100 Days Of Trump: How Did It Change Elon Musk's Fortune?

Table of Contents

The Early Trump Administration and its Economic Policies

The early days of the Trump administration were marked by a flurry of executive orders and policy announcements, many of which had the potential to significantly impact major corporations, including Tesla and SpaceX.

Regulatory Changes and their Impact on Tesla

Trump's focus on deregulation had immediate implications for Tesla.

- Environmental Regulations: The proposed rollback of fuel efficiency standards initially seemed to benefit Tesla, potentially easing production costs and boosting competitiveness. However, this move also faced strong criticism for its environmental implications, potentially impacting consumer sentiment and long-term brand perception. News outlets widely reported on the potential environmental damage of relaxed standards, influencing public opinion and, consequently, Tesla’s stock price.

- Tax Policies: Changes to corporate tax rates under the Trump administration impacted Tesla's profitability. Lower corporate taxes potentially boosted Tesla's bottom line, but the overall impact was complex and intertwined with other economic factors and market forces. Analysis from financial news sources highlighted a mixed impact, with some arguing that the tax cuts benefited Tesla more than others.

Infrastructure Spending and SpaceX

Trump's emphasis on infrastructure spending presented both opportunities and challenges for SpaceX.

- Space Exploration: Trump's stated commitment to space exploration and renewed focus on NASA programs potentially increased the demand for SpaceX's launch services and other space-related technologies. This could have led to increased government contracts and boosted investor confidence in the company. News articles at the time highlighted a renewed focus on the space race, benefiting companies like SpaceX.

- Government Contracts: Increased defense spending under the Trump administration also potentially led to more government contracts for SpaceX's satellite technology and other defense-related projects, though the actual allocation of funds remained subject to budget negotiations and political priorities.

Market Reactions and Investor Sentiment

The stock market experienced significant volatility during Trump's first 100 days, directly affecting the value of Tesla and impacting Musk's net worth.

Stock Market Volatility and Tesla's Performance

- Market Fluctuations: The initial uncertainty surrounding Trump's policies resulted in significant swings in the stock market. Tesla's stock price, known for its sensitivity to market sentiment, experienced substantial fluctuations during this period. Charts depicting Tesla's stock performance during this period clearly show this volatility.

- Correlation with Tesla Stock: While some analysts attributed Tesla's stock price increases to positive expectations around deregulation and potential infrastructure investments, others pointed out the overall market volatility as a significant contributing factor. Market analysis from the time reflected these differing opinions.

Investor Confidence and Musk's Public Statements

Elon Musk's own public statements played a significant role in shaping investor sentiment towards Tesla.

- Twitter Activity: Musk's frequent use of Twitter, sometimes making controversial pronouncements, added an unpredictable element to investor perception. Positive tweets could boost the stock price, while negative or controversial statements could lead to declines.

- Impact of Controversies: Any controversies surrounding Musk during this time, whether related to his business dealings or personal life, could have influenced investor confidence and affected the stock price. News coverage at the time highlighted the potential impact of Musk's statements on market behavior.

Indirect Impacts and Long-Term Consequences

Beyond direct regulatory changes and immediate market reactions, Trump's policies had broader indirect impacts on both Tesla and SpaceX.

Global Trade and Supply Chains

Trump's trade policies, including tariffs on imported goods, potentially affected Tesla's supply chains and manufacturing costs.

- Tariffs on Materials: Increased tariffs on materials sourced from overseas could have raised production costs for Tesla, potentially impacting profitability. Industry analyses at the time explored the potential impact of these tariffs on car manufacturers.

- Supply Chain Disruptions: Trade tensions and potential disruptions to global supply chains also presented challenges to Tesla's ability to maintain consistent production and delivery schedules.

Geopolitical Instability and its Effect on SpaceX

International relations and geopolitical instability during Trump's first 100 days could have influenced SpaceX's operations and international collaborations.

- International Collaborations: SpaceX's international partnerships and collaborations could have been affected by shifting geopolitical dynamics. Potential trade restrictions or sanctions imposed by the Trump administration might have impacted SpaceX's ability to collaborate on international space projects.

- Global Expansion Plans: Geopolitical uncertainty might have influenced SpaceX's long-term expansion plans and investment decisions in international markets.

Conclusion

The first 100 days of the Trump presidency had a multifaceted and complex impact on Elon Musk's fortune. While some policies potentially benefited Tesla and SpaceX, others introduced uncertainty and challenges. The interplay between regulatory changes, market reactions, and geopolitical events created a dynamic environment that significantly influenced the value of Tesla and SpaceX, directly affecting Musk's net worth. Understanding this relationship requires careful consideration of various factors and their intertwined effects.

To understand the full impact of political shifts on major business figures like Elon Musk, continue exploring the intersection of politics and business. Further research into the '100 Days of Trump' and its economic consequences will reveal further insights into the evolving relationship between government policy and entrepreneurial success.

Featured Posts

-

Melanie Griffith And Dakota Johnsons Siblings At Materialist Screening

May 09, 2025

Melanie Griffith And Dakota Johnsons Siblings At Materialist Screening

May 09, 2025 -

Natos Ai Revolution Palantirs Partnership And Its Public Sector Significance

May 09, 2025

Natos Ai Revolution Palantirs Partnership And Its Public Sector Significance

May 09, 2025 -

Jeanine Pirros Biography Education Legal Career And Financial Success

May 09, 2025

Jeanine Pirros Biography Education Legal Career And Financial Success

May 09, 2025 -

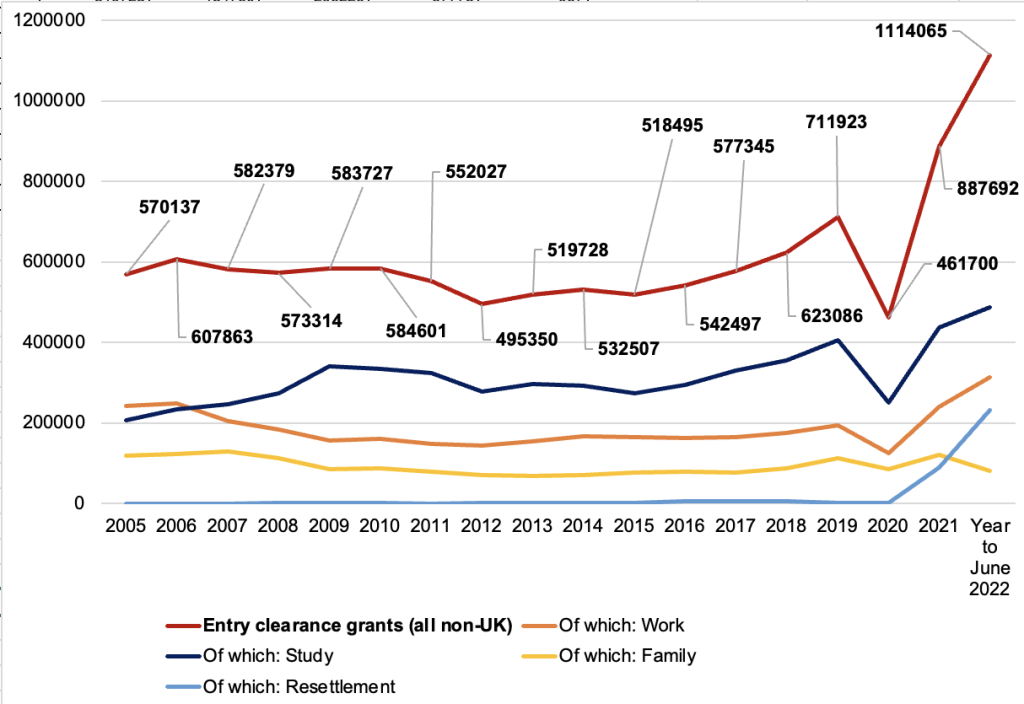

Changes To Uk Immigration Enhanced English Language Requirements

May 09, 2025

Changes To Uk Immigration Enhanced English Language Requirements

May 09, 2025 -

Rio Ferdinand Alters Champions League Final Prediction Psg Vs Arsenal

May 09, 2025

Rio Ferdinand Alters Champions League Final Prediction Psg Vs Arsenal

May 09, 2025