2% LVMH Share Drop Follows Disappointing Q1 Sales Report

Table of Contents

Disappointing Q1 Sales Figures: A Detailed Breakdown

LVMH's Q1 sales figures revealed a concerning slowdown in growth, prompting the 2% LVMH stock price drop. Several factors contributed to this underperformance, impacting investor confidence in the luxury goods market.

-

Specific Percentage Decline: LVMH reported a 1% decline in organic revenue compared to Q1 of the previous year, falling short of analyst expectations. This represents a significant departure from the robust growth seen in previous quarters.

-

Brand Performance Breakdown: While some brands within the LVMH portfolio performed relatively well, others lagged. Louis Vuitton, typically a consistent performer, showed signs of slowing growth, while Sephora experienced a more pronounced decline due to increased competition and changing consumer preferences. Dior, however, bucked the trend, showing solid growth, driven largely by its cosmetics and fragrance lines.

-

Regional Sales Performance: The Asia-Pacific region, a crucial market for luxury goods, showed a noticeable decline in sales growth. This weakness was only partially offset by stronger performance in Europe and the Americas. The slowdown in China, a key driver of luxury growth in recent years, is a significant concern.

-

Comparison to Analyst Expectations: LVMH missed analyst projections, which had anticipated more robust growth. This shortfall contributed to the negative investor reaction and subsequent share price drop.

-

Reasons for Underperformance: Several factors likely contributed to the disappointing results. Weakening consumer demand in key markets due to inflation and economic uncertainty played a significant role. Supply chain disruptions, while less impactful than in previous years, still presented challenges. Currency fluctuations also negatively impacted reported revenue.

Impact on LVMH Share Price and Investor Sentiment

The 2% drop in LVMH's share price reflects the market's immediate reaction to the disappointing Q1 sales report. This significant decline illustrates the sensitivity of investor sentiment to any sign of weakness in the luxury sector.

-

Share Price Volatility: Following the report's release, LVMH's stock price experienced increased volatility. Trading volume spiked as investors reacted to the news, with many choosing to sell shares, contributing to the decline.

-

Investor Reaction and Trading Volume: The immediate reaction was largely negative, with a significant sell-off. Long-term investors expressed concerns about the sustainability of growth in the luxury market.

-

Impact on Market Capitalization: The share price drop resulted in a substantial reduction in LVMH's overall market capitalization. This loss of value reflects the market's reassessment of LVMH's short-term and long-term prospects.

-

Analyst Downgrades/Upgrades: Several analysts downgraded their outlook for LVMH following the report, further contributing to negative sentiment. However, some maintained a positive outlook, citing the company's strong brand portfolio and long-term potential.

-

Investor Sentiment: The overall investor sentiment shifted from optimistic to cautiously pessimistic. Concerns about a potential slowdown in global luxury spending and the impact of macroeconomic factors are at the forefront.

The Broader Implications for the Luxury Goods Market

LVMH's Q1 performance raises questions about the broader health of the luxury goods market. The results suggest that the sector is not immune to macroeconomic pressures.

-

Luxury Market Trends: The slowdown in LVMH's sales reflects wider concerns about a potential cooling of the luxury market, fueled by inflation, interest rate hikes, and geopolitical uncertainties.

-

Is LVMH indicative of wider issues? While LVMH is a bellwether for the luxury sector, it's crucial to assess whether its underperformance reflects broader industry trends or is specific to its own circumstances. Further analysis of the performance of other luxury brands is needed to draw broader conclusions.

-

Macroeconomic Factors: Inflation, high interest rates, and geopolitical instability are impacting consumer spending, particularly on discretionary items like luxury goods. The economic slowdown in certain key regions further dampens demand.

-

Comparison to other Luxury Brands: Analyzing the performance of competing luxury brands like Hermès, Kering, and Richemont is essential to determine if LVMH's struggles are unique or represent a wider trend in the industry.

Looking Ahead: Potential Scenarios for LVMH

Despite the disappointing Q1 results, LVMH's long-term prospects remain relatively strong, given its powerful brand portfolio and global reach. However, strategic adaptations will be crucial.

-

Growth Strategies: LVMH may focus on expanding into new markets, particularly in regions showing growth potential. Investing in digital channels and personalized customer experiences will also be vital. Cost-cutting measures and supply chain optimization will likely be explored.

-

Catalysts for Recovery: A rebound in consumer spending, easing of geopolitical tensions, and successful product launches could drive a recovery in LVMH's share price.

-

Potential Scenarios: The most likely scenario involves moderate growth in the coming quarters, as LVMH adapts to the current economic challenges. A more optimistic scenario involves a swift return to strong growth, driven by successful strategic initiatives. A pessimistic scenario might involve a prolonged period of sluggish growth, potentially leading to further share price declines.

-

Expert Opinions and Market Predictions: Analyst predictions for LVMH's stock price vary, but most expect a gradual recovery, contingent upon economic conditions and LVMH's strategic responses.

Conclusion

The 2% drop in LVMH's share price following its disappointing Q1 sales report highlights challenges within the luxury goods sector, raising concerns about the impact of macroeconomic factors on consumer spending. The underperformance of several key brands, coupled with weaker-than-expected regional sales, contributed to this decline. While the future remains uncertain, analyzing the detailed sales figures, investor sentiment, and broader market trends is crucial for understanding the potential for recovery. LVMH's ability to navigate these challenges through strategic adaptations will determine its future trajectory.

Call to Action: Stay informed about the evolving situation by regularly checking for updates on LVMH's performance and the luxury goods market. Understanding the factors impacting the LVMH stock price is vital for investors navigating the complexities of the luxury market. Follow our blog for further analysis and insights on LVMH stock and the luxury goods sector.

Featured Posts

-

1 08 Euro Live Updates Over Kapitaalmarktrentes En Wisselkoersen

May 24, 2025

1 08 Euro Live Updates Over Kapitaalmarktrentes En Wisselkoersen

May 24, 2025 -

Kudi Podilisya Peremozhtsi Yevrobachennya Za Ostannye Desyatilittya

May 24, 2025

Kudi Podilisya Peremozhtsi Yevrobachennya Za Ostannye Desyatilittya

May 24, 2025 -

Porsche Indonesia Classic Art Week 2025 Perayaan Seni Dan Otomotif

May 24, 2025

Porsche Indonesia Classic Art Week 2025 Perayaan Seni Dan Otomotif

May 24, 2025 -

New Ferrari Hot Wheels Sets A Mamma Mia Moment For Collectors

May 24, 2025

New Ferrari Hot Wheels Sets A Mamma Mia Moment For Collectors

May 24, 2025 -

Memorial Day 2025 Air Travel Smartest Flight Dates To Book

May 24, 2025

Memorial Day 2025 Air Travel Smartest Flight Dates To Book

May 24, 2025

Latest Posts

-

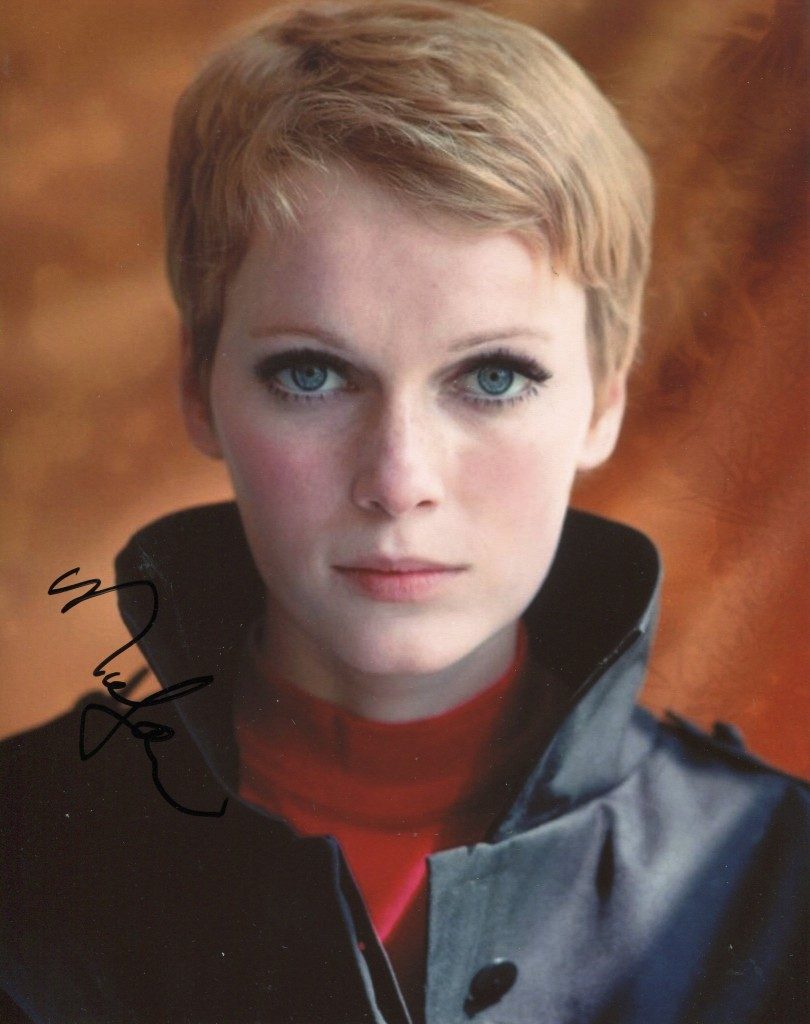

Caine On Mia Farrow A Sex Scene And An Ex Husbands Surprise

May 24, 2025

Caine On Mia Farrow A Sex Scene And An Ex Husbands Surprise

May 24, 2025 -

Sean Penns Doubts Re Examining The Woody Allen Dylan Farrow Allegations

May 24, 2025

Sean Penns Doubts Re Examining The Woody Allen Dylan Farrow Allegations

May 24, 2025 -

Sean Penn Questions Dylan Farrows Allegations Against Woody Allen

May 24, 2025

Sean Penn Questions Dylan Farrows Allegations Against Woody Allen

May 24, 2025 -

Michael Caine Recalls Awkward Mia Farrow Sex Scene Encounter

May 24, 2025

Michael Caine Recalls Awkward Mia Farrow Sex Scene Encounter

May 24, 2025 -

Sean Penns Support Of Woody Allen A Me Too Blind Spot

May 24, 2025

Sean Penns Support Of Woody Allen A Me Too Blind Spot

May 24, 2025