5 Tips To Get Hired In The Booming Private Credit Industry

Table of Contents

Network Strategically Within the Private Credit Sector

Building a strong network is crucial for success in the private credit industry. It's not just about who you know, but about building meaningful relationships with individuals who can offer insights, mentorship, and potential job opportunities.

-

Build relationships: Attend industry events, conferences like SuperReturn and ACG conferences, and webinars. Actively participate, ask insightful questions, and follow up with new contacts. Leverage LinkedIn effectively by joining relevant groups, engaging in discussions, and connecting with professionals in private credit. Don't just connect; personalize your connection requests to show genuine interest.

-

Informational interviews: Reach out to professionals in your target roles for informational interviews. These conversations provide invaluable insights into the industry, specific firms, and the skills needed to succeed. Prepare thoughtful questions beforehand, and remember to express your gratitude afterward.

-

Target your networking: Don't just network broadly; focus your efforts on firms and individuals specializing in areas of private credit that align with your skills and interests (e.g., direct lending, distressed debt, mezzanine financing, unitranche lending, private debt). Research firms thoroughly to understand their investment strategies and identify potential mentors.

-

Follow industry news: Stay up-to-date on market trends and company news through relevant publications like Private Debt Investor, PEI Media, and The Deal, as well as online resources such as Bloomberg and Refinitiv. This will help you engage in more meaningful conversations and demonstrate your knowledge during interviews.

Master the Essential Skills for Private Credit Roles

Private credit roles demand a specific skill set. While a strong academic background is helpful, practical skills and experience are even more crucial.

-

Financial modeling: Proficiency in Excel and financial modeling software like Argus and the Bloomberg Terminal is paramount. Practice building complex models, including discounted cash flow (DCF) analysis, leveraged buyout (LBO) models, and understanding valuation techniques like comparable company analysis and precedent transactions.

-

Credit analysis: Develop a deep understanding of credit analysis principles, including financial statement analysis (ratio analysis, trend analysis), covenant analysis (understanding restrictive covenants and maintenance covenants), and risk assessment (evaluating creditworthiness and potential defaults).

-

Industry knowledge: Stay informed about market trends, regulatory changes (such as LIBOR transition), and competitive landscapes in the private credit space. Read industry publications and reports to understand current market dynamics and emerging trends.

-

Communication & presentation skills: The ability to clearly and effectively communicate complex financial information to both technical and non-technical audiences is crucial. Practice presenting your analysis concisely and persuasively.

Tailor Your Resume and Cover Letter for Private Credit Positions

Your resume and cover letter are your first impression; make it count. Tailoring them specifically to each private credit position will significantly increase your chances.

-

Keyword optimization: Incorporate relevant keywords from job descriptions into your resume and cover letter (e.g., "direct lending," "leveraged finance," "credit underwriting," "asset-based lending," "senior secured debt"). Use a keyword research tool to identify the most relevant terms.

-

Quantify your achievements: Use numbers to showcase your accomplishments and demonstrate the impact of your work. Instead of simply stating "Improved efficiency," quantify it as "Improved efficiency by 15% resulting in $X cost savings."

-

Highlight relevant experience: Even if your background isn't directly in private credit, highlight transferable skills and experiences that demonstrate your suitability (e.g., financial analysis, project management, accounting, due diligence).

-

Proofread carefully: Ensure your resume and cover letter are free of grammatical errors and typos. Have a friend or mentor proofread them before submitting your application.

Ace the Private Credit Interview Process

The interview process is your chance to shine and demonstrate your knowledge and personality. Thorough preparation is key.

-

Research the firm thoroughly: Understand their investment strategy, portfolio companies, recent transactions, and the team you'll be working with. Demonstrate your understanding during the interview.

-

Prepare for behavioral questions: Practice answering common interview questions, focusing on your strengths, weaknesses, and experiences relevant to private credit. Use the STAR method (Situation, Task, Action, Result) to structure your answers.

-

Ask insightful questions: Prepare thoughtful questions to demonstrate your genuine interest and understanding of the firm and role. Avoid questions easily answered through online research.

-

Practice your responses: Rehearse your answers to technical questions related to financial modeling, credit analysis, and industry trends. Practice with a friend or mentor to identify areas for improvement.

Leverage Your Network and Explore Alternative Job Search Strategies

Don't rely solely on online job boards. A multifaceted approach significantly broadens your reach.

-

Recruiters: Connect with recruiters specializing in private credit placement. They often have access to unadvertised roles and can provide valuable guidance.

-

Networking events: Attend industry events to make connections and learn about unadvertised opportunities. These events are invaluable for building relationships and discovering hidden job opportunities.

-

Online job boards: Utilize job boards specializing in finance and private credit, such as eFinancialCareers, LinkedIn, and specialized finance job boards.

-

Informational interviews: Seek insights and advice from professionals in the field. These conversations can help you refine your job search strategy and learn about potential opportunities.

Conclusion

Landing a job in the competitive yet rewarding private credit industry requires a proactive and strategic approach. By diligently following these five tips—networking effectively, mastering essential skills, crafting a compelling application, acing the interview process, and exploring diverse job search avenues—you can significantly enhance your chances of success. Don't delay; begin implementing these strategies today to secure your place in the booming private credit industry! Start building your career in private credit now!

Featured Posts

-

Futur De Gibraltar Perspectives Post Brexit

May 13, 2025

Futur De Gibraltar Perspectives Post Brexit

May 13, 2025 -

Bollywoods Biggest Failure Salman Khans R2 Crore Movie And Its Aftermath

May 13, 2025

Bollywoods Biggest Failure Salman Khans R2 Crore Movie And Its Aftermath

May 13, 2025 -

Home Run Prop Bets Mlb Odds And Predictions For April 26th

May 13, 2025

Home Run Prop Bets Mlb Odds And Predictions For April 26th

May 13, 2025 -

Liga Hannover Drohkulisse Statt Derby Stimmung Im Abstiegskampf

May 13, 2025

Liga Hannover Drohkulisse Statt Derby Stimmung Im Abstiegskampf

May 13, 2025 -

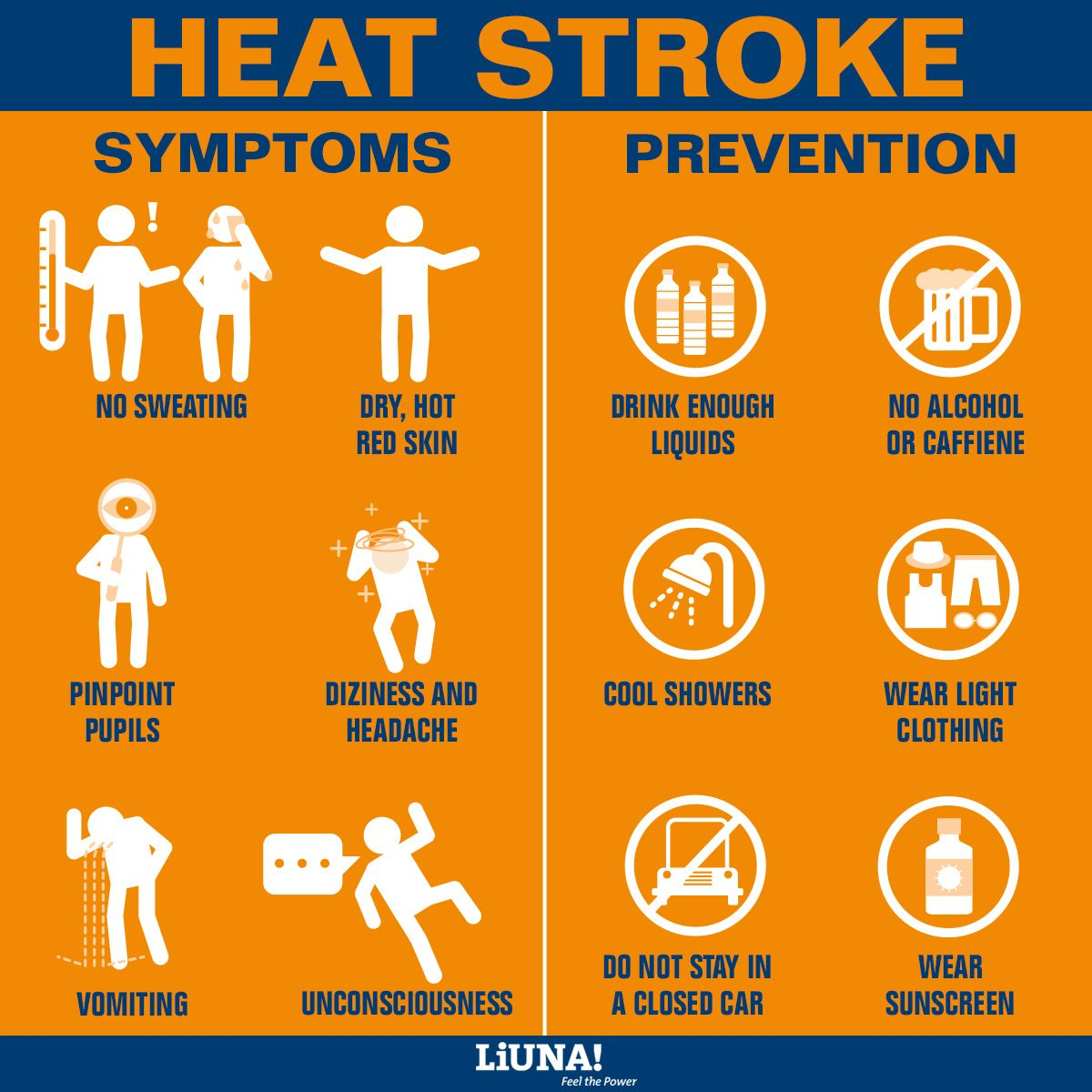

La And Orange Counties Sizzle Under Record Breaking Heat Safety Tips And Resources

May 13, 2025

La And Orange Counties Sizzle Under Record Breaking Heat Safety Tips And Resources

May 13, 2025

Latest Posts

-

Recall Alert Wegmans Braised Beef With Vegetables What To Do Next

May 14, 2025

Recall Alert Wegmans Braised Beef With Vegetables What To Do Next

May 14, 2025 -

14 Great Value Brand Product Recalls You Need To Know About

May 14, 2025

14 Great Value Brand Product Recalls You Need To Know About

May 14, 2025 -

Wegmans Recall Braised Beef With Vegetables Steps To Take

May 14, 2025

Wegmans Recall Braised Beef With Vegetables Steps To Take

May 14, 2025 -

Walmart Great Value Recalls A Comprehensive List Of 14 Major Incidents

May 14, 2025

Walmart Great Value Recalls A Comprehensive List Of 14 Major Incidents

May 14, 2025 -

Wegmans Product Recall Action Plan For Braised Beef With Vegetables

May 14, 2025

Wegmans Product Recall Action Plan For Braised Beef With Vegetables

May 14, 2025