A Step-by-Step Guide To Finance Loans: Application, Interest, And Repayment

Table of Contents

Understanding Finance Loan Applications

Successfully applying for a finance loan begins with understanding the different types available and gathering the necessary documentation. The application process itself requires careful attention to detail to maximize your chances of approval.

Choosing the Right Loan Type

Different finance loans cater to different needs. Choosing the right one is the first step towards securing funding.

- Personal Loans: Used for various purposes like debt consolidation, home improvements, or unexpected expenses. They typically have shorter repayment terms than other loan types.

- Mortgage Loans: Specifically designed for purchasing real estate. These loans are secured by the property itself, making them a significant financial commitment.

- Business Loans: Help entrepreneurs and business owners fund operations, expansion, or equipment purchases. Approval often depends on business financials and creditworthiness.

- Student Loans: Assist individuals in financing their education. Repayment typically begins after graduation or completion of studies.

Choosing the right loan type depends heavily on your financial situation and the intended use of the funds. Carefully consider your options and compare loan types before making a decision. Keywords: Personal loan, mortgage loan, business loan, student loan, loan types, loan options.

Gathering Necessary Documentation

A successful loan application hinges on providing complete and accurate documentation. Lenders require this to assess your creditworthiness and ability to repay the loan. Common required documents include:

- Income statements: Pay stubs, W-2 forms, or tax returns demonstrating your income.

- Bank statements: Showing your financial history and available funds.

- Credit reports: Your credit score and history are crucial indicators of your creditworthiness.

- Tax returns: Provide further details about your income and financial situation.

- Proof of address: Verifying your residency.

Ensure all documents are up-to-date and accurately reflect your current financial standing. Keywords: Loan application documents, required documents, financial documents.

Completing the Application Process

The application process can vary depending on the lender and loan type. Many lenders offer online applications, streamlining the process. However, some may still require in-person applications.

- Online Applications: Generally faster and more convenient, often providing instant feedback on application status.

- In-Person Applications: May involve meeting with a loan officer and providing physical copies of documents.

Regardless of the method, carefully review the application form before submission. Double-check all information for accuracy to avoid delays or rejection. Keywords: Loan application process, online loan application, completing loan application.

Decoding Interest Rates and Fees

Understanding interest rates and associated fees is crucial for comparing loan offers and making informed financial decisions.

Understanding Interest Rates

The Annual Percentage Rate (APR) represents the total cost of borrowing, including interest and fees. It's expressed as a yearly percentage. There are two main types:

- Fixed Interest Rates: Remain constant throughout the loan term, offering predictable monthly payments.

- Variable Interest Rates: Fluctuate based on market conditions, potentially leading to changes in monthly payments.

Understanding the difference between fixed and variable interest rates is critical for budgeting and financial planning. Keywords: Interest rate, APR, fixed interest rate, variable interest rate, loan interest.

Identifying and Avoiding Hidden Fees

Beyond the interest rate, several fees can impact the total cost of borrowing. Be aware of:

- Origination Fees: Charged by lenders to process the loan application.

- Processing Fees: Cover the administrative costs involved in handling your loan.

- Prepayment Penalties: Penalties for paying off the loan early.

- Late Payment Fees: Charged for missed or late payments.

Transparency is key. Look for lenders who clearly outline all fees upfront to avoid unexpected costs. Keywords: Loan fees, hidden fees, origination fee, processing fee, prepayment penalty, late payment fee.

Comparing Loan Offers

Before committing to a loan, compare multiple offers from different lenders. Use online comparison tools to easily evaluate options. Consider these factors:

- Total cost of borrowing: Including interest, fees, and the loan term.

- Repayment schedule: Choose a repayment plan that fits your budget.

- Loan terms: The length of the loan and its impact on your total interest payments.

Keywords: Compare loan offers, best loan rates, loan comparison tools.

Managing Finance Loan Repayment

Effective repayment management ensures you avoid late payments and maintain a healthy credit score.

Creating a Repayment Budget

A realistic budget is essential to accommodate your loan repayments. Track your income and expenses carefully.

- Prioritize loan repayments alongside essential living expenses.

- Explore strategies for increasing income or reducing expenses to free up funds.

- Automate payments to avoid missed payments and late fees.

Keywords: Loan repayment budget, debt repayment plan, managing loan payments.

Understanding Repayment Schedules

Most finance loans follow an amortization schedule, detailing the breakdown of principal and interest payments over the loan's lifespan.

- Standard Amortization: Equal payments spread over the loan term.

- Accelerated Repayment: Making larger payments to reduce the loan term and overall interest paid.

Understanding your repayment schedule allows for better financial planning and helps you track progress. Keywords: Loan repayment schedule, amortization schedule, loan payment plan.

Handling Potential Repayment Challenges

Life can throw curveballs. If you face repayment difficulties:

- Contact your lender immediately: Discuss your situation and explore potential solutions, such as forbearance or modification.

- Explore refinancing options: A lower interest rate or extended term may ease your burden.

- Seek professional financial advice: A financial advisor can provide guidance and help you create a debt management plan.

Keywords: Loan repayment challenges, loan default, refinancing loan, financial hardship.

Conclusion

Successfully navigating the world of finance loans involves careful planning and understanding. By following the steps outlined in this guide – from carefully selecting the right loan type and gathering the necessary documents to understanding interest rates and managing your repayment schedule – you can significantly increase your chances of securing a loan that meets your needs and fits your budget. Remember to compare different finance loan options and always read the fine print before signing any agreement. Don't hesitate to seek professional financial advice if you need further assistance with your finance loan application and repayment. Start your search for the perfect finance loan today!

Featured Posts

-

Akp Djauhari Mengawali Tugas Sebagai Kasatlantas Polresta Balikpapan Dengan Memimpin Sholat Subuh

May 28, 2025

Akp Djauhari Mengawali Tugas Sebagai Kasatlantas Polresta Balikpapan Dengan Memimpin Sholat Subuh

May 28, 2025 -

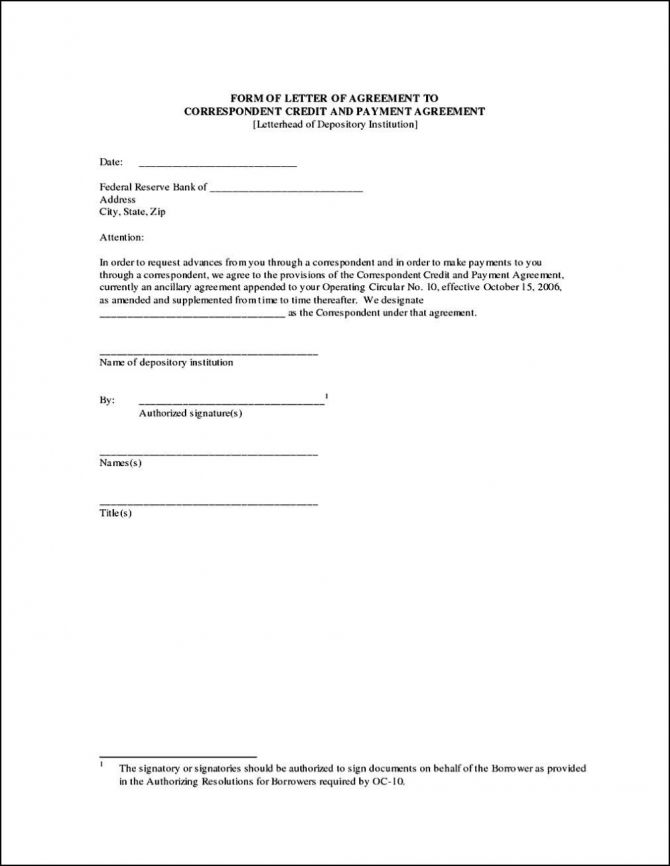

Understanding The Impacts Of Dangerous Climate Whiplash In Global Cities

May 28, 2025

Understanding The Impacts Of Dangerous Climate Whiplash In Global Cities

May 28, 2025 -

Polresta Balikpapan Kasatlantas Baru Akp Djauhari Pimpin Sholat Subuh Berjamaah

May 28, 2025

Polresta Balikpapan Kasatlantas Baru Akp Djauhari Pimpin Sholat Subuh Berjamaah

May 28, 2025 -

The 99th Minute Heartbreak Ajaxs Nine Point Title Collapse

May 28, 2025

The 99th Minute Heartbreak Ajaxs Nine Point Title Collapse

May 28, 2025 -

Maintaining The Reign The Story Of Romes Champion

May 28, 2025

Maintaining The Reign The Story Of Romes Champion

May 28, 2025

Latest Posts

-

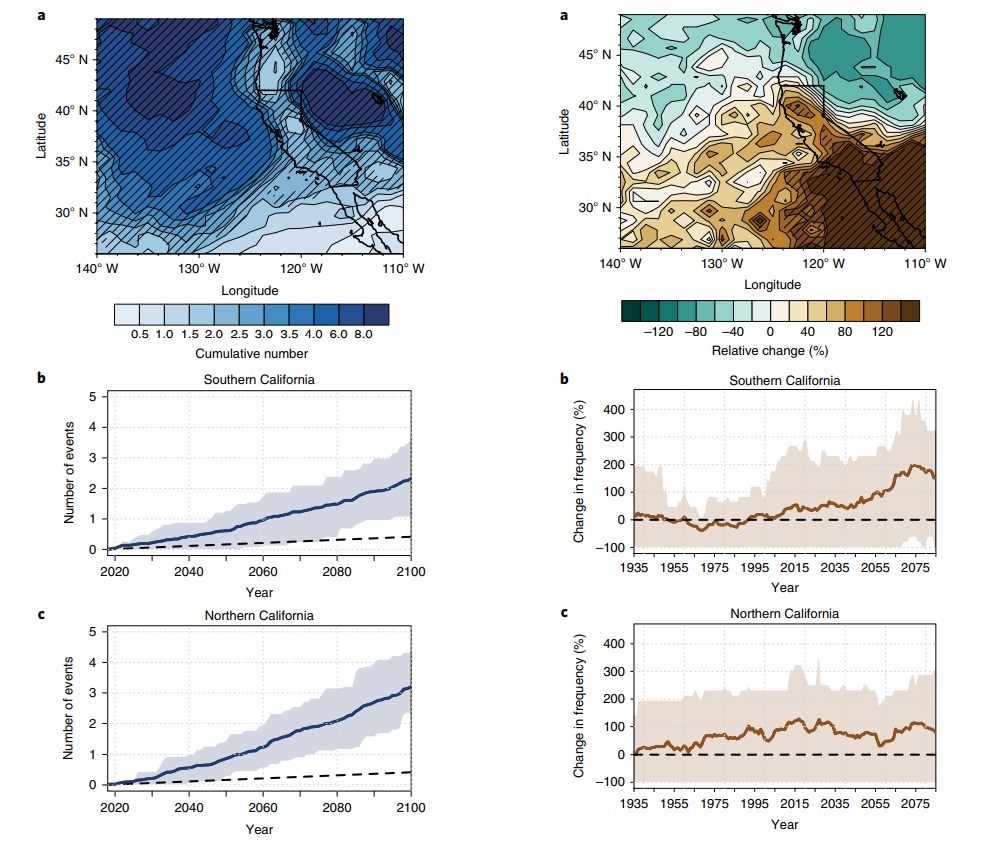

Le Jugement De Marine Le Pen Divisions Et Consequences De La Sentence

May 30, 2025

Le Jugement De Marine Le Pen Divisions Et Consequences De La Sentence

May 30, 2025 -

Ineligibilite De Marine Le Pen L Impact De La Decision Sur La Politique Francaise

May 30, 2025

Ineligibilite De Marine Le Pen L Impact De La Decision Sur La Politique Francaise

May 30, 2025 -

La Condamnation De Marine Le Pen Analyse D Une Decision Judiciaire Contestee

May 30, 2025

La Condamnation De Marine Le Pen Analyse D Une Decision Judiciaire Contestee

May 30, 2025 -

Marine Le Pen Condamnee 5 Ans D Ineligibilite Et Les Reactions Politiques

May 30, 2025

Marine Le Pen Condamnee 5 Ans D Ineligibilite Et Les Reactions Politiques

May 30, 2025 -

Cinq Ans D Ineligibilite Pour Marine Le Pen Une Decision Judiciaire Divisive

May 30, 2025

Cinq Ans D Ineligibilite Pour Marine Le Pen Une Decision Judiciaire Divisive

May 30, 2025