5 Essential Do's And Don'ts To Succeed In The Private Credit Market

Table of Contents

Do: Conduct Thorough Due Diligence

Before investing in any private debt instrument, meticulous due diligence is paramount. This involves a comprehensive assessment of both the borrower and the deal structure itself.

Understanding the Borrower

A thorough understanding of the borrower is crucial for mitigating risk in the private credit market. This requires a deep dive into their financial health and operational capabilities.

- Analyze financial statements for inconsistencies: Scrutinize balance sheets, income statements, and cash flow statements for any red flags or discrepancies. Look for inconsistencies between reported figures and industry benchmarks.

- Verify information with independent sources: Don't solely rely on the borrower's provided information. Verify key data points with independent sources such as credit bureaus, industry reports, and third-party audits.

- Assess the management team's experience and track record: The quality of the management team is a key indicator of a borrower's success. Investigate their experience, expertise, and past performance in similar ventures.

Assessing the Deal Structure

The terms of the loan agreement are just as important as the borrower's financial health. A poorly structured loan can significantly increase your risk.

- Look for hidden risks or unfavorable terms: Carefully review the loan agreement for any hidden clauses, unfavorable interest rates, or penalties that could negatively impact your investment.

- Ensure the loan documentation is comprehensive and protects your interests: The loan documents should clearly outline the terms of the agreement, including repayment schedules, collateral, and default provisions. Ensure these protect your investment.

- Consider seeking legal counsel to review the loan agreement: Engaging legal expertise is crucial to ensure you understand the complexities of the legal framework and the protection it offers to your investment in the private credit market.

Don't: Neglect Risk Management

The private credit market, while offering significant potential returns, is also susceptible to market volatility and borrower default. Effective risk management is non-negotiable.

Diversification is Key

Diversification is a cornerstone of successful private credit investing. Don't concentrate your investments in a single borrower or industry.

- Spread your investments to mitigate the risk of default: Diversify your portfolio across different borrowers, industries, and loan structures to reduce the impact of a single default.

- Consider using a variety of investment strategies: Explore different private credit investment strategies, such as direct lending, fund investments, and mezzanine financing, to achieve a more balanced portfolio.

- Regularly rebalance your portfolio to manage risk effectively: Regularly review and adjust your portfolio allocation to maintain your desired risk profile and optimize returns.

Underestimate Market Volatility

Economic downturns and market fluctuations can significantly impact private credit investments. Have a robust risk management plan in place.

- Factor in potential interest rate changes: Interest rate increases can impact both the borrower's ability to repay and the overall value of your investment.

- Assess your tolerance for risk: Understand your own risk appetite and invest accordingly. Don't invest in projects that exceed your comfort level.

- Have an exit strategy in place: Develop a clear exit strategy for each investment, outlining how you will liquidate your assets if necessary.

Do: Build Strong Relationships

Networking and transparent communication are vital for success in the private credit market. Strong relationships can unlock opportunities and mitigate risks.

Networking is Essential

Building a strong network within the private credit market can provide access to valuable information, potential deals, and crucial support.

- Attend industry conferences and events: Participate in industry events to connect with other professionals and learn about new opportunities.

- Join relevant professional organizations: Membership in relevant organizations provides networking opportunities and access to industry insights.

- Build relationships with potential borrowers and lenders: Cultivating relationships with both borrowers and other lenders can provide a competitive edge in the private credit market.

Transparency and Communication

Maintain open and honest communication with your borrowers and other stakeholders. This fosters trust and collaboration.

- Regularly provide updates on your portfolio's performance: Keep your investors informed about the performance of your portfolio, highlighting both successes and challenges.

- Address concerns promptly and transparently: Deal with any concerns or issues swiftly and openly, maintaining transparency with all parties.

- Foster trust and collaboration: Build strong, collaborative relationships with borrowers and other stakeholders to ensure successful outcomes.

Don't: Underestimate the Importance of Legal Expertise

Navigating the legal complexities of private credit investments requires experienced legal counsel. Overlooking this can have serious consequences.

Legal Counsel is Crucial

Engaging experienced legal counsel is crucial for reviewing loan documentation, ensuring compliance, and navigating potential disputes.

- Review all loan documentation thoroughly: A lawyer specializing in private credit can identify potential legal risks and ensure the loan documents adequately protect your interests.

- Ensure compliance with all relevant regulations: Legal counsel can help you navigate the complex regulatory landscape and ensure compliance with all applicable laws.

- Seek advice on complex legal issues: Legal experts can offer guidance on complex legal matters, such as loan restructuring or enforcement.

Overlooking Regulatory Compliance

Ignoring regulatory requirements can lead to significant penalties and reputational damage. Stay up-to-date on regulations.

- Understand the legal implications of each investment: Thoroughly investigate the legal ramifications of each investment before committing funds.

- Ensure all transactions are properly documented: Maintain meticulous records of all transactions and comply with all relevant reporting requirements.

- Seek clarification on any unclear regulations: Don't hesitate to seek legal guidance if you encounter any unclear or ambiguous regulations.

Do: Stay Informed and Adapt

The private credit market is dynamic and constantly evolving. Continuous learning and adaptation are vital for long-term success.

Market Research and Analysis

Regularly monitor market trends, economic indicators, and industry news to make informed investment decisions.

- Regularly review your investment strategy: Periodically review your investment strategy to ensure it remains aligned with your goals and the current market conditions.

- Adapt to changing market conditions: Be prepared to adjust your investment strategy in response to changes in the market, economic conditions, or regulatory developments.

- Stay informed about new investment opportunities: Keep abreast of emerging trends and new investment opportunities in the private credit market.

Continuous Learning

Continuously enhance your knowledge and skills to remain competitive in the private credit market.

- Attend workshops and seminars: Participate in educational events to stay informed about the latest trends and best practices.

- Read industry publications: Regularly read industry publications and research reports to expand your knowledge and understanding of the market.

- Network with other professionals: Maintain an active network of contacts within the private credit industry to share insights and learn from others' experiences.

Conclusion

Success in the private credit market hinges on careful planning, thorough due diligence, and a proactive approach to risk management. By following these five essential do's and don'ts – conducting thorough due diligence, managing risk effectively, building strong relationships, utilizing legal expertise, and staying informed – you can significantly improve your chances of navigating the complexities of this dynamic sector and achieving your investment goals. Don't delay – start building your success in the private credit market today!

Featured Posts

-

Auto Dealers Intensify Opposition To Mandatory Ev Sales

May 05, 2025

Auto Dealers Intensify Opposition To Mandatory Ev Sales

May 05, 2025 -

Seagrass Planting A Key To Scottish Coastal Ecosystem Recovery

May 05, 2025

Seagrass Planting A Key To Scottish Coastal Ecosystem Recovery

May 05, 2025 -

Georgetown Woman Takes Kentucky Derby Festival Queen Crown In 2025

May 05, 2025

Georgetown Woman Takes Kentucky Derby Festival Queen Crown In 2025

May 05, 2025 -

Churchill Downs Race Track Undergoes Major Renovations Before Kentucky Derby

May 05, 2025

Churchill Downs Race Track Undergoes Major Renovations Before Kentucky Derby

May 05, 2025 -

Jean Silvas Road To The Ufc Defeating An Undefeated Future Star

May 05, 2025

Jean Silvas Road To The Ufc Defeating An Undefeated Future Star

May 05, 2025

Latest Posts

-

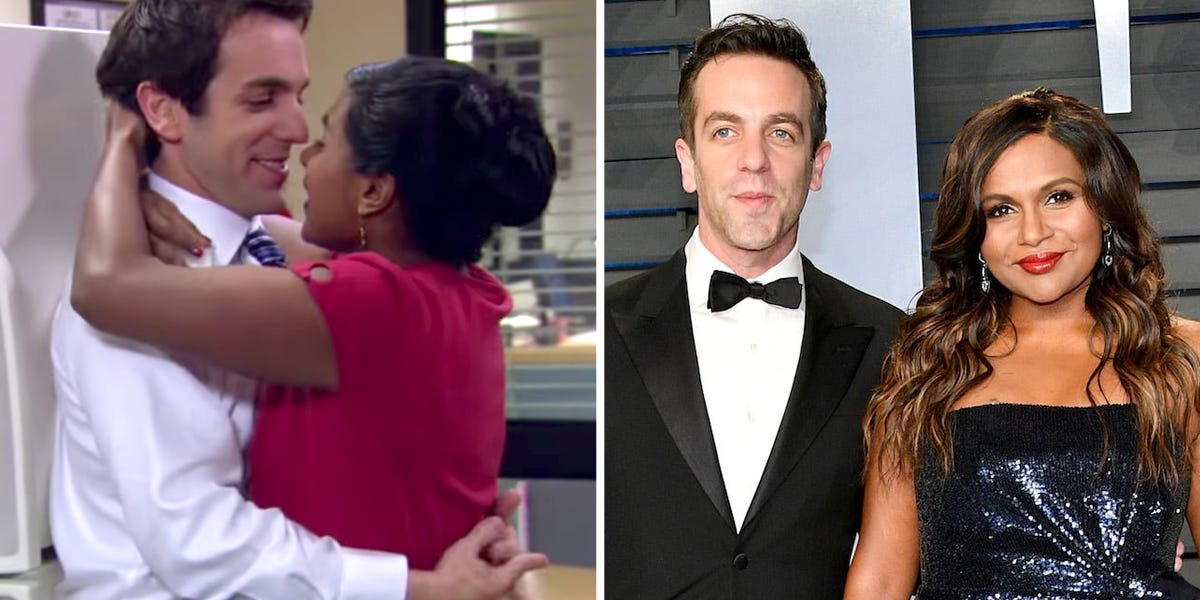

Understanding The Public Perception Of Bj Novak And Delaney Rowes Romance

May 06, 2025

Understanding The Public Perception Of Bj Novak And Delaney Rowes Romance

May 06, 2025 -

Bj Novak And Delaney Rowes Relationship Public Reaction And Analysis

May 06, 2025

Bj Novak And Delaney Rowes Relationship Public Reaction And Analysis

May 06, 2025 -

Bj Novak And Delaney Rowe A Normal Relationship

May 06, 2025

Bj Novak And Delaney Rowe A Normal Relationship

May 06, 2025 -

Mindy Kalings Dramatic Weight Loss A New Look At The Premiere

May 06, 2025

Mindy Kalings Dramatic Weight Loss A New Look At The Premiere

May 06, 2025 -

Mindy Kalings Dramatic Weight Change Before And After

May 06, 2025

Mindy Kalings Dramatic Weight Change Before And After

May 06, 2025