10-Week High Broken: Is Bitcoin's $100,000 Price Target Achievable?

Table of Contents

Factors Supporting a Bitcoin Price Surge Towards $100,000

Several powerful forces could propel Bitcoin towards its coveted $100,000 price target.

Increasing Institutional Adoption

Institutional investors, once hesitant, are increasingly embracing Bitcoin. Hedge funds like MicroStrategy and BlackRock, along with numerous other corporations, are accumulating significant Bitcoin holdings. This institutional Bitcoin investment injects substantial capital into the market, driving up demand and influencing price.

- MicroStrategy's substantial Bitcoin purchases have demonstrated a clear commitment to Bitcoin as a long-term asset, influencing other institutional players.

- The potential approval of Bitcoin ETFs in major markets like the US would dramatically increase accessibility for institutional and retail investors, further boosting demand. This increased liquidity could be a significant catalyst for price appreciation.

- Growing acceptance of Bitcoin as a legitimate asset class by major financial institutions is shifting the narrative and legitimizing Bitcoin within traditional finance. This institutional adoption cryptocurrency strategy is a key driver of price increases.

Growing Global Demand and Scarcity

Bitcoin's inherent scarcity, capped at 21 million coins, is a fundamental driver of its value. As global demand continues to grow, particularly from emerging markets experiencing high inflation, this limited supply becomes increasingly valuable.

- The fixed supply contrasts sharply with inflationary fiat currencies, making Bitcoin an attractive store of value and hedge against inflation.

- Increased adoption in countries with unstable economies further fuels demand, as citizens seek alternative assets to preserve their wealth.

- News reports highlighting Bitcoin's adoption in El Salvador and other countries demonstrate its growing global reach and acceptance. This global Bitcoin adoption is pushing its price higher.

Macroeconomic Factors and Inflation

Global macroeconomic instability and persistent inflation are pushing investors towards alternative assets like Bitcoin. Bitcoin's decentralized nature and resistance to inflation make it an attractive hedge.

- High inflation erodes the purchasing power of fiat currencies, making Bitcoin, with its fixed supply, a compelling alternative.

- Geopolitical uncertainty and economic downturns often drive investors towards safe-haven assets, and Bitcoin is increasingly viewed as one such asset.

- Bitcoin's potential as a store of value is being increasingly recognized, attracting long-term investors seeking to protect their wealth. This Bitcoin inflation hedge strategy is becoming more popular.

Challenges and Obstacles to Reaching $100,000

While the bullish case for Bitcoin is compelling, several challenges could impede its ascent to $100,000.

Regulatory Uncertainty and Government Intervention

Regulatory uncertainty remains a significant obstacle. Governments worldwide are still grappling with how to regulate cryptocurrencies, and inconsistent policies across jurisdictions create market instability.

- Varying regulatory approaches can lead to confusion and uncertainty, affecting investor confidence and potentially dampening demand.

- Potential government crackdowns on cryptocurrency exchanges or outright bans could significantly impact Bitcoin's price.

- Ongoing discussions around Bitcoin regulation in various countries highlight the unpredictable nature of the regulatory landscape. This Bitcoin regulation is a key factor influencing the price.

Market Volatility and Price Corrections

Bitcoin is notoriously volatile, prone to significant price swings. Sharp corrections are a regular feature of the cryptocurrency market, posing a risk to investors aiming for the $100,000 target.

- Historical examples of Bitcoin price crashes highlight the inherent risks involved in investing in cryptocurrencies.

- The potential for another market downturn could significantly derail Bitcoin's price trajectory.

- Understanding Bitcoin price volatility is crucial for any investor considering a long-term strategy. This Bitcoin price correction risk cannot be ignored.

Competition from Other Cryptocurrencies

The cryptocurrency landscape is constantly evolving, with new projects and technologies emerging. The competition from altcoins could potentially divert investment away from Bitcoin, hindering its price growth.

- The emergence of alternative cryptocurrencies with innovative features could attract investors away from Bitcoin.

- Technological advancements in other blockchain networks might challenge Bitcoin's dominance.

- Market share dynamics within the cryptocurrency space are constantly shifting, impacting Bitcoin's overall market capitalization. This Bitcoin competitors landscape is dynamic and complex.

Conclusion: The Future of Bitcoin and its $100,000 Target

Whether Bitcoin will reach its $100,000 price target is a complex question with no easy answer. While strong factors like institutional adoption, growing global demand, and macroeconomic conditions support a bullish outlook, challenges such as regulatory uncertainty, market volatility, and competition from other cryptocurrencies must be considered. A balanced perspective acknowledges both the significant potential and inherent risks associated with Bitcoin. Before investing, thorough research and a clear understanding of the market dynamics are paramount. Stay informed about Bitcoin's price trajectory and the factors influencing its potential to reach $100,000. Learn more about Bitcoin and its future price predictions. Is Bitcoin's $100,000 price target within reach? Keep reading to find out!

Featured Posts

-

Cavaliers Defeat Clippers Despite Late Rally

May 07, 2025

Cavaliers Defeat Clippers Despite Late Rally

May 07, 2025 -

Sony Ps 5 Pro Teardown Liquid Metal Cooling System Revealed

May 07, 2025

Sony Ps 5 Pro Teardown Liquid Metal Cooling System Revealed

May 07, 2025 -

Warriors Pursuit Of Kevon Looney Nba Free Agency Update

May 07, 2025

Warriors Pursuit Of Kevon Looney Nba Free Agency Update

May 07, 2025 -

John Wick 5 The Case For A Keanu Reeves Ensemble Cast

May 07, 2025

John Wick 5 The Case For A Keanu Reeves Ensemble Cast

May 07, 2025 -

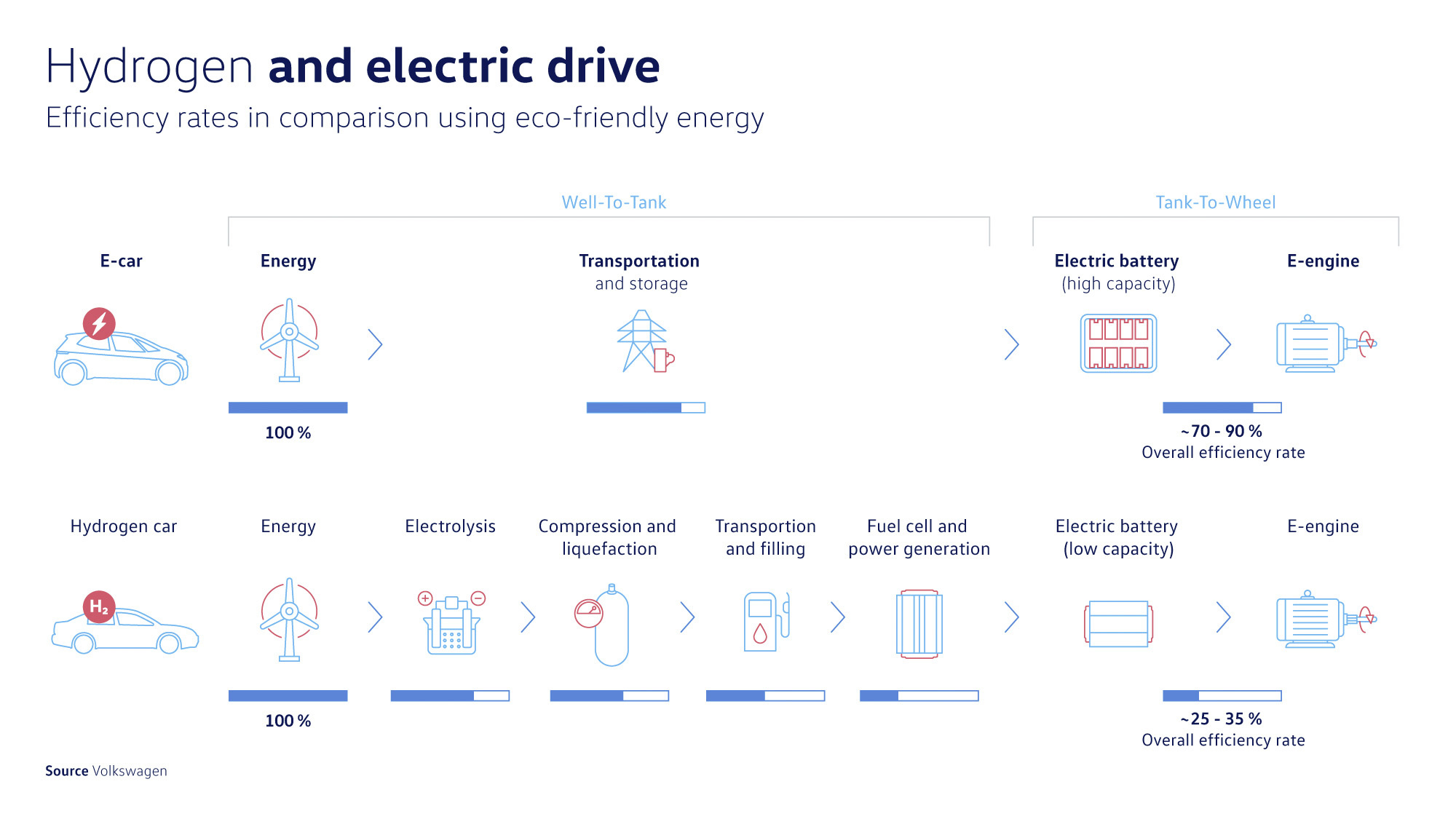

The Future Of European Public Transport Hydrogen Vs Battery Buses

May 07, 2025

The Future Of European Public Transport Hydrogen Vs Battery Buses

May 07, 2025

Latest Posts

-

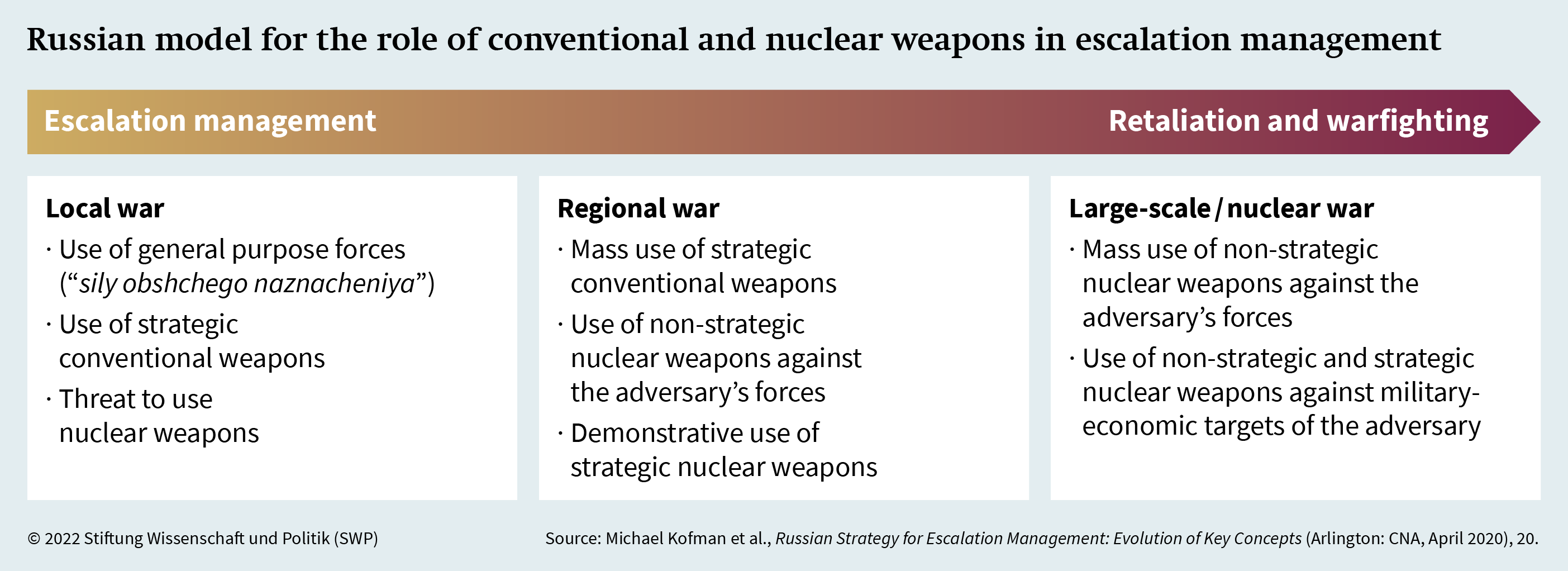

Greenlands Strategic Importance Understanding Trumps Concerns

May 08, 2025

Greenlands Strategic Importance Understanding Trumps Concerns

May 08, 2025 -

The Sonos And Ikea Partnership Is Over Impact On Smart Home Audio

May 08, 2025

The Sonos And Ikea Partnership Is Over Impact On Smart Home Audio

May 08, 2025 -

Cadillac Celestiq First Drive Review A 360 000 Electric Luxury Experience

May 08, 2025

Cadillac Celestiq First Drive Review A 360 000 Electric Luxury Experience

May 08, 2025 -

The Us China And Greenland A Geopolitical Power Struggle

May 08, 2025

The Us China And Greenland A Geopolitical Power Struggle

May 08, 2025 -

Ikea And Sonos Part Ways Future Of The Collaborative Speakers Uncertain

May 08, 2025

Ikea And Sonos Part Ways Future Of The Collaborative Speakers Uncertain

May 08, 2025