ABN Amro: Dutch Central Bank Investigates Bonus Payments

Table of Contents

The Trigger for the DNB Investigation

The DNB investigation into ABN Amro's bonus payments wasn't triggered by a single event but rather a confluence of concerns. Reports suggest that the central bank's scrutiny stems from several potential breaches of financial regulations and concerns about risk management practices linked to the bank's bonus schemes. These concerns likely emerged from a combination of factors, including:

- Potential violations of bonus caps: The Netherlands, like many other European countries, has regulations limiting the size of bonuses paid to executives in financial institutions. The DNB may be investigating whether ABN Amro exceeded these legally mandated limits.

- Insufficient risk management oversight: Concerns may exist regarding the link between the bank's bonus structure and potentially excessive risk-taking. Did the incentive structure encourage employees to prioritize short-term gains over long-term stability and sound risk management?

- Whistleblower allegations: Internal concerns raised by employees could have played a significant role in prompting the investigation. Whistleblowers often provide critical insights into internal practices that might otherwise remain hidden.

- Public pressure and media scrutiny: Negative media coverage and public pressure regarding the ethical implications of exorbitant bonuses in the financial sector may have also contributed to the DNB initiating this formal investigation.

While the DNB has not publicly disclosed the precise reasons for the investigation, these factors represent plausible explanations given the current regulatory climate and public sensitivity surrounding executive compensation in the banking industry.

The Scope of the Investigation

The DNB's investigation is likely comprehensive, encompassing various aspects of ABN Amro's bonus system. The central bank is probably examining:

- The size and distribution of bonuses: The DNB will be meticulously reviewing the amounts paid as bonuses, comparing them to regulatory limits and analyzing their proportionality to individual performance and the bank's overall financial health.

- Criteria for awarding bonuses: The investigation will scrutinize the methodology used to determine bonus eligibility and amounts. Were the criteria transparent, objective, and aligned with risk management principles?

- Transparency of the bonus structure: The DNB will assess whether the bank’s bonus system was clearly communicated to employees and stakeholders, ensuring accountability and understanding of the processes involved.

- Time period covered: The investigation will cover a specific time frame, the exact length of which hasn’t been publicly revealed, but it’s likely to be several years to allow for a thorough assessment of trends and patterns in bonus payments.

The DNB's methodology likely involves a thorough review of internal documents, interviews with ABN Amro employees, and potentially external expert analysis.

Potential Consequences for ABN Amro

If the DNB's investigation uncovers irregularities in ABN Amro's bonus payment practices, the bank faces significant consequences:

- Substantial financial penalties: The DNB has the power to impose hefty fines on ABN Amro for any breaches of financial regulations.

- Reputational damage: A negative outcome could severely damage ABN Amro's reputation, impacting its ability to attract clients and talent.

- Changes to executive compensation policies: The bank might be required to overhaul its bonus system, aligning it more closely with regulatory requirements and best practices in risk management.

- Potential legal action: Depending on the severity of the findings, ABN Amro could face legal action from investors, regulators, or even employees.

The impact on shareholder confidence and ABN Amro's stock price would be considerable, potentially leading to a decline in the bank's market value.

Wider Implications for the Dutch Banking Sector

The DNB's investigation into ABN Amro's bonus payments has implications that extend beyond a single institution. It sets a precedent for other Dutch banks, signaling a renewed focus on regulatory compliance in executive compensation. This investigation might trigger:

- Increased regulatory scrutiny: Other Dutch banks can expect stricter monitoring of their bonus structures and risk management practices.

- Changes to banking regulations: The outcome of the investigation could lead to adjustments in Dutch banking regulations, potentially tightening controls over bonus payments and strengthening oversight mechanisms.

- Industry-wide reforms: The investigation might spur a broader reform of bonus structures within the Dutch banking sector, promoting more responsible and ethical compensation practices.

ABN Amro's Response to the Investigation

ABN Amro has issued a statement expressing its cooperation with the DNB's investigation. The bank has pledged to provide all necessary information and documentation to facilitate a thorough and transparent review. While specific actions taken by ABN Amro in response to the investigation haven't been detailed publicly, the bank likely aims to demonstrate its commitment to regulatory compliance and ethical conduct. Further statements from ABN Amro executives will be crucial in shaping public understanding of the bank's position and any planned reforms.

Conclusion: Understanding the ABN Amro Bonus Payment Investigation and its Future Ramifications

The DNB's investigation into ABN Amro's bonus payments is a significant event with wide-ranging implications for the Dutch banking sector. The potential consequences for ABN Amro—fines, reputational damage, and policy changes—are substantial. Furthermore, the investigation could trigger increased regulatory scrutiny across the Dutch banking sector, leading to potential changes in banking regulations and industry-wide reforms regarding executive compensation and risk management. Staying informed about the developments in this investigation is crucial for understanding the future of bonus payments and regulatory compliance within the Dutch financial system. Stay updated on the unfolding investigation into ABN Amro's bonus payments by subscribing to our newsletter or following us on social media.

Featured Posts

-

Vanja Mijatovic Detalji O Razvodu I Borbi Protiv Traceva

May 21, 2025

Vanja Mijatovic Detalji O Razvodu I Borbi Protiv Traceva

May 21, 2025 -

10 Man Juventus Held To Draw By Lazio

May 21, 2025

10 Man Juventus Held To Draw By Lazio

May 21, 2025 -

Cassis Blackcurrant From Berry To Bottle

May 21, 2025

Cassis Blackcurrant From Berry To Bottle

May 21, 2025 -

Mntkhb Amryka Thlathy Jdyd Yqthm Qaymt Bwtshytynw

May 21, 2025

Mntkhb Amryka Thlathy Jdyd Yqthm Qaymt Bwtshytynw

May 21, 2025 -

Railroad Bridge Accident Two Adults Killed Children Injured And One Missing

May 21, 2025

Railroad Bridge Accident Two Adults Killed Children Injured And One Missing

May 21, 2025

Latest Posts

-

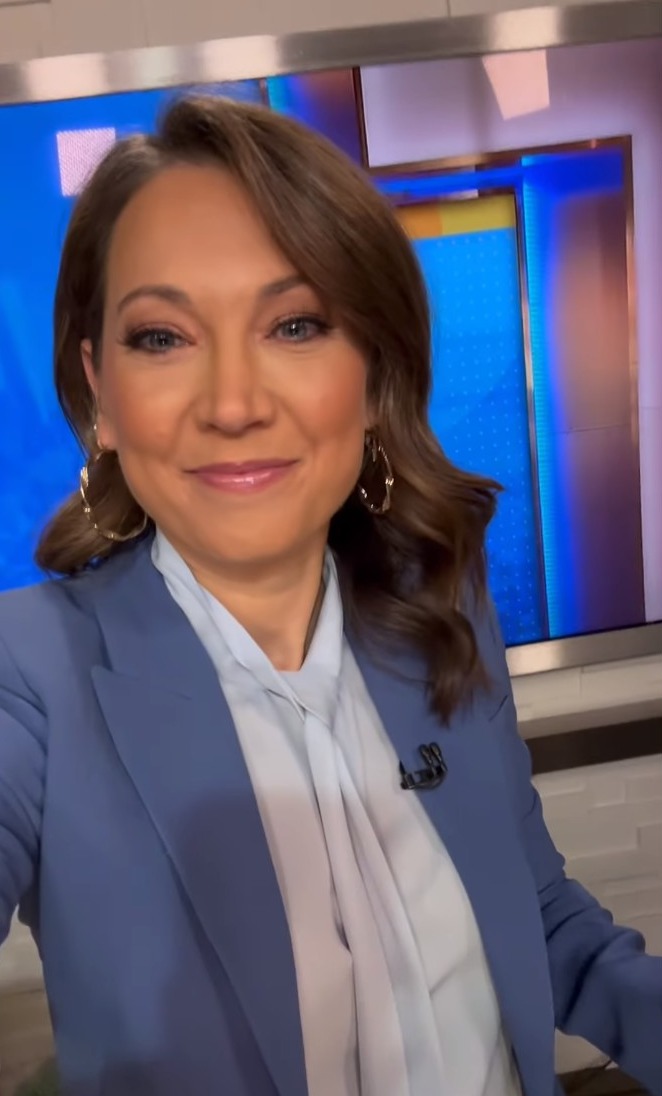

Robin Roberts Announces Addition To Her Family On Gma

May 21, 2025

Robin Roberts Announces Addition To Her Family On Gma

May 21, 2025 -

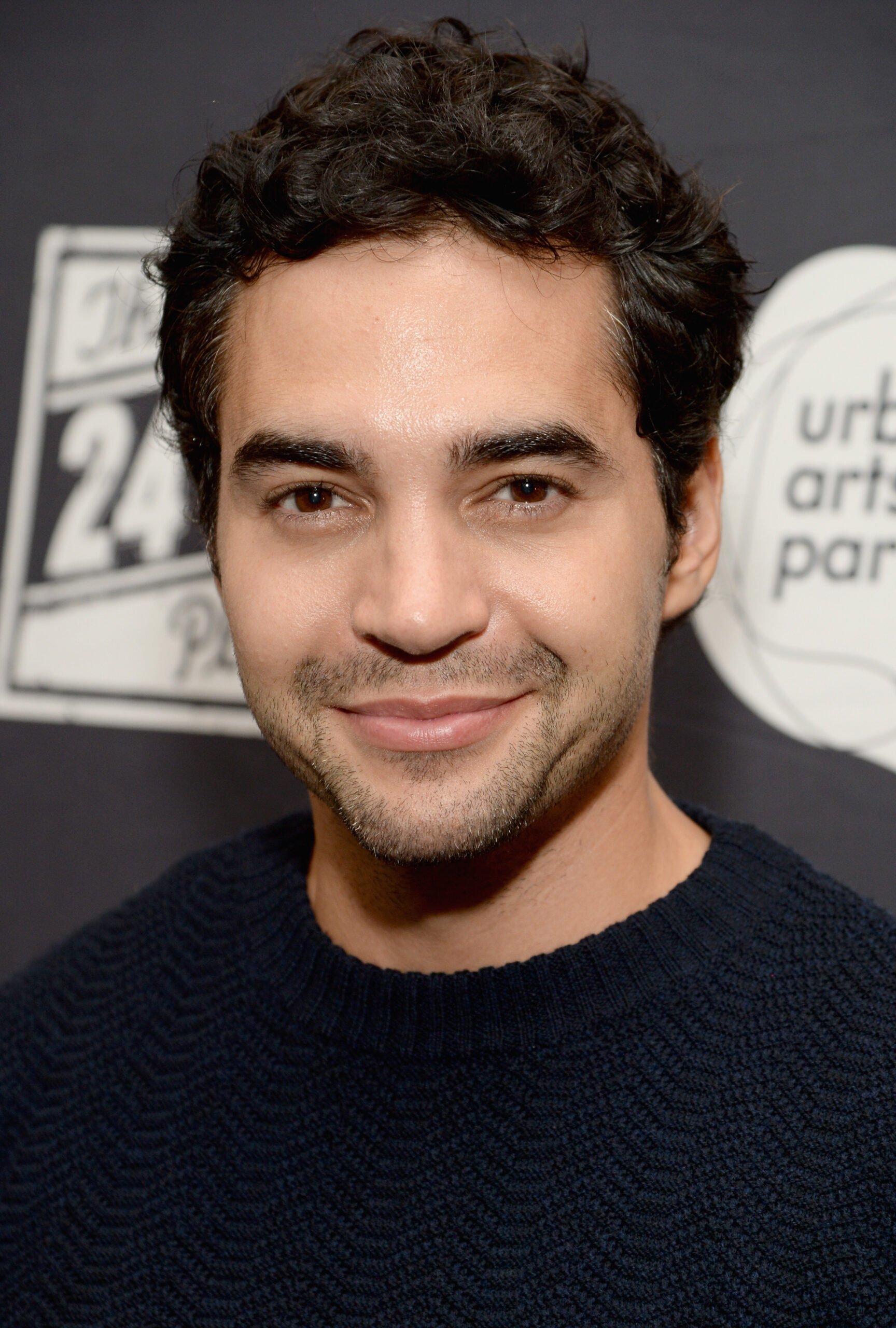

Actor Ramon Rodriguez Shares Story Of Sleeping Through Multiple Scorpion Stings On Will Trent Set

May 21, 2025

Actor Ramon Rodriguez Shares Story Of Sleeping Through Multiple Scorpion Stings On Will Trent Set

May 21, 2025 -

Will Trent Actor Ramon Rodriguezs Unexpected Scorpion Encounter

May 21, 2025

Will Trent Actor Ramon Rodriguezs Unexpected Scorpion Encounter

May 21, 2025 -

Michael Strahans Departure From Good Morning America The Real Reason

May 21, 2025

Michael Strahans Departure From Good Morning America The Real Reason

May 21, 2025 -

Gmas Ginger Zee In Asheville Promoting The Helene Special On Wlos

May 21, 2025

Gmas Ginger Zee In Asheville Promoting The Helene Special On Wlos

May 21, 2025