31% Pay Cut For BP's Chief Executive Officer

Table of Contents

The Magnitude of the Pay Cut and its Impact

The sheer scale of Bernard Looney's pay cut is striking. While the exact figures haven't been publicly detailed in every aspect, reports suggest a reduction exceeding £1 million. This represents a significant decrease from his previous compensation package, which included a substantial base salary, substantial bonuses tied to performance targets, and a significant share of stock options.

Financial Details of the Reduction:

- Pre-cut salary: While the precise figures remain partially undisclosed pending official releases, it's understood that Looney's total compensation package significantly exceeded £3 million annually before the reduction.

- Post-cut salary: The exact post-cut figures are still being clarified publicly, but the 31% reduction signifies a considerable decrease in his overall compensation.

- Breakdown of compensation: The specifics of the compensation breakdown—base salary, performance-related bonuses, and long-term incentives like stock options—are subject to ongoing transparency efforts by BP. Comparing these figures to those of other energy CEOs, particularly at competitors such as Shell and ExxonMobil, will be vital in understanding the true extent of this reduction within the context of the wider industry. This comparison will allow for a more robust assessment of the significance of this BP CEO salary reduction.

This substantial reduction in Bernard Looney's compensation package, using BP CEO salary reduction as a keyword phrase, necessitates a detailed analysis of the compensation structure and how it impacts the future trajectory of the BP CEO's pay and the overall compensation of other executives.

Reasons Behind the Significant Reduction in Pay

The reasons behind this dramatic cut in Bernard Looney's compensation are multifaceted and require careful consideration.

Performance-Based Metrics:

It's likely that BP's recent financial performance played a significant role. While BP has seen periods of profitability, it has also faced challenges, including fluctuating oil prices and increased pressure to transition towards cleaner energy sources. Whether specific targets were missed or if the reduction is a proactive measure to align executive pay with overall company performance remains to be seen in coming official statements.

Public and Shareholder Pressure:

The considerable public and shareholder scrutiny surrounding executive pay within the energy sector cannot be ignored. Activist investors and environmental groups have long campaigned for more responsible and equitable compensation practices, especially in light of the environmental impact of fossil fuel extraction and the need for sustainable business practices, as discussed in relation to BP pay cut reasons. Any public statements and actions will shed light on the influence of public opinion on the matter.

Corporate Governance and Ethical Considerations:

The decision could also be interpreted as a strategic move towards improving corporate governance and transparency. Reducing executive pay can enhance public perception, demonstrate a commitment to ethical practices, and potentially increase shareholder confidence and overall company trust. Further information regarding changes in BP's executive compensation policies should clarify this element.

The Broader Implications for the Energy Sector

The BP CEO pay cut has significant implications that extend far beyond a single executive's compensation.

Setting a Precedent:

This decision could very well set a precedent for other energy companies. It may trigger a wave of similar pay reductions or prompt a wider reevaluation of executive compensation structures across the industry, making "energy sector executive pay" a key topic of discussion.

Impact on Employee Morale and Public Trust:

The impact on employee morale within BP and the broader public perception of the company needs careful assessment. While some may see it as a positive step toward fairness, others might question the impact on attracting and retaining top talent within the energy sector. The ripple effects across the industry should be closely monitored.

Conclusion:

The 31% pay cut for BP CEO Bernard Looney is a momentous event, raising critical questions about executive compensation in the energy sector. The reduction, while substantial, is likely influenced by a complex interplay of performance-based metrics, public pressure, and evolving corporate governance principles. The ramifications are potentially far-reaching, influencing compensation practices throughout the industry and potentially shaping public perception of the energy sector. What are your thoughts on the BP CEO pay cut? Share your insights on this significant change in executive compensation and discuss the future of BP CEO pay and its effect on the energy sector.

Featured Posts

-

Serie A Lazio Fight Back For Draw Against Reduced Juventus

May 21, 2025

Serie A Lazio Fight Back For Draw Against Reduced Juventus

May 21, 2025 -

Aims Group Partners With World Trading Tournament Wtt

May 21, 2025

Aims Group Partners With World Trading Tournament Wtt

May 21, 2025 -

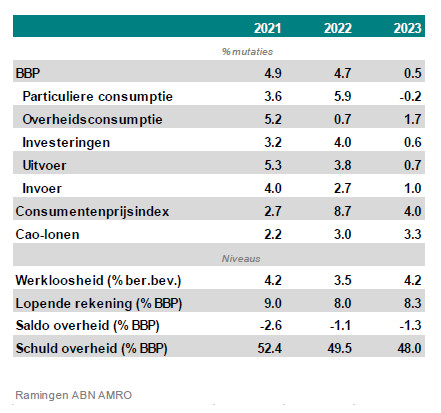

Abn Amro Voedingsbedrijven En De Afhankelijkheid Van Goedkope Arbeidsmigranten

May 21, 2025

Abn Amro Voedingsbedrijven En De Afhankelijkheid Van Goedkope Arbeidsmigranten

May 21, 2025 -

Louths Young Food Business Leader A Case Study In Success And Mentorship

May 21, 2025

Louths Young Food Business Leader A Case Study In Success And Mentorship

May 21, 2025 -

Cartoon Network Stars Join Looney Tunes In New 2025 Animated Short

May 21, 2025

Cartoon Network Stars Join Looney Tunes In New 2025 Animated Short

May 21, 2025

Latest Posts

-

Abn Amro Potential Fine From Dutch Central Bank Over Bonuses

May 21, 2025

Abn Amro Potential Fine From Dutch Central Bank Over Bonuses

May 21, 2025 -

Abn Amro Zijn Nederlandse Huizen Wel Betaalbaar Reactie Geen Stijl

May 21, 2025

Abn Amro Zijn Nederlandse Huizen Wel Betaalbaar Reactie Geen Stijl

May 21, 2025 -

Half Domes New Client Abn Group Victoria

May 21, 2025

Half Domes New Client Abn Group Victoria

May 21, 2025 -

Abn Amro Rapporteert Flinke Groei In Occasionverkoop

May 21, 2025

Abn Amro Rapporteert Flinke Groei In Occasionverkoop

May 21, 2025 -

Abn Group Victoria Awards Media Account To Half Dome

May 21, 2025

Abn Group Victoria Awards Media Account To Half Dome

May 21, 2025