5 Do's And Don'ts For Landing A Private Credit Job In Today's Boom

Table of Contents

5 Do's for Landing Your Dream Private Credit Job

Do 1: Network Strategically

Landing a private credit job often hinges on who you know. Networking isn't just about collecting business cards; it's about building genuine relationships.

- Attend industry events: Conferences, seminars, and even smaller networking events offer invaluable opportunities to connect with professionals in private credit. Look for events focused on direct lending, mezzanine financing, or other niche areas within the industry.

- Leverage LinkedIn effectively: Optimize your LinkedIn profile with relevant keywords like "private credit analyst," "debt financing," "credit underwriting," and "portfolio management." Actively engage with posts, join relevant groups, and connect with recruiters specializing in private credit placements.

- Build relationships with recruiters: Recruiters possess insider knowledge of open private credit opportunities and can significantly accelerate your job search. Develop rapport with recruiters who focus on the financial services sector, specifically private credit.

- Informational interviews: Reach out to professionals working in private credit for informational interviews. These conversations provide valuable insights into the industry and can lead to unexpected opportunities.

Do 2: Showcase Relevant Skills and Experience

Your resume and cover letter are your first impression. Make them count.

- Highlight relevant experience: Clearly articulate your experience in underwriting, credit analysis, portfolio management, or other relevant areas within private debt.

- Quantify your achievements: Instead of simply stating your responsibilities, quantify your accomplishments using metrics and numbers. For example, "Increased portfolio yield by 15% through proactive risk management."

- Tailor your resume and cover letter: Don't send generic applications. Customize your materials to match the specific requirements and culture of each firm you apply to.

- Emphasize key skills: Showcase your proficiency in financial modeling, debt structuring, risk assessment, and due diligence processes – all crucial skills for a successful private credit career.

Do 3: Master the Private Credit Interview

The interview is your chance to shine.

- Practice behavioral interview questions: Use the STAR method (Situation, Task, Action, Result) to structure your responses and showcase your problem-solving abilities.

- Demonstrate strong technical knowledge: Be prepared to discuss your understanding of private credit markets, different financing structures, and relevant regulatory frameworks.

- Research the firm and interviewer: Show your genuine interest by researching the firm's investment strategy, recent transactions, and the interviewer's background.

- Prepare insightful questions: Asking thoughtful questions demonstrates your engagement and allows you to learn more about the role and the firm's culture.

Do 4: Highlight Your Understanding of Private Credit Trends

Demonstrate your awareness of the current market landscape.

- Stay updated on market trends: Keep abreast of regulatory changes, economic conditions, and emerging trends within the private credit industry. Subscribe to relevant publications and follow key industry influencers.

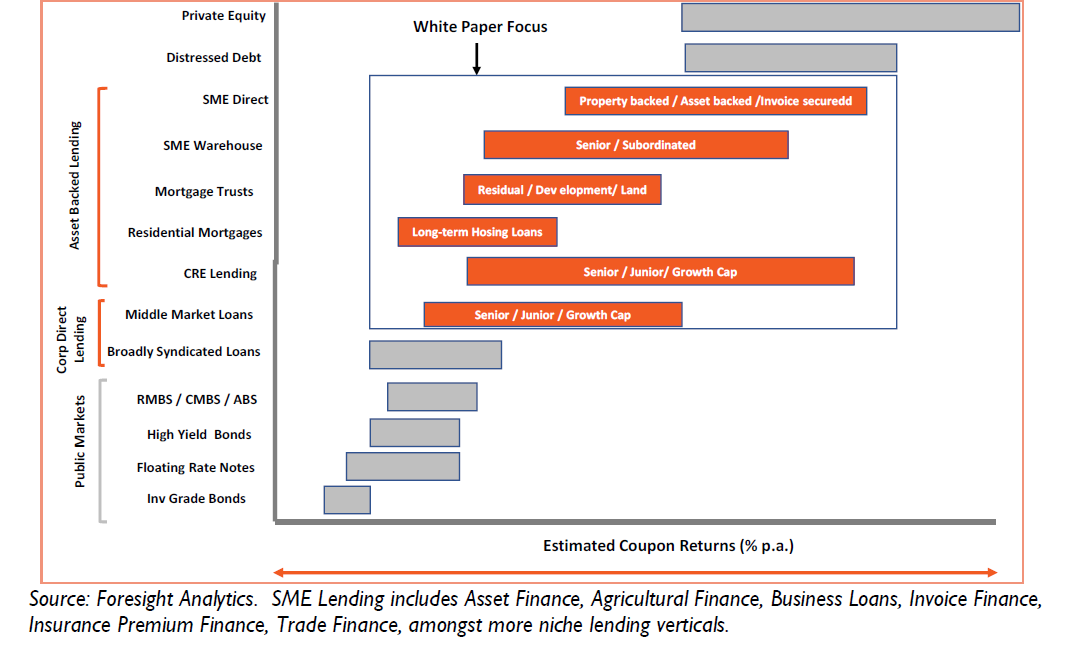

- Demonstrate familiarity with different strategies: Show your understanding of various private credit strategies, including direct lending, mezzanine financing, distressed debt investing, and other specialized approaches.

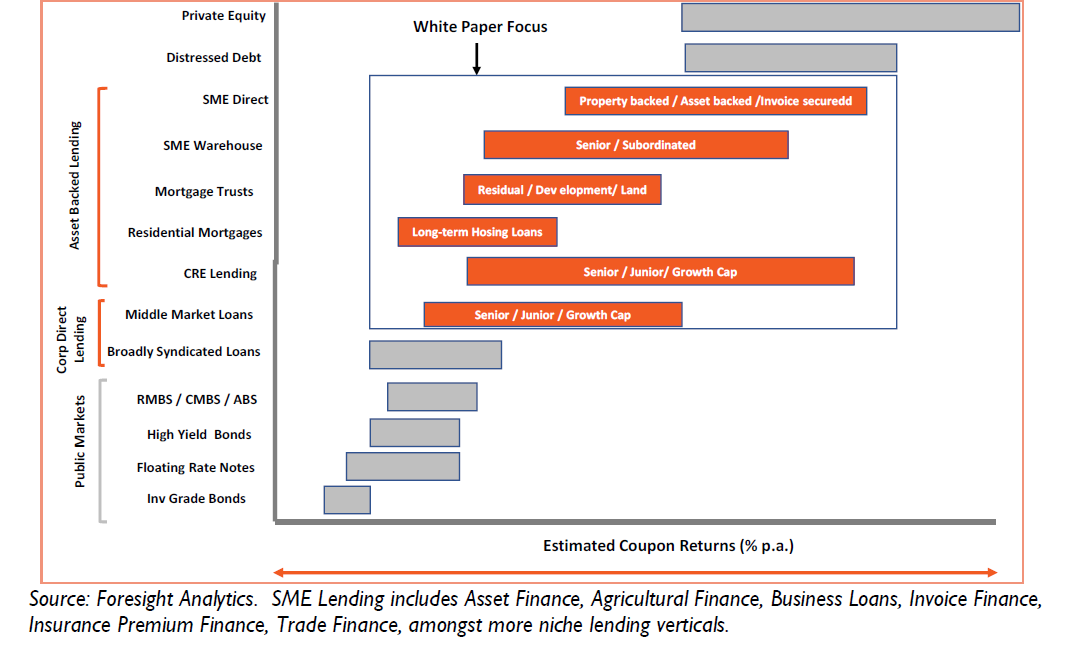

- Discuss current economic conditions: Articulate how current economic conditions, such as interest rate hikes or inflation, impact the private credit market and investment decisions.

Do 5: Follow Up Professionally

Don't let your efforts end with the interview.

- Send a thank-you note: Express your gratitude for the interviewer's time and reiterate your interest in the position.

- Follow up with recruiters and hiring managers: Maintain contact, but avoid being overly persistent. A timely follow-up demonstrates your continued enthusiasm.

- Maintain consistent communication: Use email or LinkedIn to subtly remind the hiring manager of your interest, but respect their time and avoid being intrusive.

5 Don'ts for Securing a Private Credit Role

Don't 1: Neglect Networking

Don't rely solely on online job boards. Networking is crucial for uncovering hidden private credit opportunities.

Don't 2: Submit Generic Applications

Avoid sending cookie-cutter applications. Each application should be tailored to the specific job description and company culture.

Don't 3: Underprepare for Interviews

Thorough preparation is essential. Research the firm, practice your answers, and prepare thoughtful questions.

Don't 4: Ignore Market Trends

Staying informed about market dynamics demonstrates your commitment and professionalism.

Don't 5: Forget to Follow Up

A simple follow-up can make a big difference. It reinforces your interest and keeps you top-of-mind.

Conclusion

Securing a private credit job in this competitive market requires a multifaceted approach. By following these five crucial "do's" and avoiding the five common "don'ts," you'll significantly improve your chances of landing your dream role. Start networking, refine your application materials, and master the interview process to take advantage of the booming private credit opportunities available today. Your rewarding private credit career awaits!

Featured Posts

-

Access To Birth Control Examining The Post Roe Otc Landscape

May 28, 2025

Access To Birth Control Examining The Post Roe Otc Landscape

May 28, 2025 -

Tyrese Haliburtons Impact Game 2 Pacers Vs Knicks Betting Analysis And Picks

May 28, 2025

Tyrese Haliburtons Impact Game 2 Pacers Vs Knicks Betting Analysis And Picks

May 28, 2025 -

Jannik Sinners Italian Open Break A Papal Photo Opportunity

May 28, 2025

Jannik Sinners Italian Open Break A Papal Photo Opportunity

May 28, 2025 -

Design Museum To Showcase Wes Andersons Film Archives

May 28, 2025

Design Museum To Showcase Wes Andersons Film Archives

May 28, 2025 -

Following Nicolas Anelka Current News Results And Multimedia

May 28, 2025

Following Nicolas Anelka Current News Results And Multimedia

May 28, 2025

Latest Posts

-

The Good Life A Journey Of Self Discovery And Growth

May 31, 2025

The Good Life A Journey Of Self Discovery And Growth

May 31, 2025 -

Your Good Life Creating A Life Of Purpose And Intention

May 31, 2025

Your Good Life Creating A Life Of Purpose And Intention

May 31, 2025 -

The Good Life A Holistic Approach To Well Being

May 31, 2025

The Good Life A Holistic Approach To Well Being

May 31, 2025 -

How To Build The Good Life Strategies For Wellbeing

May 31, 2025

How To Build The Good Life Strategies For Wellbeing

May 31, 2025 -

Building The Good Life Strategies For A More Balanced And Fulfilling Life

May 31, 2025

Building The Good Life Strategies For A More Balanced And Fulfilling Life

May 31, 2025