ABN Amro Facing Dutch Central Bank Scrutiny Over Bonus Payments

Table of Contents

The Nature of the DNB Investigation

The DNB's investigation into ABN Amro's bonus schemes focuses on several key aspects. The central bank is examining the size of bonuses awarded to employees, the criteria used to determine bonus eligibility, and whether these practices align with Dutch banking regulations. The investigation aims to ensure fair and responsible compensation practices within the financial institution, preventing excessive risk-taking incentivized by overly generous bonus structures.

- Timeline: The investigation began in [Insert Start Date if known, otherwise, use phrasing like "recent months"] and is ongoing. The DNB has not yet disclosed a projected completion date.

- Regulations: The investigation likely centers around compliance with Dutch banking laws concerning responsible risk management and the prevention of excessive risk-taking driven by bonus structures. Specific legislation, such as [mention relevant Dutch banking laws if known, otherwise, use general phrasing like "laws pertaining to responsible banking practices and executive compensation"], is likely under review.

- Preliminary Findings: At the time of writing, the DNB has not publicly released any preliminary findings or statements regarding the specifics of the investigation. However, the very initiation of such a high-profile investigation suggests significant concerns regarding ABN Amro’s bonus payment practices.

Potential Implications for ABN Amro

If the DNB finds ABN Amro to be in violation of regulations concerning its bonus payments, the consequences could be severe. The repercussions extend beyond simple financial penalties; reputational damage could significantly impact investor confidence and future business prospects.

- Financial Penalties: ABN Amro faces the possibility of substantial fines, depending on the severity of any violations discovered. The amount of the fine could be considerable, affecting the bank's profitability and financial stability.

- Reputational Damage: A negative outcome in the DNB's investigation could severely damage ABN Amro's reputation. Loss of public trust and diminished investor confidence could lead to decreased share prices and difficulties attracting and retaining clients.

- Policy Changes: To avoid future regulatory issues, ABN Amro may need to overhaul its bonus structures and internal policies related to executive compensation. This would involve significant restructuring and could lead to increased compliance costs.

- Impact on Business Operations: The ongoing investigation and potential penalties could negatively impact ABN Amro's ability to invest in growth opportunities and may lead to a tightening of lending practices.

Wider Implications for the Dutch Banking Sector

The DNB's investigation into ABN Amro's bonus payments has significant implications for the entire Dutch banking sector. Other financial institutions are likely facing increased scrutiny, leading to a potential wave of reviews and adjustments to compensation structures.

- Increased Regulatory Scrutiny: The DNB's actions signal a stricter regulatory environment for bonus payments across the Dutch banking industry. Banks will need to ensure meticulous compliance with existing regulations and anticipate potential changes.

- Similar Investigations: The ABN Amro investigation could trigger similar probes into other Dutch banks' bonus practices. This increased oversight could result in industry-wide changes in compensation policies.

- Industry-Wide Changes: The outcome of this investigation could push the entire Dutch banking sector to adopt more cautious and transparent bonus systems, aligning with stricter ethical and regulatory standards.

- Investor Sentiment: The DNB's actions could impact investor confidence in the Dutch banking sector as a whole, potentially affecting share prices and attracting less investment.

Comparison to International Banking Practices

While specific details of ABN Amro's bonus practices are not publicly available within the context of the investigation, comparing them to international banking standards reveals a trend toward stricter regulation globally. Many countries have implemented stricter rules following the 2008 financial crisis to curtail excessive risk-taking. While details vary across jurisdictions, the overarching goal is to align compensation schemes with responsible risk management, preventing practices that might incentivize reckless behavior.

Conclusion

The DNB's investigation into ABN Amro bonus payments is a significant development with far-reaching consequences. The potential penalties for ABN Amro are substantial, but the broader impact on the Dutch banking sector—increased scrutiny, potential policy changes, and shifts in investor sentiment—could be even more profound. The investigation underscores the need for greater transparency and stricter regulation of bonus practices within the financial industry.

Stay informed about the ongoing developments regarding ABN Amro bonus payments and the DNB's investigation. Follow [Your Publication/Website Name] for further updates on this crucial story impacting ABN Amro’s bonus schemes and the Dutch banking landscape. Learn more about the evolving regulations surrounding ABN Amro bonus payments and similar issues in the financial sector.

Featured Posts

-

Southport Stabbing Mothers Tweet Leads To Jail Time And Housing Crisis

May 21, 2025

Southport Stabbing Mothers Tweet Leads To Jail Time And Housing Crisis

May 21, 2025 -

Abc News Show Future Uncertain Amidst Company Restructuring

May 21, 2025

Abc News Show Future Uncertain Amidst Company Restructuring

May 21, 2025 -

T And T Minister Restricts Vybz Kartels Movement

May 21, 2025

T And T Minister Restricts Vybz Kartels Movement

May 21, 2025 -

Top Gbr News Grocery Savings Rare Coin Discovery And Doge Poll Outcomes

May 21, 2025

Top Gbr News Grocery Savings Rare Coin Discovery And Doge Poll Outcomes

May 21, 2025 -

The Love Monster In Literature And Popular Culture Exploring Its Portrayal

May 21, 2025

The Love Monster In Literature And Popular Culture Exploring Its Portrayal

May 21, 2025

Latest Posts

-

D Wave Quantum Qbts Stock Market Movement A Comprehensive Overview

May 21, 2025

D Wave Quantum Qbts Stock Market Movement A Comprehensive Overview

May 21, 2025 -

Is Qbts The Right Quantum Computing Stock For Your Portfolio

May 21, 2025

Is Qbts The Right Quantum Computing Stock For Your Portfolio

May 21, 2025 -

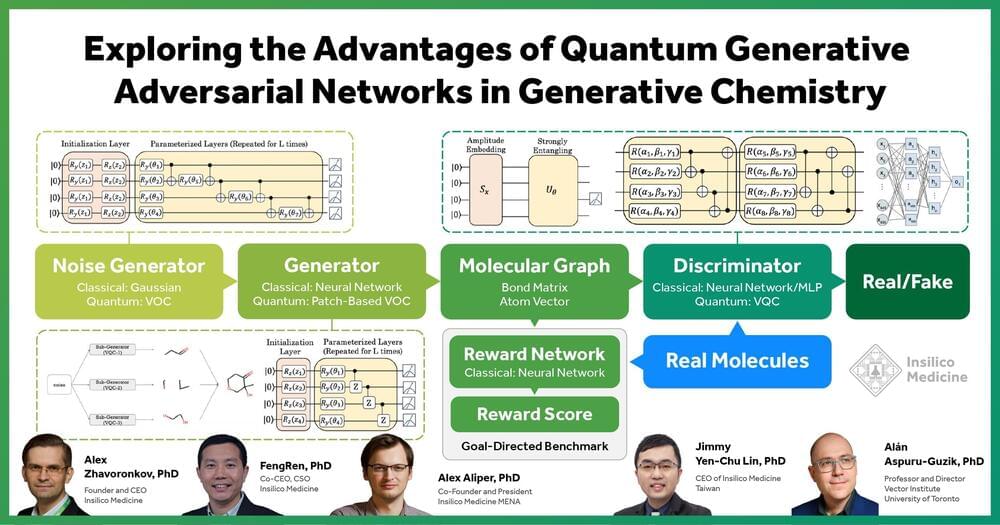

Revolutionizing Drug Discovery The Convergence Of Quantum Computing D Wave Qbts And Ai

May 21, 2025

Revolutionizing Drug Discovery The Convergence Of Quantum Computing D Wave Qbts And Ai

May 21, 2025 -

Understanding Mondays Rise In D Wave Quantum Inc Qbts Stock Price

May 21, 2025

Understanding Mondays Rise In D Wave Quantum Inc Qbts Stock Price

May 21, 2025 -

Analyzing The Factors Contributing To D Wave Quantum Inc S Qbts Stock Price Increase

May 21, 2025

Analyzing The Factors Contributing To D Wave Quantum Inc S Qbts Stock Price Increase

May 21, 2025