$14.6 Billion Deficit Projected For Ontario: Impact Of Tariffs And Economic Implications

Table of Contents

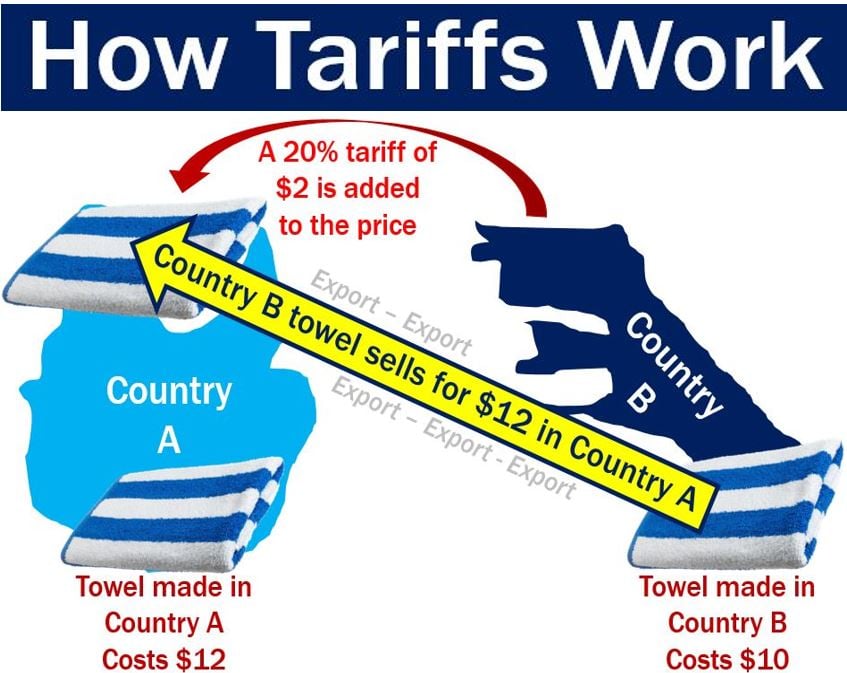

The Role of Tariffs in Ontario's Projected Deficit

Tariffs, taxes imposed on imported goods, significantly impact Ontario's economy. Increased import tariffs lead to higher prices for businesses and consumers, reducing purchasing power and potentially hindering economic growth. The tariff impact Ontario is felt across various sectors.

For example, the manufacturing sector, a cornerstone of the Ontario economy, relies heavily on imported raw materials and components. Higher tariffs on these inputs increase production costs, making Ontario-made goods less competitive in both domestic and global markets. Similarly, the agricultural sector faces challenges as tariffs on imported fertilizers and machinery drive up operating expenses. This effect is compounded by potential export restrictions impacting the ability of Ontario producers to access international markets.

The ripple effect is substantial:

- Increased costs for imported goods: Higher prices for consumers and businesses.

- Reduced competitiveness of Ontario businesses in global markets: Loss of market share to international competitors.

- Potential job losses due to decreased production and trade: Businesses may cut back on production or even close down.

- Impact on consumer spending due to higher prices: Reduced consumer confidence and spending.

Keywords: tariff impact Ontario, trade deficit, import tariffs, export restrictions.

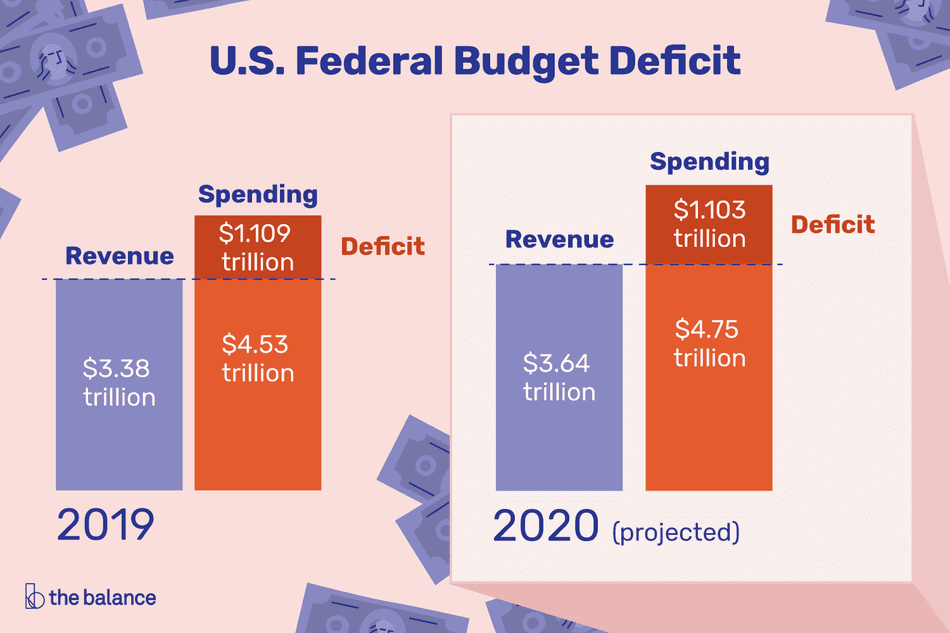

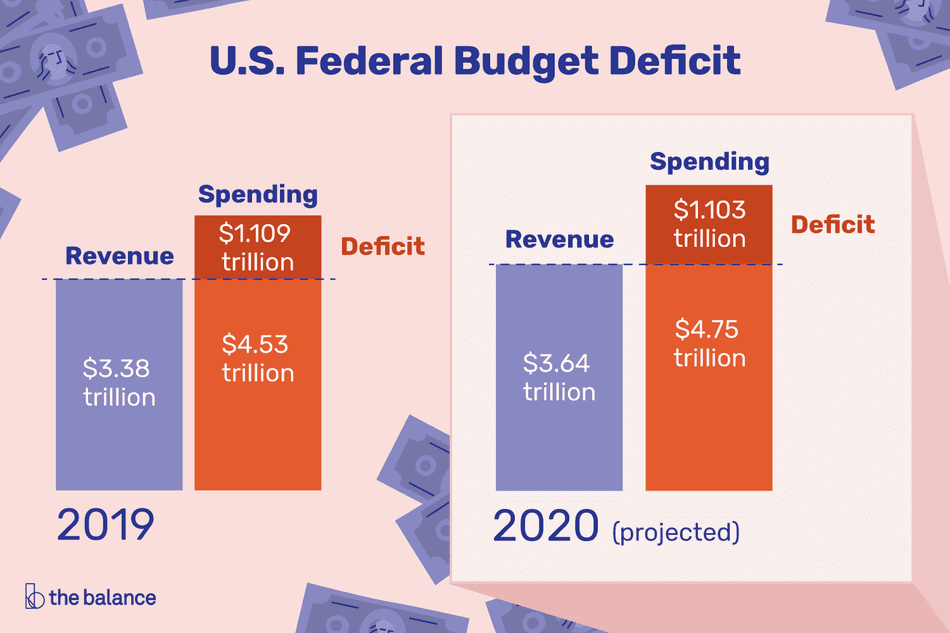

Other Contributing Factors to Ontario's Fiscal Deficit

While tariffs play a significant role, the $14.6 billion Ontario deficit stems from a confluence of factors. Government spending on vital social programs, such as healthcare and education, constitutes a substantial portion of the budget. While crucial for social well-being, increased spending contributes to the fiscal deficit.

Simultaneously, decreased tax revenues, a direct consequence of economic slowdown, further exacerbate the situation. Reduced economic activity translates to lower income tax collections and sales tax revenues. Moreover, increased interest payments on the accumulating provincial debt represent a significant drain on resources.

Let's examine the data:

- Analysis of government spending in key areas: Healthcare, education, and social services represent the lion's share of provincial expenditure.

- Data on tax revenue fluctuations: A decline in economic activity has directly impacted tax revenue collection.

- Explanation of interest rate impacts on debt servicing: Rising interest rates increase the cost of servicing the provincial debt.

Keywords: Ontario government spending, tax revenue, provincial debt, economic slowdown, fiscal policy.

Economic Implications of the $14.6 Billion Deficit

The projected $14.6 billion deficit carries significant economic implications for Ontario. A large deficit can negatively affect Ontario's credit rating, making it more expensive for the province to borrow money in the future. This could lead to a vicious cycle, impacting future investments and potentially leading to economic stagnation or even recession.

The consequences are far-reaching:

- Consequences for businesses and investors: Uncertainty about the economic climate may discourage investment and business expansion.

- Impact on public services and infrastructure: Budget cuts may lead to reduced funding for essential public services and infrastructure projects.

- Long-term economic growth projections: A large deficit could significantly hamper long-term economic growth prospects.

The impact on different sectors will vary, but the overall effect could be a significant slowdown in economic activity.

Keywords: economic recession, Ontario economy, credit rating, government services, economic growth.

Potential Mitigation Strategies for Ontario's Deficit

Addressing the $14.6 billion deficit requires a multi-pronged approach. The Ontario government could explore several mitigation strategies:

- Increased tax revenue through tax reforms: This could involve adjustments to existing tax rates or the introduction of new taxes.

- Reduced government spending through fiscal consolidation: This could require identifying areas where government spending can be streamlined or reduced.

- Stimulating economic growth through targeted investments: Investments in infrastructure projects and initiatives promoting innovation could boost economic activity and increase tax revenues.

Each of these strategies has potential benefits and drawbacks that need careful consideration. For instance, tax increases might negatively impact consumer spending, while spending cuts could compromise essential public services. Finding the right balance is critical.

Keywords: fiscal consolidation, tax reform, economic stimulus, government policy.

Conclusion: Understanding and Addressing Ontario's $14.6 Billion Deficit

Ontario's $14.6 billion projected deficit is a serious concern resulting from a complex interplay of factors, including the impact of tariffs on key industries and broader economic challenges. The consequences, ranging from reduced credit ratings to potential service cuts, underscore the urgent need for effective government action. Addressing this deficit requires a combination of strategic fiscal consolidation, carefully considered tax reforms, and initiatives to stimulate economic growth. Learn more about the Ontario deficit and understand the impact of tariffs on the Ontario economy. Stay informed about future budget updates to understand the government's plans to manage this significant financial challenge and its impact on your community. Keywords: Ontario deficit, economic impact, tariffs, Ontario budget, fiscal deficit, economic downturn.

Featured Posts

-

Is Jackbit The Best Bitcoin Casino For 2025 A Detailed Analysis

May 17, 2025

Is Jackbit The Best Bitcoin Casino For 2025 A Detailed Analysis

May 17, 2025 -

Impact Of Trump Tariffs On Japans Economy Q1 2018 As A Baseline

May 17, 2025

Impact Of Trump Tariffs On Japans Economy Q1 2018 As A Baseline

May 17, 2025 -

Analyzing Ralph Laurens Fall 2025 Riser Collection

May 17, 2025

Analyzing Ralph Laurens Fall 2025 Riser Collection

May 17, 2025 -

Knicks Coach Thibodeau Seeks Increased Resolve After 37 Point Defeat

May 17, 2025

Knicks Coach Thibodeau Seeks Increased Resolve After 37 Point Defeat

May 17, 2025 -

Fortnite Cosmetic Changes A Refund Indicates Major Updates

May 17, 2025

Fortnite Cosmetic Changes A Refund Indicates Major Updates

May 17, 2025