11 Million ETH Accumulated: Implications For Ethereum's Price

Table of Contents

Potential Reasons Behind the Massive ETH Accumulation

Several factors could explain the accumulation of 11 million ETH. Understanding these contributing elements provides a more nuanced perspective on the potential trajectory of Ethereum's price.

Whale Accumulation and Institutional Investment

Large institutional investors and high-net-worth individuals ("whales") are likely major contributors to this accumulation. Their motivations are multifaceted:

- Long-term Investment: Many see Ethereum as a long-term, secure investment, anticipating significant price appreciation driven by growing adoption and technological advancements.

- Anticipation of Future Price Increases: Whales often accumulate assets before anticipated price surges, potentially driving further price increases through their purchasing power.

- Market Manipulation (Debunked): While large transactions can influence market liquidity, accusations of deliberate price manipulation are difficult to prove and often unsubstantiated. The sheer volume of ETH involved, however, suggests a significant influence on market dynamics.

ETH Staking and DeFi Growth

The rise of Ethereum 2.0 and the expanding DeFi ecosystem are significant drivers of ETH demand:

- ETH Staking: Staking ETH to secure the network and earn rewards incentivizes holding, reducing the circulating supply and potentially driving up the price. The increasing number of ETH staked demonstrates a growing commitment to Ethereum's long-term prospects.

- DeFi Growth: The burgeoning DeFi sector relies heavily on ETH for transactions and collateral. The increasing popularity of decentralized applications (dApps) directly correlates with the demand for ETH, fueling accumulation. The growth of DeFi lending and borrowing platforms further contributes to this trend.

Anticipation of Ethereum's Future Developments

Upcoming Ethereum upgrades are anticipated to significantly improve the network's scalability, transaction speed, and efficiency, further driving ETH accumulation:

- Sharding: The implementation of sharding is expected to dramatically improve transaction throughput and reduce congestion, making Ethereum more appealing for users and developers alike.

- Improved Scalability: These upgrades directly address scalability challenges, attracting more users and potentially increasing the value of ETH.

- Positive Market Sentiment: Anticipation of successful upgrades contributes to positive market sentiment and encourages further accumulation of ETH.

Impact on Ethereum's Price: Bullish or Bearish?

The massive ETH accumulation presents both bullish and bearish possibilities for the price.

Bullish Arguments

The accumulation could signal a significant price increase:

- Supply and Demand Dynamics: Increased demand with a relatively limited supply typically drives price appreciation. The 11 million ETH accumulation represents a considerable increase in demand.

- Price Appreciation Potential: The combination of institutional investment, staking, and DeFi growth creates a powerful bullish narrative for ETH.

- Historical Precedents: Past instances of large-scale cryptocurrency accumulation have often preceded substantial price increases.

Bearish Arguments

However, there are potential downsides:

- Selling Pressure: A large-scale sell-off by whales or institutions could negate the bullish effects of accumulation and cause a temporary price drop.

- Market Saturation: While unlikely in the short term, market saturation could eventually limit further price increases.

- Macroeconomic Factors: Broader macroeconomic conditions, such as inflation and regulatory uncertainty, can influence the price of cryptocurrencies, regardless of accumulation trends.

Market Sentiment and Volatility

The news of 11 million ETH accumulated has significantly impacted market sentiment, leading to increased volatility:

- Price Chart Analysis: Analyzing price charts reveals significant price fluctuations immediately following the news, highlighting the market's sensitivity to this development.

- Market Sentiment Indicators: Social media sentiment and trading volume analysis offer insights into market sentiment, showing a mix of excitement and caution.

- Future Volatility Prediction: Predicting future volatility is challenging, but the current market dynamics suggest that fluctuations are likely to continue in the short term.

Strategies for Investors

Investors should consider both short-term and long-term strategies:

Long-Term vs. Short-Term Investment

- Long-Term: A long-term approach mitigates short-term volatility and allows investors to benefit from potential long-term price appreciation.

- Short-Term: Short-term trading requires careful monitoring of market trends and a higher risk tolerance.

Risk Management Techniques

Effective risk management is crucial:

- Diversification: Diversifying investments across different cryptocurrencies reduces risk.

- Stop-Loss Orders: Setting stop-loss orders helps limit potential losses if the price drops unexpectedly.

Conclusion

The accumulation of 11 million ETH is a significant event with far-reaching implications for Ethereum's price. While both bullish and bearish arguments exist, understanding the underlying factors driving this accumulation is crucial for informed investment decisions. The interplay of institutional investment, ETH staking, DeFi growth, and anticipated future developments creates a dynamic and complex market environment. Stay informed about the latest developments surrounding 11 million ETH accumulated and its impact on the Ethereum price, and remember to always conduct thorough research and implement effective risk management techniques before making any investment decisions. Learn more about investing in Ethereum and managing your risk effectively.

Featured Posts

-

Ella Mai And Jayson Tatums Son Confirmation In New Commercial

May 08, 2025

Ella Mai And Jayson Tatums Son Confirmation In New Commercial

May 08, 2025 -

Us Presidents Post On Trump And Ripple Sends Xrp Soaring

May 08, 2025

Us Presidents Post On Trump And Ripple Sends Xrp Soaring

May 08, 2025 -

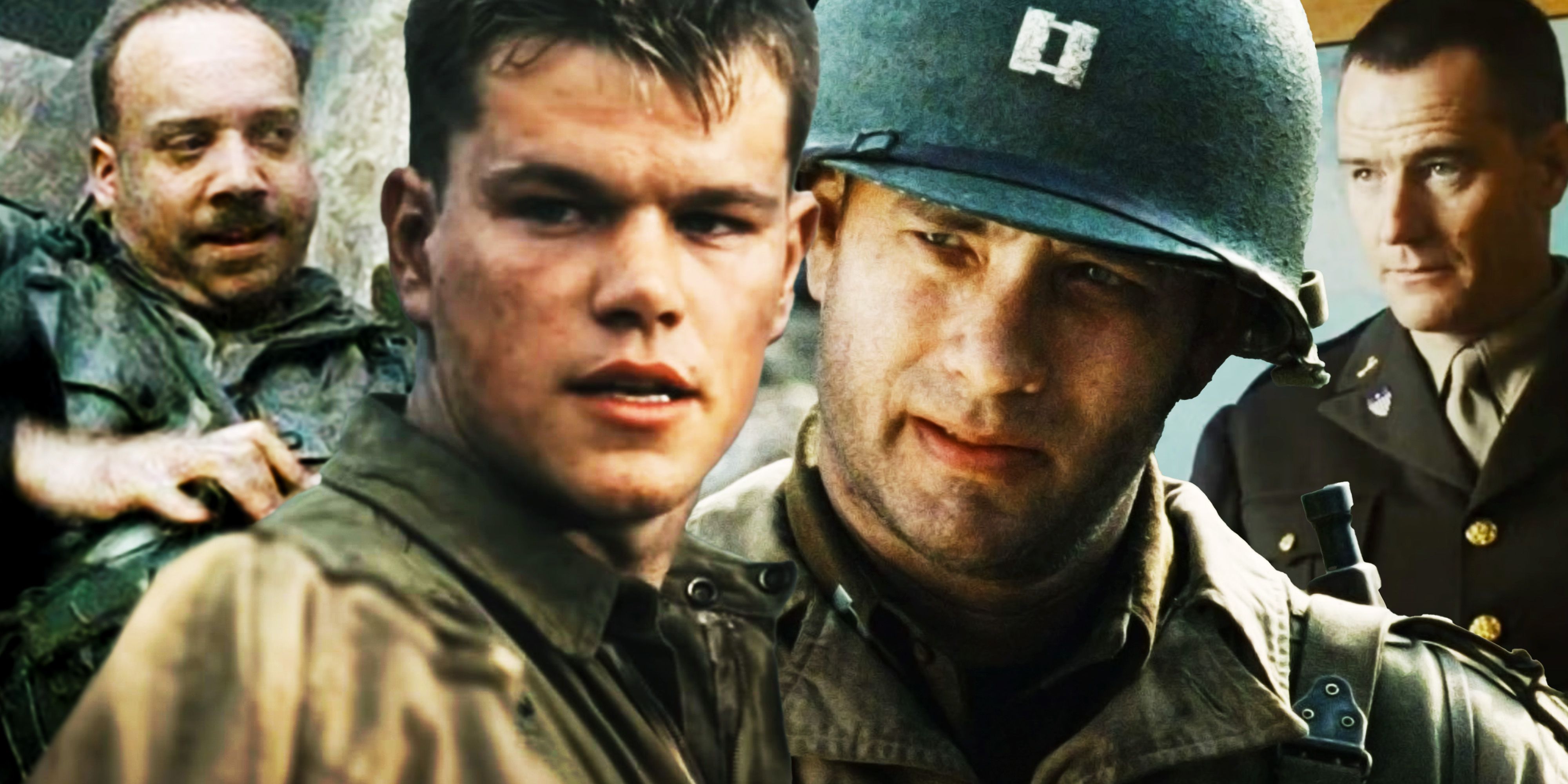

Top 7 Steven Spielberg War Films A Definitive Ranking Without Saving Private Ryan

May 08, 2025

Top 7 Steven Spielberg War Films A Definitive Ranking Without Saving Private Ryan

May 08, 2025 -

How To Claim A Universal Credit Refund From The Dwp

May 08, 2025

How To Claim A Universal Credit Refund From The Dwp

May 08, 2025 -

Ethereum Price Holds Strong Is A Breakout Imminent

May 08, 2025

Ethereum Price Holds Strong Is A Breakout Imminent

May 08, 2025