5 Do's And Don'ts For Landing A Job In The Private Credit Boom

Table of Contents

The private credit market is booming, creating a surge of exciting opportunities for finance professionals. However, with this growth comes fierce competition. Securing a coveted role in private credit requires a strategic and well-executed job search. This article outlines five crucial do's and don'ts to significantly improve your chances of landing your dream job in this rapidly expanding sector of the finance industry. We'll cover everything from networking strategies to mastering the interview process, helping you navigate the path to a successful career in private debt and alternative lending.

<h2>Do's for Securing a Private Credit Job</h2>

<h3>1. Network Strategically</h3>

Building a strong network is paramount in the competitive world of private credit jobs. Don't rely solely on online job boards. Actively cultivate relationships with professionals in the field.

- LinkedIn: Optimize your profile, connect with recruiters and professionals working in private credit firms, and engage in relevant industry discussions.

- Industry Events: Attend conferences, webinars, and networking events focused on private credit, alternative lending, and related areas of finance. These events provide invaluable opportunities to meet potential employers and learn about current market trends.

- Informational Interviews: Reach out to professionals in private credit firms for informational interviews. This allows you to learn more about their work, gain insights into the industry, and make a personal connection.

- Target Specific Niches: Research firms specializing in areas that align with your interests and expertise, such as real estate private credit, distressed debt, or infrastructure finance. This targeted approach increases your chances of landing a role that's a good fit.

- Leverage Existing Connections: Tap into your existing network—friends, family, former colleagues—to see if they have any connections in the private credit industry. You never know where a hidden opportunity might be.

<h3>2. Tailor Your Resume and Cover Letter</h3>

Generic applications rarely succeed in a competitive market. Each application should be meticulously tailored to the specific requirements of the job description.

- Highlight Relevant Skills: Emphasize skills directly relevant to private credit, such as financial modeling, credit analysis, due diligence, portfolio management, and valuation.

- Quantify Accomplishments: Use numbers and data to demonstrate the impact of your past experiences. For example, instead of saying "Improved operational efficiency," say "Improved operational efficiency by 15%, resulting in $X cost savings."

- Customize for Each Application: Thoroughly research each firm and job description, and tailor your resume and cover letter to reflect the specific requirements and company culture.

- Keyword Optimization: Incorporate keywords from the job description into your resume and cover letter to improve your chances of getting noticed by applicant tracking systems (ATS). This is crucial for private credit analyst jobs and other similar roles.

<h3>3. Showcase Specialized Knowledge</h3>

Demonstrate a strong understanding of private credit principles, methodologies, and the broader financial landscape.

- Financial Modeling Expertise: Highlight your proficiency in building complex financial models, including discounted cash flow (DCF) models and leveraged buyout (LBO) models.

- Credit Analysis Skills: Showcase your ability to conduct thorough credit analysis, assess risk, and evaluate potential investments.

- Due Diligence: Emphasize your experience in conducting comprehensive due diligence on potential investments, including financial statement analysis and legal review.

- Portfolio Management: If relevant, highlight your experience in managing portfolios of private credit investments.

- Certifications and Software Proficiency: Mention any relevant certifications (CFA, CAIA) and your familiarity with industry-standard software (Bloomberg Terminal, Argus).

<h3>4. Master the Interview Process</h3>

Preparation is key to acing the interview. Private credit firms often employ rigorous interview processes, assessing both technical and behavioral skills.

- Behavioral Questions: Practice answering common behavioral questions using the STAR method (Situation, Task, Action, Result).

- Technical Questions: Prepare for technical questions on financial modeling, credit analysis, and valuation techniques.

- Case Study Interviews: Practice solving case study questions that assess your problem-solving and analytical abilities.

- Firm Research: Thoroughly research the firm's investment strategy, portfolio, and recent transactions.

- Insightful Questions: Prepare insightful questions to demonstrate your genuine interest and understanding of the firm.

<h3>5. Follow Up Professionally</h3>

Don't underestimate the importance of following up after each interview. A professional follow-up reinforces your interest and keeps you top of mind.

- Thank-You Notes: Send personalized thank-you notes within 24 hours of each interview, reiterating your key qualifications and expressing your continued interest.

- Maintain Contact: Maintain contact with recruiters and hiring managers through occasional follow-up emails, but avoid being overly persistent.

<h2>Don'ts for Landing a Job in Private Credit</h2>

<h3>1. Neglect Networking</h3>

Don't solely rely on online job boards. Networking is crucial for uncovering hidden opportunities and making valuable connections.

<h3>2. Submit Generic Applications</h3>

Avoid submitting generic applications. Each application should be tailored to the specific job and firm.

<h3>3. Underestimate the Importance of Technical Skills</h3>

Don't underestimate the need for strong financial modeling, analytical, and credit analysis skills. Proficiency in industry-standard software is also essential.

<h3>4. Fail to Prepare for Interviews</h3>

Thoroughly prepare for interviews by practicing common questions, researching the firm, and developing insightful questions to ask.

<h3>5. Neglect Following Up</h3>

Don't neglect to send thank-you notes and follow up on your application. This shows your continued interest and professionalism.

<h2>Conclusion</h2>

Landing a job in the thriving private credit sector requires a strategic and proactive approach. By diligently following these do's and don'ts—networking effectively, tailoring your application materials, showcasing your expertise, mastering the interview process, and following up professionally—you'll dramatically improve your chances of success. Don't delay; start implementing these tips today to secure your place in the exciting world of private credit jobs! Begin your journey to a successful career in private debt by leveraging these strategies to find the right private credit analyst jobs or alternative lending jobs for you.

Featured Posts

-

Los Angeles Wildfires A Troubling New Market For Betting

May 13, 2025

Los Angeles Wildfires A Troubling New Market For Betting

May 13, 2025 -

Sabalenka Claims 19th Career Title In Miami

May 13, 2025

Sabalenka Claims 19th Career Title In Miami

May 13, 2025 -

Leveraged Semiconductor Etfs Investor Exodus Precedes Price Jump

May 13, 2025

Leveraged Semiconductor Etfs Investor Exodus Precedes Price Jump

May 13, 2025 -

Tuckers Remarks On Chicago Cubs Fans Generate Buzz

May 13, 2025

Tuckers Remarks On Chicago Cubs Fans Generate Buzz

May 13, 2025 -

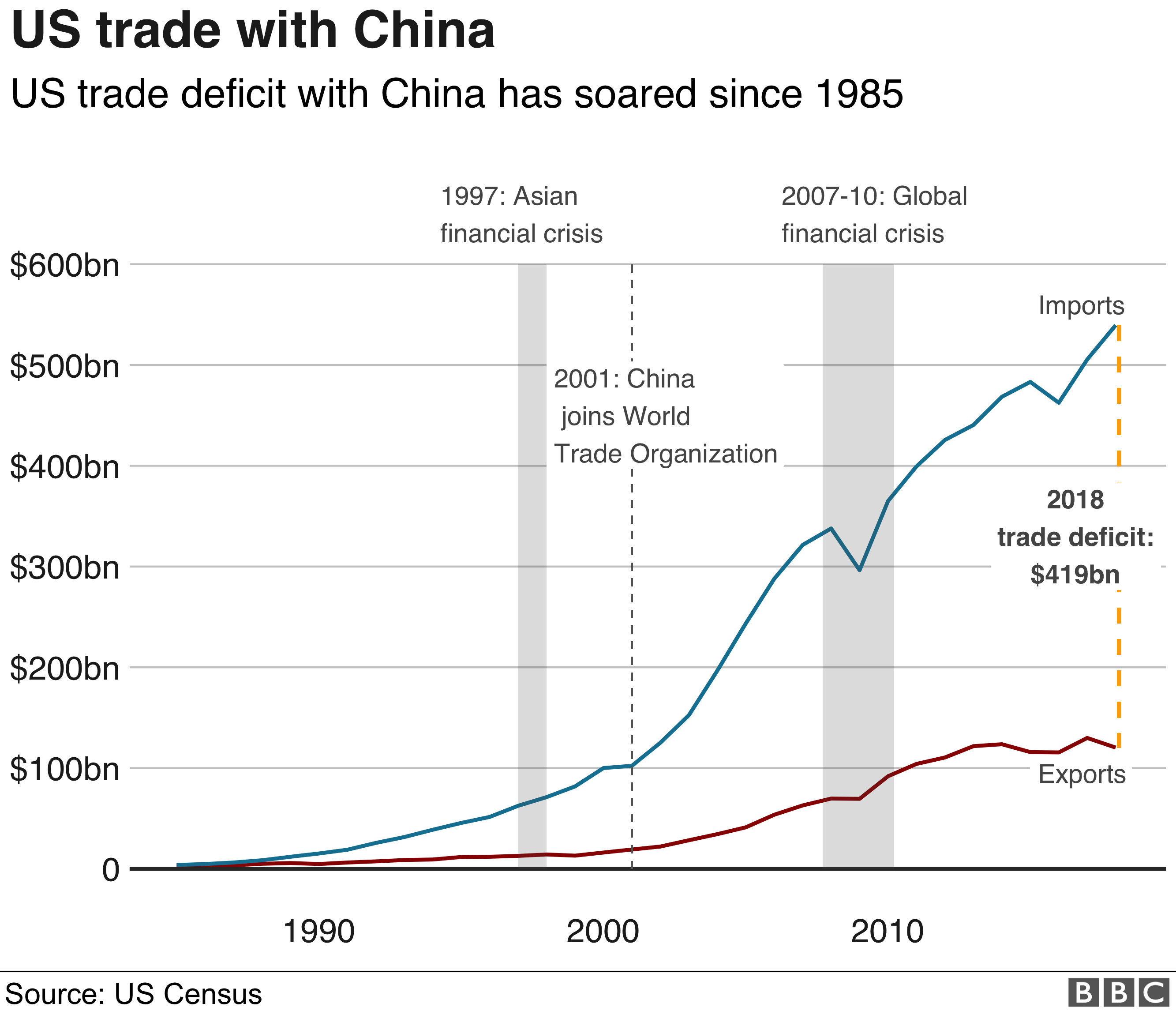

Europe And The Resumption Of Trump Era Tariffs An Economic Analysis

May 13, 2025

Europe And The Resumption Of Trump Era Tariffs An Economic Analysis

May 13, 2025

Latest Posts

-

Video Scotty Mc Creerys Son Pays Sweet Tribute To George Strait

May 14, 2025

Video Scotty Mc Creerys Son Pays Sweet Tribute To George Strait

May 14, 2025 -

Scotty Mc Creerys Son Honors George Strait A Must Watch Video

May 14, 2025

Scotty Mc Creerys Son Honors George Strait A Must Watch Video

May 14, 2025 -

Adorable Video Scotty Mc Creerys Son Pays Tribute To George Strait

May 14, 2025

Adorable Video Scotty Mc Creerys Son Pays Tribute To George Strait

May 14, 2025 -

Watch Scotty Mc Creerys Sons Heartwarming George Strait Homage

May 14, 2025

Watch Scotty Mc Creerys Sons Heartwarming George Strait Homage

May 14, 2025 -

Following In Dads Footsteps Scotty Mc Creerys Son Sings George Strait

May 14, 2025

Following In Dads Footsteps Scotty Mc Creerys Son Sings George Strait

May 14, 2025