5 Key Dos And Don'ts To Succeed In The Private Credit Market

Table of Contents

Do Your Due Diligence: Thorough Research is Paramount

Investing in the private credit market necessitates meticulous due diligence. Failing to conduct thorough research can lead to significant financial losses. This involves a comprehensive evaluation of both the borrower and the collateral offered.

Understand the Borrower's Financial Health:

Before committing capital, a thorough understanding of the borrower's financial health is critical. This goes beyond simply reviewing a balance sheet.

- Analyze financial statements meticulously, looking for red flags. Examine trends in revenue, expenses, profitability, and debt levels over several years. Look for inconsistencies or unusual patterns.

- Verify information provided by the borrower with independent sources. Don't rely solely on the borrower's self-reported data. Cross-reference information with public records, industry reports, and credit bureaus.

- Employ experienced financial analysts to conduct comprehensive audits. An independent professional can provide an unbiased assessment and identify potential risks that might be missed.

- Assess the borrower's cash flow projections realistically. Carefully scrutinize the borrower's projections and compare them to historical performance. Consider potential headwinds and market downturns.

Evaluate the Collateral:

The collateral securing the loan plays a vital role in mitigating risk in the private credit market. A thorough assessment is crucial.

- Conduct an independent appraisal of any collateral offered. An unbiased appraisal ensures that the collateral's value is accurately reflected.

- Ensure the collateral is adequately insured and protected. Insurance policies can safeguard against unforeseen events like damage or theft.

- Understand the market value of the collateral and potential fluctuations. Market conditions can impact the collateral's value, potentially affecting your recovery in case of default.

- Consider the ease and cost of liquidating the collateral in case of default. A quick and cost-effective liquidation process is essential to minimize losses.

Don't Neglect Risk Management: Mitigate Potential Losses

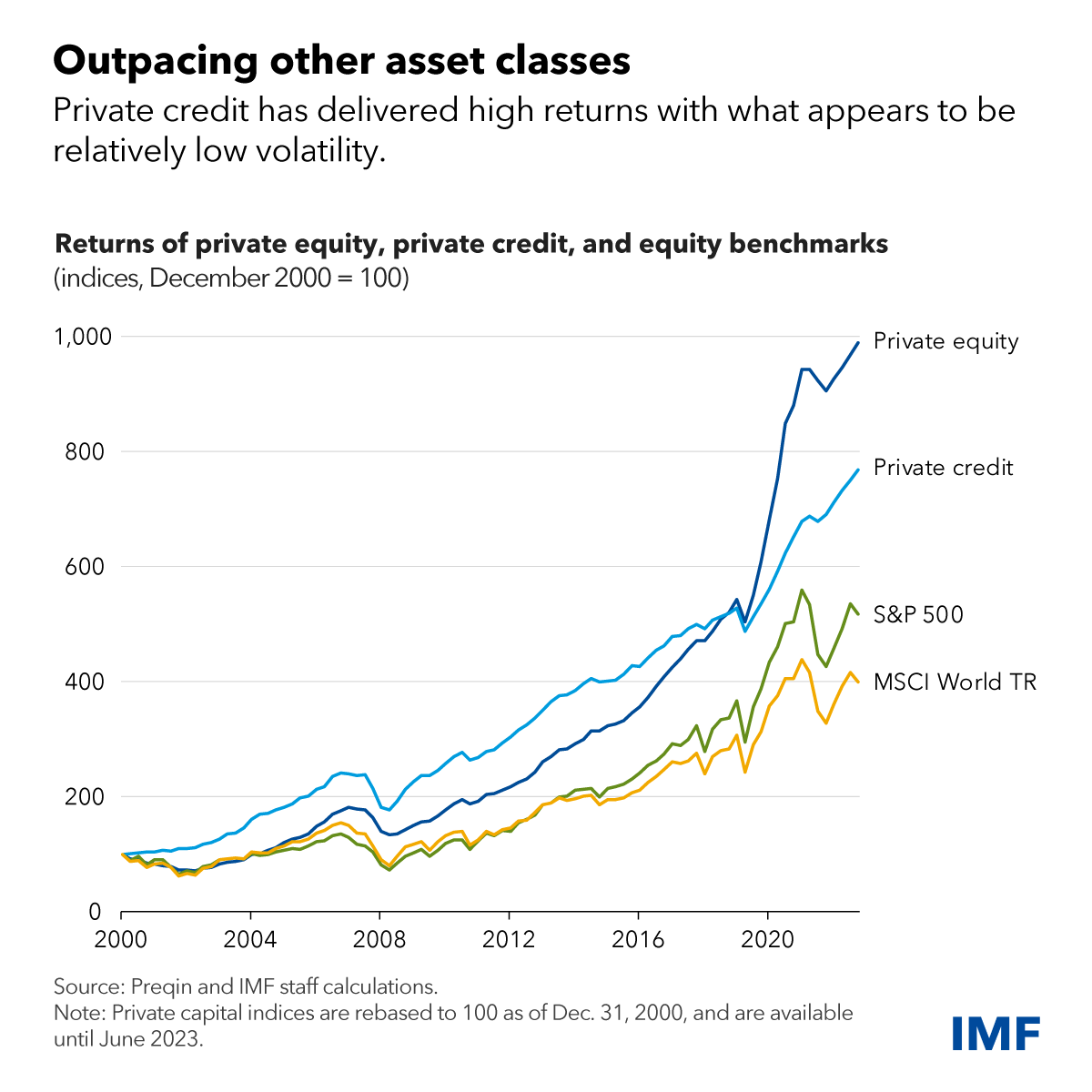

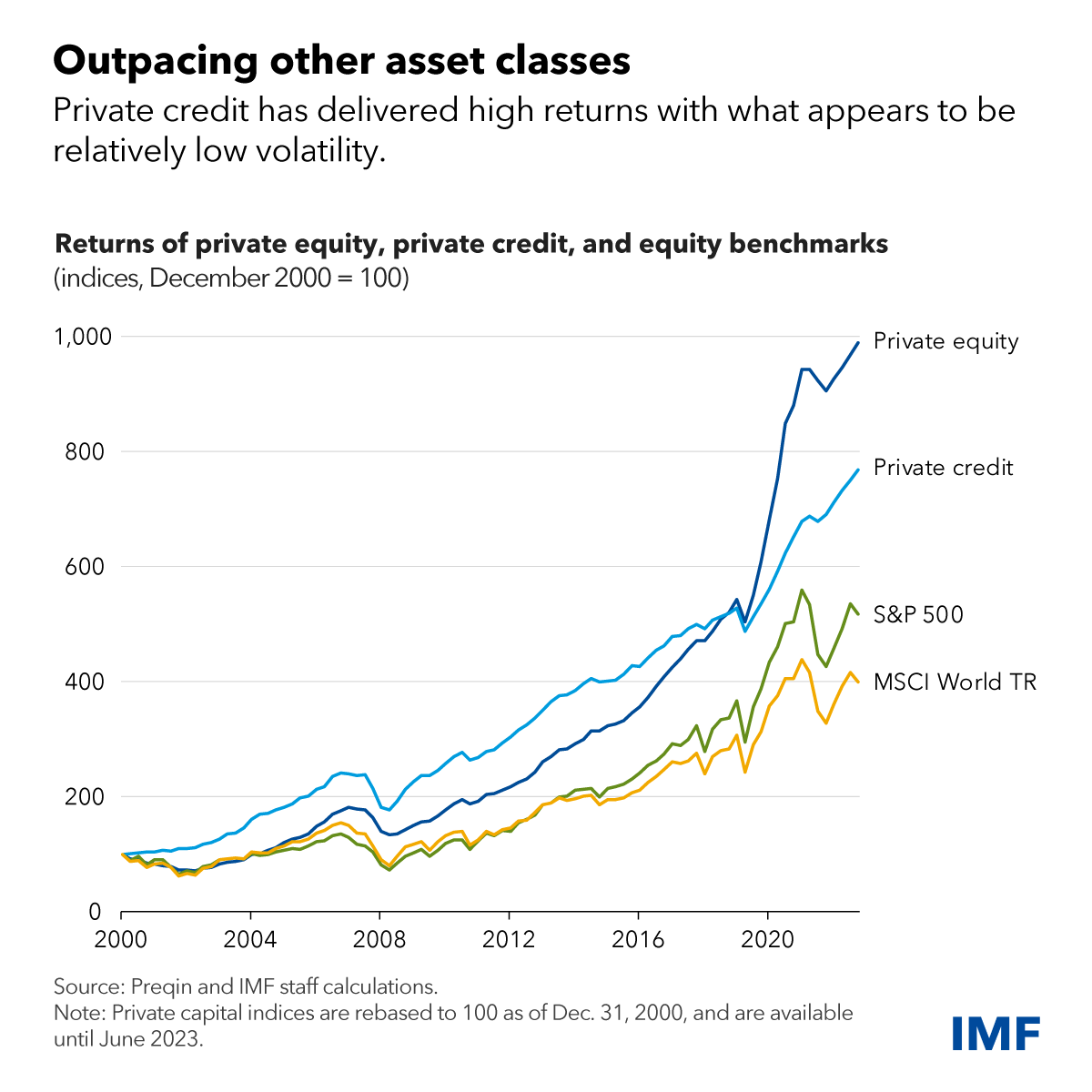

The private credit market, while offering high returns, also carries inherent risks. Effective risk management is paramount.

Diversify Your Portfolio:

Diversification is a cornerstone of successful investing in the private credit market.

- Spread investments across various borrowers and industries to reduce overall risk. Don't put all your eggs in one basket.

- Avoid overexposure to any single borrower or sector. Concentrated exposure increases your vulnerability to sector-specific downturns.

- Utilize sophisticated portfolio management tools to monitor risk effectively. Software and analytical tools can help you track your portfolio's performance and identify potential risks.

Implement Robust Legal Frameworks:

Strong legal protections are crucial in the private credit market.

- Utilize comprehensive loan agreements that protect your interests. These agreements should clearly define the terms of the loan, including repayment schedules, interest rates, and default provisions.

- Consult experienced legal counsel to ensure the contracts are airtight. A knowledgeable attorney can help you draft contracts that are legally sound and protect your investment.

- Include appropriate covenants and clauses to safeguard against default. These covenants can include financial ratios, operational restrictions, and other safeguards to protect your investment.

Do Build Strong Relationships: Networking is Key in Private Credit

Building strong relationships is essential for success in the private credit market. This involves both networking and fostering trust.

Network Strategically:

Networking within the private credit market opens doors to new opportunities.

- Attend industry events and conferences to build connections with potential borrowers and investors. These events are excellent opportunities to meet key players and learn about new deals.

- Cultivate relationships with experienced professionals in the private credit space. Mentorship and collaboration can provide valuable insights and support.

- Leverage professional networks such as LinkedIn to expand your reach. Online platforms provide a powerful means to connect with professionals and businesses.

Foster Trust and Transparency:

Trust and transparency are cornerstones of successful relationships in the private credit market.

- Maintain open communication with borrowers and investors. Regular communication fosters strong, productive relationships.

- Be upfront about risks and potential challenges. Honesty and transparency build credibility and trust.

- Build a reputation for integrity and fair dealings. A strong reputation is invaluable in this relationship-driven market.

Don't Underestimate the Importance of Market Knowledge: Stay Informed and Adapt

The private credit market is dynamic and constantly evolving. Staying informed is crucial for success.

Track Market Trends:

Understanding market trends enables informed decision-making.

- Monitor interest rates, economic indicators, and regulatory changes that impact the private credit market. These factors can significantly affect investment performance.

- Stay updated on industry news and publications. Trade publications and financial news sources provide valuable market insights.

- Utilize market analysis tools to gain insights into emerging opportunities and risks. Analytical tools provide a data-driven perspective.

Adapt to Changing Conditions:

Flexibility and adaptability are key to navigating the changing landscape of the private credit market.

- Be prepared to adjust your investment strategies in response to evolving market dynamics. Market conditions can shift rapidly, requiring adaptability.

- Develop contingency plans to mitigate the impact of unexpected events. Unexpected events, such as economic downturns, necessitate preparedness.

- Remain flexible and adaptable to changing market conditions. The ability to adapt quickly is a critical skill for success.

Do Employ Sophisticated Analytics: Data-Driven Decision Making is Crucial

Data-driven decision-making is crucial for maximizing returns and minimizing risks in the private credit market.

Utilize Credit Scoring Models:

Sophisticated credit scoring models help assess the creditworthiness of potential borrowers.

- Employ sophisticated credit scoring models to assess borrower creditworthiness. These models provide quantitative assessments of risk.

- Compare different scoring models to validate your assessment. Utilizing multiple models provides a more comprehensive evaluation.

- Continuously refine your credit scoring models to improve accuracy. Regular refinement enhances the model’s predictive power.

Leverage Data Analytics Tools:

Data analytics tools provide powerful insights into market trends and portfolio performance.

- Use data analytics tools to identify profitable investment opportunities. These tools help unearth potentially profitable opportunities.

- Monitor portfolio performance closely using data-driven insights. Regular monitoring ensures you're on track to meet your goals.

- Utilize predictive analytics to forecast potential risks and returns. Predictive analytics helps anticipate future outcomes.

Conclusion:

Success in the private credit market hinges on a combination of thorough due diligence, robust risk management, strategic networking, market awareness, and sophisticated analytics. By adhering to the "dos" and avoiding the "don'ts" outlined in this article, investors and lenders can significantly increase their chances of achieving profitability and long-term success in this rewarding yet challenging arena. Remember, understanding the intricacies of the private credit market and applying these principles are paramount to achieving your investment goals. Start leveraging these strategies today to thrive in the private credit market!

Featured Posts

-

Vehicle Subsystem Malfunction Delays Blue Origin Launch

Apr 29, 2025

Vehicle Subsystem Malfunction Delays Blue Origin Launch

Apr 29, 2025 -

Key Factors In Deadly Black Hawk And Jet Collision Revealed In New Report

Apr 29, 2025

Key Factors In Deadly Black Hawk And Jet Collision Revealed In New Report

Apr 29, 2025 -

British Paralympian Sam Ruddock Missing In Las Vegas Urgent Search Underway

Apr 29, 2025

British Paralympian Sam Ruddock Missing In Las Vegas Urgent Search Underway

Apr 29, 2025 -

Higher Prices Fewer Goods Examining The Legacy Of Trumps Tariffs On China

Apr 29, 2025

Higher Prices Fewer Goods Examining The Legacy Of Trumps Tariffs On China

Apr 29, 2025 -

Carsten Jancker Wechsel Nach Seinem Engagement In Leoben

Apr 29, 2025

Carsten Jancker Wechsel Nach Seinem Engagement In Leoben

Apr 29, 2025