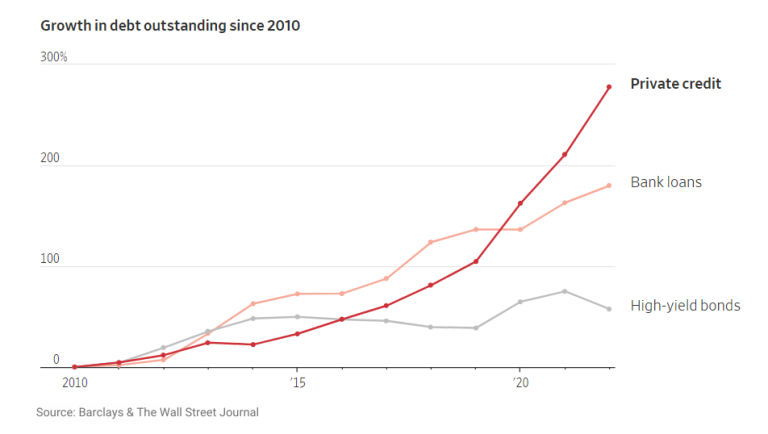

5 Key Actions To Secure A Role In Today's Private Credit Market

Table of Contents

Network Strategically within the Private Credit Industry

Building a strong network is paramount in the private credit market. It's not just about who you know, but about building genuine relationships that can lead to opportunities.

Leverage LinkedIn Effectively

Your LinkedIn profile is your digital resume. Optimize it for private credit jobs:

- Keyword Optimization: Incorporate relevant keywords like "private debt," "credit analysis," "distressed debt," "leveraged lending," "private credit investing," and "private equity credit" throughout your profile summary and experience sections.

- Active Engagement: Join relevant LinkedIn groups focused on private credit, private equity, and alternative investments. Participate in discussions, share insightful articles, and comment on posts to establish yourself as a thought leader.

- Targeted Connections: Connect with recruiters specializing in private credit placements and individuals working at firms you admire. Don't be afraid to send personalized connection requests highlighting your shared interests.

Attend Industry Events and Conferences

Industry events are invaluable for networking and gaining insights:

- Private Credit Conferences: Attend conferences and workshops specifically focused on private credit. These provide opportunities to learn from industry experts and meet potential employers.

- Industry Networking: Take advantage of industry mixers and happy hours to connect with professionals in a relaxed setting.

- Follow Up: After attending any event, be sure to follow up with the individuals you connected with, reinforcing your interest and exchanging contact information.

Informational Interviews are Key

Informational interviews are an often underestimated tool:

- Reaching Out: Reach out to professionals working in private credit for informational interviews. Express your genuine interest in their career path and the industry.

- Gaining Insights: These interviews offer invaluable insights into different career paths within private credit, firm cultures, and current market trends.

- Building Relationships: Focus on building genuine relationships, demonstrating your enthusiasm, and showing your knowledge of the private credit market.

Develop In-Demand Skills for Private Credit Roles

Possessing the right skills is crucial to securing a private credit job. Employers look for a blend of technical expertise and soft skills.

Master Financial Modeling and Analysis

Proficiency in financial modeling and analysis is a cornerstone skill:

- Software Proficiency: Develop advanced skills in Excel, and consider learning specialized financial modeling software like Argus or Bloomberg Terminal.

- Credit Analysis Expertise: Gain expertise in credit analysis, valuation, and financial statement analysis, including understanding key financial ratios and metrics.

- Model Building: Practice building comprehensive financial models for various scenarios, demonstrating your ability to analyze and predict financial outcomes.

Understand Legal and Regulatory Aspects

A solid understanding of the legal and regulatory landscape is essential:

- Regulatory Compliance: Familiarize yourself with relevant regulations and compliance requirements in the private credit industry.

- Legal Aspects: Understand the legal aspects of private credit transactions, including loan agreements, security documents, and regulatory compliance.

- Certifications: Consider pursuing relevant certifications such as the Chartered Financial Analyst (CFA) designation or other specialized certifications.

Hone Your Communication and Presentation Skills

Effective communication is vital for success in private credit:

- Clear Communication: Practice clear and concise written and verbal communication.

- Presentation Skills: Develop strong presentation skills to effectively convey complex financial information to both technical and non-technical audiences.

- Storytelling: Master the art of storytelling to connect with potential employers and demonstrate your understanding of the private credit market.

Craft a Targeted Resume and Cover Letter for Private Credit Positions

Your resume and cover letter are your first impression. Tailoring them to each specific job description is key.

Highlight Relevant Experience and Skills

Your resume should be a targeted document:

- Tailored Approach: Tailor your resume to each specific job description, highlighting the skills and experiences most relevant to the role.

- Quantifiable Results: Quantify your achievements with measurable results whenever possible.

- Relevant Skills: Focus on skills directly applicable to private credit, such as due diligence, portfolio management, credit underwriting, and risk assessment.

Showcase Your Understanding of the Private Credit Market

Demonstrate your knowledge of the industry:

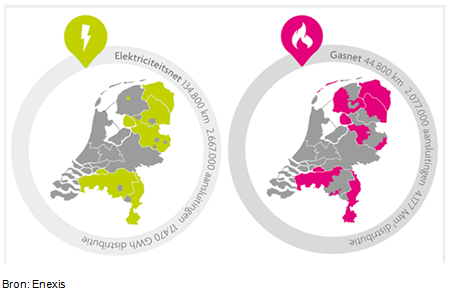

- Market Trends: Demonstrate your knowledge of current market trends and challenges within the private credit industry.

- Specific Firms: Mention specific firms or strategies that interest you, showcasing your research and genuine interest.

- Industry Passion: Express your passion for the private credit industry and explain why you're drawn to this career path.

Write a Compelling Cover Letter

Your cover letter personalizes your application:

- Personalization: Personalize your cover letter for each application, referencing specific aspects of the job description and the company.

- Career Goals: Clearly articulate your career goals and aspirations within private credit.

- Strong Fit: Explain why you're a strong fit for the specific role and company, highlighting your relevant skills and experience.

Ace the Private Credit Interview Process

Thorough preparation is key to succeeding in the interview process.

Prepare for Technical and Behavioral Questions

Expect a mix of technical and behavioral questions:

- Technical Questions: Practice answering common technical questions related to financial modeling, credit analysis, valuation, and specific private credit strategies.

- Behavioral Questions: Prepare examples to showcase your behavioral competencies, such as teamwork, problem-solving, and leadership skills, using the STAR method (Situation, Task, Action, Result).

- Company Research: Thoroughly research the firm and the interviewer to demonstrate your interest and engagement.

Demonstrate Your Understanding of Private Credit Strategies

Show your expertise in various private credit strategies:

- Investment Strategies: Show your knowledge of various private credit investment strategies, such as direct lending, mezzanine financing, distressed debt investing, and special situations.

- Market Trends: Discuss current market trends and their impact on the private credit industry and specific investment strategies.

- Investment Philosophy: Articulate your investment philosophy and approach, demonstrating your understanding of risk and return.

Ask Insightful Questions

Asking insightful questions shows your engagement:

- Thoughtful Questions: Prepare thoughtful questions to demonstrate your interest and engagement.

- Firm Culture: Ask about the firm's culture, investment strategies, deal flow, and future plans.

- Genuine Curiosity: Show your genuine curiosity about the role and the organization, highlighting your proactive nature.

Follow Up and Stay Persistent in Your Job Search

The job search process can be lengthy. Persistence and follow-up are vital.

Send Thank-You Notes

Express your gratitude after each interview:

- Personalized Notes: Send personalized thank-you notes after each interview, reiterating your interest and enthusiasm for the role.

- Key Takeaways: Highlight key takeaways from the conversation, demonstrating that you actively listened and engaged.

- Reinforce Interest: Reiterate your continued interest and enthusiasm for the opportunity.

Maintain Consistent Contact

Stay in touch with recruiters and hiring managers:

- Periodic Follow-Up: Follow up with recruiters and hiring managers periodically, showing your continued interest in the opportunities.

- Positive Attitude: Remain positive and persistent throughout the process, even if you haven't received an immediate response.

- Professionalism: Maintain professional communication and respect throughout the entire job search process.

Learn from Rejection

Use rejection as a learning opportunity:

- Feedback Analysis: Use feedback from unsuccessful applications to improve your resume, cover letter, and interview skills.

- Persistence: Don't be discouraged by setbacks. View each rejection as an opportunity to learn and refine your approach.

- Continuous Improvement: Keep refining your skills and job search strategy.

Conclusion:

Securing a role in the competitive private credit market requires a strategic and multifaceted approach. By focusing on networking, skill development, targeted applications, interview preparation, and persistent follow-up, you can significantly increase your chances of success. Don't let the challenges deter you; embrace these key actions to launch a thriving career in private credit. Start building your network and developing your skills today—your dream private credit job awaits!

Featured Posts

-

Xrp Etf Hopes Sec Shakeups And A Ripple Of Change A Big Moment

May 01, 2025

Xrp Etf Hopes Sec Shakeups And A Ripple Of Change A Big Moment

May 01, 2025 -

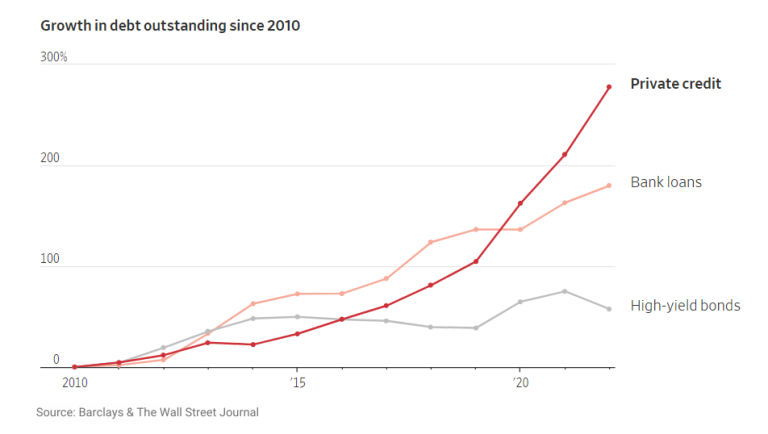

Auto Opladen In Noord Nederland Met Enexis Alles Over Buitenpiek Tarieven

May 01, 2025

Auto Opladen In Noord Nederland Met Enexis Alles Over Buitenpiek Tarieven

May 01, 2025 -

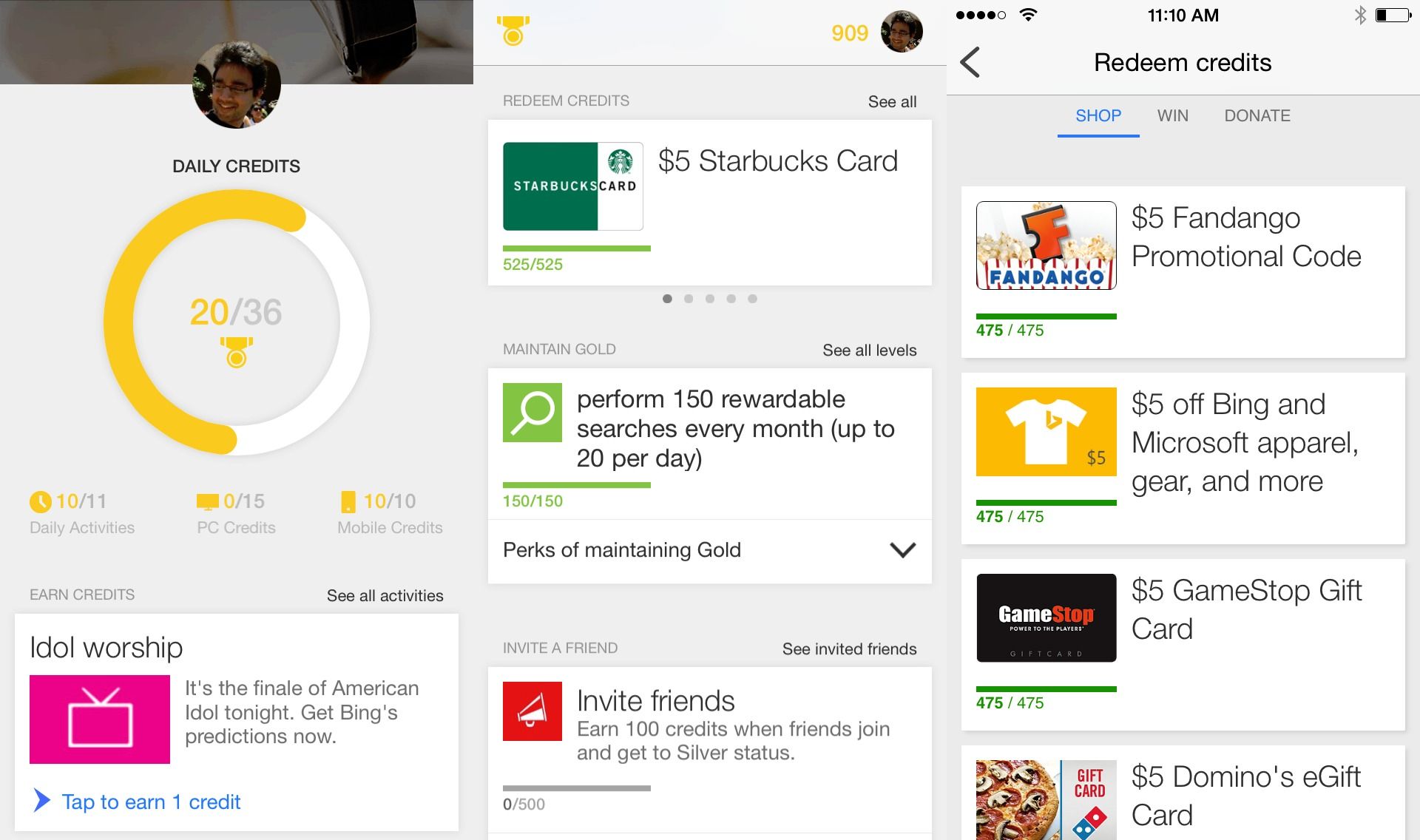

Earn More Cruise More Cruises Com Introduces Industry First Rewards Program

May 01, 2025

Earn More Cruise More Cruises Com Introduces Industry First Rewards Program

May 01, 2025 -

How Michael Sheen Erased 1 Million In Debt For 900 People

May 01, 2025

How Michael Sheen Erased 1 Million In Debt For 900 People

May 01, 2025 -

Thang Dam 6 Doi Thu Tam Hop Dam Nhan Du An Cap Nuoc Gia Dinh

May 01, 2025

Thang Dam 6 Doi Thu Tam Hop Dam Nhan Du An Cap Nuoc Gia Dinh

May 01, 2025

Latest Posts

-

New York Yankees Rodon Fuels 5 1 Win Against Cleveland Guardians

May 01, 2025

New York Yankees Rodon Fuels 5 1 Win Against Cleveland Guardians

May 01, 2025 -

Yankees Victory Over Guardians Ends Series On High Note

May 01, 2025

Yankees Victory Over Guardians Ends Series On High Note

May 01, 2025 -

Rodons Dominance Yankees Secure 5 1 Win Against Guardians

May 01, 2025

Rodons Dominance Yankees Secure 5 1 Win Against Guardians

May 01, 2025 -

New York Yankees Edge Out Cleveland Guardians

May 01, 2025

New York Yankees Edge Out Cleveland Guardians

May 01, 2025 -

Yankees Defeat Guardians 5 1 Rodon Shines In Series Finale

May 01, 2025

Yankees Defeat Guardians 5 1 Rodon Shines In Series Finale

May 01, 2025