100,000 Job Cuts Predicted: TD Bank Warns Of Imminent Recession

Table of Contents

Keywords: Job cuts, recession, TD Bank, economic downturn, layoffs, financial crisis, economic forecast, job market, unemployment, financial planning, economic recession, consumer spending, investment, housing market, government response.

The financial world is buzzing with concern after TD Bank, a major North American financial institution, issued a stark warning: a potential recession looming on the horizon, resulting in a staggering 100,000 job cuts. This prediction has sent shockwaves through the economy, raising anxieties about widespread layoffs and an impending financial crisis. The gravity of this forecast demands attention and proactive planning from individuals and businesses alike.

TD Bank's Recession Prediction: The Details

TD Bank's prediction isn't based on mere speculation. Their analysts cite several factors contributing to their gloomy economic forecast. Persistently high inflation rates, coupled with aggressive interest rate hikes by central banks to combat inflation, are significantly impacting consumer spending. This decreased spending power, along with continued geopolitical uncertainty, is creating a perfect storm for economic contraction.

- Specific numbers: While the exact number of job losses remains an estimate, TD Bank projects that approximately 100,000 jobs could be lost across various sectors if a recession materializes.

- Industries most impacted: The tech sector, already experiencing significant layoffs, is likely to be hard hit, alongside the real estate industry, facing a cooling market and decreased investment.

- Geographic regions: While the impact will be felt nationwide, regions heavily reliant on specific industries vulnerable to the recession (like tech hubs or areas with significant real estate activity) could experience a more pronounced impact.

- Comparison to previous recessions: The projected scale of job cuts is comparable to those experienced during previous significant recessions, highlighting the potential severity of the upcoming economic downturn. The speed of the predicted decline also sets this apart.

Impact of 100,000 Job Cuts on the Economy

The ripple effect of 100,000 job cuts would be far-reaching and devastating. Such widespread unemployment would significantly impact several key economic indicators.

- Decreased consumer confidence and spending: Job losses lead to reduced disposable income, forcing individuals to cut back on spending, further slowing economic growth and creating a negative feedback loop. This diminished consumer confidence can become self-fulfilling.

- Increased bankruptcies and defaults: Businesses and individuals struggling to meet financial obligations due to job losses will likely face increased bankruptcies and loan defaults. This strain on the financial system can further exacerbate the economic downturn.

- Impact on the housing market: A recession typically leads to a decline in home values and reduced sales, creating difficulties for both homeowners and the real estate industry. Mortgage defaults can rise.

- Strain on government resources: Increased unemployment will strain government resources as demands for social safety nets, like unemployment benefits and social assistance programs, surge. This places further pressure on government budgets.

Sectors Most Vulnerable to Layoffs

Several sectors are predicted to be particularly vulnerable to layoffs during this potential recession.

- Technology sector: The tech sector, known for its cyclical nature and recent hiring spree, is already experiencing significant layoffs. This trend is expected to continue as companies tighten their belts and consolidate operations.

- Real estate: The real estate market, after a period of rapid growth, is showing signs of cooling. Reduced demand, higher interest rates, and tighter lending standards point towards job losses in construction, real estate brokerage, and related industries.

- Retail and hospitality: These sectors, often the first to be affected during economic downturns, are highly susceptible to reduced consumer spending. Layoffs in these labor-intensive sectors could be substantial.

- Manufacturing and other sectors: Depending on the severity and duration of the recession, job losses could extend to other sectors, including manufacturing, transportation, and finance, through supply chain disruptions and reduced demand.

Preparing for a Potential Recession: Financial Strategies

Proactive financial planning is crucial to navigate a potential recession and its accompanying job losses.

- Building an emergency fund: A robust emergency fund (ideally 3-6 months of living expenses) can cushion the blow of job loss, allowing individuals time to find new employment without financial stress.

- Reducing debt: Lowering debt levels minimizes financial vulnerability during tough economic times. Focus on paying down high-interest debts first.

- Diversifying investments: Diversifying investment portfolios helps to mitigate potential losses. Consult with a financial advisor to create a suitable strategy.

- Seeking professional financial advice: Financial advisors can provide personalized guidance on managing finances during economic uncertainty.

- Updating resumes and networking: Proactively updating resumes and networking with industry contacts helps prepare for potential job searches.

- Exploring alternative income streams: Consider side hustles or gig work to supplement income and enhance financial resilience.

Government Response and Policy Implications

Government intervention will likely play a significant role in mitigating the recession's impact.

- Potential government interventions: Fiscal stimulus measures (increased government spending or tax cuts) and monetary policy adjustments (interest rate cuts) could be implemented to boost economic activity and reduce unemployment.

- Analysis of past responses: Examining the effectiveness of past government interventions during similar economic crises can help inform current policy decisions.

- Effectiveness of policy options: The effectiveness of various policy tools will depend on factors such as the severity of the recession, the timing of interventions, and their implementation.

Conclusion

TD Bank's prediction of 100,000 job cuts underscores the very real possibility of an imminent recession. The potential economic consequences, including widespread unemployment, decreased consumer spending, and increased financial strain, are significant. However, proactive financial planning and preparedness can mitigate the negative impacts. Don't wait for the recession to hit; start preparing today. Learn more about protecting your finances in the face of potential job cuts by consulting with a financial advisor and exploring resources from government agencies such as the [insert relevant government agency link here]. The seriousness of this prediction cannot be overstated; taking action now is essential.

Featured Posts

-

Offre Limitee Galaxy S25 Ultra 1 To A 1294 90 E

May 28, 2025

Offre Limitee Galaxy S25 Ultra 1 To A 1294 90 E

May 28, 2025 -

Manchester Uniteds Response To Chelseas Approach For Garnacho

May 28, 2025

Manchester Uniteds Response To Chelseas Approach For Garnacho

May 28, 2025 -

Opposition Mailers Target Bethlehem Mayor And Councilwoman Races

May 28, 2025

Opposition Mailers Target Bethlehem Mayor And Councilwoman Races

May 28, 2025 -

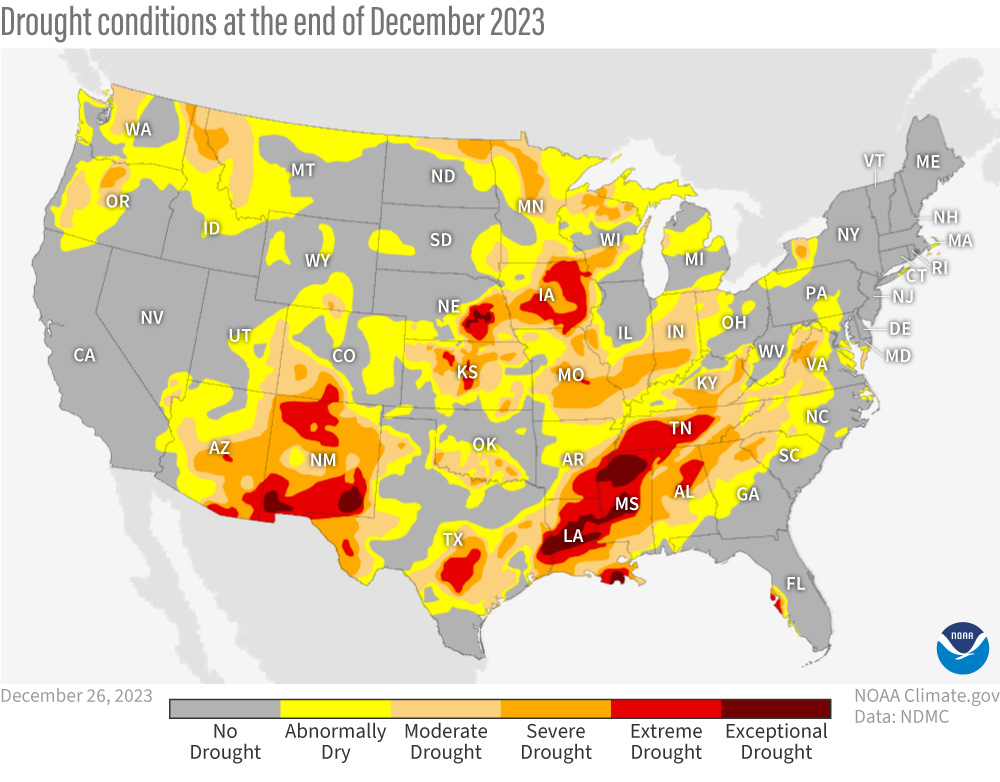

Will History Repeat Itself Comparing Spring 1968 To Spring 2024 And Summer Drought Forecasts

May 28, 2025

Will History Repeat Itself Comparing Spring 1968 To Spring 2024 And Summer Drought Forecasts

May 28, 2025 -

Shortstop Absence Highlights Angels Victory Over Dodgers

May 28, 2025

Shortstop Absence Highlights Angels Victory Over Dodgers

May 28, 2025

Latest Posts

-

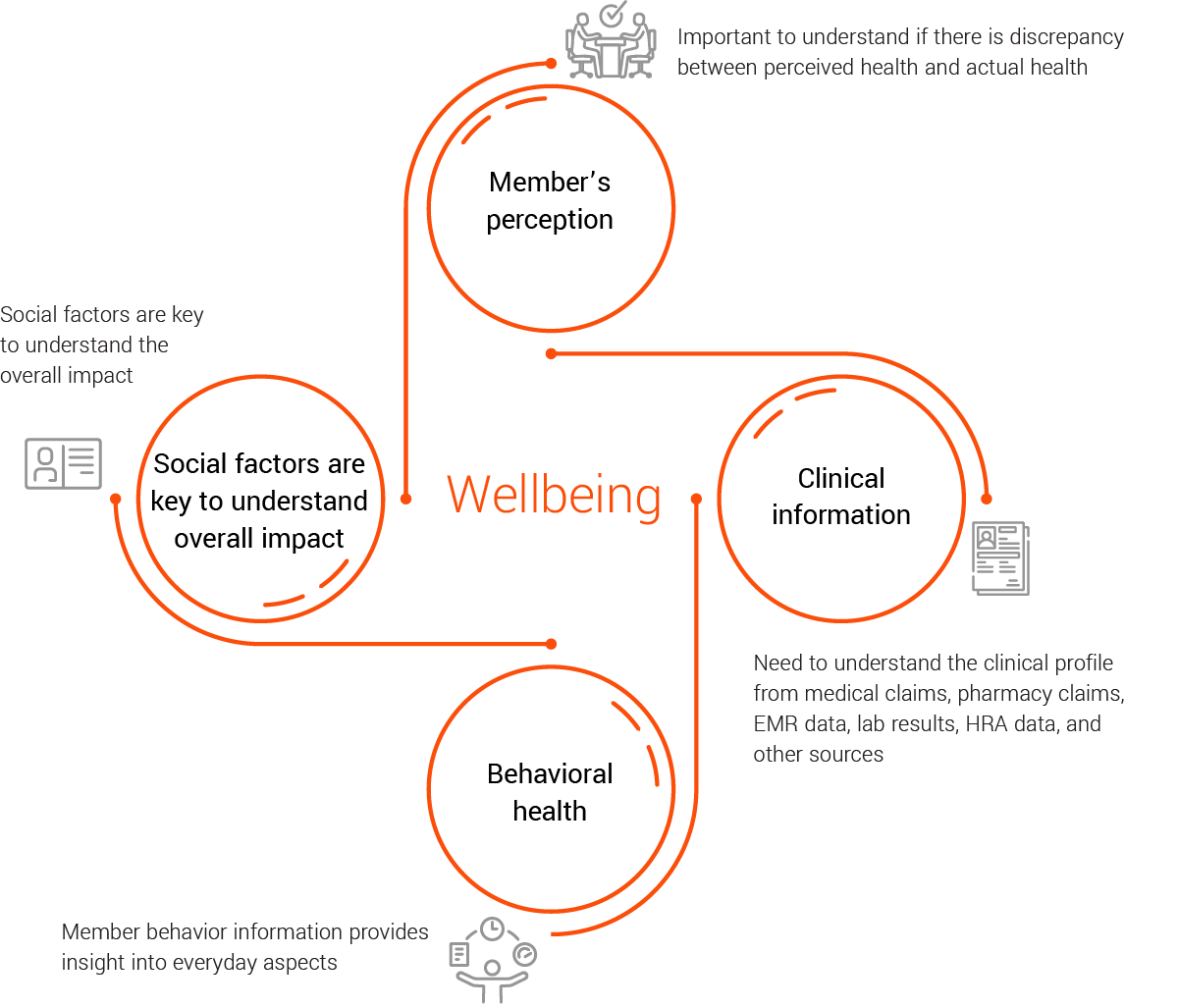

Understanding The Good Life A Holistic Perspective

May 31, 2025

Understanding The Good Life A Holistic Perspective

May 31, 2025 -

Your Good Life A Personalized Approach To Wellbeing

May 31, 2025

Your Good Life A Personalized Approach To Wellbeing

May 31, 2025 -

Cultivating Robust Rosemary And Thyme Plants A Practical Guide

May 31, 2025

Cultivating Robust Rosemary And Thyme Plants A Practical Guide

May 31, 2025 -

Understanding The Good Life A Holistic Approach To Personal Growth

May 31, 2025

Understanding The Good Life A Holistic Approach To Personal Growth

May 31, 2025 -

Creating Your Good Life A Personalized Plan For Lasting Happiness

May 31, 2025

Creating Your Good Life A Personalized Plan For Lasting Happiness

May 31, 2025