2025 Gold Losses: Double Dip In Weekly Prices

Table of Contents

Economic Headwinds and Their Impact on Gold Prices in 2025

Several significant economic factors could conspire to drive down gold prices in 2025, potentially leading to the predicted double dip.

Rising Interest Rates and Their Influence

The relationship between interest rates and gold prices is inversely correlated. Higher interest rates generally diminish the appeal of gold, a non-yielding asset. When interest rates rise, investors often shift their capital towards interest-bearing instruments like bonds, reducing demand for gold.

- Federal Reserve Projections: The Federal Reserve's projected interest rate path for 2025 will be a crucial determinant of gold's performance. Any unexpected increases could trigger further gold price declines.

- Global Interest Rate Hikes: Similar actions by central banks worldwide will amplify the downward pressure on gold prices. A global tightening of monetary policy creates a less favorable environment for gold investment.

- Implications for Gold Investment Strategies: Investors might need to re-evaluate their gold investment strategies, considering alternative assets that offer higher returns in a rising interest rate environment.

Strong US Dollar and its Effect on Gold Demand

A strong US dollar typically exerts downward pressure on gold prices. This is because gold is priced in US dollars, making it more expensive for holders of other currencies when the dollar strengthens. Reduced demand from international buyers contributes to lower prices.

- Factors Contributing to Dollar Strength: Several factors, such as economic strength, geopolitical stability, and safe-haven demand, could influence the dollar's value in 2025.

- Historical Correlations: Historically, a strong correlation exists between dollar strength and gold price weakness. Analyzing past trends can offer valuable insights into potential future movements.

- Hedging Strategies: In a strong dollar environment, hedging strategies become crucial for protecting against gold price fluctuations. These could involve using currency-hedged gold investments.

Geopolitical Risks and Their Uncertain Impact

Geopolitical instability, including wars, trade tensions, and political uncertainty, can significantly impact gold prices. While these events often drive investors towards gold as a safe haven, the effects can be unpredictable, leading to price volatility and potentially contributing to a double dip scenario.

- Specific Geopolitical Risks: Identifying specific geopolitical risks likely to impact the gold market in 2025 is crucial for accurate forecasting. Ongoing conflicts and potential future escalations warrant close monitoring.

- Price Increases and Decreases: Geopolitical risks can trigger both sharp increases and decreases in gold prices. The direction depends on the specific event and investor sentiment.

- Inherent Uncertainty: The unpredictable nature of geopolitical events makes accurate forecasting extremely challenging, increasing the uncertainty surrounding 2025 gold price movements.

Technical Analysis: Predicting the Double Dip in Weekly Gold Prices

Technical analysis provides another lens through which to view the potential double dip in weekly gold prices.

Chart Patterns and Indicators

Analyzing weekly gold price charts reveals potential patterns indicative of a double dip. Key technical indicators such as moving averages and the Relative Strength Index (RSI) can be utilized for a more comprehensive assessment.

- Chart Patterns: Specific chart patterns, such as head and shoulders or double tops, can signal potential price reversals and downturns.

- Technical Indicators: Moving averages, RSI, and other indicators provide valuable insights into momentum, overbought/oversold conditions, and potential trend changes. These indicators help confirm potential chart patterns.

- Visual Aids: Charts illustrating these patterns and indicators are indispensable for visualizing the potential double dip scenario.

Support and Resistance Levels

Identifying key support and resistance levels is crucial in predicting potential price drops. These levels represent psychological barriers that can influence price action.

- Support and Resistance Levels: Analyzing historical price data can help identify significant support and resistance levels for gold prices in 2025.

- Double Dip Significance: Breaks below key support levels could indicate a continuation of the downward trend, potentially leading to the predicted double dip.

- Potential Breakouts: Monitoring these levels and anticipating potential breakouts is critical for informed trading decisions.

Mitigation Strategies for Gold Investors in 2025

Investors can employ several strategies to mitigate potential losses in a volatile gold market.

Diversification and Risk Management

Diversifying your investment portfolio is vital to reducing risk and minimizing losses in the event of a gold price downturn.

- Alternative Investments: Consider incorporating other assets like stocks, bonds, real estate, or other precious metals to balance your portfolio.

- Risk Management Strategies: Implement risk management techniques such as stop-loss orders to limit potential losses on gold holdings.

Hedging Strategies

Employing hedging strategies can help protect against potential gold price declines.

- Options and Futures Contracts: Options and futures contracts offer ways to hedge against gold price risk.

- Pros and Cons: Carefully weigh the pros and cons of each hedging strategy before implementing it. Consider factors like cost and complexity.

Conclusion

The potential for 2025 gold losses, including a "double dip" in weekly gold prices, is significant, fueled by economic headwinds like rising interest rates and a strong US dollar, alongside technical indicators suggesting a potential downturn. Geopolitical uncertainty further complicates the forecast. However, by closely monitoring the gold market, conducting thorough research, and implementing appropriate diversification and risk management strategies, investors can navigate this challenging environment. Stay informed about 2025 gold price predictions and develop a robust investment plan to effectively manage your exposure to potential gold price fluctuations. For more resources on gold investment and trading, [link to relevant resource].

Featured Posts

-

Alexander Volkanovski Vs Diego Lopes Ufc 314 Fight Card Analysis

May 05, 2025

Alexander Volkanovski Vs Diego Lopes Ufc 314 Fight Card Analysis

May 05, 2025 -

Addressing The Slow Traffic Movement In Darjeeling

May 05, 2025

Addressing The Slow Traffic Movement In Darjeeling

May 05, 2025 -

Saturdays Nhl Action Playoff Implications And Standings Update

May 05, 2025

Saturdays Nhl Action Playoff Implications And Standings Update

May 05, 2025 -

Anna Kendrick The Missing Piece For The Accountant 3

May 05, 2025

Anna Kendrick The Missing Piece For The Accountant 3

May 05, 2025 -

Fox Sports Indy Car Coverage What To Expect This Season

May 05, 2025

Fox Sports Indy Car Coverage What To Expect This Season

May 05, 2025

Latest Posts

-

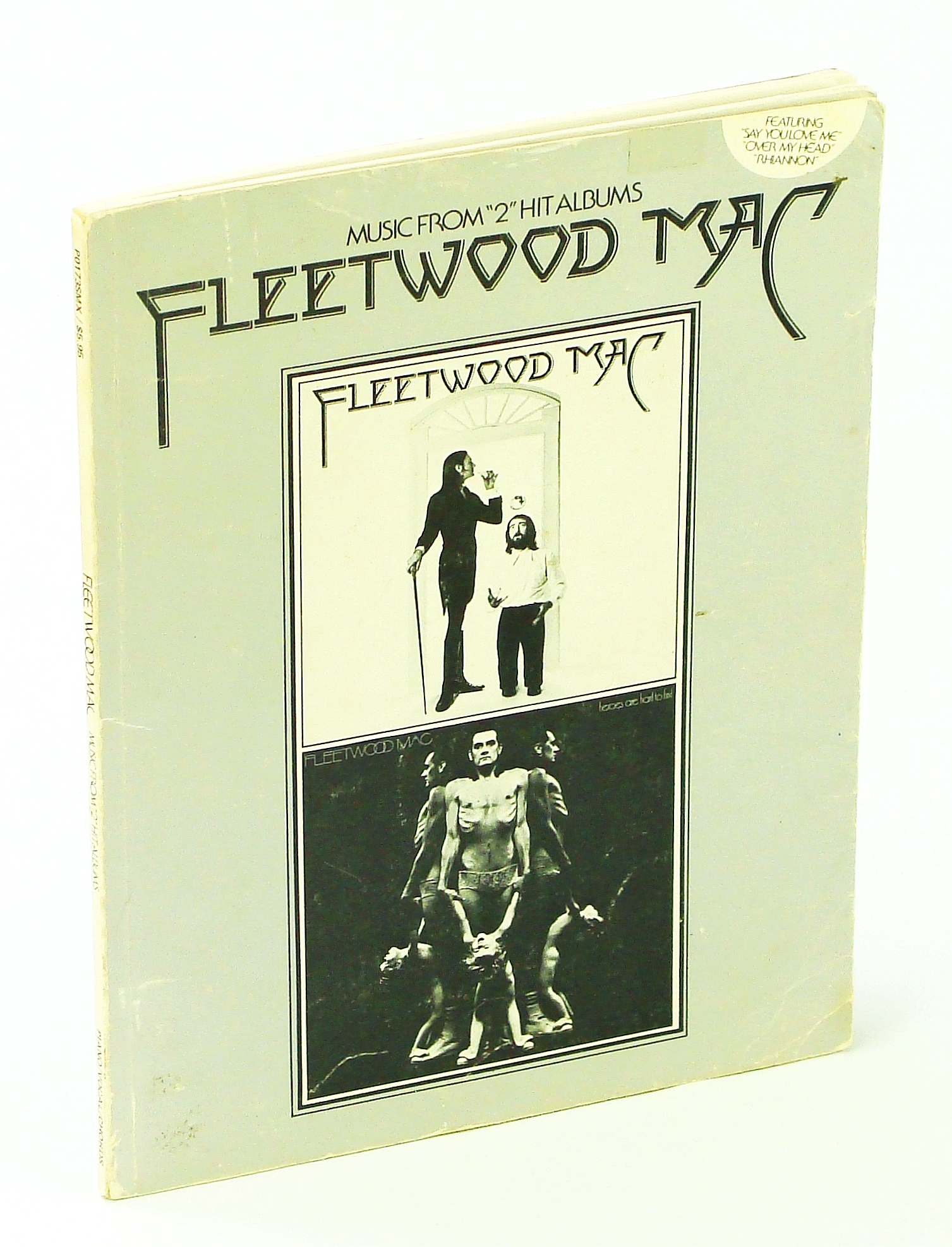

Untangling The Success Of Fleetwood Macs Multi Platinum Albums A Legacy Of Hit Songs

May 05, 2025

Untangling The Success Of Fleetwood Macs Multi Platinum Albums A Legacy Of Hit Songs

May 05, 2025 -

Fleetwood Macs Vast And Varied Discography Chart Topping Albums That Stand The Test Of Time

May 05, 2025

Fleetwood Macs Vast And Varied Discography Chart Topping Albums That Stand The Test Of Time

May 05, 2025 -

The Buckingham Fleetwood Reunion Hope For A Fleetwood Mac Revival

May 05, 2025

The Buckingham Fleetwood Reunion Hope For A Fleetwood Mac Revival

May 05, 2025 -

Buckingham And Fleetwoods Reunion What It Means For Fleetwood Mac Fans

May 05, 2025

Buckingham And Fleetwoods Reunion What It Means For Fleetwood Mac Fans

May 05, 2025 -

The Enduring Power Of Fleetwood Macs Hit Albums A Deep Dive Into Their Catalog

May 05, 2025

The Enduring Power Of Fleetwood Macs Hit Albums A Deep Dive Into Their Catalog

May 05, 2025