$9 Billion Budget Boost: Australia's Opposition Outlines Economic Plan

Table of Contents

Key Pillars of the $9 Billion Budget Boost

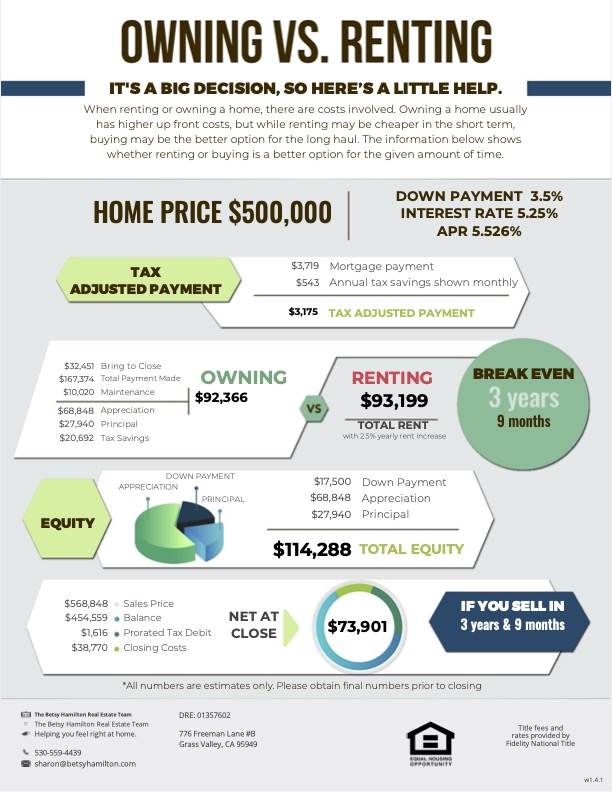

The opposition's $9 billion budget boost is built on three core pillars: investment in renewable energy, tax relief for small businesses, and a significant boost to education and skills training. This multi-pronged approach aims to stimulate economic growth, improve productivity, and create a more resilient and inclusive economy.

-

Increased funding for renewable energy initiatives – $3 billion: This substantial investment aims to accelerate the transition to cleaner energy, creating thousands of jobs in manufacturing, installation, and maintenance. The plan projects the creation of 50,000 jobs within the renewable energy sector over the next five years, contributing significantly to economic diversification and reducing carbon emissions.

-

Tax relief for small businesses – $2 billion: Targeting small and medium-sized enterprises (SMEs), this measure aims to reduce the tax burden on businesses employing under 20 people. The opposition argues this will encourage investment, job creation, and overall economic activity within this crucial sector of the Australian economy. The projected impact includes a 2% increase in SME investment and the creation of 30,000 new jobs.

-

Investment in education and skills training – $4 billion: Focusing on vocational training and higher education, this initiative aims to upskill the Australian workforce and equip it for the jobs of the future. The plan anticipates a significant improvement in workforce productivity, improved employment rates, and a more competitive Australian economy in the global market. This investment projects a 1.5% increase in workforce productivity within five years.

Funding Sources and Fiscal Responsibility

The opposition's plan details how this significant budget boost will be financed. While full details are still emerging, initial proposals suggest a combination of targeted tax reforms and strategic spending reductions in less efficient government programs.

-

Targeted Tax Reform: A proposed increase in tax on multinational corporations operating in Australia, focusing on those who haven't been paying their fair share, is expected to generate $1.5 billion. This measure aims to ensure greater equity in the tax system and increase government revenue.

-

Strategic Spending Reductions: The opposition plan includes cutting wasteful government spending. Approximately $1 billion in savings is projected by streamlining bureaucratic processes and reducing administrative costs within various government departments.

-

Fiscal Responsibility: The opposition emphasizes its commitment to fiscal responsibility. While acknowledging the increase in the national debt, they argue that this investment will yield significant long-term economic benefits, far outweighing the initial cost. Independent economic modelling will be commissioned to validate these claims.

Projected Economic Impact and Job Creation

The opposition projects a substantial positive impact on the Australian economy as a result of this $9 billion budget boost. Their economic modelling suggests significant growth and job creation across various sectors.

-

GDP Growth: The opposition projects a 1% increase in annual GDP growth within three years of implementing the plan. This improved economic growth rate is largely attributed to the increased investment and employment opportunities created by the plan’s initiatives.

-

Job Creation: Beyond the previously mentioned job creation figures, the opposition forecasts a total of 100,000 new jobs created across all sectors due to the indirect effects of increased economic activity, including construction, tourism, and the service industry.

-

Inflation and Interest Rates: The opposition acknowledges potential inflationary pressures but believes these will be manageable through fiscal prudence and responsible monetary policy. They are confident that the overall positive economic impact will outweigh any negative effects on interest rates.

Political Implications and Public Response

The opposition's $9 billion budget boost has sparked considerable political debate and public interest. The incumbent government has criticized the plan, questioning its funding sources and projected economic benefits.

-

Government Response: The government has labeled the plan as fiscally irresponsible and unrealistic, while offering its own competing economic strategies.

-

Public Opinion: Early public opinion polls indicate a generally positive response to the proposed plan, particularly regarding the investment in renewable energy and the tax relief for small businesses. However, concerns remain about the potential impact on the national debt.

-

Election Impact: This ambitious economic plan is likely to be a central issue in the upcoming election campaign, potentially influencing voter preferences and shaping the future political landscape.

Conclusion: Analyzing Australia's $9 Billion Budget Boost

Australia's opposition party has presented a comprehensive $9 billion budget boost plan designed to stimulate the Australian economy, create jobs, and build a more sustainable future. The plan's core pillars—investment in renewable energy, tax relief for small businesses, and education upgrades—aim to address key economic challenges. While concerns about funding and potential inflationary pressures exist, the projected economic growth and job creation figures offer a compelling vision for the future of the Australian economy. To learn more about the specifics of this "$9 billion budget boost" and to engage in the national conversation surrounding this crucial policy, visit the opposition party's website and review independent economic analyses of the proposal. This significant economic plan holds the potential to reshape the future of the Australian economy and improve the lives of Australians.

Featured Posts

-

Fortnite 34 30 Release Date Maintenance Schedule And Early Patch Notes

May 03, 2025

Fortnite 34 30 Release Date Maintenance Schedule And Early Patch Notes

May 03, 2025 -

Saturday Lotto Results April 12th Winning Numbers Revealed

May 03, 2025

Saturday Lotto Results April 12th Winning Numbers Revealed

May 03, 2025 -

Offshore Wind Weighing The Costs Against The Benefits

May 03, 2025

Offshore Wind Weighing The Costs Against The Benefits

May 03, 2025 -

Rumored Play Station Showcase What To Expect For Ps 5 Gamers

May 03, 2025

Rumored Play Station Showcase What To Expect For Ps 5 Gamers

May 03, 2025 -

I Skia Tis Diafthoras Pos Epireazei I Poleodomiki Diafthora Tin Epanidrysi Toy Kratoys

May 03, 2025

I Skia Tis Diafthoras Pos Epireazei I Poleodomiki Diafthora Tin Epanidrysi Toy Kratoys

May 03, 2025

Latest Posts

-

16 Million Fine For T Mobile Details On Three Years Of Data Security Lapses

May 04, 2025

16 Million Fine For T Mobile Details On Three Years Of Data Security Lapses

May 04, 2025 -

Open Ai Unveils Streamlined Voice Assistant Development At 2024 Event

May 04, 2025

Open Ai Unveils Streamlined Voice Assistant Development At 2024 Event

May 04, 2025 -

Open Ais 2024 Developer Event Easier Voice Assistant Development

May 04, 2025

Open Ais 2024 Developer Event Easier Voice Assistant Development

May 04, 2025 -

Open Ai Simplifies Voice Assistant Creation 2024 Developer Event Highlights

May 04, 2025

Open Ai Simplifies Voice Assistant Creation 2024 Developer Event Highlights

May 04, 2025 -

Millions In Losses Inside The Executive Office365 Hacking Scheme

May 04, 2025

Millions In Losses Inside The Executive Office365 Hacking Scheme

May 04, 2025