5 Key Dos And Don'ts To Secure A Role In The Private Credit Boom

Table of Contents

Do: Network Strategically within the Private Credit Industry

Building a strong network is crucial for securing a private credit position. The industry thrives on relationships, and knowing the right people can open doors to unadvertised opportunities.

Attend industry events and conferences.

- Private credit conferences (e.g., SuperReturn, PEI)

- Industry networking events (e.g., those hosted by industry associations)

- Meetups focused on alternative lending

Actively participating in these events allows you to build relationships with key players in private credit firms, including fund managers, analysts, and legal professionals. Don't just attend; actively engage in conversations, exchange business cards, and follow up afterward.

Leverage LinkedIn and professional online platforms.

- Targeted LinkedIn searches for private credit roles and professionals

- Joining relevant LinkedIn groups (e.g., groups focused on private equity, alternative investments, or specific areas within private credit)

- Engaging in discussions about private credit trends and news

- Following key influencers and thought leaders in the private credit space

Crafting a compelling LinkedIn profile that highlights your skills and experience in areas relevant to private credit is essential. Make sure to use keywords relevant to the industry, such as "credit analysis," "underwriting," "portfolio management," and "due diligence." Actively participating in online communities demonstrates your knowledge and passion for the field.

Cultivate relationships with alumni and former colleagues.

- Informational interviews to learn more about the industry and specific firms

- Leveraging your network for referrals and introductions

- Attending alumni events related to your education or previous employers

Don't underestimate the power of referrals. Reaching out to your network can provide invaluable insights and access to hidden job opportunities within private credit.

Don't: Neglect Your Financial Modeling Skills

Proficiency in financial modeling is paramount in private credit. Your ability to analyze deals, build models, and present your findings clearly will significantly impact your candidacy.

Master essential financial modeling techniques.

- Discounted Cash Flow (DCF) analysis

- Leveraged Buyout (LBO) modeling

- Credit modeling (including various credit risk assessment methodologies)

- Valuation techniques specific to private credit investments (e.g., valuation of distressed debt)

A strong grasp of these techniques is essential for assessing the financial viability of potential investments.

Underestimate the importance of accuracy and efficiency.

- Attention to detail to avoid errors in your financial models

- Time management skills to meet tight deadlines

- Model validation and thorough error checking

- Proficiency in relevant software (e.g., Excel, Bloomberg Terminal)

In the fast-paced private credit world, accuracy and efficiency are highly valued. Demonstrating these skills during the interview process is critical.

Do: Tailor Your Resume and Cover Letter to Private Credit

Generic applications won't cut it in a competitive market. You need to demonstrate a deep understanding of private credit and how your skills align with specific roles.

Highlight relevant skills and experience.

- Credit analysis and underwriting experience

- Portfolio management skills

- Due diligence experience

- Legal expertise (if applicable)

Use keywords found in private credit job descriptions. Tailor your resume and cover letter to each specific opportunity.

Showcase your understanding of the private credit market.

- Mention relevant market trends and their impact on private credit investments

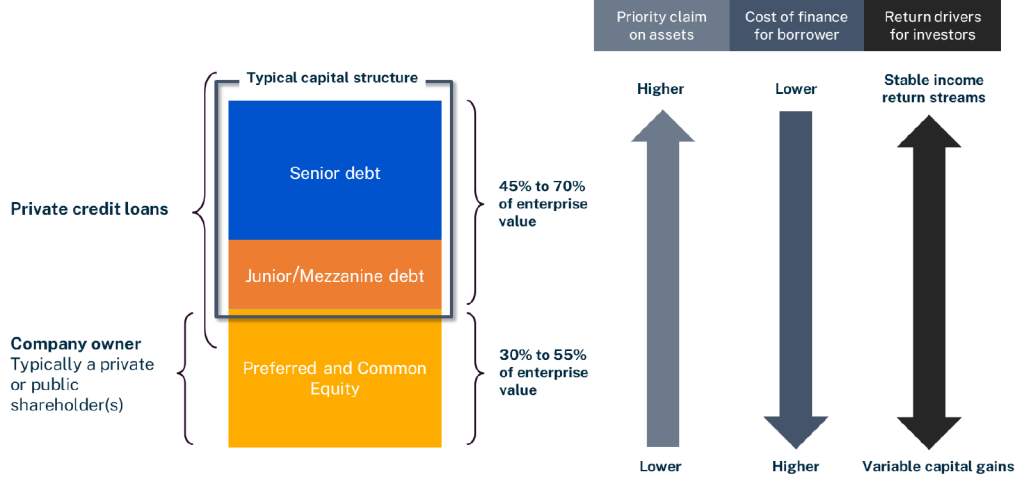

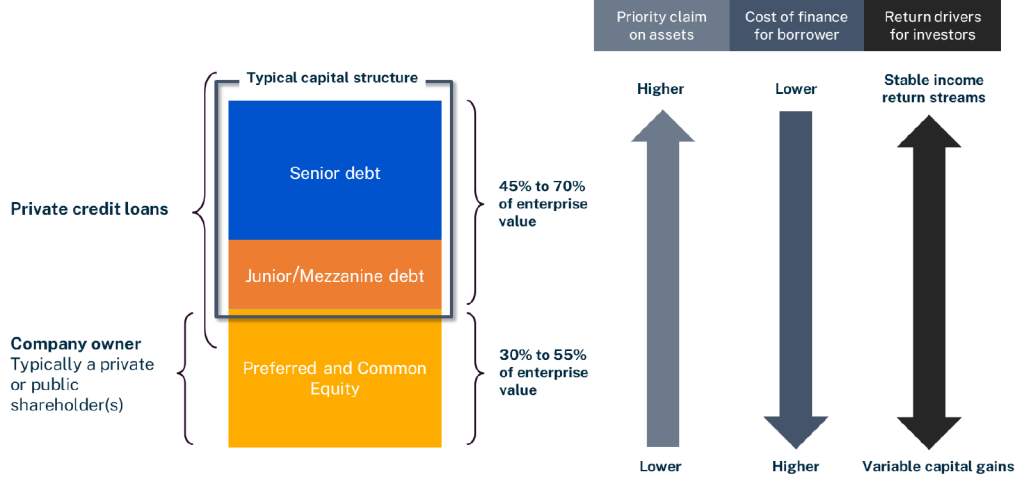

- Demonstrate knowledge of different private credit strategies (e.g., direct lending, mezzanine financing, distressed debt)

- Display familiarity with key players and firms in the private credit landscape

Showcasing your understanding of the private credit market demonstrates your commitment and passion for the field.

Quantify your accomplishments wherever possible.

- Use numbers to demonstrate the impact of your contributions in previous roles

- Highlight successful deals and transactions you've been involved in

- Quantify your contributions to previous employers (e.g., increased efficiency by X%, reduced costs by Y%)

Quantifiable achievements make your resume more impactful and easier to assess for recruiters.

Don't: Underprepare for Interviews

The interview process is your chance to shine and demonstrate your understanding of private credit. Thorough preparation is key.

Practice common interview questions.

- Behavioral questions (e.g., "Tell me about a time you failed.")

- Technical questions related to private credit (e.g., "Explain your understanding of LBO modeling.")

- Questions about market trends and their impact on private credit

Practice your answers aloud to build confidence and refine your responses.

Research the firm and interviewers thoroughly.

- Review the firm's investment strategy, recent investments, and portfolio companies.

- Understand their target market and investment approach.

- Learn about the interviewers' backgrounds and experience.

Demonstrating a genuine understanding of the firm shows initiative and seriousness.

Neglect to prepare thoughtful questions.

- Prepare questions that demonstrate your interest in the role and the firm.

- Ask questions that reveal your insights into the private credit market.

- Ask questions about the firm's culture and work environment.

Asking insightful questions shows you're engaged and thinking critically about the opportunity.

Do: Follow Up After Interviews

Following up is a crucial step often overlooked. It demonstrates your professionalism and continued interest.

Send a thank-you note to each interviewer.

- Send personalized thank-you notes within 24 hours of each interview.

- Reiterate your interest in the position and highlight key points from the conversation.

- Briefly mention something specific you discussed to personalize the note.

Maintain contact and continue networking.

- Maintain communication with recruiters and hiring managers to check on the status of your application.

- Continue expanding your network within the private credit industry.

- Attend industry events and keep learning about market trends.

Persistent and professional follow-up significantly improves your chances of success.

Conclusion

Securing a role in the exciting world of private credit requires preparation, strategy, and a proactive approach. By following these dos and don'ts, you can significantly increase your chances of success. Remember to network strategically, master financial modeling, tailor your applications, prepare thoroughly for interviews, and follow up diligently. Embrace these key strategies and take the first step toward launching your career in the dynamic field of private credit. Don't delay; start building your network and honing your skills in private credit today!

Featured Posts

-

Litige Amazon Syndicat Fermeture D Entrepots Au Quebec

May 18, 2025

Litige Amazon Syndicat Fermeture D Entrepots Au Quebec

May 18, 2025 -

Will The Cardinals Opener Overcome Jansen A Preview Of The Crucial Game

May 18, 2025

Will The Cardinals Opener Overcome Jansen A Preview Of The Crucial Game

May 18, 2025 -

Jose Sorianos Shutout Performance Delivers Angels 1 0 Win Against White Sox

May 18, 2025

Jose Sorianos Shutout Performance Delivers Angels 1 0 Win Against White Sox

May 18, 2025 -

Voyager Technologies Space Defense Ipo What Investors Need To Know

May 18, 2025

Voyager Technologies Space Defense Ipo What Investors Need To Know

May 18, 2025 -

Public Opinion In The Netherlands No To Eu Countermeasures On Trump Tariffs

May 18, 2025

Public Opinion In The Netherlands No To Eu Countermeasures On Trump Tariffs

May 18, 2025

Latest Posts

-

Amanda Bynes Joins Only Fans A Look At The Stipulations

May 18, 2025

Amanda Bynes Joins Only Fans A Look At The Stipulations

May 18, 2025 -

Amanda Bynes Joins Only Fans A Strict Content Policy Explained

May 18, 2025

Amanda Bynes Joins Only Fans A Strict Content Policy Explained

May 18, 2025 -

Amanda Bynes Past A Classmates Perspective

May 18, 2025

Amanda Bynes Past A Classmates Perspective

May 18, 2025 -

Amanda Bynes Launches Only Fans With A Significant Condition

May 18, 2025

Amanda Bynes Launches Only Fans With A Significant Condition

May 18, 2025 -

Former Child Star Amanda Bynes Launches Only Fans With A Warning

May 18, 2025

Former Child Star Amanda Bynes Launches Only Fans With A Warning

May 18, 2025