2% GDP Contraction In The U.S.: Analysis Of Spending And Tariff Effects

Table of Contents

The Role of Consumer Spending in the 2% GDP Contraction

Consumer spending forms the backbone of the U.S. economy, representing roughly 70% of GDP. Any significant dip in consumer confidence and spending directly translates into economic contraction. The 2% GDP contraction witnessed a marked decrease in consumer activity, revealing a complex interplay of factors.

Decreased Consumer Confidence and its Ripple Effects

Declining consumer confidence significantly impacts various sectors. When consumers are hesitant to spend, businesses feel the pinch immediately.

- Retail: Reduced foot traffic and online sales lead to inventory build-up and potential layoffs.

- Automotive: New car sales plummet as consumers postpone major purchases.

- Housing: Demand for new homes and mortgages weakens, affecting the construction industry.

Data from the Conference Board's Consumer Confidence Index showed a sharp decline during the contraction period, falling to its lowest point in [Insert specific data point, e.g., "10 years"]. This decrease reflects growing concerns about inflation, rising interest rates, and overall economic uncertainty. The resulting decrease in consumer spending directly contributed to the overall 2% GDP contraction in the U.S.

Impact of Inflation on Disposable Income and Spending Habits

High inflation significantly erodes purchasing power. Rising prices for essential goods and services reduce disposable income, leaving less money for discretionary spending.

- Reduced Purchasing Power: Inflation eats into wages, meaning consumers can buy fewer goods and services with the same amount of money.

- Shifting Spending Habits: Consumers are forced to cut back on non-essential expenses and seek cheaper alternatives.

- Delayed Purchases: Major purchases like appliances, vehicles, and homes are postponed, impacting related industries.

Data shows that inflation rates reached [Insert specific data point, e.g., "a 40-year high of X%"] during the contraction, outpacing wage growth. This resulted in a decline in real wages, leaving consumers with less money to spend after accounting for the increased cost of living. Consequently, consumer spending decreased, exacerbating the 2% GDP contraction in the U.S.

The Influence of Tariffs on the U.S. Economy and the 2% GDP Contraction

The imposition of tariffs, while intended to protect domestic industries, can have unintended consequences. Increased import costs ripple through the economy, affecting businesses and consumers alike.

Impact of Tariffs on Import Prices and Business Costs

Tariffs directly increase the price of imported goods, raising costs for businesses that rely on these imports for production.

- Increased Production Costs: Businesses face higher input costs, leading to reduced profit margins.

- Price Increases for Consumers: Businesses often pass these increased costs onto consumers in the form of higher prices.

- Reduced Competitiveness: Higher prices can make U.S. goods less competitive in both domestic and international markets.

For example, tariffs on steel and aluminum [Insert specific data point, e.g., "increased costs for manufacturers by X%," and provide relevant examples]. This led to reduced profitability and in some cases, job losses within affected industries, contributing to the overall 2% GDP contraction in the U.S.

Retaliatory Tariffs and their Impact on U.S. Exports

The imposition of tariffs can trigger retaliatory measures from other countries, harming U.S. exports and further impacting the economy.

- Reduced Export Demand: Other countries may impose tariffs on U.S. goods in response, reducing demand and harming U.S. businesses.

- Loss of Market Share: U.S. businesses may lose market share to competitors in countries unaffected by the trade dispute.

- Job Losses in Export-Oriented Sectors: Reduced exports can lead to job losses in sectors reliant on international trade.

Data reveals a decline in U.S. exports to [Insert specific data point, e.g., "China and the European Union"] following the imposition of tariffs. This decline further contributed to the overall 2% GDP contraction in the U.S.

Interconnectedness of Spending and Tariff Effects on the 2% GDP Contraction

The decrease in consumer spending and the negative effects of tariffs are not isolated events; they are intertwined and mutually reinforcing.

[Insert a chart or graph visually representing the interconnectedness of decreased consumer spending and tariff impacts on GDP.]

- Reduced Consumer Confidence due to Tariff-Induced Inflation: Higher prices due to tariffs further erode consumer confidence, leading to even less spending.

- Business Investment Decline due to Tariff Uncertainty: Uncertainty caused by trade wars discourages businesses from investing, further slowing economic growth.

- Synergistic Effect: The combined effect of decreased consumer spending and tariff-related economic shocks creates a negative feedback loop, amplifying the overall contraction.

Conclusion: Understanding the 2% GDP Contraction and its Implications for Future Economic Policy

The 2% GDP contraction in the U.S. resulted from a complex interplay of factors, with decreased consumer spending and the impacts of tariffs playing significant roles. High inflation, eroding purchasing power, and the resulting decline in consumer confidence were key drivers of the spending decrease. Simultaneously, tariffs increased import costs, impacting business profitability and triggering retaliatory measures that hurt U.S. exports. The interaction of these factors created a synergistic effect, amplifying the overall economic downturn. Understanding the intricacies of the 2% GDP contraction in the U.S. requires ongoing vigilance. Stay informed on the latest economic data and policy changes related to consumer spending and tariffs to gain a better understanding of the economic outlook. Further research into the long-term effects of these factors is crucial for formulating effective economic policies to prevent future contractions.

Featured Posts

-

Unlocking The Good Life Practical Steps To Happiness And Wellbeing

May 31, 2025

Unlocking The Good Life Practical Steps To Happiness And Wellbeing

May 31, 2025 -

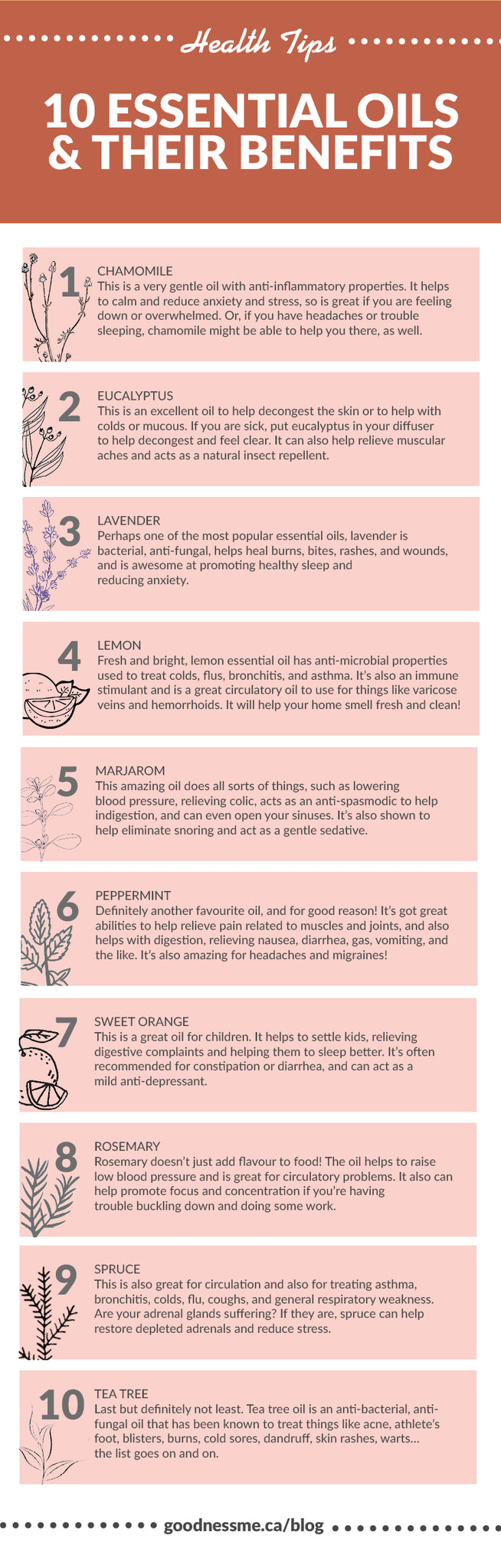

Rosemary And Thyme Essential Oils And Their Benefits

May 31, 2025

Rosemary And Thyme Essential Oils And Their Benefits

May 31, 2025 -

Tigers Announce Doubleheader Details Following Friday Postponement

May 31, 2025

Tigers Announce Doubleheader Details Following Friday Postponement

May 31, 2025 -

Detroit Tigers Pitcher Skubal Prepares For Rematch Putting Grand Slam Behind Him

May 31, 2025

Detroit Tigers Pitcher Skubal Prepares For Rematch Putting Grand Slam Behind Him

May 31, 2025 -

Glastonbury Festival Budget Friendly Tip From Seasoned Attendees

May 31, 2025

Glastonbury Festival Budget Friendly Tip From Seasoned Attendees

May 31, 2025