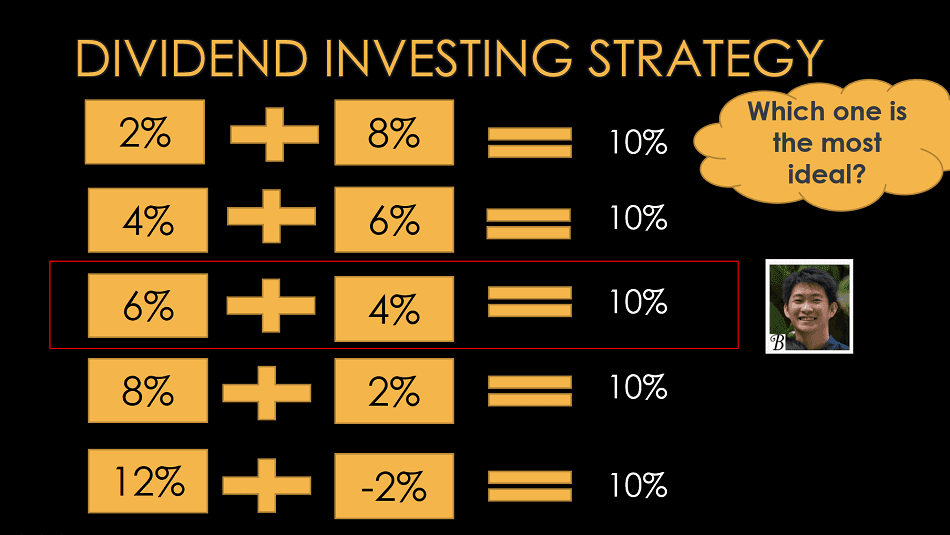

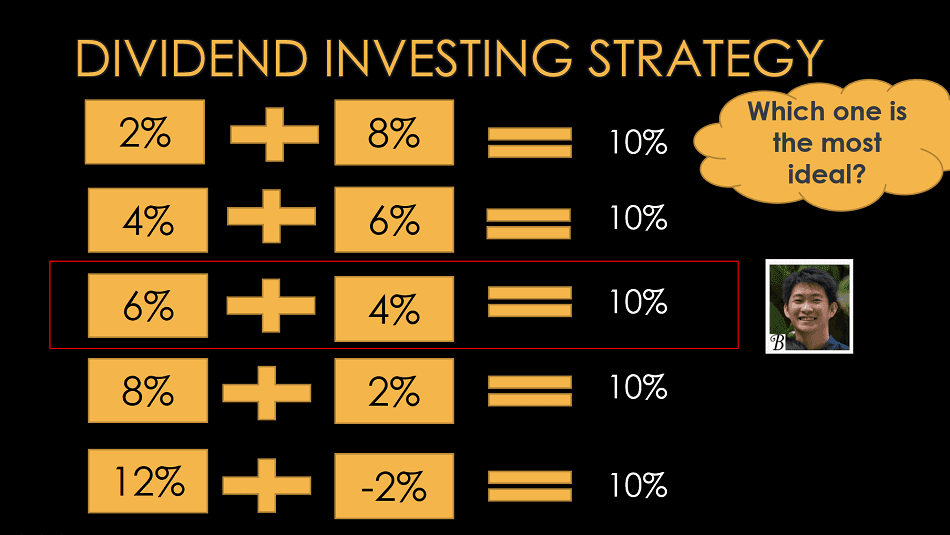

A Simple, High-Yield Dividend Strategy For Maximum Returns

Table of Contents

Understanding High-Yield Dividend Stocks

High-yield dividend stocks are equities that pay out a substantial portion of their earnings as dividends, typically exceeding the average dividend yield of the broader market. These stocks can offer a steady stream of income, potentially supplementing retirement funds or providing a regular cash flow. However, it's vital to understand the inherent risks. Companies offering exceptionally high dividend yields might be facing financial difficulties, leading to potential dividend cuts or even bankruptcy. This underscores the importance of meticulous due diligence.

- Focus on established companies with a long history of dividend payments: Look for companies with a proven track record of consistent dividend payouts, indicating financial stability and commitment to shareholders.

- Analyze payout ratios to assess sustainability: The payout ratio (dividends paid/earnings) reveals how much of a company's earnings are distributed as dividends. A high payout ratio might signal unsustainable dividend levels.

- Consider dividend growth history: Companies that consistently increase their dividends year-over-year demonstrate strong financial health and a commitment to rewarding shareholders.

- Diversify across sectors to mitigate risk: Don't put all your eggs in one basket. Spreading your investments across various sectors reduces the impact of poor performance in a single industry.

Identifying High-Yield Dividend Opportunities

Finding suitable high-yield dividend stocks requires a strategic approach. Several methods can help you identify promising opportunities. Utilizing financial ratios is critical. The dividend yield (annual dividend/stock price) is a key indicator, but it shouldn't be the sole determinant. Analyzing the payout ratio and return on equity (ROE) provides a more comprehensive picture of a company's financial health and dividend sustainability.

- Use reputable financial websites and databases: Utilize resources like Yahoo Finance, Google Finance, and Bloomberg to access company financials and stock screening tools.

- Look beyond just the dividend yield; consider the company's overall financial health: A high dividend yield alone doesn't guarantee a safe investment. Analyze factors like debt levels, revenue growth, and profitability.

- Pay attention to industry trends and economic forecasts: Understanding the broader economic landscape and industry-specific trends can help you anticipate potential risks and opportunities.

- Regularly review and rebalance your portfolio: Market conditions change, and companies' performance fluctuates. Regularly reviewing and rebalancing your portfolio is essential to maintain a healthy high-yield dividend strategy.

Building a Diversified Dividend Portfolio

Diversification is paramount in mitigating risk within a high-yield dividend strategy. A well-diversified portfolio reduces the impact of poor performance by any single stock or sector. This involves spreading your investments across different sectors, geographies, and company sizes. Gradually building your portfolio allows for careful consideration and reduces the risk of impulsive decisions. Reinvesting dividends through a Dividend Reinvestment Plan (DRIP) accelerates your wealth-building process via compounding.

- Spread investments across multiple sectors (e.g., technology, healthcare, consumer staples): This approach ensures that your portfolio isn't overly reliant on the performance of a single industry.

- Consider geographical diversification (international stocks): Investing in companies outside your home country can reduce risk and potentially expose you to higher growth opportunities.

- Don't put all your eggs in one basket – diversify across multiple companies: Avoid concentrating your investments in a few companies; spread your risk across a larger number of holdings.

- Reinvest dividends to compound your returns (DRIP – Dividend Reinvestment Plan): Automatically reinvesting your dividends buys more shares, leading to accelerated growth over time.

Managing Your High-Yield Dividend Portfolio

A successful high-yield dividend strategy necessitates ongoing monitoring and adaptation. Regular portfolio reviews are crucial to identify underperforming assets and adjust your holdings accordingly. Rebalancing your portfolio periodically ensures that your asset allocation remains aligned with your investment goals and risk tolerance. Furthermore, understanding the tax implications of dividend income is essential for effective financial planning.

- Track dividend payments and yields: Keep a close eye on your dividend income to monitor the performance of your investments.

- Rebalance your portfolio periodically (e.g., annually or semi-annually): This ensures that your asset allocation remains aligned with your investment strategy.

- Stay informed about market trends and company news: Staying abreast of current events can help you make informed decisions about your portfolio.

- Consult a financial advisor for personalized advice: A financial advisor can provide tailored guidance based on your individual circumstances and investment objectives.

Conclusion

A simple, high-yield dividend strategy can be an effective approach to building long-term wealth. By carefully selecting high-quality dividend stocks, diversifying your portfolio, and regularly monitoring your investments, you can significantly increase your chances of maximizing returns. Remember to always conduct thorough research and consider seeking professional financial advice before making any investment decisions. Start building your high-yield dividend strategy today and watch your income grow! Don't delay – begin exploring the world of high-yield dividends and unlock the potential for consistent, substantial returns.

Featured Posts

-

Parliamentary Majority Defeats No Confidence Motion On Asylum Minister

May 11, 2025

Parliamentary Majority Defeats No Confidence Motion On Asylum Minister

May 11, 2025 -

2025 Indy 500 Notable Driver Absence Confirmed

May 11, 2025

2025 Indy 500 Notable Driver Absence Confirmed

May 11, 2025 -

Bctvs Daily Dispatch News On Superman Daredevil Vs Bullseye And 1923

May 11, 2025

Bctvs Daily Dispatch News On Superman Daredevil Vs Bullseye And 1923

May 11, 2025 -

Ray Epps Sues Fox News For Defamation Details Of The Jan 6th Case

May 11, 2025

Ray Epps Sues Fox News For Defamation Details Of The Jan 6th Case

May 11, 2025 -

Aaron Judge Ties Babe Ruths Yankees Record A Historic Feat

May 11, 2025

Aaron Judge Ties Babe Ruths Yankees Record A Historic Feat

May 11, 2025