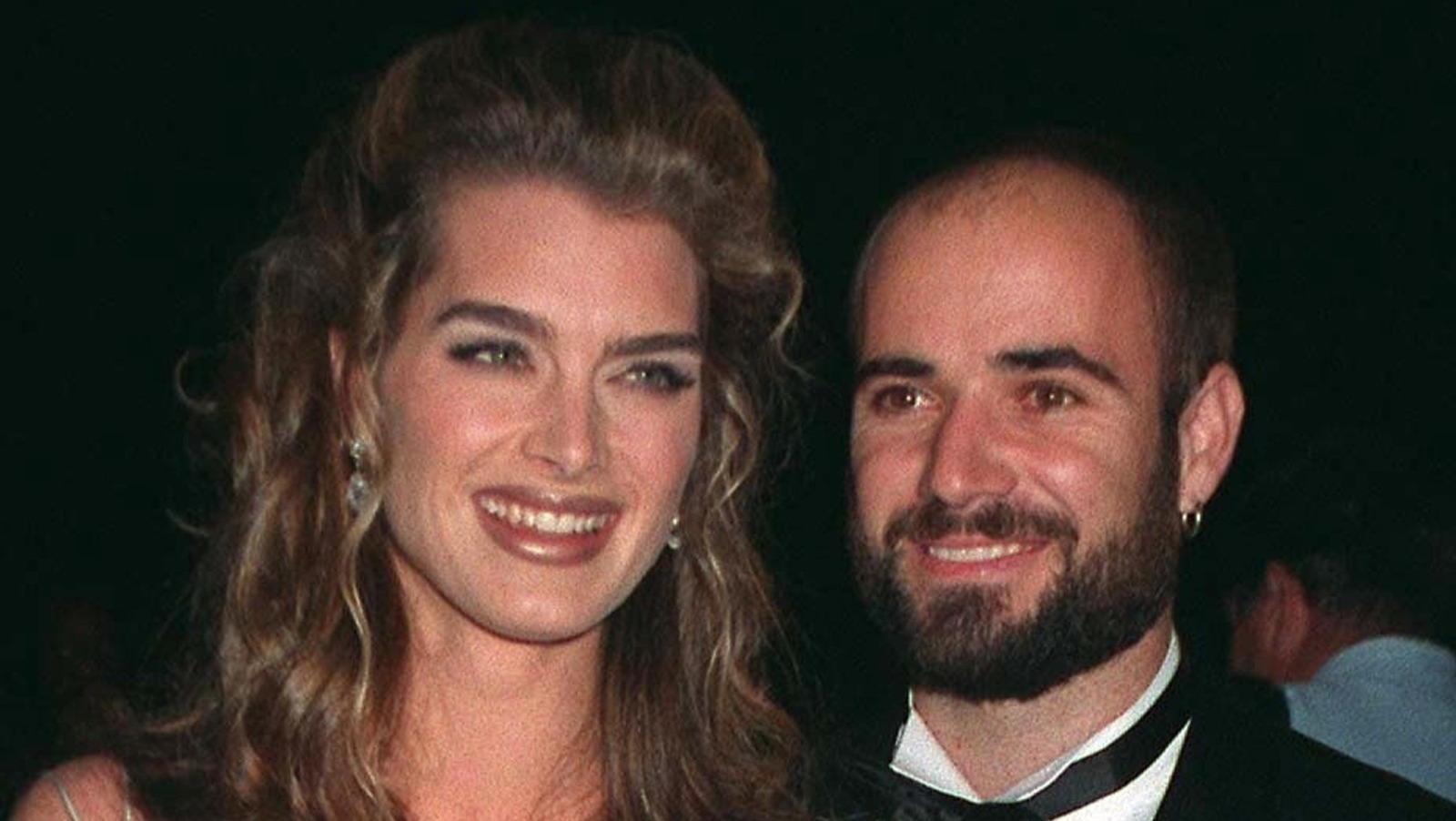

Brooke Shields Book No Kids With Andre Agassi A Fortunate Escape

May 30, 2025

Brooke Shields Book No Kids With Andre Agassi A Fortunate Escape

May 30, 2025 -

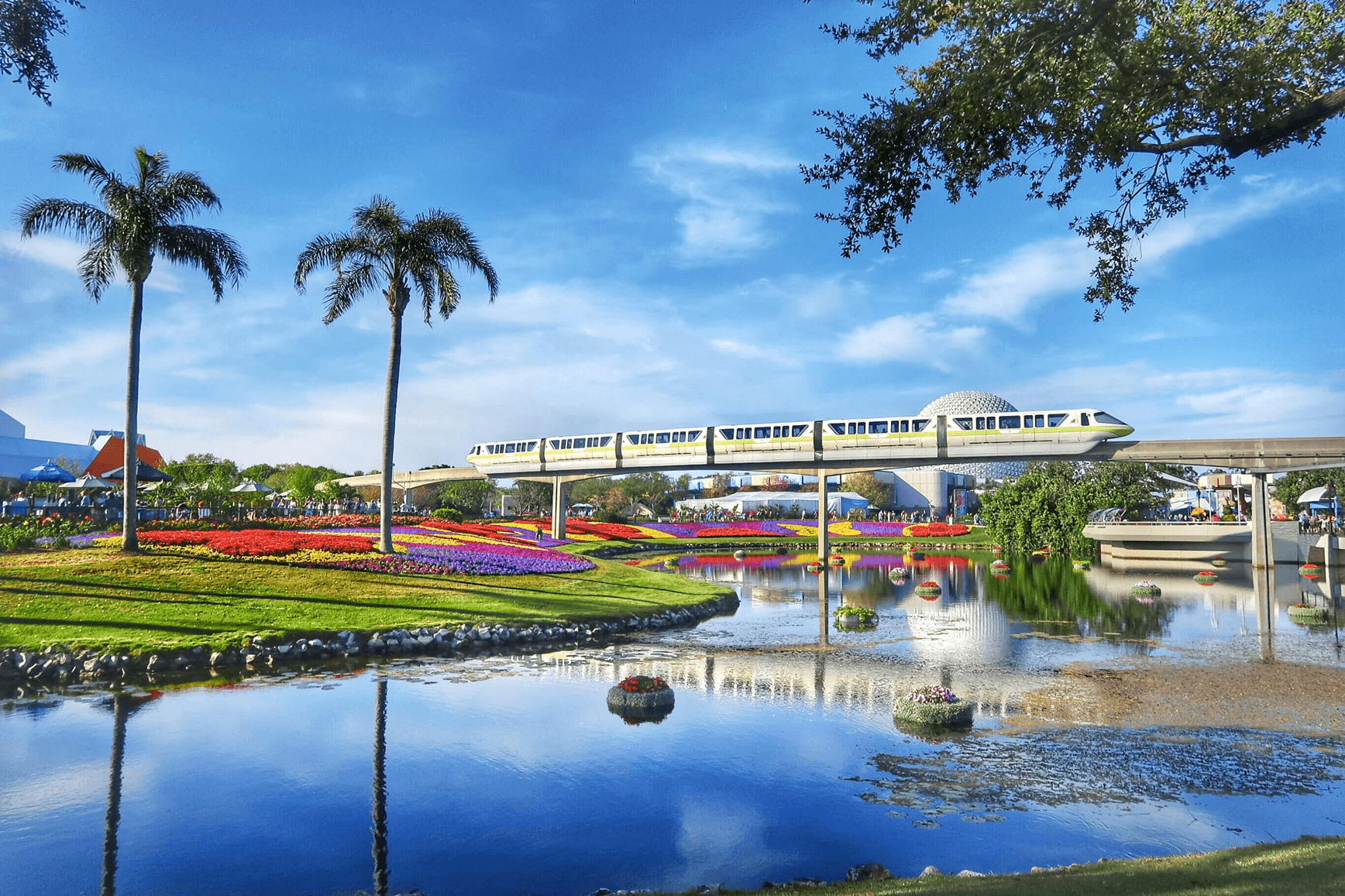

Planning Your Visit To The Epcot Flower And Garden Festival

May 30, 2025

Planning Your Visit To The Epcot Flower And Garden Festival

May 30, 2025

Latest Posts

-

Megarasaray Hotels Acik Turnuvasi Bondar Ve Waltert In Ciftler Sampiyonlugu Basarisi

May 31, 2025

Megarasaray Hotels Acik Turnuvasi Bondar Ve Waltert In Ciftler Sampiyonlugu Basarisi

May 31, 2025 -

Bondar Ve Waltert Megarasaray Hotels Acik Turnuvasi Nda Ciftler Sampiyonu Oldu

May 31, 2025

Bondar Ve Waltert Megarasaray Hotels Acik Turnuvasi Nda Ciftler Sampiyonu Oldu

May 31, 2025 -

Megarasaray Hotels Acik Turnuvasi Nda Ciftler Sampiyonlugu Bondar Ve Waltert In Zaferi

May 31, 2025

Megarasaray Hotels Acik Turnuvasi Nda Ciftler Sampiyonlugu Bondar Ve Waltert In Zaferi

May 31, 2025 -

Bondar Ve Waltert Megarasaray Hotels Acik Turnuvasi Ciftler Sampiyonu

May 31, 2025

Bondar Ve Waltert Megarasaray Hotels Acik Turnuvasi Ciftler Sampiyonu

May 31, 2025 -

Rekorlar Kitabina Yeni Bir Giris Novak Djokovic In Basarisi

May 31, 2025

Rekorlar Kitabina Yeni Bir Giris Novak Djokovic In Basarisi

May 31, 2025