30-Year Treasury Yield At 5%: Implications For The 'Sell America' Thesis

Table of Contents

The Allure of Higher Yields and the Flight to Safety

A 5% 30-year Treasury yield is undeniably attractive in the current economic climate. High inflation and persistent interest rate hikes by the Federal Reserve have driven yields upward, making US Treasuries a relatively safer haven compared to other asset classes. This increase in yield offers investors a potentially lucrative return, especially against the backdrop of global economic uncertainty.

- Higher yields offer better returns compared to other asset classes. Compared to low-yielding bonds in other developed nations or the relatively volatile returns of the stock market, a 5% yield on a 30-year Treasury bond appears compelling for risk-averse investors.

- Increased demand for safe-haven assets during economic uncertainty. In times of global economic instability, investors often flock to assets perceived as safe and stable. US Treasuries, backed by the full faith and credit of the US government, frequently fulfill this role.

- Potential impact on the US dollar's strength. Higher yields can attract foreign capital seeking higher returns, strengthening the US dollar. This can impact international trade and investment flows.

- Counterargument: Are these yields truly attractive considering inflation? While a 5% yield seems high, it's crucial to consider inflation. If inflation remains above 5%, the real return on the investment might be negligible or even negative. This is a key factor that investors must carefully weigh.

Impact on US Government Borrowing Costs

The higher 30-year Treasury yield significantly impacts the US government's borrowing costs. Increased yields mean the Treasury Department will pay more interest on its debt, increasing the national debt burden.

- Increased interest expense for the US Treasury. Higher yields directly translate to a larger interest payment on the national debt, requiring increased government spending just to service the existing debt.

- Potential impact on future government spending. The increased interest expense could constrain future government spending on other programs, potentially leading to difficult fiscal policy choices.

- Fiscal policy implications. The government may need to implement austerity measures or find ways to increase revenue to offset the rising interest expense associated with the higher 30-year Treasury yield.

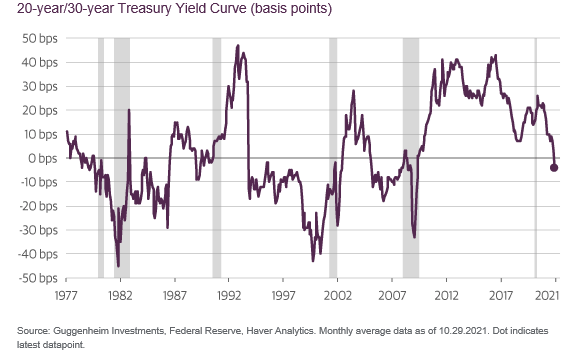

- Comparison with historical borrowing costs. Comparing the current 5% yield to historical levels provides context. While higher than recent years, it's not unprecedented in US history, offering perspective on the current situation.

Reassessing the 'Sell America' Thesis in Light of Higher Yields

The rise of the 30-year Treasury yield to 5% complicates the "Sell America" narrative. The higher yields might attract investors back to US assets, potentially weakening the "Sell America" thesis.

- Are investors now less inclined to "sell America" due to attractive yields? The increased attractiveness of US Treasuries due to the higher yield could mitigate the "Sell America" trend, at least in the bond market.

- Could the increased yield attract foreign investment back into US Treasuries? Higher yields could entice foreign investors seeking higher returns, reversing some of the capital outflow associated with the "Sell America" thesis.

- Analysis of alternative investment options. While the 5% yield is attractive, investors will still compare this with alternatives, potentially influencing the strength of the "Sell America" sentiment.

- Discussion of geopolitical risks that might still drive "Sell America" sentiment. Geopolitical factors, such as trade wars or political instability, can still influence investor sentiment, regardless of the 30-year Treasury yield.

Alternative Investment Strategies and Their Appeal

Despite the allure of a 5% 30-year Treasury yield, alternative investment strategies remain appealing. Investors may still prefer diversification across global markets.

- Growth potential in developing economies. Emerging markets often offer higher growth potential, although with increased risk, compared to the relatively stable, but slower-growing, US market.

- Attractiveness of European bonds compared to US Treasuries. European bonds, while potentially offering lower yields, might offer a different risk profile and diversification benefits for a global portfolio.

- Diversification benefits of global investment portfolios. Diversifying across different asset classes and geographies helps to mitigate risk.

- Risks associated with alternative investments. Alternative investments often carry higher risk than US Treasuries, requiring careful consideration of risk tolerance.

Conclusion: The Future of the 'Sell America' Thesis in a High-Yield Environment

The 5% 30-year Treasury yield significantly impacts the "Sell America" thesis. While the higher yields might attract some investment back into US assets, the overall validity of the thesis depends on a complex interplay of factors, including inflation, geopolitical risks, and investor sentiment. The future of investment in US assets remains uncertain, requiring constant monitoring of the evolving situation. To make informed decisions in this high-yield environment, stay informed about evolving 30-year Treasury yields and consult with financial advisors to navigate the complexities of the "Sell America" thesis and develop a sound investment strategy. Understanding the interplay between high 30-year Treasury yields and the "Sell America" thesis is crucial for successful investment in this dynamic market.

Featured Posts

-

Hmrc Child Benefit Warning Dont Ignore These Messages

May 20, 2025

Hmrc Child Benefit Warning Dont Ignore These Messages

May 20, 2025 -

Gma Layoffs Robin Roberts Addresses Fan Concerns With Getting Fancy Message

May 20, 2025

Gma Layoffs Robin Roberts Addresses Fan Concerns With Getting Fancy Message

May 20, 2025 -

Lou Gala Breakout Star Of The Decameron A Comprehensive Guide

May 20, 2025

Lou Gala Breakout Star Of The Decameron A Comprehensive Guide

May 20, 2025 -

Suki Waterhouses Met Gala Style From Then To Now

May 20, 2025

Suki Waterhouses Met Gala Style From Then To Now

May 20, 2025 -

Michael Schumacher Une Petite Fille Pour Le Septuple Champion Du Monde

May 20, 2025

Michael Schumacher Une Petite Fille Pour Le Septuple Champion Du Monde

May 20, 2025

Latest Posts

-

Robin Roberts Gma Family Announcement A New Addition

May 20, 2025

Robin Roberts Gma Family Announcement A New Addition

May 20, 2025 -

Ramon Rodriguez Will Trent Star Reveals Triple Scorpion Sting While Sleeping

May 20, 2025

Ramon Rodriguez Will Trent Star Reveals Triple Scorpion Sting While Sleeping

May 20, 2025 -

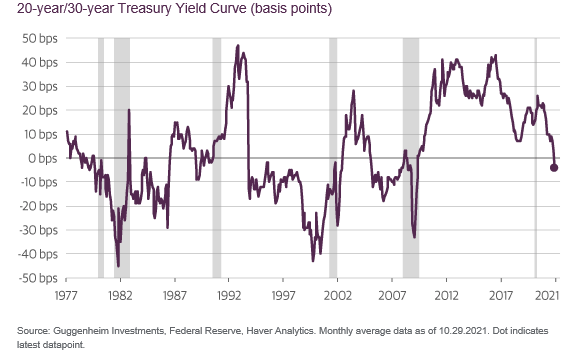

Asheville Rising Helene Special Gmas Ginger Zee Visits Wlos

May 20, 2025

Asheville Rising Helene Special Gmas Ginger Zee Visits Wlos

May 20, 2025 -

Michael Strahans Gma Departure The Real Reason He Left

May 20, 2025

Michael Strahans Gma Departure The Real Reason He Left

May 20, 2025 -

Ginger Zee Of Gma Visits Wlos To Promote Asheville Rising Helene Special

May 20, 2025

Ginger Zee Of Gma Visits Wlos To Promote Asheville Rising Helene Special

May 20, 2025