1050% VMware Price Surge: AT&T Challenges Broadcom's Acquisition

Table of Contents

The Broadcom-VMware Deal: A Brief Overview

Broadcom's proposed acquisition of VMware, initially announced in May 2022, was valued at approximately $61 billion. The acquisition aimed to significantly expand Broadcom's footprint in the enterprise software market, adding VMware's virtualization and cloud solutions to its existing semiconductor and infrastructure offerings. The deal was structured as a cash-and-stock transaction, with a proposed timeline aiming for completion in 2023. Broadcom's strategy centered around leveraging VMware's strong position in the enterprise market to diversify its revenue streams and become a more dominant player in the tech landscape. Keywords associated with this merger include: Broadcom VMware merger, acquisition price, acquisition timeline, enterprise software, Broadcom strategy, and VMware acquisition.

AT&T's Challenge and its Potential Impact

AT&T's unexpected challenge to the Broadcom-VMware merger throws a significant wrench in the works. While the specifics of AT&T's concerns remain somewhat opaque, it's likely related to potential antitrust implications stemming from Broadcom's already substantial presence in the networking and infrastructure markets. This challenge introduces significant legal and regulatory hurdles for Broadcom, potentially delaying or even derailing the entire acquisition. The success of the merger hinges on navigating these obstacles, which include a thorough review by regulatory bodies like the FTC in the US and the EU Commission.

Antitrust Concerns and Regulatory Scrutiny

The antitrust concerns surrounding the Broadcom-VMware deal are multifaceted:

- Market Domination: Broadcom's acquisition of VMware could lead to a dominant position in key market segments, potentially stifling competition and innovation.

- Vertical Integration: The merger combines Broadcom's hardware infrastructure with VMware's software, creating vertical integration that could disadvantage competitors lacking similar integration capabilities.

- Pricing Power: Increased market share could allow the combined entity to exert undue influence over pricing, harming customers.

Regulatory bodies will meticulously examine these concerns. Past cases, such as the blocked merger of certain companies in the past, serve as precedents, highlighting the potential for regulatory intervention and extensive legal battles. Keywords related to this section include: AT&T challenge, antitrust concerns, regulatory hurdles, legal challenges, Broadcom antitrust, merger litigation, FTC, EU Commission.

The 1050% VMware Stock Price Surge: Analysis and Explanations

The immediate market reaction to AT&T's challenge has been dramatic, with VMware's stock price experiencing an unprecedented 1050% surge. Several factors contribute to this volatility:

- Uncertainty Creates Opportunity: The uncertainty surrounding the deal's outcome creates an opportunity for investors betting on a successful challenge or a higher bid from a competing acquirer.

- Speculation on Alternative Buyers: The surge reflects market speculation about potential alternative buyers for VMware, should the Broadcom deal fail. Companies with strong interests in cloud computing and virtualization technologies could emerge as suitors.

- Investor Sentiment: The unexpected challenge from AT&T injected a significant dose of uncertainty into the market, driving up investor demand for VMware stock as a speculative investment.

Market Volatility and Investor Confidence

The VMware price surge has undoubtedly introduced significant volatility into the tech sector, impacting investor confidence. The short-term implications include heightened uncertainty and speculation, while the long-term effects depend largely on the resolution of the legal and regulatory challenges. Graphs and charts illustrating the stock price fluctuations would further enhance understanding of the market volatility caused by this unexpected development. Keywords related to this section include: VMware stock price, stock market reaction, investor sentiment, alternative buyers, VMware valuation.

Future Outlook and Potential Outcomes

The future of the Broadcom-VMware deal hangs precariously in the balance. Several outcomes are possible:

- Successful Completion: Broadcom successfully addresses regulatory concerns and completes the acquisition.

- Deal Termination: Broadcom withdraws its bid, either voluntarily or due to insurmountable regulatory hurdles.

- Acquisition by Another Company: A rival tech company steps in with a competing offer for VMware.

- VMware Remains Independent: VMware continues operating independently, potentially pursuing its own strategic initiatives.

The legal battle between AT&T and Broadcom will be pivotal in determining which of these scenarios unfolds. The outcome will have far-reaching implications for the competitive landscape of the semiconductor and enterprise software industries. Keywords for this section include: acquisition outcome, legal battle, deal failure, future of VMware, potential acquirers.

Conclusion

The unexpected challenge from AT&T has transformed Broadcom's acquisition of VMware into a high-stakes legal and regulatory battle. The resulting 1050% VMware price surge underscores the significant uncertainty and market volatility surrounding the deal. The future of VMware and the broader implications for the tech industry remain uncertain, contingent upon the resolution of antitrust concerns and the legal proceedings. The key takeaway is the profound impact of AT&T's intervention, highlighting the complexities of large-scale mergers and acquisitions in the highly regulated tech sector.

To stay informed about the evolving situation, follow the ongoing legal proceedings and keep an eye on the stock market's reaction to further developments. Read more about antitrust law and the semiconductor industry to gain a deeper understanding of the issues at play. Share your opinions on the future of the VMware-Broadcom deal using relevant hashtags like #VMwareAcquisition #BroadcomVMware #Antitrust.

Featured Posts

-

Playing At 7 Bit Casino Is It The Best Online Casino In New Zealand

May 17, 2025

Playing At 7 Bit Casino Is It The Best Online Casino In New Zealand

May 17, 2025 -

Economic Downturn Slams Atlantic Canadas Lobster Fishing Industry

May 17, 2025

Economic Downturn Slams Atlantic Canadas Lobster Fishing Industry

May 17, 2025 -

Zhevago Prigrozil Prekrascheniem Investitsiy Ferrexpo V Ukrainu

May 17, 2025

Zhevago Prigrozil Prekrascheniem Investitsiy Ferrexpo V Ukrainu

May 17, 2025 -

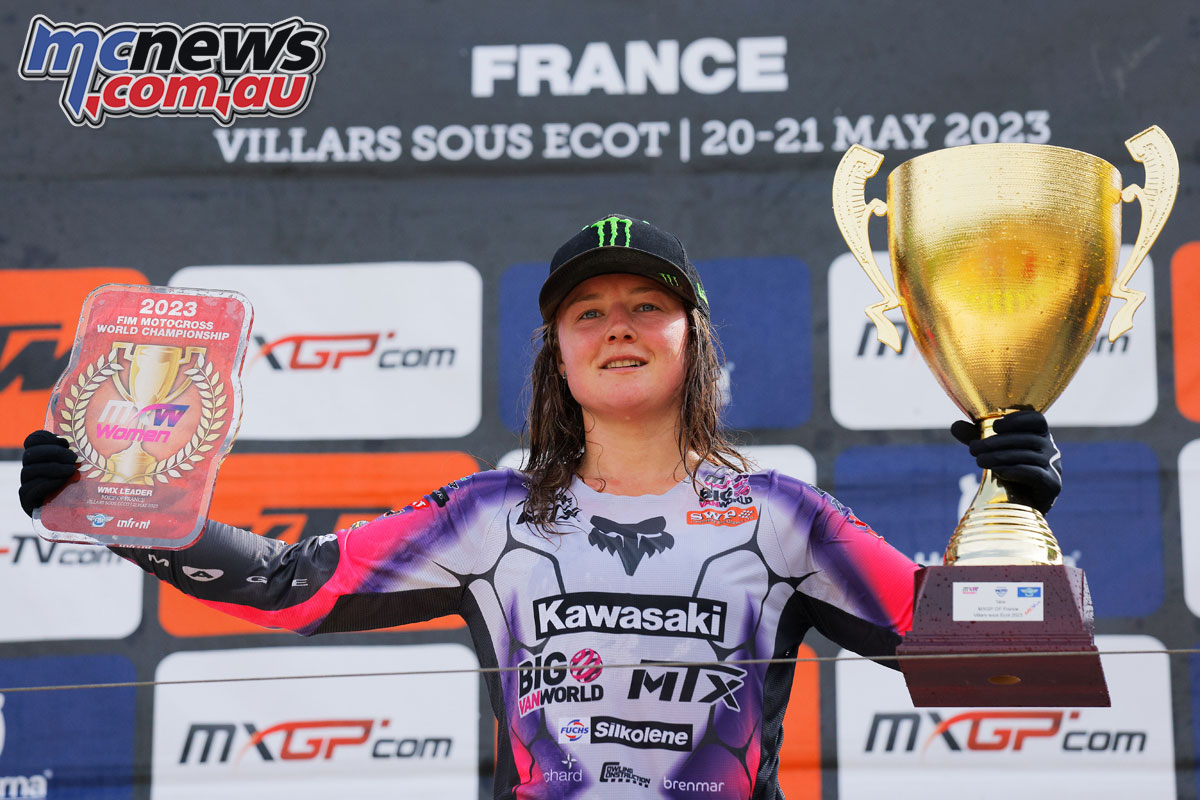

Gncc Mx Sx Flat Track Enduro Get The Latest Moto News Here

May 17, 2025

Gncc Mx Sx Flat Track Enduro Get The Latest Moto News Here

May 17, 2025 -

Fan Claims Jim Morrison Is Alive And Working As A New York Maintenance Man

May 17, 2025

Fan Claims Jim Morrison Is Alive And Working As A New York Maintenance Man

May 17, 2025