7-Year Sentence For GPB Capital Founder David Gentile In Ponzi-Scheme Case

Table of Contents

David Gentile, founder of GPB Capital, has been sentenced to seven years in prison for his role in a massive Ponzi scheme. This landmark case highlights the devastating consequences of investment fraud and underscores the critical need for robust investor protection. This article delves into the specifics of the case, the sentencing, and its implications for victims and the financial industry. Understanding the intricacies of the GPB Capital Ponzi scheme is crucial for preventing future financial losses.

The GPB Capital Ponzi Scheme: A Detailed Overview

GPB Capital Holdings, once a prominent player in the alternative investment market, orchestrated a complex Ponzi scheme that defrauded thousands of investors. The scheme primarily focused on private equity and alternative investments, promising exceptionally high returns with minimal risk – a classic red flag for potential fraud. These investments, however, were largely fictitious. Gentile and his associates actively engaged in fraudulent activities, including:

- Misrepresentation of Assets and Returns: Investors were presented with falsified financial statements and performance data, grossly exaggerating the value of underlying assets and the profitability of their investments.

- Millions of Dollars Raised from Investors: The scheme successfully raised millions of dollars from unsuspecting individuals and institutions, fueled by promises of lucrative, secure returns.

- False Promises of High Returns and Low Risk: The marketing materials emphasized unusually high returns, with little to no mention of inherent risks associated with such investments. This was a deliberate tactic to lure in investors.

- Misuse of Investor Funds for Personal Gain: Instead of investing the funds as promised, Gentile and his associates diverted significant portions of the money for personal enrichment, lavish lifestyles, and other illegitimate purposes.

- Lack of Transparency and Proper Accounting Practices: GPB Capital consistently lacked transparency in its operations, failing to provide investors with accurate and timely financial reporting, further obscuring the fraudulent activities.

The Sentencing of David Gentile and its Significance

David Gentile received a seven-year prison sentence for his involvement in the GPB Capital Ponzi scheme. He was charged with multiple felonies, including securities fraud, wire fraud, and conspiracy to commit fraud. The judge's decision reflected the severity of the crimes, the scale of the fraud, and the significant financial harm inflicted upon countless victims.

- Length of Sentence and Potential Fines: The seven-year sentence serves as a strong deterrent, signaling the legal consequences of orchestrating such large-scale financial crimes. Additional significant fines are likely.

- Restitution Orders for Victims: While a prison sentence is impactful, restitution orders are crucial for attempting to compensate victims for their financial losses, although full recovery is often unlikely in such cases.

- Legal Precedent Set by the Case: The Gentile sentencing sets a significant legal precedent, reinforcing the seriousness of Ponzi scheme prosecutions and potentially influencing future cases.

- Impact on Investor Confidence: While the sentencing may not fully restore investor confidence, it demonstrates a commitment to prosecuting those responsible for investment fraud, potentially helping rebuild some trust in the financial markets.

Impact on GPB Capital Investors and the Financial Industry

The GPB Capital Ponzi scheme inflicted substantial financial losses on thousands of investors. The precise amount of losses is still being determined, but it's estimated to be in the hundreds of millions of dollars. The ongoing efforts to recover funds for victims are complex and challenging, often involving lengthy legal battles and asset recovery processes.

- Number of Investors Affected: The scheme impacted a significant number of investors, both individuals and institutional investors, many of whom lost their life savings.

- Estimated Total Losses: The overall losses are substantial and continue to be assessed as investigations proceed.

- Role of Regulatory Bodies (e.g., SEC): The Securities and Exchange Commission (SEC) played a vital role in investigating and prosecuting the GPB Capital scheme. This highlights the importance of robust regulatory oversight in the financial industry.

- Increased Scrutiny of Alternative Investments: The GPB Capital scandal has led to increased scrutiny of the alternative investment industry as a whole, prompting calls for stricter regulations and enhanced investor protections.

Lessons Learned and Prevention Strategies

The GPB Capital Ponzi scheme serves as a stark reminder of the importance of due diligence and vigilance when making investment decisions. Several critical lessons can be learned from this case:

- Thorough Research of Investment Opportunities: Always conduct thorough research before investing in any opportunity, particularly those promising unusually high returns.

- Verification of Investment Claims and Returns: Never rely solely on marketing materials. Independently verify investment claims and past performance using reputable sources.

- Seeking Advice from Qualified Financial Professionals: Consult with a qualified and independent financial advisor before making significant investment decisions.

- Understanding Investment Risks: Be aware that all investments carry some level of risk. Understand the potential risks associated with any investment before committing your funds.

Conclusion

The seven-year sentence for David Gentile in the GPB Capital Ponzi scheme case underscores the devastating consequences of investment fraud. The scale of the scheme and the losses suffered by victims highlight the critical need for robust investor protection and increased vigilance against fraudulent investment opportunities. This case serves as a cautionary tale, emphasizing the importance of due diligence, seeking professional advice, and understanding the risks associated with investment decisions.

Call to Action: Learn more about protecting yourself from investment fraud and understanding the risks associated with GPB Capital-type schemes. Stay informed about financial scams and utilize resources available to ensure your investments are safe and secure. Understanding the intricacies of the GPB Capital Ponzi scheme case serves as a crucial step towards preventing future financial losses.

Featured Posts

-

Newark Mayor Ras Baraka Arrested Details On Ice Detention Center Protest

May 11, 2025

Newark Mayor Ras Baraka Arrested Details On Ice Detention Center Protest

May 11, 2025 -

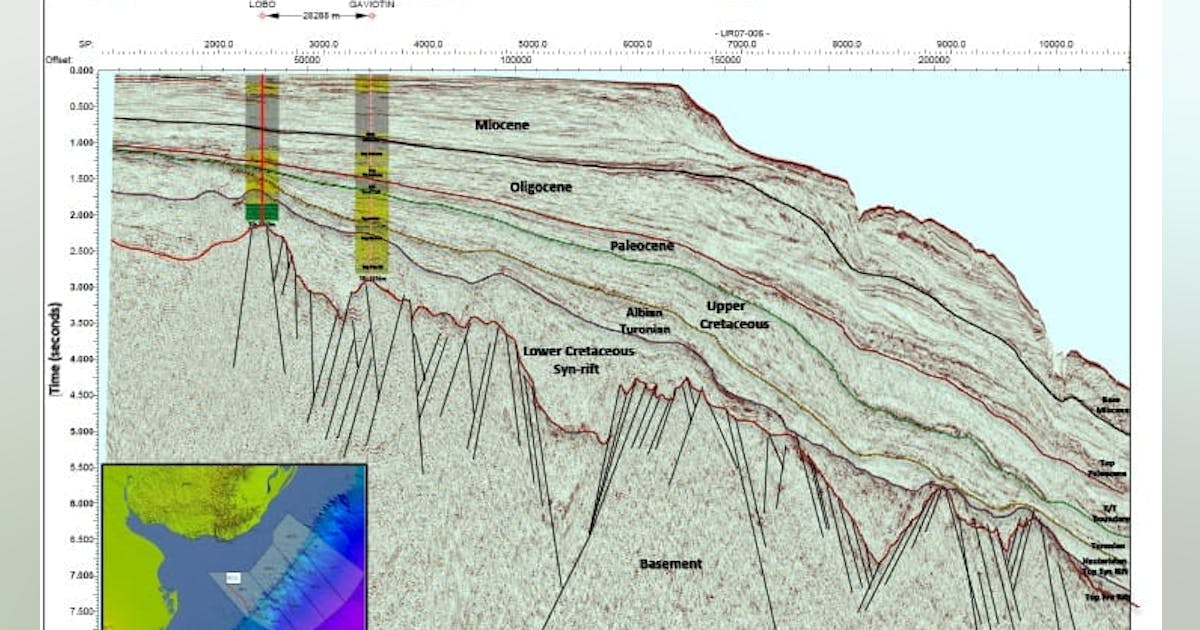

Can Uruguay Strike Black Gold Assessing Offshore Drilling Prospects

May 11, 2025

Can Uruguay Strike Black Gold Assessing Offshore Drilling Prospects

May 11, 2025 -

Discover Uruguay A Prime Location For Film And Television Production

May 11, 2025

Discover Uruguay A Prime Location For Film And Television Production

May 11, 2025 -

L Autruche De Mask Singer 2025 Indices Pronostics Et Identite Revelee

May 11, 2025

L Autruche De Mask Singer 2025 Indices Pronostics Et Identite Revelee

May 11, 2025 -

Cati Bani A Castigat Sylvester Stallone Din Rocky

May 11, 2025

Cati Bani A Castigat Sylvester Stallone Din Rocky

May 11, 2025