$3.40 For XRP? Assessing Ripple's Potential

Table of Contents

Current Market Conditions and XRP's Performance

The cryptocurrency market is inherently volatile, influenced by macroeconomic factors, regulatory changes, and overall investor sentiment. XRP, like other major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), experiences price swings based on these market forces. Recently, XRP has shown [insert recent price movement data and percentage change]. Trading volume has also [insert recent trading volume data and trend – increasing, decreasing, stable].

Several factors significantly influence XRP's price:

- Regulatory News: Regulatory clarity (or lack thereof) around cryptocurrencies globally, and particularly concerning Ripple's legal battles, heavily impacts XRP's price.

- Market Sentiment: Positive news regarding partnerships or technological advancements can boost investor confidence and drive up the price, while negative news can lead to sell-offs.

- Adoption Rate: Wider adoption of XRP in cross-border payments and other applications directly correlates with increased demand and, consequently, price appreciation.

Bullet Points:

- XRP's Price History: XRP has seen significant price volatility throughout its history, reaching all-time highs during the 2017 bull run and experiencing substantial drops during subsequent market corrections.

- Comparison to BTC and ETH: XRP's performance often correlates with, but also diverges from, the price movements of BTC and ETH, showcasing its unique market dynamics.

- Technical Indicators: Analyzing technical indicators such as moving averages (MA) and the Relative Strength Index (RSI) can provide insights into potential price trends, although these should not be the sole basis for investment decisions.

The Ripple Lawsuit and its Impact on XRP

The SEC lawsuit against Ripple Labs, alleging the sale of unregistered securities, casts a long shadow over XRP's price. The outcome of this case will significantly influence investor confidence and XRP's future trajectory. The SEC argues that XRP is a security, while Ripple contends it is a currency.

Bullet Points:

- Key Legal Arguments: Understanding the core arguments presented by both the SEC and Ripple is essential for assessing the potential outcomes. [ Briefly summarize each side's key arguments].

- Expert Opinions: Legal experts offer varying opinions on the likelihood of different outcomes, ranging from a complete victory for the SEC to a dismissal of the case or a negotiated settlement.

- Impact on Investor Confidence: Uncertainty surrounding the lawsuit has created volatility in XRP's price, impacting investor confidence and causing some investors to remain cautious.

Adoption and Partnerships: Fueling XRP's Growth?

Ripple's success hinges on the adoption of its RippleNet technology by financial institutions. Numerous partnerships with banks and payment providers worldwide demonstrate the growing use of XRP for cross-border payments. These partnerships facilitate faster, cheaper, and more efficient transactions.

Bullet Points:

- Key Partnerships: [List several key partnerships and briefly explain their impact on XRP's adoption]. Examples include partnerships that showcase real-world applications of XRP in international money transfers.

- Real-World Applications: Highlight specific instances where XRP has successfully facilitated cross-border payments, demonstrating the practical utility of the technology.

- Potential for Future Adoption: The potential for XRP adoption extends beyond cross-border payments, including potential use cases in supply chain management and other sectors.

Technological Advancements and Future Developments

Ripple continues to invest heavily in research and development, constantly improving RippleNet and exploring new applications for its technology. These advancements can positively impact XRP's value proposition.

Bullet Points:

- Improvements to RippleNet: Discuss recent updates to RippleNet, including increased speed, efficiency, and security features.

- Research and Development: Highlight ongoing research initiatives that might lead to breakthroughs in blockchain technology, potentially boosting XRP's utility and value.

- Potential for New Use Cases: Explore potential future applications of XRP and RippleNet, such as decentralized finance (DeFi) or other innovative uses.

Analyzing the $3.40 XRP Prediction: Realistic or Overly Optimistic?

Reaching a price of $3.40 for XRP requires a confluence of positive factors, including a favorable outcome in the Ripple lawsuit, widespread adoption of RippleNet, and a generally bullish cryptocurrency market.

Bullet Points:

- Factors Supporting $3.40: List the conditions that could potentially drive XRP's price to $3.40 (e.g., widespread institutional adoption, positive regulatory developments, significant technological advancements).

- Factors Challenging $3.40: Identify potential obstacles that could prevent XRP from reaching this price target (e.g., an unfavorable outcome in the Ripple lawsuit, increased competition from other cryptocurrencies, a bearish cryptocurrency market).

- Alternative Price Scenarios: Present a range of possible price scenarios and their likelihood, emphasizing the inherent uncertainty in predicting cryptocurrency prices.

Conclusion

Predicting the future price of XRP, including the possibility of it reaching $3.40, remains speculative. The outcome of the Ripple lawsuit, the pace of adoption, and the overall cryptocurrency market sentiment all play crucial roles. While a price of $3.40 for XRP remains uncertain, understanding the various factors impacting its value – from the Ripple lawsuit to technological advancements and market conditions – is crucial for informed investing. Continue your research on XRP and make your own assessment of its future potential. Remember to diversify your portfolio and only invest what you can afford to lose in the volatile cryptocurrency market.

Featured Posts

-

People On Universal Credit Dwp Overhaul And Potential Loss Of Benefits

May 08, 2025

People On Universal Credit Dwp Overhaul And Potential Loss Of Benefits

May 08, 2025 -

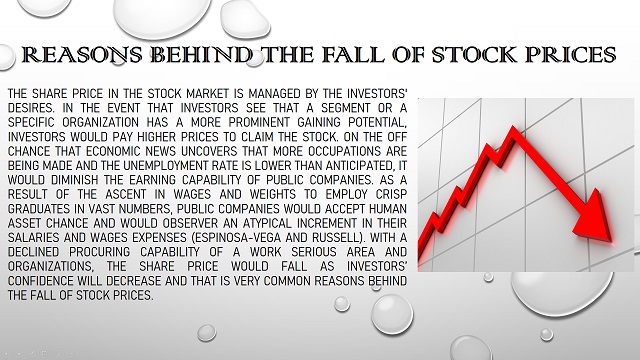

Scholar Rock Stock Reasons Behind Mondays Price Decrease

May 08, 2025

Scholar Rock Stock Reasons Behind Mondays Price Decrease

May 08, 2025 -

The Importance Of Middle Management Benefits For Companies And Their Workforces

May 08, 2025

The Importance Of Middle Management Benefits For Companies And Their Workforces

May 08, 2025 -

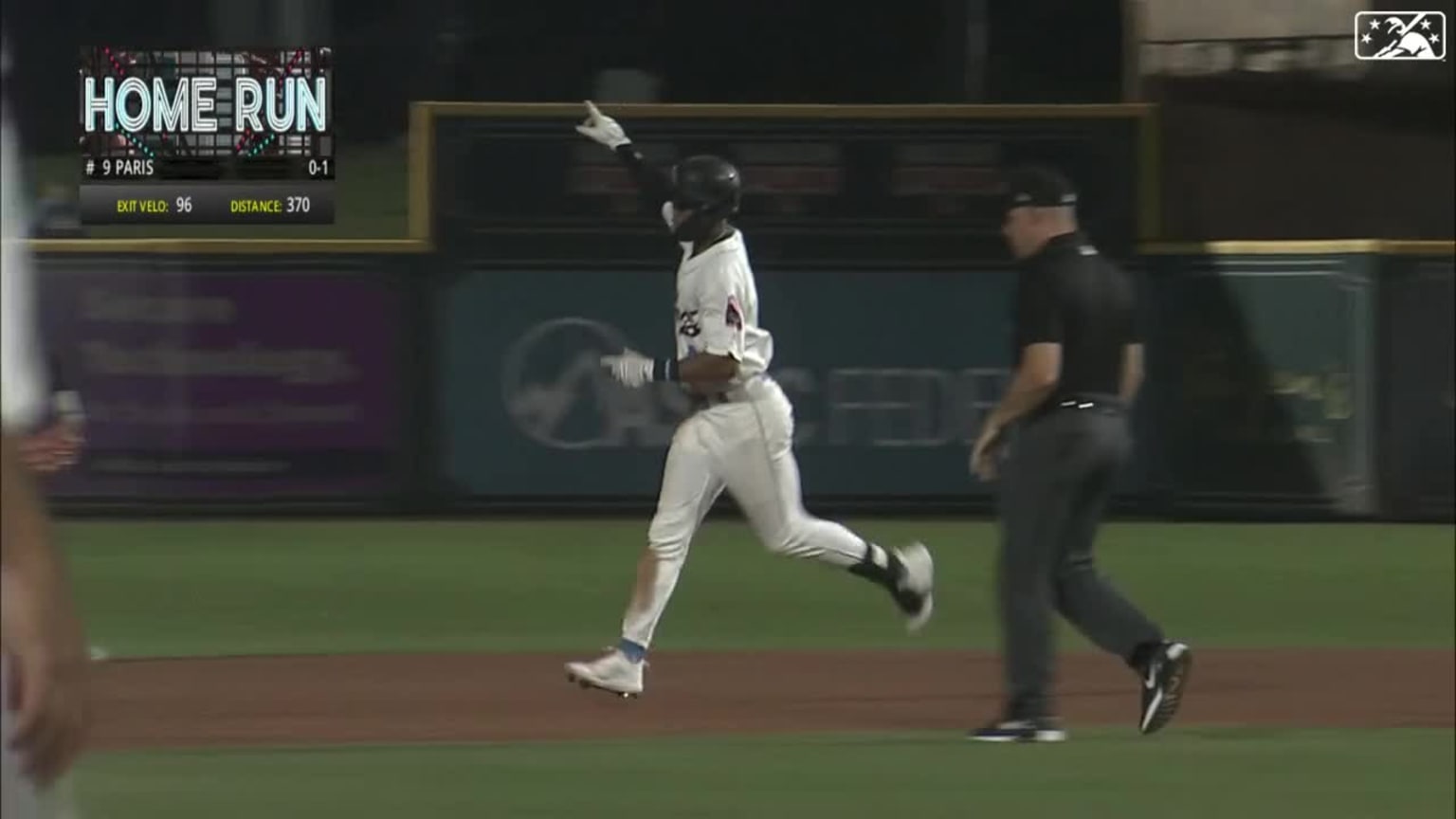

Kyren Paris Late Homer Powers Angels To Rain Soaked Victory Over White Sox

May 08, 2025

Kyren Paris Late Homer Powers Angels To Rain Soaked Victory Over White Sox

May 08, 2025 -

Did Saturday Night Live Change Everything For Counting Crows

May 08, 2025

Did Saturday Night Live Change Everything For Counting Crows

May 08, 2025