5 Key Actions To Secure A Role In The Private Credit Boom

Table of Contents

Network Strategically within the Private Credit Industry

Building a strong network is crucial for landing a coveted role in private credit. This isn't about simply collecting contacts; it's about cultivating meaningful relationships with key players.

- Networking Events: Attend industry conferences like the SuperReturn conferences, private debt forums, and smaller, niche events focused on specific sectors within private credit (e.g., real estate private debt). These events offer invaluable opportunities to meet fund managers, analysts, and other professionals. Don't just attend; actively participate in discussions and engage with speakers.

- LinkedIn Optimization: Your LinkedIn profile is your digital resume. Make it shine! Use keywords like "private credit," "direct lending," "alternative lending," "debt investing," "private debt," "fund manager," "credit analyst," and "portfolio manager." Showcase your experience in areas like financial modeling, credit risk assessment, and due diligence. Join relevant LinkedIn groups and participate in discussions to increase your visibility.

- Informational Interviews: Don't underestimate the power of informational interviews. Reaching out to professionals for a brief conversation can provide invaluable insights into their roles, the industry, and potential job openings. Prepare thoughtful questions beforehand and follow up afterward with a thank-you note.

- Alumni Networks: Leverage your university's alumni network. Many alumni work in finance and may have connections within the private credit industry. Reach out to them and explore potential opportunities.

Develop Specialized Skills in Private Credit Analysis

Private credit requires a unique skillset beyond general finance knowledge. Developing specialized expertise will significantly enhance your candidacy.

- Financial Modeling: Master advanced financial modeling techniques, including discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and sensitivity analysis. Proficiency in Excel and specialized financial modeling software like Argus is essential.

- Credit Risk Assessment: Develop expertise in credit risk assessment, encompassing covenant analysis, collateral valuation, and detailed financial statement analysis. Understanding credit metrics like leverage ratios, interest coverage ratios, and debt-to-equity ratios is paramount. Familiarity with Bloomberg Terminal and other financial data platforms is highly beneficial.

- Legal and Regulatory Knowledge: A strong grasp of the legal and regulatory landscape is critical. Familiarize yourself with relevant compliance standards and due diligence procedures.

- Industry-Specific Knowledge: Gain in-depth knowledge of specific sectors within private credit, such as real estate, infrastructure, technology, or energy. Understanding the nuances of each sector will significantly enhance your analytical capabilities.

Enhance Your Technical Proficiency with Relevant Software

Proficiency in relevant software is non-negotiable.

- Financial Modeling Software: Master Excel, including advanced functions and VBA scripting. Consider learning specialized financial modeling software such as Argus or other industry-standard tools.

- Data Analysis Tools: Learn SQL, Python, or R for efficient data manipulation and analysis. Large private credit firms rely heavily on data-driven decision making.

- CRM Software: Familiarize yourself with CRM (Customer Relationship Management) systems used in the industry for managing client relationships and deal flow.

Tailor Your Resume and Cover Letter to Private Credit Roles

Your resume and cover letter are your first impression. Make them count.

- Keyword Optimization: Incorporate relevant keywords throughout your resume and cover letter, mirroring those used in job descriptions.

- Quantifiable Achievements: Instead of simply listing responsibilities, highlight your accomplishments with quantifiable results (e.g., "Increased portfolio returns by 15%").

- Targeted Applications: Don't use a generic resume. Tailor each application to the specific job description, emphasizing skills and experiences directly relevant to the role.

- Strong Summary Statement: Craft a compelling summary statement that concisely showcases your interest in private credit and your relevant qualifications.

Obtain Relevant Certifications and Education

Boost your credentials with relevant certifications and education.

- CFA Charter: The Chartered Financial Analyst (CFA) charter is highly respected and demonstrates a strong foundation in finance.

- CAIA Charter: The Chartered Alternative Investment Analyst (CAIA) charter is specifically tailored to alternative investments, including private credit.

- Relevant Master's Degrees: A Master's degree in finance, accounting, or a related field can significantly improve your prospects.

- Continuing Education: Stay current with industry trends and regulatory changes through ongoing professional development.

Prepare for the Interview Process

Thorough preparation is essential for a successful interview.

- Behavioral Questions: Practice answering behavioral interview questions, focusing on your teamwork, problem-solving, and experience handling pressure.

- Technical Questions: Prepare for in-depth technical questions on financial modeling, credit analysis, and private credit market dynamics.

- Case Studies: Practice solving case studies, which are common in private credit interviews.

- Networking Before the Interview: Research the firm and the interviewer beforehand to personalize your interactions.

Secure Your Future in the Private Credit Boom

Securing a role in the thriving private credit market demands strategic effort. By focusing on strategic networking, specialized skill development, resume optimization, relevant certifications, and meticulous interview preparation, you can significantly increase your chances of success. Don't wait – start taking these actions today to capitalize on the exciting opportunities presented by the private credit boom. Begin your journey to a rewarding career in private credit now!

Featured Posts

-

Analysis Teslas Canadian Pricing Strategy And Inventory Management

Apr 27, 2025

Analysis Teslas Canadian Pricing Strategy And Inventory Management

Apr 27, 2025 -

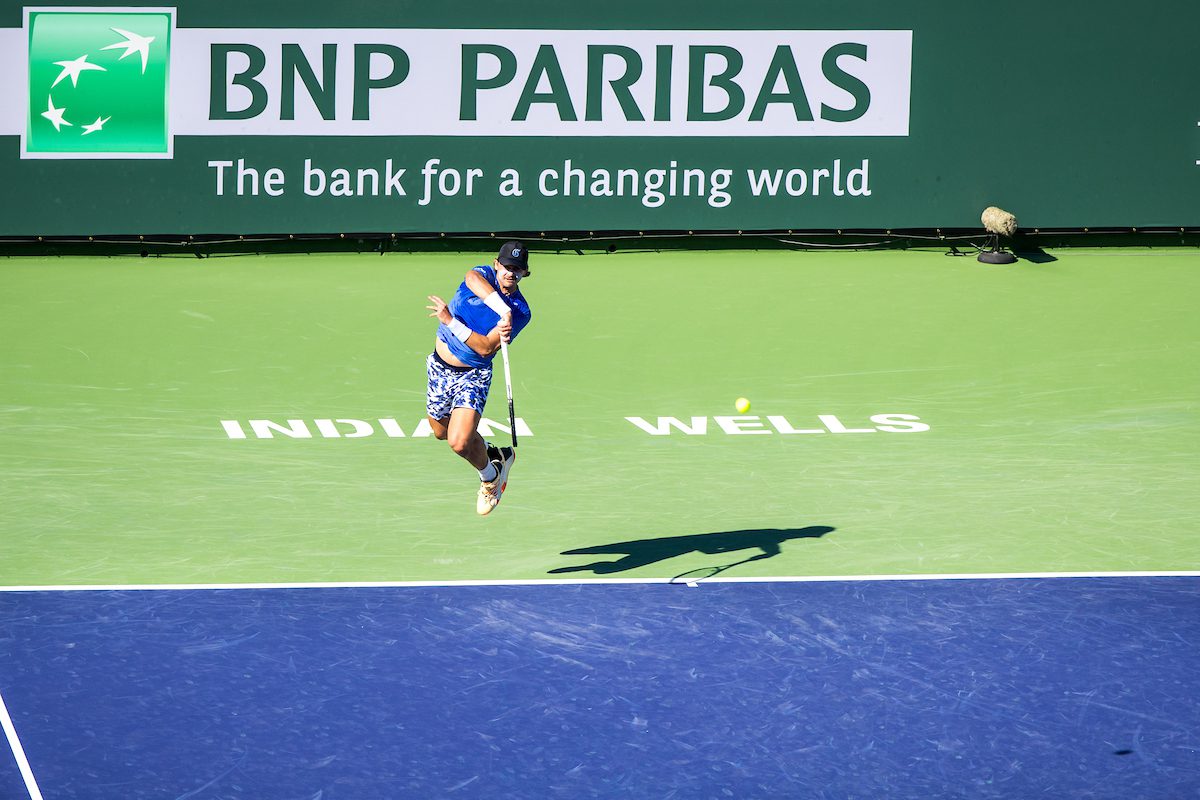

Indian Wells 2024 Eliminacion De Favorita Genera Conmocion

Apr 27, 2025

Indian Wells 2024 Eliminacion De Favorita Genera Conmocion

Apr 27, 2025 -

Elina Svitolina Dominates Anna Kalinskaya In Us Open First Round

Apr 27, 2025

Elina Svitolina Dominates Anna Kalinskaya In Us Open First Round

Apr 27, 2025 -

Bucking Fastard Werner Herzogs New Film With Real Life Sister Leads

Apr 27, 2025

Bucking Fastard Werner Herzogs New Film With Real Life Sister Leads

Apr 27, 2025 -

New Hair New Tattoos Ariana Grandes Style Evolution

Apr 27, 2025

New Hair New Tattoos Ariana Grandes Style Evolution

Apr 27, 2025

Latest Posts

-

Updated Red Sox Lineup Outfielders Return And Casas Demoted Position

Apr 28, 2025

Updated Red Sox Lineup Outfielders Return And Casas Demoted Position

Apr 28, 2025 -

Boston Red Sox Adjust Lineup Casas Lowered Outfielder Back In Action

Apr 28, 2025

Boston Red Sox Adjust Lineup Casas Lowered Outfielder Back In Action

Apr 28, 2025 -

Red Sox Lineup Shuffle Casas Demoted Struggling Outfielder Returns

Apr 28, 2025

Red Sox Lineup Shuffle Casas Demoted Struggling Outfielder Returns

Apr 28, 2025 -

Jarren Duran 2 0 A Deep Dive Into This Red Sox Outfielders Potential

Apr 28, 2025

Jarren Duran 2 0 A Deep Dive Into This Red Sox Outfielders Potential

Apr 28, 2025 -

Is This Red Sox Outfielder The Next Jarren Duran A Breakout Season Prediction

Apr 28, 2025

Is This Red Sox Outfielder The Next Jarren Duran A Breakout Season Prediction

Apr 28, 2025