5 Actions To Secure A Position In The Booming Private Credit Sector

Table of Contents

Develop Specialized Skills and Knowledge

The private credit sector demands a unique blend of financial acumen, legal awareness, and technological proficiency. To stand out, you need to cultivate specific skills and knowledge.

Master the Fundamentals of Credit Analysis

Strong analytical skills are paramount in private credit. You need to be able to dissect complex financial data and make informed investment decisions.

- Understanding financial statements: Balance sheets, income statements, cash flow statements are your bread and butter. You must be able to interpret them accurately and identify key trends and risks.

- Credit scoring models: Familiarity with various credit scoring models and their limitations is crucial for assessing borrower creditworthiness.

- Risk assessment methodologies: Understanding different risk assessment frameworks, including quantitative and qualitative methods, is essential for managing portfolio risk.

- Covenant analysis: The ability to analyze loan covenants and understand their implications for borrowers and lenders is vital.

- Debt structuring: Knowledge of different debt structures, including senior secured, subordinated, and mezzanine debt, is necessary to understand the capital stack and risk profile of investments.

Consider pursuing relevant certifications like the Chartered Financial Analyst (CFA) or Chartered Alternative Investment Analyst (CAIA) designations to further enhance your credibility and expertise.

Gain Expertise in Legal and Regulatory Frameworks

The private credit landscape is heavily regulated. Understanding the legal and regulatory environment is crucial for compliance and sound investment practices.

- Familiarity with relevant regulations: A strong understanding of regulations like Dodd-Frank in the US, or equivalent regulations in other jurisdictions, is essential.

- Legal aspects of debt financing: You need to understand loan agreements, security documents, and other legal instruments involved in private credit transactions.

- Regulatory compliance: Knowledge of regulatory compliance requirements related to reporting, disclosures, and anti-money laundering (AML) is crucial.

Developing a strong understanding of the legal and regulatory landscape will allow you to navigate the complexities of private credit transactions effectively.

Embrace Technology and Data Analytics

Technology is rapidly transforming the private credit industry. Professionals who can leverage data effectively have a significant advantage.

- Proficiency in financial modeling software: Mastering Excel and potentially Bloomberg Terminal is essential for building financial models, analyzing data, and creating presentations.

- Data visualization tools: The ability to present data clearly and concisely through visualizations is a valuable skill.

- Familiarity with alternative data sources: Leveraging alternative data sources, such as satellite imagery or social media data, can provide valuable insights into borrower creditworthiness.

Demonstrating proficiency in these areas will show employers your ability to work efficiently and extract actionable insights from data.

Network Strategically within the Private Credit Industry

Building a strong network is critical for securing a position in the competitive private credit sector.

Attend Industry Conferences and Events

Networking events provide invaluable opportunities to meet professionals and learn about potential job openings.

- SuperReturn: A leading global private equity and credit conference.

- Industry-specific events: Look for smaller, niche conferences or workshops related to areas within private credit that interest you, such as direct lending or distressed debt.

These events are not just about collecting business cards; they're about building genuine relationships that can lead to future opportunities.

Leverage Professional Networking Platforms

Online platforms provide another avenue for expanding your network.

- LinkedIn: Maintain a professional profile, actively engage with industry discussions, and connect with individuals working in private credit.

- Industry-specific forums: Participate in online communities related to private credit to learn from others and engage in discussions.

A strong online presence helps you build visibility and connect with potential employers and mentors.

Informational Interviews

Informational interviews are a powerful tool for learning about different roles, firms, and career paths.

- Preparing questions: Research the individual and the firm beforehand to ask relevant and insightful questions.

- Following up: Send a thank-you note after the interview to express your gratitude and maintain contact.

- Building genuine relationships: Focus on building a genuine connection, rather than just seeking a job.

These interviews provide valuable insights into the industry and can lead to unexpected opportunities.

Craft a Compelling Resume and Cover Letter

Your resume and cover letter are your first impression. Make them count.

Highlight Relevant Experience and Skills

Quantify your achievements and use keywords relevant to private credit roles. Tailor your resume and cover letter to each specific position you apply for.

- Quantify achievements: Use metrics to demonstrate your impact in previous roles. Instead of saying "Improved efficiency," say "Improved efficiency by 15%."

- Use keywords: Incorporate relevant keywords found in job descriptions, such as "credit analysis," "debt structuring," and "risk management."

- Tailor to specific roles: Don't use a generic resume; customize it for each job application.

Showcase Your Understanding of the Private Credit Market

Demonstrate your knowledge of current market trends, investment strategies, and key players in the private credit sector.

- Current market trends: Stay up-to-date on the latest news and developments in the private credit market.

- Investment strategies: Demonstrate an understanding of different investment strategies used by private credit firms.

- Key players: Show that you're familiar with the major players and their investment approaches.

Proofread Carefully

Typos and grammatical errors are unacceptable. Have multiple people proofread your documents before submitting them.

Prepare for Interviews with Confidence

Thorough preparation is crucial for success in private credit interviews.

Research the Firm and Interviewers

Understanding the firm's investment strategy, recent deals, and key personnel demonstrates genuine interest.

Practice Behavioral Interview Questions

The STAR method (Situation, Task, Action, Result) is effective for answering behavioral questions. Practice common interview questions, such as "Tell me about a time you failed" or "Describe a challenging situation you overcame."

Prepare Thoughtful Questions to Ask

Asking insightful questions shows your engagement and interest in the role and the firm. Prepare questions about the role, the team, the firm's culture, and its future plans.

Gain Relevant Experience Through Internships or Entry-Level Roles

Gaining practical experience is valuable, even if it isn't directly in private credit.

Seek Out Internships in Related Fields

Internships in investment banking, asset management, or financial analysis provide valuable skills and networking opportunities.

Consider Entry-Level Roles in the Financial Services Sector

Entry-level roles can provide a solid foundation for a career in private credit. Analyst positions, associate roles, or junior positions in related areas can be valuable stepping stones.

Conclusion

Securing a position in the competitive yet rewarding private credit sector demands proactive steps. By focusing on developing specialized skills, networking effectively, crafting a compelling application, preparing thoroughly for interviews, and gaining relevant experience, you significantly increase your chances of success. Don't delay – take action today to launch your career in the booming private credit sector. Start building your expertise and network in this exciting and rapidly growing field – the opportunities are vast and waiting for you.

Featured Posts

-

Munguia Fails Drug Test Surace Calls For Victory Reversal

May 31, 2025

Munguia Fails Drug Test Surace Calls For Victory Reversal

May 31, 2025 -

Bomberos Forestales Luchan Contra Incendio En Constanza Residentes Afectados Por Humo

May 31, 2025

Bomberos Forestales Luchan Contra Incendio En Constanza Residentes Afectados Por Humo

May 31, 2025 -

L Ingenierie Des Castors Une Etude Comparative Sur Deux Cours D Eau De La Drome

May 31, 2025

L Ingenierie Des Castors Une Etude Comparative Sur Deux Cours D Eau De La Drome

May 31, 2025 -

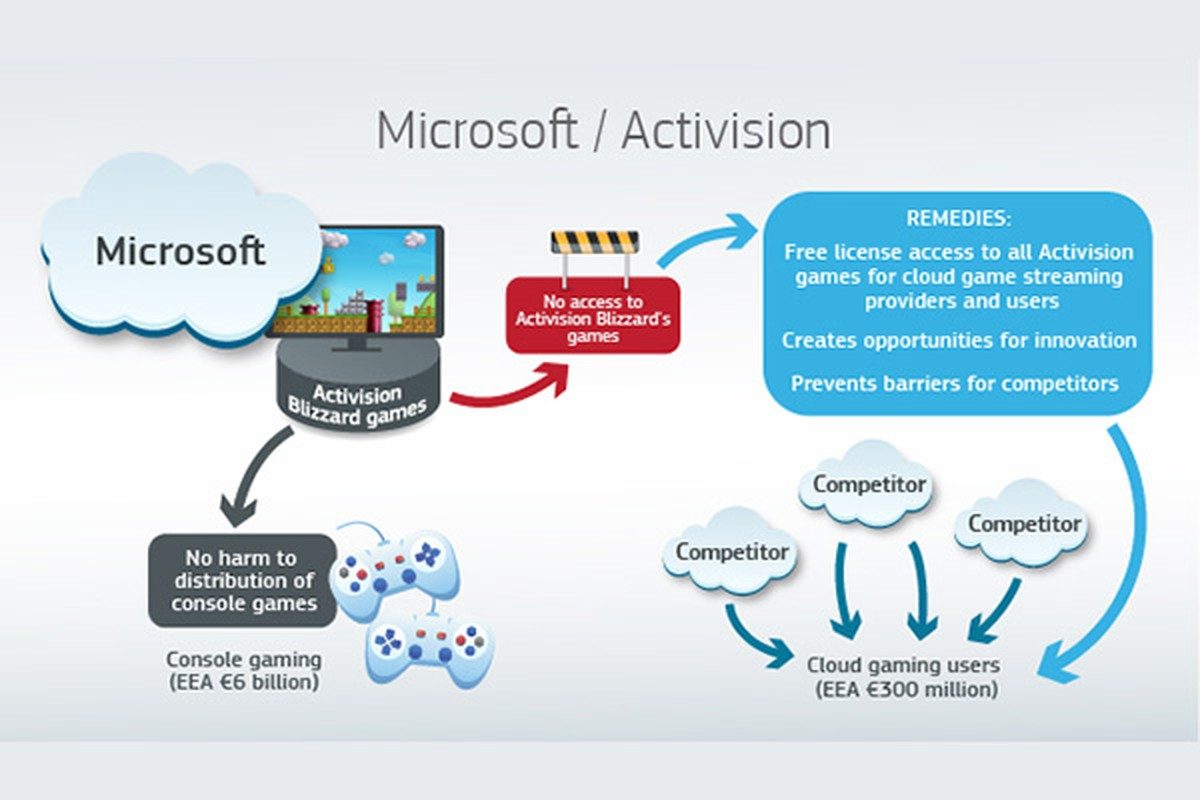

Future Of Gaming Uncertain Ftcs Appeal Against Microsoft Activision Merger

May 31, 2025

Future Of Gaming Uncertain Ftcs Appeal Against Microsoft Activision Merger

May 31, 2025 -

Cleveland Guardians Opening Day Weather Historically Cold

May 31, 2025

Cleveland Guardians Opening Day Weather Historically Cold

May 31, 2025