ABN Amro Under Scrutiny: Potential Fine For Employee Bonuses

Table of Contents

The Allegations Against ABN Amro's Bonus Scheme

The core of the issue revolves around alleged violations within ABN Amro's employee bonus scheme. While specifics remain under investigation, the allegations center around concerns regarding insufficient risk management and potential non-compliance with regulatory guidelines on executive compensation. The investigation is being led by [Insert Name of Regulatory Body, e.g., De Nederlandsche Bank (DNB)], the Dutch central bank.

- Specific details of the alleged misconduct: Reports suggest that excessive bonuses were awarded to employees despite poor performance in certain areas and a failure to adequately consider significant risk factors when calculating bonus payouts. This raises serious concerns about the bank’s internal controls and risk assessment processes.

- Regulatory involvement: The DNB's investigation is thorough and could lead to substantial penalties if irregularities are confirmed. The authority is known for its stringent approach to ensuring compliance within the Dutch financial sector.

- Previous similar cases: While this specific case is unfolding, ABN Amro and other major financial institutions have faced similar scrutiny in the past regarding bonus structures, highlighting the ongoing challenges in this area of financial regulation. The precedents set in those cases may influence the outcome of the current investigation and the potential size of any fine.

Potential Impact of the Fine on ABN Amro

The potential ABN Amro bonus fine carries significant implications for the bank. The financial penalty could be substantial, depending on the severity of the violations found.

- Impact on share price and investor confidence: News of the investigation and the potential fine has already caused volatility in ABN Amro's share price. A large fine would likely further erode investor confidence, leading to potential capital flight and decreased market valuation.

- Effect on profitability and future financial planning: A hefty fine would directly impact ABN Amro's profitability, potentially requiring adjustments to its financial forecasts and strategic plans. This could also affect its ability to invest in future growth opportunities.

- Reputational damage and loss of public trust: Beyond the financial implications, the reputational damage resulting from the investigation could be long-lasting. Loss of public trust could affect customer relationships and future business prospects.

ABN Amro's Response and Future Actions

ABN Amro has publicly stated its commitment to cooperating fully with the DNB investigation. The bank has acknowledged the seriousness of the allegations and has undertaken measures to address the concerns raised.

- Public statements: ABN Amro has issued press releases emphasizing its dedication to compliance and its commitment to implementing changes to improve its internal processes. Transparency in communication during this process is crucial for regaining public and investor trust.

- Changes to bonus structure and compensation policies: In response to the investigation, ABN Amro is likely to review and revise its bonus structure and overall compensation policies. This may involve implementing stricter criteria for bonus eligibility and strengthening risk-assessment methodologies.

- Enhanced compliance and risk management: The bank is likely to invest in strengthening its compliance framework and risk management systems. This could involve hiring additional compliance personnel, implementing new technologies, and enhancing employee training programs.

Implications for the Broader Financial Sector

The ABN Amro case holds significant implications for the broader financial sector, both in the Netherlands and internationally. It serves as a stark reminder of the importance of responsible compensation practices and robust risk management within financial institutions.

- Increased regulatory scrutiny and stricter rules: The case may prompt regulators to increase their scrutiny of bonus schemes across the financial industry, potentially leading to stricter rules and regulations on executive compensation.

- Impact on compensation practices: The investigation could influence compensation practices across the financial services industry, prompting banks to adopt more cautious and responsible approaches to bonus allocation.

- Shift towards more responsible and sustainable bonus structures: The case might accelerate a shift towards more responsible and sustainable bonus structures, aligning incentives with long-term value creation and risk mitigation.

Conclusion:

The ABN Amro bonus fine investigation highlights the critical need for responsible compensation practices and robust risk management within the financial industry. The potential financial penalties and reputational damage facing ABN Amro serve as a cautionary tale for other financial institutions. Stay informed about developments in the ABN Amro bonus fine investigation and the ongoing discussions regarding responsible banking practices. Follow reputable news sources for updates on this significant case and its implications for the future of financial regulation. Search for "ABN Amro bonus fine" for the latest news and analysis.

Featured Posts

-

Could The Dexter New Blood Trailer Release Date Be Imminent

May 21, 2025

Could The Dexter New Blood Trailer Release Date Be Imminent

May 21, 2025 -

Van Rekening Tot Tikkie Navigeren Door Het Nederlandse Banksysteem

May 21, 2025

Van Rekening Tot Tikkie Navigeren Door Het Nederlandse Banksysteem

May 21, 2025 -

Southern French Alps Weather Update Late Season Snow And Storms

May 21, 2025

Southern French Alps Weather Update Late Season Snow And Storms

May 21, 2025 -

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Detail Capitol Attack

May 21, 2025

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Detail Capitol Attack

May 21, 2025 -

The Goldbergs Everything You Need To Know About The Cast And Characters

May 21, 2025

The Goldbergs Everything You Need To Know About The Cast And Characters

May 21, 2025

Latest Posts

-

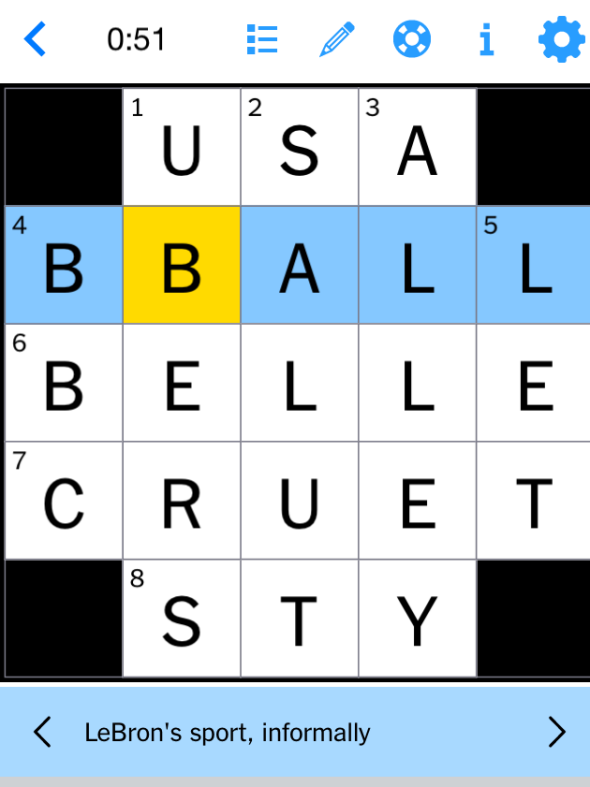

Complete Nyt Mini Crossword Answers March 13 Solutions And Strategies

May 21, 2025

Complete Nyt Mini Crossword Answers March 13 Solutions And Strategies

May 21, 2025 -

Hudsons Bay Company And Canadian Tire Examining The Merits Of A Merger

May 21, 2025

Hudsons Bay Company And Canadian Tire Examining The Merits Of A Merger

May 21, 2025 -

Transparency And Trumps Aerospace Legacy A Review Of Publicly Available Information

May 21, 2025

Transparency And Trumps Aerospace Legacy A Review Of Publicly Available Information

May 21, 2025 -

Canadian Tire And Hudsons Bay A Strategic Fit

May 21, 2025

Canadian Tire And Hudsons Bay A Strategic Fit

May 21, 2025 -

Future Of Canada Post Report Recommends Phasing Out Daily Home Mail Delivery

May 21, 2025

Future Of Canada Post Report Recommends Phasing Out Daily Home Mail Delivery

May 21, 2025