2025 Hurun Global Rich List: Elon Musk's Position Remains Unchallenged Despite $100 Billion Drop

Table of Contents

The $100 Billion Drop: Understanding the Fluctuations in Elon Musk's Net Worth

Elon Musk's $100 billion decrease in net worth is a significant event, demanding a closer look at the contributing factors. This substantial fluctuation wasn't a sudden collapse but rather a reflection of several interconnected market forces and business dynamics.

Impact of Tesla Stock Performance:

The undeniable correlation between Tesla's stock price and Elon Musk's net worth is a key factor in understanding this significant drop. Musk's wealth is heavily tied to his stake in Tesla, making the electric vehicle manufacturer's market performance a major determinant of his overall net worth.

- Market Volatility: The volatile nature of the stock market, particularly in the technology sector, played a crucial role. Significant market corrections in 2024-2025 directly impacted Tesla's stock price, leading to a decrease in Musk's wealth.

- Stock Fluctuations: Specific events, such as shifts in investor sentiment, economic uncertainty, and competition within the EV market, all contributed to the fluctuation of Tesla's stock, directly affecting Musk's net worth. Precise statistics regarding Tesla's stock performance during this period would provide a clearer picture. (Note: Insert specific statistical data on Tesla stock performance for 2024-2025 here if available).

- Wealth Impact: The impact of these fluctuations on Musk’s wealth is undeniable, highlighting the inherent risks associated with holding significant portions of one's wealth in a single company's stock.

The Influence of SpaceX Investments:

While Tesla's stock performance dominated the headlines, SpaceX's ongoing ventures played a crucial mitigating role in cushioning the blow. SpaceX's ambitious projects, from Starlink's global internet expansion to the development of reusable rockets and interplanetary travel, represent significant long-term investments.

- SpaceX Valuation: Though not publicly traded, SpaceX's valuation continues to climb, indicating a strong future potential. The company's groundbreaking achievements in space exploration and private spaceflight contribute to Musk's overall financial picture.

- Long-Term Investments: Musk's long-term investment strategy in SpaceX represents a hedge against the volatility of the Tesla stock market. These long-term investments are less susceptible to short-term market fluctuations.

- Mitigating Tesla Losses: SpaceX’s success is partially mitigating the losses incurred from Tesla stock performance, demonstrating the power of diversification in wealth management.

Other Contributing Factors to Net Worth Change:

Beyond Tesla and SpaceX, other factors contribute to the overall fluctuation of Musk's net worth.

- Diversification: Although heavily reliant on Tesla, Musk has diversified his investments across various sectors, offering some level of protection against the risks associated with a single venture.

- Personal Investments: Musk's personal investment portfolio, though largely undisclosed, likely encompasses diverse assets that contribute to his overall wealth.

- Philanthropic Activities: While his philanthropic efforts might not directly impact his net worth in the short term, they potentially have a long-term positive effect on his legacy and overall image.

- Legal Challenges: Any ongoing legal battles or controversies, though not explicitly detailed in the available information, might influence his wealth, especially in terms of potential financial liabilities.

Why Elon Musk Remains Unchallenged at the Top of the 2025 Hurun Global Rich List

Despite the substantial drop, Elon Musk's position at the top remains unchallenged. This is largely attributed to two key factors.

The Power of Diversification:

While Tesla's stock performance undeniably affects his wealth, Musk's diversification strategy played a crucial role in softening the blow.

- Portfolio Diversification: The existence of SpaceX, alongside other potential investments, creates a more resilient financial portfolio less vulnerable to the volatility of a single asset.

- Risk Mitigation: Diversification inherently mitigates the risk associated with concentrating wealth in a single venture, especially within a volatile market.

- Business Diversification: Musk's involvement in multiple sectors demonstrates a shrewd understanding of risk management and wealth protection.

Future Projections and Long-Term Growth Potential:

The future projections for both Tesla and SpaceX remain positive, supporting Musk's continued dominance.

- Future Growth: Analysts predict sustained growth for both companies, with Tesla continuing its expansion in the electric vehicle market and SpaceX making significant strides in space exploration.

- Long-Term Strategy: Musk’s long-term vision and strategic planning are key drivers of his success. His companies are positioned for sustained growth over the coming decades.

- Market Forecast: Positive market forecasts for both companies contribute to an optimistic outlook on Musk's future net worth.

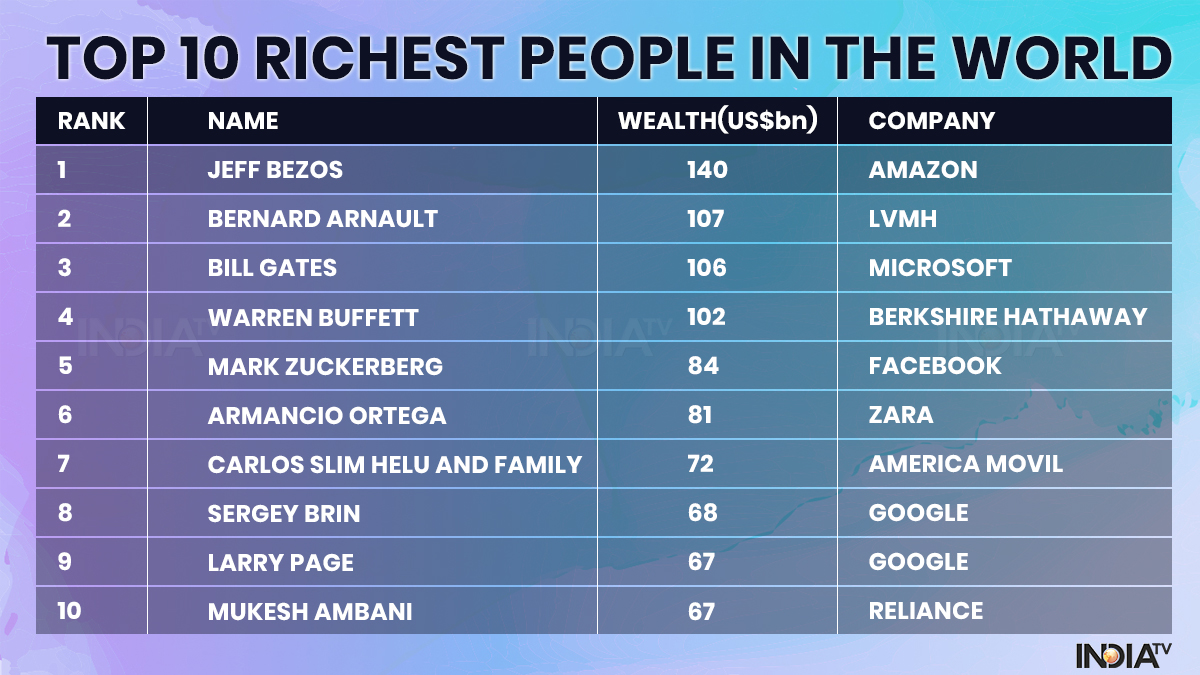

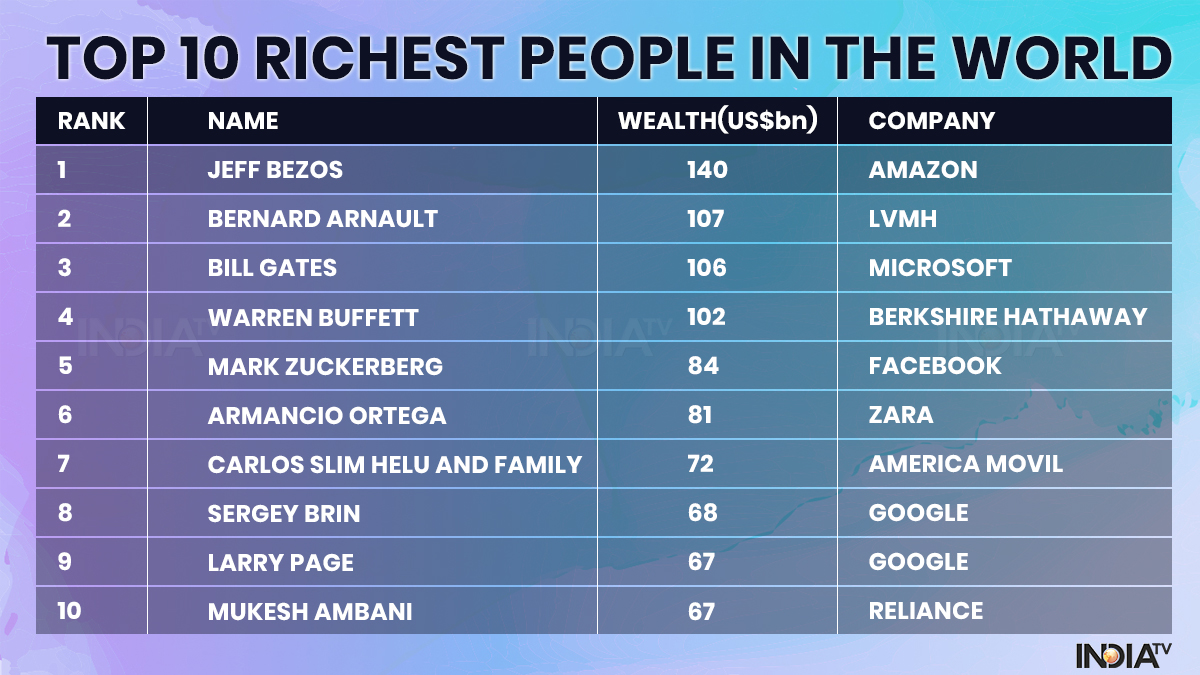

Comparing Elon Musk's Position to Other Billionaires on the 2025 List

Analyzing Elon Musk's position relative to other billionaires on the 2025 Hurun Global Rich List provides additional context.

Analysis of Top Competitors:

(Note: Insert a brief comparative analysis of other top billionaires and their positions here. Mention specific names and key details of their performance relative to Musk's.)

Key Differences in Wealth Generation Strategies:

(Note: Insert a brief comparison of Musk's wealth generation strategies with those of other top billionaires. Highlight the unique aspects of Musk's entrepreneurial approach and investment strategy.)

Conclusion: Elon Musk’s Continued Reign in the 2025 Hurun Global Rich List

Even with a $100 billion drop in net worth, Elon Musk's position at the top of the 2025 Hurun Global Rich List remains unchallenged. This resilience stems from a combination of factors: the mitigating effect of SpaceX's success, the power of diversification across various business ventures, and the strong future prospects of his core companies. The significant fluctuations highlight the volatility inherent in high-net-worth portfolios, particularly those heavily reliant on single-company stock performance. However, Musk's strategic approach to wealth management and his long-term vision for his companies ultimately secure his leading position. Stay updated on the latest developments in the world of billionaires and the ever-changing dynamics of the Hurun Global Rich List. Learn more about the 2025 Hurun Global Rich List and the strategies of leading figures like Elon Musk – understanding wealth creation strategies can be a key to understanding economic trends.

Featured Posts

-

Elizabeth Arden Skincare Value And Quality At Walmart

May 10, 2025

Elizabeth Arden Skincare Value And Quality At Walmart

May 10, 2025 -

Renaissance Et Modem Vers Une Fusion Pour Clarifier La Majorite Presidentielle

May 10, 2025

Renaissance Et Modem Vers Une Fusion Pour Clarifier La Majorite Presidentielle

May 10, 2025 -

Nhl Playoffs Golden Knights Secure Postseason Spot After 3 2 Loss To Oilers

May 10, 2025

Nhl Playoffs Golden Knights Secure Postseason Spot After 3 2 Loss To Oilers

May 10, 2025 -

Ftc Appeals Activision Blizzard Ruling Microsoft Deal Uncertain

May 10, 2025

Ftc Appeals Activision Blizzard Ruling Microsoft Deal Uncertain

May 10, 2025 -

Trumps Tariffs 174 Billion Wipeout For Top 10 Billionaires

May 10, 2025

Trumps Tariffs 174 Billion Wipeout For Top 10 Billionaires

May 10, 2025