7% Drop In Amsterdam Stock Market: Trade War Uncertainty Deepens

Table of Contents

The Impact of the Trade War on the Netherlands Economy

The Netherlands, with its highly export-oriented economy and intricate global supply chains, is particularly vulnerable to trade disputes. The country's economic model relies heavily on international trade, making it susceptible to disruptions caused by trade wars.

-

High dependence on global supply chains: Dutch companies are deeply integrated into global manufacturing and distribution networks. Trade disruptions can lead to significant delays, increased costs, and shortages of essential goods and components.

-

Significant export sector: Sectors like agriculture, chemicals, and logistics are crucial to the Dutch economy, and all are heavily reliant on exports. A trade war directly impacts their ability to sell goods and services internationally.

-

Impact on foreign investment in the Netherlands: Uncertainty surrounding trade policies can deter foreign investors, potentially slowing economic growth and hindering job creation. This is especially true in sectors that depend on international collaborations.

-

Potential job losses and reduced economic growth: The ripple effects of reduced exports and foreign investment can lead to job losses and slower economic growth, impacting the overall prosperity of the Netherlands. This is a serious concern for the Dutch government.

The trade war's impact ripples through Dutch companies. For example, companies in the agricultural sector face potential tariffs on exports to key markets, impacting their profitability and competitiveness. Similarly, logistics companies experience disruptions in supply chains, increasing transportation costs and reducing efficiency.

Analysis of the 7% Drop: Market Reactions and Investor Sentiment

The 7% drop in the Amsterdam Stock Market triggered immediate market reactions and a significant shift in investor sentiment.

-

Decline in major stock indices: The fall wasn't isolated; other major stock indices also experienced declines, reflecting a broader global market concern.

-

Increased volatility in trading: Trading volumes surged as investors reacted to the news, leading to increased market volatility and uncertainty.

-

Investor flight to safer assets: Many investors sought refuge in safer assets like gold and government bonds, deemed less risky in times of economic uncertainty.

-

Impact on investor confidence in the Dutch economy: The sharp decline significantly impacted investor confidence in the Dutch economy, leading to a cautious approach to future investments.

Investors reacted to the uncertainty by employing various strategies. Some opted for risk aversion, shifting investments to safer havens. Others sought opportunities in undervalued sectors, hoping to profit from a potential market rebound.

Potential Long-Term Consequences for the Amsterdam Stock Market

The trade war's long-term implications for the Amsterdam Stock Market could be substantial and far-reaching.

-

Sustained economic slowdown: A prolonged trade war could lead to a sustained economic slowdown in the Netherlands, negatively impacting corporate earnings and stock valuations.

-

Reduced corporate profitability: Increased costs, reduced export demand, and supply chain disruptions can significantly reduce corporate profitability, leading to lower stock prices.

-

Potential for further market corrections: The 7% drop could be a precursor to further market corrections, particularly if trade tensions remain high.

-

Long-term implications for investor confidence: Continued uncertainty can erode investor confidence, leading to a prolonged period of subdued market activity and slower recovery.

Several scenarios are possible. A quick resolution of trade disputes could lead to a faster market recovery. However, a prolonged trade war could result in a more significant and prolonged downturn, with lasting effects on the Amsterdam Stock Market.

Government Response and Mitigation Strategies

The Dutch government is actively responding to the economic challenges posed by the trade war and is implementing several mitigation strategies.

-

Government announcements and policy responses: The government has announced several measures to support businesses and stimulate economic growth.

-

Financial support measures for businesses: Financial aid packages and tax breaks are being considered to help companies cope with the economic fallout.

-

Efforts to attract foreign investment: The government is working to attract foreign investment to diversify the economy and reduce its reliance on specific export markets.

-

Potential trade negotiations and diplomatic efforts: The Netherlands is actively involved in diplomatic efforts to de-escalate trade tensions and negotiate favorable trade agreements.

The effectiveness of the government's response will play a critical role in determining the speed and extent of the market's recovery. A swift and effective response can help mitigate the negative impacts of the trade war.

Expert Opinions and Future Predictions

Economists and financial analysts offer diverse perspectives on the current situation and future predictions for the Amsterdam Stock Market.

-

Quotes from relevant experts: [Insert quotes from relevant experts, attributing them properly].

-

Varying perspectives on the situation: Some experts believe the market will recover quickly, while others foresee a more prolonged period of uncertainty.

-

Predictions on market recovery timelines: Recovery timelines vary widely, depending on the evolution of the trade war and government policies.

-

Potential for further market volatility: Many predict continued market volatility until the trade war uncertainty subsides.

A balanced overview of expert opinions helps provide a comprehensive perspective on the evolving situation and informs investment decisions.

Conclusion

The 7% drop in the Amsterdam Stock Market underscores the significant impact of escalating trade war uncertainty on the Dutch economy. The country's reliance on exports and global supply chains makes it highly susceptible to disruptions caused by trade disputes. The potential long-term consequences include sustained economic slowdown, reduced corporate profitability, and further market corrections. The Dutch government's response, while crucial, will determine the speed and extent of market recovery.

Call to Action: Stay informed about developments in the Amsterdam Stock Market and the global trade war to make informed investment decisions. Monitor news and analysis related to the Amsterdam Stock Market drop and trade war uncertainty for updated information. Regularly review your investment portfolio and consider diversifying to mitigate risks associated with Amsterdam Stock Market fluctuations and global trade tensions. Understanding the dynamics of the Amsterdam Stock Market and global trade is vital for navigating the current economic climate.

Featured Posts

-

Yevrobachennya Scho Stalosya Z Peremozhtsyami Za Ostannye Desyatilittya

May 25, 2025

Yevrobachennya Scho Stalosya Z Peremozhtsyami Za Ostannye Desyatilittya

May 25, 2025 -

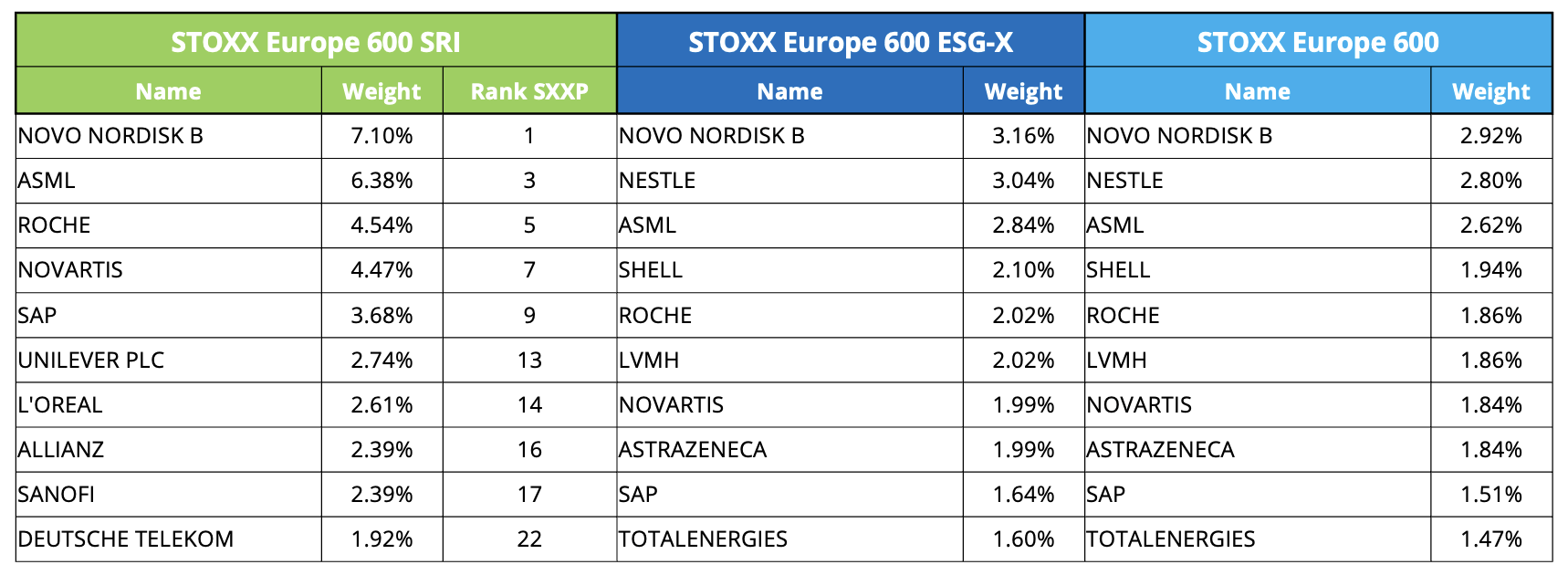

Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme Avrupa Piyasalarinda Duesues

May 25, 2025

Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme Avrupa Piyasalarinda Duesues

May 25, 2025 -

80 Millioert Extrazott Porsche 911 Erdemes

May 25, 2025

80 Millioert Extrazott Porsche 911 Erdemes

May 25, 2025 -

Joy Crookes Drops Haunting New Track I Know You D Kill Details Inside

May 25, 2025

Joy Crookes Drops Haunting New Track I Know You D Kill Details Inside

May 25, 2025 -

V Teatre Mossoveta Pamyati Sergeya Yurskogo

May 25, 2025

V Teatre Mossoveta Pamyati Sergeya Yurskogo

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025 -

Actress Mia Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 25, 2025

Actress Mia Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 25, 2025 -

Overnight Disasters 17 Celebrities Whose Careers Imploded

May 25, 2025

Overnight Disasters 17 Celebrities Whose Careers Imploded

May 25, 2025 -

From Fame To Shame 17 Celebrity Downfalls

May 25, 2025

From Fame To Shame 17 Celebrity Downfalls

May 25, 2025 -

17 Famous Faces How One Mistake Ruined Their Reputations

May 25, 2025

17 Famous Faces How One Mistake Ruined Their Reputations

May 25, 2025