47% Rise In India's Real Estate Investments: Q1 2024 Report

Table of Contents

Key Drivers of the 47% Increase in Real Estate Investments

Several interconnected factors contributed to the phenomenal 47% rise in India's real estate investments during Q1 2024. Understanding these drivers is key to predicting future trends and capitalizing on investment opportunities.

Increased Disposable Incomes and Consumer Confidence

Rising salaries, coupled with a general improvement in economic conditions, have significantly boosted consumer confidence. This increased purchasing power has directly translated into higher spending on property, fueling the surge in real estate investments.

- Lower Interest Rates: Lower interest rates on home loans have made property significantly more affordable, further stimulating demand. This accessibility has broadened the pool of potential homebuyers, pushing investment numbers higher.

- Government Initiatives: Government initiatives like the Pradhan Mantri Awas Yojana (PMAY) have played a crucial role in increasing affordability and accessibility to housing, particularly for lower- and middle-income groups. This scheme has spurred considerable demand within the affordable housing segment.

- Data Analysis: Analysis of Q1 2024 data reveals a strong positive correlation between income growth across various socioeconomic groups and the subsequent increase in real estate investment.

- Case Studies: Case studies of successful homebuyers who benefited from lower interest rates and government schemes showcase the tangible impact of these factors on individual investment decisions and the overall market.

Infrastructure Development and Urbanization

Massive infrastructure projects underway across major Indian cities are significantly impacting property values. These projects are not only upgrading existing urban centers but also driving development in surrounding areas.

- Improved Connectivity: Improved connectivity and transportation networks, including new metro lines, highways, and airports, are opening up previously inaccessible areas, making them attractive for both residential and commercial real estate investment.

- City-Specific Examples: Infrastructure projects like the Delhi-Mumbai Industrial Corridor and various metro expansions in cities like Bengaluru and Mumbai are directly impacting property prices and investment in their surrounding areas.

- Data Correlation: Data clearly illustrates a strong correlation between increased infrastructure spending and subsequent property price appreciation in impacted regions. This demonstrates the direct link between infrastructure development and real estate investment.

Government Policies and Regulatory Reforms

Simplified regulatory processes and streamlined approvals are making it easier and faster to invest in Indian real estate. Favorable government policies are also attracting both domestic and foreign investment.

- Regulatory Ease: The simplification of regulatory procedures, including faster approvals for construction projects, has reduced bureaucratic hurdles and encouraged greater investment.

- Attracting Foreign Investment: Favorable government policies aimed at attracting foreign direct investment (FDI) in the real estate sector are playing a significant role in driving the increase in overall investment.

- Policy Impact: Specific government policies, such as those related to REITs (Real Estate Investment Trusts), are actively shaping the real estate investment landscape.

- Quarterly Comparison: A comparison of regulatory ease in Q1 2024 with previous quarters highlights the positive impact of recent reforms on investment activity.

Investment Trends in Different Property Sectors

The 47% increase in overall investment is spread across different property sectors, each exhibiting unique trends.

Residential Real Estate

The residential real estate sector is a major contributor to the overall growth, with investment across various segments.

- Segment Analysis: Investment trends vary across luxury, affordable, and mid-segment residential properties. The affordable housing segment is particularly robust due to factors mentioned earlier.

- Geographic Hotspots: Certain cities and regions are experiencing disproportionately high investment in residential real estate, reflecting localized economic growth and infrastructure development.

- Investment Distribution: Data reveals the distribution of investment across different residential property types, highlighting the areas experiencing the strongest growth.

- Future Predictions: Predictions for future growth in residential real estate investment are positive, particularly in areas with strong infrastructure development and growing populations.

Commercial Real Estate

The commercial real estate sector is also showing significant growth, although the impact of remote work is a factor to consider.

- Sector Breakdown: Investment trends are analyzed across office spaces, retail spaces, and industrial properties, highlighting the varying growth rates in each segment.

- Impact of Remote Work: The shift to remote work is impacting office space demand, though certain sectors and locations are proving more resilient.

- Growth Data: Data illustrates the growth in specific commercial real estate sectors, highlighting the resilience of certain segments despite economic headwinds.

- Future Prospects: Future prospects for commercial real estate investment are dependent on evolving work patterns and economic conditions, but certain segments are expected to maintain strong growth.

Challenges and Future Outlook for India's Real Estate Market

Despite the positive trends, certain challenges and potential risks could impact the market in the future.

- Inflation and Interest Rate Hikes: Inflation and potential interest rate hikes pose potential risks that could impact consumer affordability and investment decisions.

- Long-Term Projections: Long-term projections for real estate investment growth in India remain positive, fueled by continued urbanization and economic growth.

- Regulatory Changes: Potential regulatory changes could influence future investment, requiring investors to stay informed about policy shifts.

- Expert Opinions: Expert opinions on the future of the Indian real estate market provide valuable insights into potential challenges and opportunities.

Conclusion

The 47% rise in India's real estate investments during Q1 2024 is a testament to the sector's resilience and growth potential. Driven by increased disposable incomes, infrastructure development, and supportive government policies, the market presents attractive opportunities for investors. While challenges remain, the long-term outlook remains positive. Understanding these trends and factors is crucial for anyone considering investment in India's dynamic real estate market. Start exploring the opportunities in India's booming real estate sector today. Learn more about the latest trends and investment strategies related to India's real estate investments and make informed decisions for your portfolio.

Featured Posts

-

Uspekh V Industrialnykh Parkakh Strategii Razvitiya Biznesa V Usloviyakh Vysokoy Konkurentsii

May 17, 2025

Uspekh V Industrialnykh Parkakh Strategii Razvitiya Biznesa V Usloviyakh Vysokoy Konkurentsii

May 17, 2025 -

Comparing The Best Online Casinos In Canada For 2025 Featuring 7 Bit Casino

May 17, 2025

Comparing The Best Online Casinos In Canada For 2025 Featuring 7 Bit Casino

May 17, 2025 -

Federal Student Loan Refinancing What You Need To Know

May 17, 2025

Federal Student Loan Refinancing What You Need To Know

May 17, 2025 -

Cade Cunninghams Impact How He Makes The Pistons A Threat To The Knicks

May 17, 2025

Cade Cunninghams Impact How He Makes The Pistons A Threat To The Knicks

May 17, 2025 -

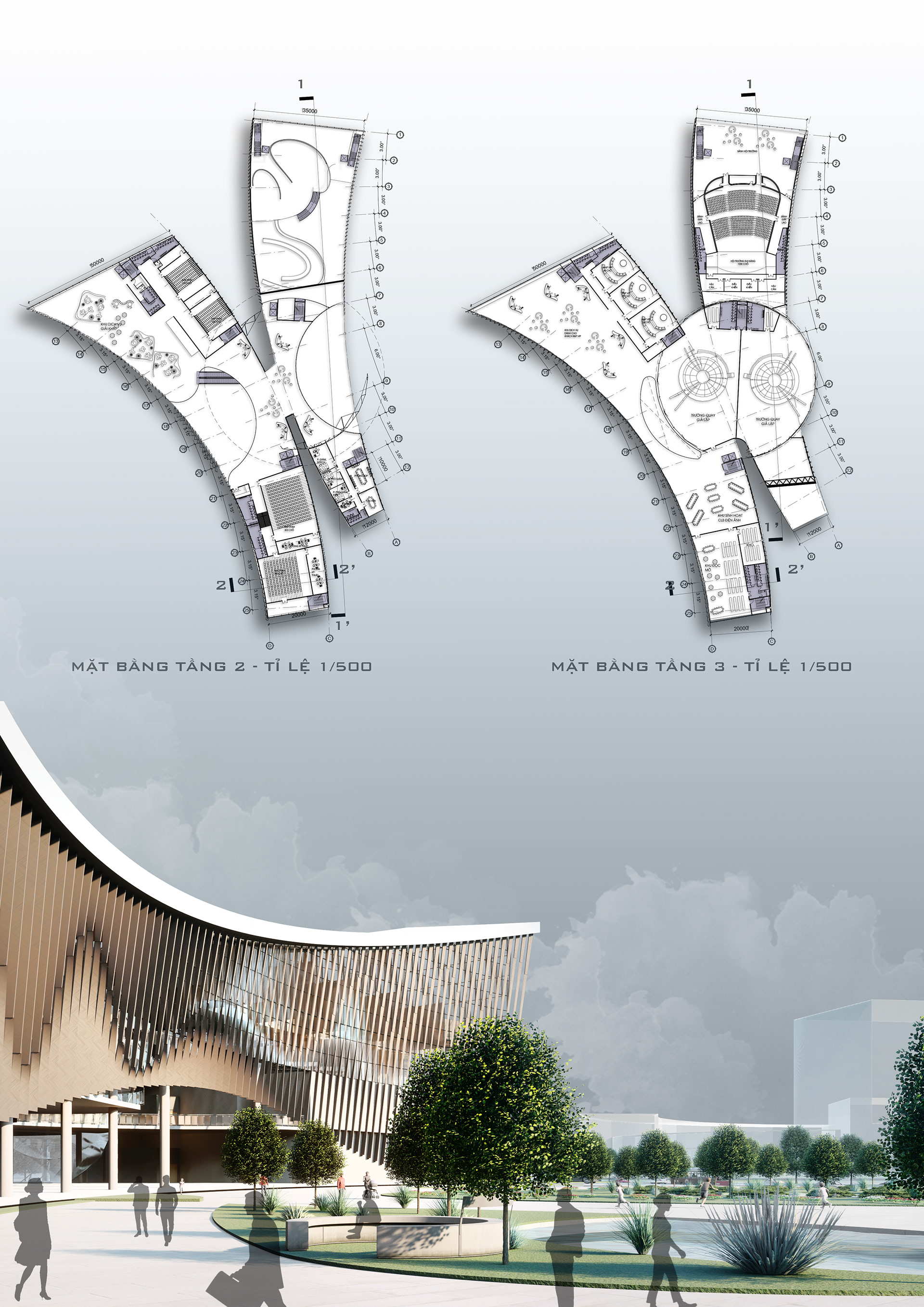

Can Canh Phoi Canh Cong Vien Dien Anh Thu Thiem De Xuat Hap Dan

May 17, 2025

Can Canh Phoi Canh Cong Vien Dien Anh Thu Thiem De Xuat Hap Dan

May 17, 2025