5 Tips For A Successful Private Credit Job Application

Table of Contents

Tailor Your Resume and Cover Letter to the Specific Private Credit Role

Your resume and cover letter are your first impression – make it count! Generic applications rarely succeed in the competitive private credit job market. To stand out, tailor your materials to each specific role and firm.

-

Research is Key: Before submitting your application, thoroughly research the firm's investment strategy, target sectors, recent deals, and the specific requirements of the role. Understanding their focus allows you to highlight relevant experience and demonstrate genuine interest. Look for information on their website, LinkedIn, and industry news sources.

-

Quantify Your Accomplishments: Instead of simply stating your responsibilities, quantify your accomplishments using concrete numbers and data. For example, instead of "Managed a portfolio of loans," write "Managed a $50 million portfolio of loans, resulting in a 15% reduction in non-performing assets."

-

Keyword Optimization: Incorporate relevant keywords from the job description throughout your resume and cover letter. Use Applicant Tracking System (ATS)-friendly formatting to ensure your application is properly scanned and considered. Common keywords include private debt, credit analysis, financial modeling, due diligence, and alternative investments.

-

Craft a Compelling Cover Letter: Avoid generic templates. Each cover letter should be uniquely tailored to the specific firm and role. Explain why you are interested in this particular firm and how your skills and experience align perfectly with their needs and the specific responsibilities outlined in the job description.

-

Highlight Transferable Skills: Even if your experience isn't directly in private credit, focus on transferable skills. Emphasize your analytical abilities, financial modeling proficiency (mention specific software like Excel, Bloomberg Terminal, or Argus), and any deal experience you possess, showcasing how these skills translate to success in a private credit environment.

Showcase Your Financial Modeling and Analytical Skills

Private credit roles demand strong financial modeling and analytical skills. Demonstrating your proficiency is crucial for a successful application.

-

Master Excel and Relevant Software: Proficiency in Excel is non-negotiable. Highlight your skills in financial modeling, including DCF analysis, LBO modeling, and other valuation techniques. Mention any experience with specialized financial software used in the private credit industry.

-

Provide Concrete Examples: Include specific examples of your previous financial modeling experience in your resume and cover letter. Describe projects where you used these skills, the challenges you faced, and the results you achieved.

-

Explain Your Approach: Be prepared to articulate your modeling approach during the interview. Explain your assumptions and conclusions clearly and concisely, showcasing your understanding of the underlying principles.

-

Deep Understanding of Credit Analysis: Demonstrate your knowledge of credit analysis principles, including financial statement analysis, credit risk assessment, covenant compliance, and industry-specific credit metrics.

-

Stay Up-to-Date: Keep your skills sharp by staying current on industry trends and best practices in financial modeling and credit analysis.

Network and Leverage Your Connections in the Private Credit Industry

Networking is invaluable in securing a private credit job. Leverage your existing connections and actively build new ones.

-

LinkedIn Power: Use LinkedIn effectively. Connect with professionals in private credit, engage with their posts, and participate in relevant industry discussions. This helps build your professional brand and visibility.

-

Attend Industry Events: Attend industry conferences and networking events. This provides opportunities to meet professionals, learn about new opportunities, and build relationships.

-

Informational Interviews: Reach out to your contacts for informational interviews to learn more about specific roles and firms. These conversations can provide valuable insights and potential leads.

-

The Power of Referrals: A referral can significantly increase your chances of success. Let your network know you are actively searching for a private credit job.

-

Recruiters are Your Allies: Build relationships with recruiters specializing in private credit placements. They often have access to unadvertised positions and can provide valuable career guidance.

Prepare for Behavioral and Technical Interview Questions

The interview stage requires thorough preparation. Practice answering both behavioral and technical questions.

-

Master the STAR Method: Practice answering common behavioral interview questions using the STAR method (Situation, Task, Action, Result). This structured approach ensures you provide concise and impactful answers.

-

Technical Proficiency: Prepare for technical questions related to financial modeling, credit analysis, valuation, and current industry trends. Brush up on your knowledge of relevant accounting principles and financial ratios.

-

Company Research is Crucial: Research the firm's investment strategy, recent transactions, and portfolio companies. Be ready to discuss your perspectives on their approach and potential investment opportunities.

-

Case Study Preparation: Practice answering case study questions, which assess your analytical and problem-solving skills. Familiarize yourself with common case study frameworks.

-

Ask Thoughtful Questions: Prepare insightful questions to ask the interviewer. This demonstrates your genuine interest and initiative.

Follow Up After Your Private Credit Job Application

Following up effectively demonstrates your persistence and professionalism.

-

The Thank You Note: Send a thank-you note after each interview, reiterating your interest and highlighting key takeaways from the conversation. Personalize each note.

-

Strategic Follow-Up: Follow up with the recruiter or hiring manager after a reasonable timeframe (e.g., a week after the interview) to express your continued interest and inquire about the next steps in the process.

-

Professional Persistence: Be persistent but professional in your communication. Avoid being overly pushy or demanding.

-

Positive Attitude: Maintain a positive and enthusiastic attitude throughout the process.

-

Inquire About Timeline: Don't hesitate to politely inquire about the timeline of the hiring process to gauge the status of your application.

Conclusion:

Securing a position in private credit demands careful preparation and a strategic approach. By following these five tips – tailoring your application materials, showcasing your analytical skills, leveraging your network, preparing for interviews, and following up effectively – you’ll significantly increase your chances of landing your dream private credit job. Remember, a well-crafted and thoughtfully executed application is the key to unlocking a successful career in this dynamic and rewarding field. Start refining your private credit job application strategy today!

Featured Posts

-

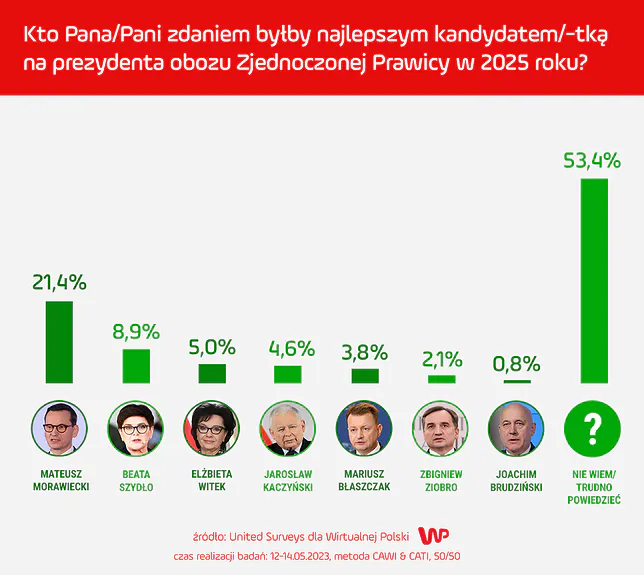

Wybory Prezydenckie 2025 Nowa Era W Polityce

May 30, 2025

Wybory Prezydenckie 2025 Nowa Era W Polityce

May 30, 2025 -

The Baim Collection A Journey Through Time A Lifetime Ago And Beyond

May 30, 2025

The Baim Collection A Journey Through Time A Lifetime Ago And Beyond

May 30, 2025 -

Prison Isere Critiques Apres Les Attaques Et La Visite Ministerielle

May 30, 2025

Prison Isere Critiques Apres Les Attaques Et La Visite Ministerielle

May 30, 2025 -

Joy Smith Foundation Launch Media Alert And Photo Advisory

May 30, 2025

Joy Smith Foundation Launch Media Alert And Photo Advisory

May 30, 2025 -

Bombe De La Seconde Guerre Mondiale Le Trafic Ferroviaire A La Gare Du Nord Chamboule

May 30, 2025

Bombe De La Seconde Guerre Mondiale Le Trafic Ferroviaire A La Gare Du Nord Chamboule

May 30, 2025