7% Plunge For Amsterdam Stocks: Trade War Uncertainty Creates Market Volatility

Table of Contents

The Impact of Trade War Uncertainty on Global Markets

The current global trade climate is characterized by rising protectionism and increasing trade tensions. This uncertainty significantly impacts investor confidence, creating a ripple effect across global markets. Increased tariffs and trade restrictions create a climate of unpredictability for businesses, hindering international trade and investment.

- Increased tariffs and trade restrictions create uncertainty for businesses: Businesses struggle to plan for the future when faced with fluctuating import and export costs. This uncertainty leads to reduced investment and hiring.

- Reduced international trade leads to lower economic growth projections: The slowdown in global trade directly impacts economic growth forecasts, creating a pessimistic outlook that further dampens investor sentiment.

- Investor uncertainty drives capital flight to safer assets: Investors seek refuge in safer assets like government bonds, leading to a decline in stock markets globally. This capital flight exacerbates the downturn.

- Direct impact on Amsterdam's stock market: Amsterdam, being a significant international trading hub, is directly exposed to these global headwinds. The reduced investor confidence and global economic slowdown translate into lower demand for Amsterdam stocks.

Amsterdam's Specific Vulnerabilities

Certain sectors of the Amsterdam stock exchange are particularly vulnerable to the anxieties surrounding the trade war. Amsterdam's economy, while diverse, has key industries heavily reliant on international trade and global supply chains.

- Key industries and global trade exposure: Sectors like technology, finance, and logistics, which are prominent in Amsterdam, are significantly exposed to global trade fluctuations. Disruptions in international supply chains directly impact these industries.

- Reliance on export markets: Many Dutch companies rely heavily on export markets. Trade wars and tariffs significantly impact their profitability and competitiveness, leading to decreased stock valuations.

- Impact on specific companies: Companies heavily reliant on international trade, particularly those involved in exporting goods and services, are experiencing a disproportionate impact from this market downturn.

- Economic dependence: Amsterdam’s relative dependence on specific sectors exposed to international trade makes the city’s economy more susceptible to global trade fluctuations.

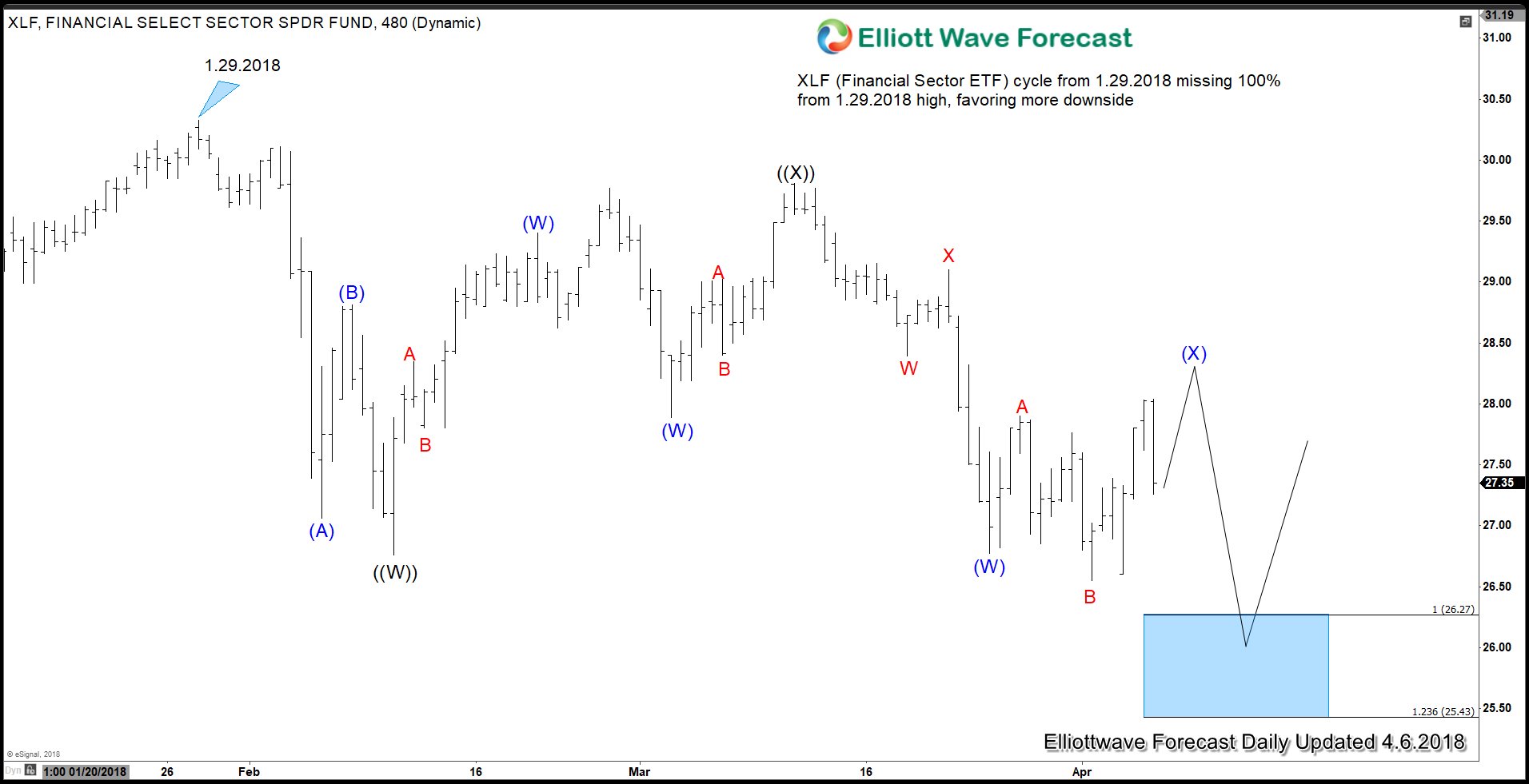

Analyzing the 7% Drop: Causes and Contributing Factors

The 7% drop in Amsterdam stocks wasn't a singular event but rather a culmination of several factors. A combination of specific news events and broader market sentiment contributed to this sharp decline.

- Specific news events: Recent announcements regarding escalating trade tensions, specifically those impacting key Dutch export industries, likely triggered a sell-off. Negative economic reports also contributed.

- Investor sentiment and panic selling: The combination of uncertainty and negative news fueled negative investor sentiment, leading to widespread panic selling. This amplified the initial drop, creating a self-fulfilling prophecy.

- Influence of global market trends: The Amsterdam exchange is intrinsically linked to global markets. Negative trends in other major global stock markets exacerbated the decline in Amsterdam stocks.

Potential Long-Term Consequences for Amsterdam's Economy

The market volatility caused by trade war uncertainty carries significant potential long-term consequences for the Dutch economy. The immediate effects could ripple through the economy for years to come.

- Potential job losses and economic slowdown: Reduced business activity and investment can lead to job losses and a general economic slowdown. This is especially true for sectors heavily reliant on exports.

- Impact on foreign investment in the Netherlands: The uncertainty created by trade wars can deter foreign investment, hindering economic growth and development.

- Government response and mitigating strategies: The Dutch government's response and potential economic stimulus packages will play a crucial role in mitigating the long-term effects of this market volatility.

Strategies for Investors Navigating Market Volatility

Navigating the current market uncertainty requires a strategic approach. Investors need to adapt their strategies to mitigate risks and capitalize on opportunities.

- Diversification strategies: Diversifying investment portfolios across different asset classes and geographies can help mitigate risk.

- Staying informed: Staying updated on global trade developments, economic indicators, and market analyses is crucial for informed decision-making.

- Long-term investment strategies: Focusing on long-term investment goals, rather than reacting to short-term market fluctuations, is essential for navigating volatility.

Conclusion

The recent 7% plunge in Amsterdam stocks underscores the significant impact of trade war uncertainty on global and regional markets. Amsterdam's economy, particularly key export-oriented sectors, is vulnerable to these international trade tensions. The resulting market volatility necessitates careful consideration and strategic adjustments by investors. Stay informed about the evolving situation impacting Amsterdam stocks and global market volatility. Understanding the interplay between trade wars and market fluctuations is crucial for navigating the complexities of investing in Amsterdam stocks and other global markets. Monitor news and analyses related to Amsterdam stocks and trade war uncertainty to make informed investment decisions.

Featured Posts

-

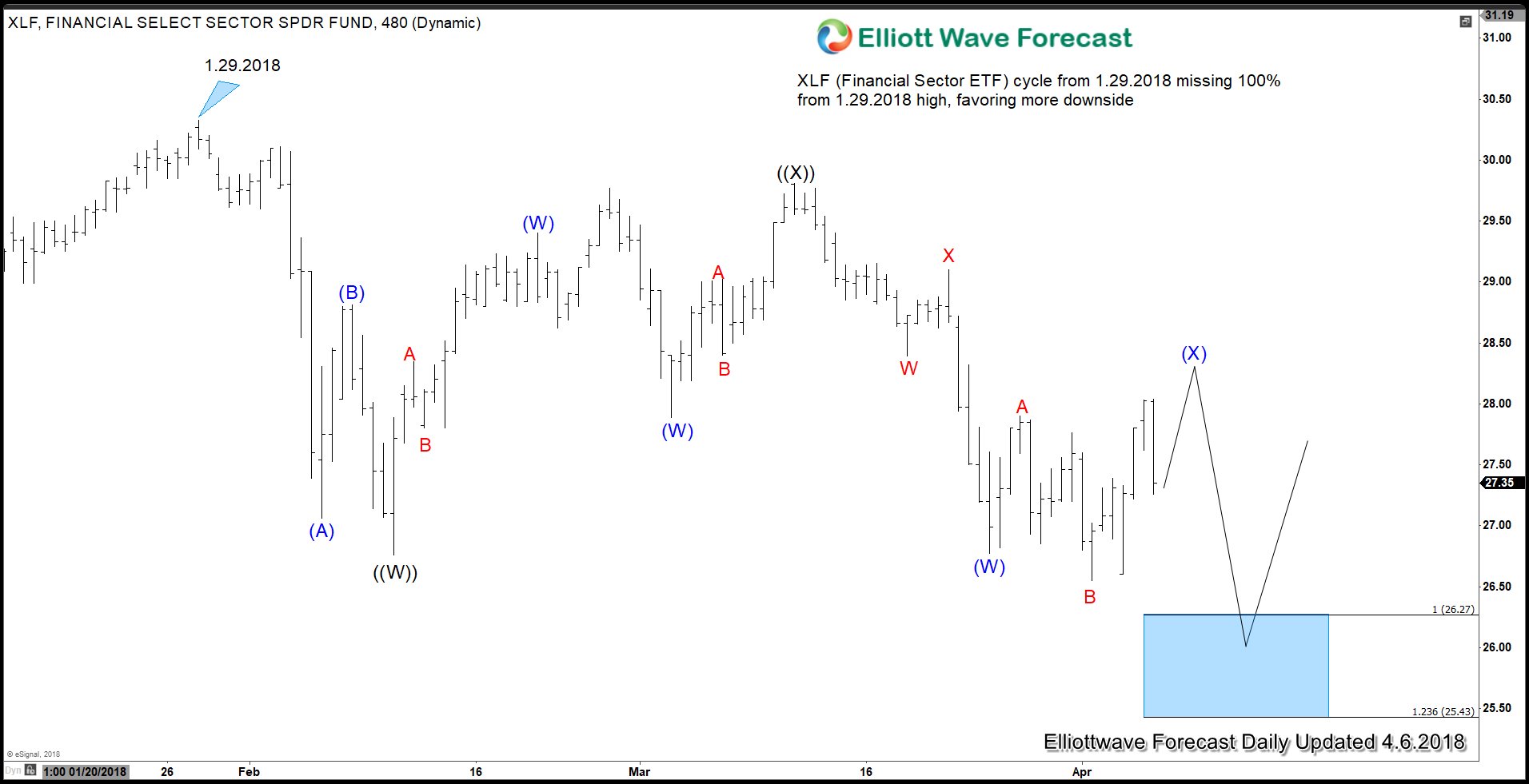

How To Prepare For And Respond To Flash Flood Warnings And Alerts

May 25, 2025

How To Prepare For And Respond To Flash Flood Warnings And Alerts

May 25, 2025 -

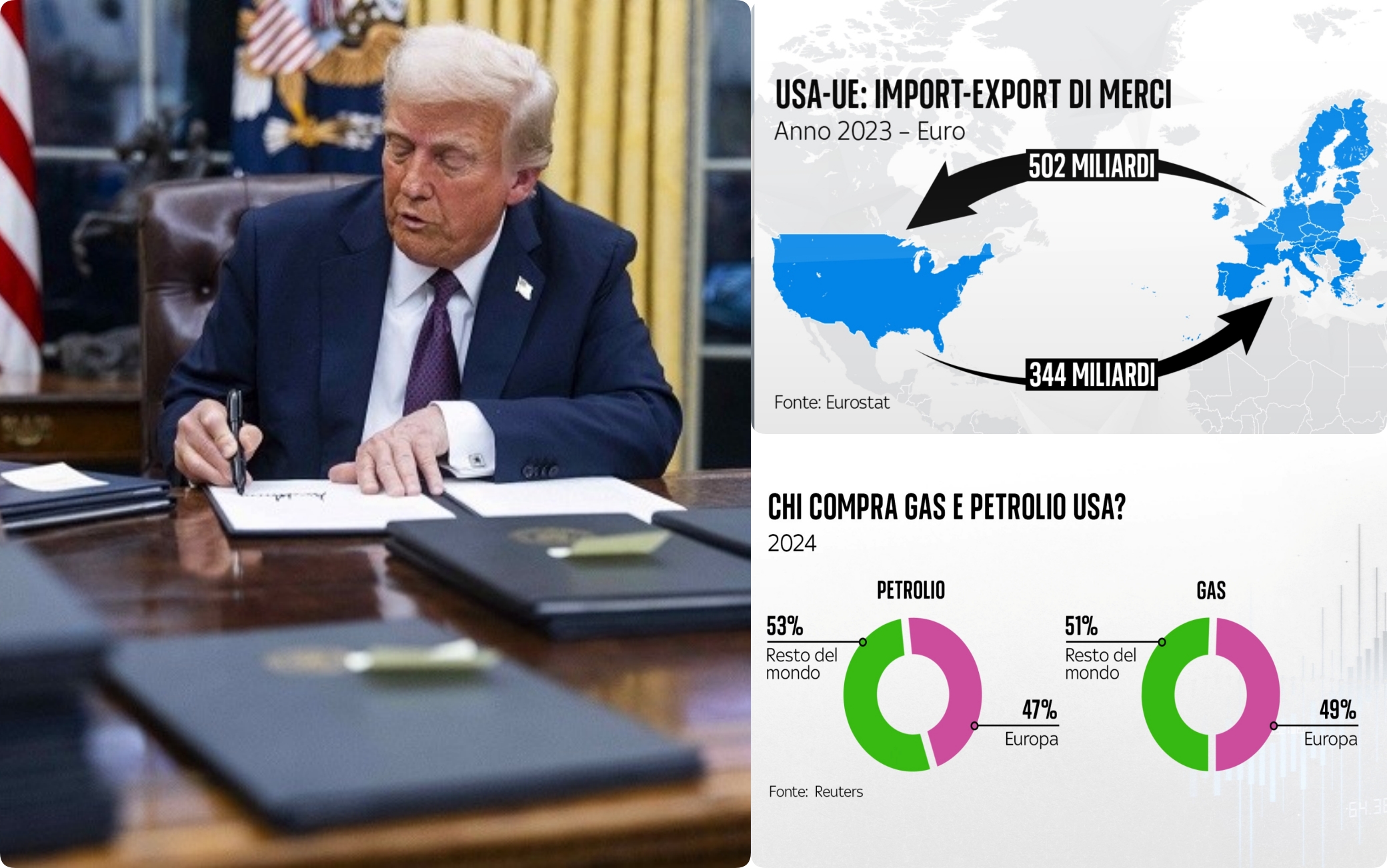

Dazi Trump 20 Impatto Sul Settore Moda Nike Lululemon E Le Conseguenze

May 25, 2025

Dazi Trump 20 Impatto Sul Settore Moda Nike Lululemon E Le Conseguenze

May 25, 2025 -

Caduta Borse Le Contromisure Dell Ue Di Fronte All Aumento Dei Dazi

May 25, 2025

Caduta Borse Le Contromisure Dell Ue Di Fronte All Aumento Dei Dazi

May 25, 2025 -

Guccis Massimo Vian Departs Supply Chain Shake Up

May 25, 2025

Guccis Massimo Vian Departs Supply Chain Shake Up

May 25, 2025 -

Glastonbury 2024 Unconfirmed Us Band Teases Festival Performance

May 25, 2025

Glastonbury 2024 Unconfirmed Us Band Teases Festival Performance

May 25, 2025

Latest Posts

-

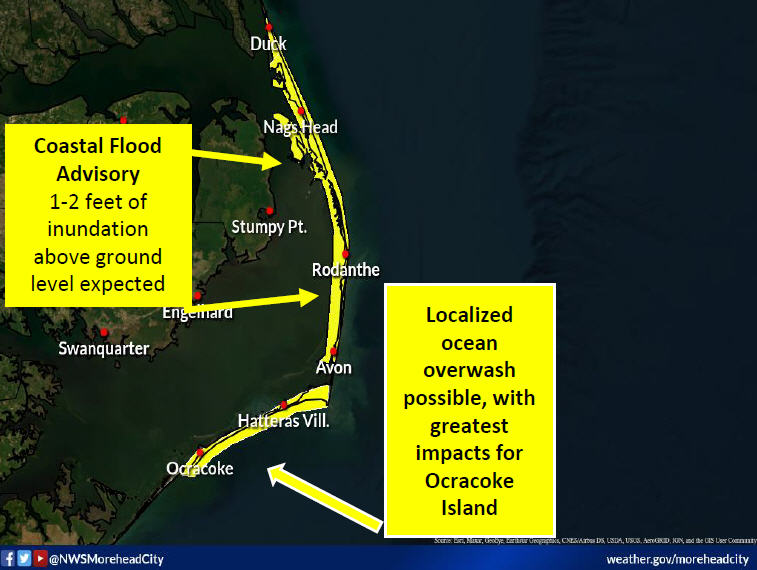

Southeast Pa Under Coastal Flood Advisory Wednesday

May 25, 2025

Southeast Pa Under Coastal Flood Advisory Wednesday

May 25, 2025 -

Pennsylvania Coastal Flood Advisory Wednesday Update

May 25, 2025

Pennsylvania Coastal Flood Advisory Wednesday Update

May 25, 2025 -

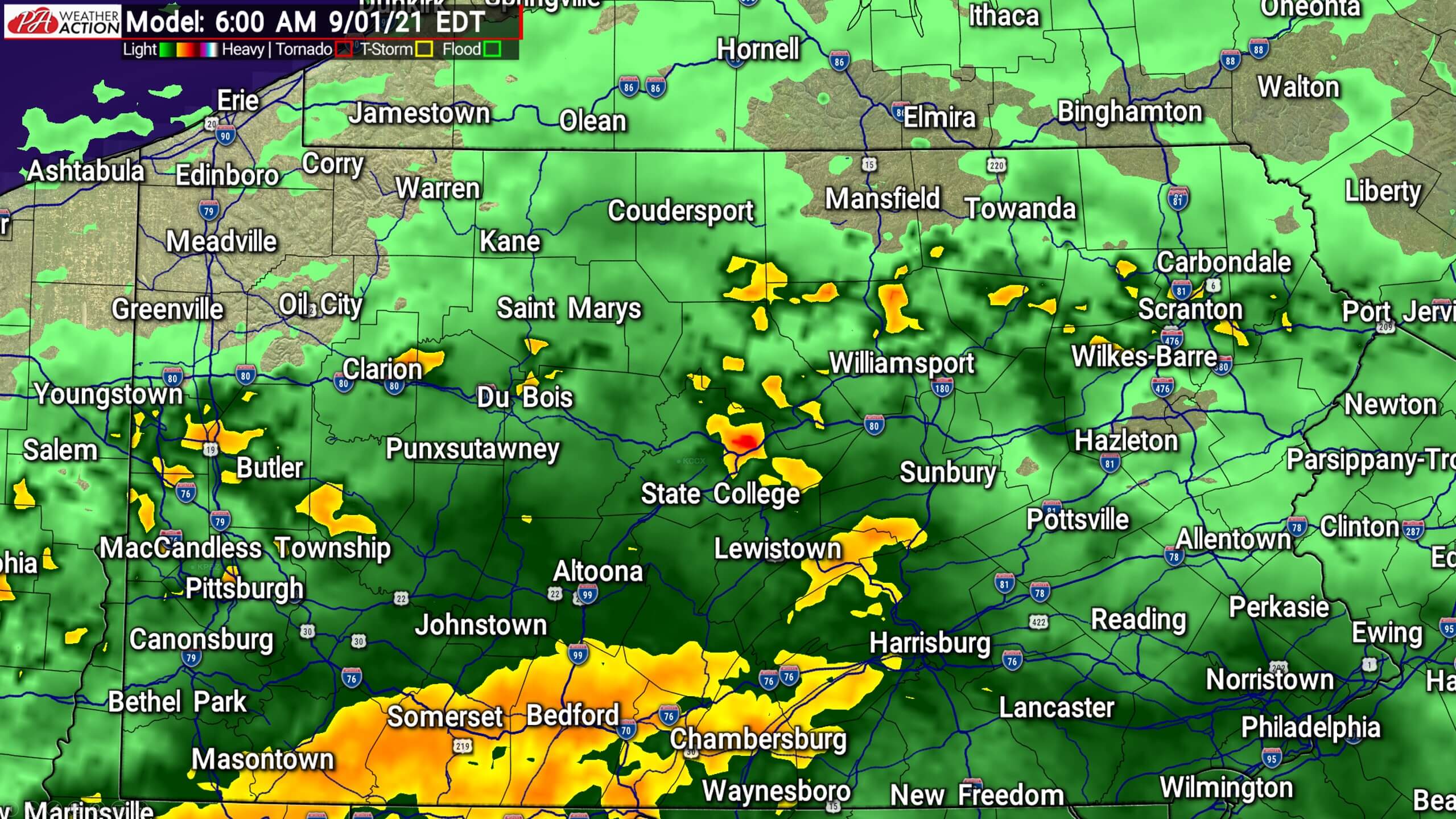

Bradford And Wyoming Counties Under Flash Flood Warning Until Tuesday

May 25, 2025

Bradford And Wyoming Counties Under Flash Flood Warning Until Tuesday

May 25, 2025 -

Urgent Coastal Flood Advisory In Effect For Southeast Pa Wednesday

May 25, 2025

Urgent Coastal Flood Advisory In Effect For Southeast Pa Wednesday

May 25, 2025 -

Coastal Flooding Warning Southeast Pennsylvania Wednesday

May 25, 2025

Coastal Flooding Warning Southeast Pennsylvania Wednesday

May 25, 2025