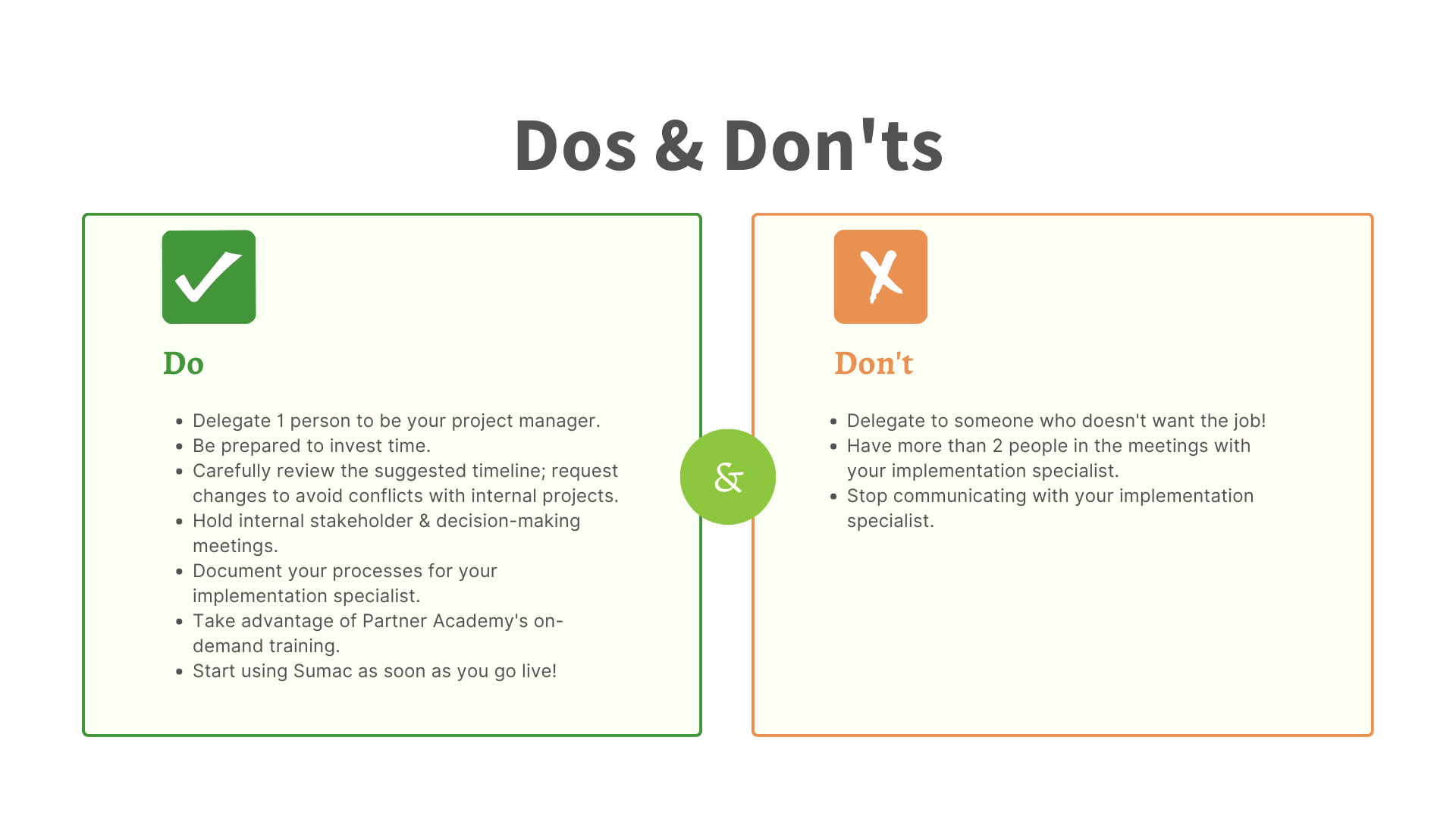

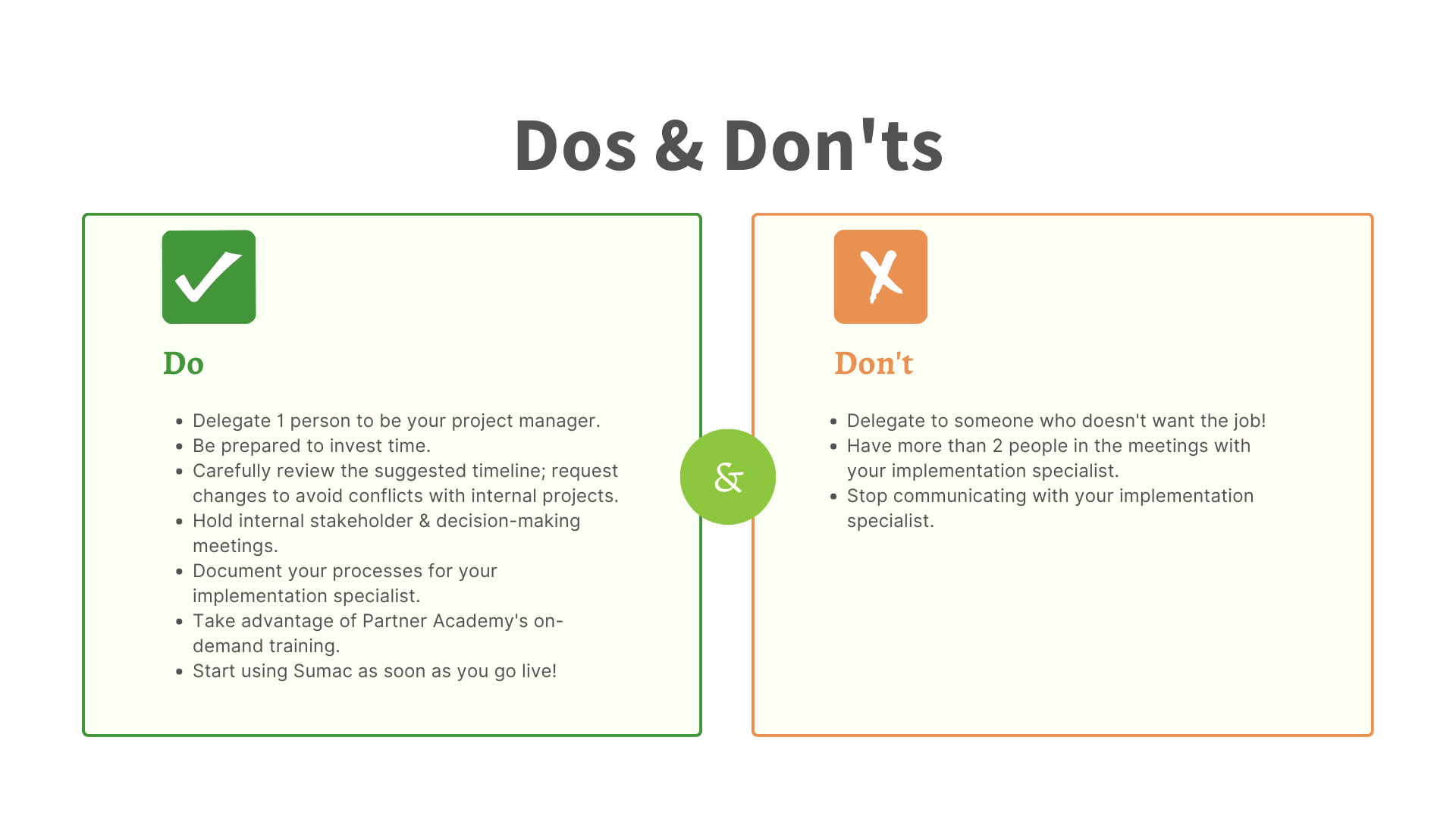

Ace The Private Credit Interview: 5 Crucial Dos And Don'ts

Table of Contents

Do Your Homework: Thoroughly Research the Lender

Before you even think about stepping into that interview room (virtual or otherwise), you need to know your audience. Thorough research isn't just about showing up; it's about demonstrating you understand the lender's investment philosophy and how your business fits within their portfolio. This shows professionalism and increases your chances of securing funding.

Understand Their Investment Thesis

Private credit firms don't invest in every business. They have a specific investment thesis – a guiding principle that dictates their investment choices. Understanding this thesis is paramount.

- Analyze their portfolio companies: What types of businesses have they invested in before? What are their common characteristics? Look for patterns in industry, size, and stage of development.

- Review their recent press releases and investor updates: These often reveal their current priorities and investment focus. Look for keywords and recurring themes.

- Identify key partners and their investment history: Understanding the individuals behind the firm and their track record provides valuable context.

Prepare for Specific Questions

The private credit interview isn't a casual conversation; it's a rigorous examination of your business. Anticipate questions about your business plan, financial projections, and risk mitigation strategies, and prepare comprehensive answers.

- Prepare a concise and compelling elevator pitch: You need to clearly articulate your business's value proposition in a short, memorable way.

- Practice explaining complex financial data in simple terms: Private credit lenders need to understand your financials, even if they aren't financial experts.

- Have a clear understanding of your key performance indicators (KPIs): These metrics demonstrate your understanding of your business's performance and its trajectory.

Don't Underestimate the Importance of Presentation

Your presentation is crucial, extending beyond just the content. It encompasses your professionalism, communication skills, and overall demeanor. Remember, you're not just selling your business; you're selling yourself as a credible and capable borrower.

Professionalism is Key

First impressions matter immensely in the world of private credit. Projecting professionalism and respect is paramount.

- Choose attire appropriate for a business meeting: Dress as you would for any important professional meeting.

- Ensure your technology is working correctly for virtual interviews: Test your internet connection, microphone, and camera well in advance.

- Be mindful of your body language and tone of voice: Maintain good posture, make eye contact, and speak clearly and confidently.

A Compelling Narrative

Avoid simply reading from your business plan. Instead, craft a compelling narrative that captivates the interviewers and showcases the potential of your business.

- Use visuals to support your key points: Charts, graphs, and images can help illustrate your narrative and make your presentation more engaging.

- Focus on the value proposition and market opportunity: Clearly articulate why your business is unique and how it addresses a specific market need.

- Show passion and enthusiasm for your business: Your excitement and belief in your venture are contagious.

Do Emphasize Financial Transparency and Accuracy

Private credit lenders are primarily concerned with financial health and risk management. Transparency and accuracy in your financial presentation are not just recommended—they are essential.

Detailed Financial Projections

Your financial projections must be realistic, well-supported, and thoroughly analyzed. Be prepared to justify every assumption and address potential risks.

- Use clear and consistent financial modeling: Maintain consistency in your assumptions and methodology.

- Include sensitivity analyses to demonstrate robustness: Show how your projections might change under different scenarios.

- Highlight key financial metrics and their implications: Focus on the metrics most relevant to the lender’s decision-making process.

Comprehensive Due Diligence

Proactive due diligence demonstrates your preparedness and professionalism. Anticipate questions and address potential concerns before they are raised.

- Gather all relevant documentation in advance: Have everything organized and readily available.

- Address any potential weaknesses or red flags proactively: Don't try to hide issues; address them honestly and transparently.

- Demonstrate a thorough understanding of regulatory compliance: This shows you take your responsibilities seriously.

Don't Overlook the Importance of Relationship Building

Securing private credit funding isn't just about presenting a strong business case; it’s about building a relationship with the lender. They're not just evaluating your business; they're evaluating you.

Authentic Connection

Building a genuine rapport with the interviewers demonstrates that you're more than just a business seeking funding.

- Ask insightful questions about their investment strategy: This shows you've done your research and are genuinely interested in their firm.

- Engage in active listening and show genuine interest: Pay close attention to what the interviewers say, and respond thoughtfully.

- Remember the interviewer's name and use it naturally: This shows respect and strengthens the connection.

Post-Interview Follow-Up

A timely and well-crafted thank-you note reinforces your interest and leaves a lasting positive impression.

- Personalize your thank-you notes: Don't send generic emails; tailor your message to each interviewer.

- Mention specific points discussed in the interview: This shows you were actively listening and engaging.

- Follow up within 24 hours of the interview: Timeliness demonstrates professionalism and eagerness.

Do Prepare for Negotiation

Negotiation is an integral part of the private credit process. Understanding your leverage and presenting your terms confidently are key to securing the best possible deal.

Understand Your Leverage

Know your needs and your boundaries. Thorough preparation ensures you negotiate effectively.

- Research market rates for similar transactions: This helps you determine a fair valuation for your business.

- Develop a range of acceptable outcomes: Be flexible but have a clear idea of your ideal scenario and your bottom line.

- Have a clear understanding of your walk-away point: Know when to walk away if the terms aren't favorable.

Confidently Present Your Terms

Present your desired terms clearly, confidently, and with sound reasoning.

- Practice articulating your desired terms clearly and concisely: Ensure you can explain your rationale effectively.

- Be prepared to address potential objections: Anticipate questions and have well-reasoned responses.

- Demonstrate flexibility while protecting your interests: Find a balance between getting what you need and maintaining a positive relationship.

Conclusion

Acing your private credit interview requires a multifaceted approach. By diligently preparing, understanding the lender's perspective, showcasing financial transparency, building rapport, and preparing for negotiation, you significantly increase your chances of securing funding. Remember to thoroughly research the lender, present a compelling narrative, and demonstrate professionalism. Don't underestimate the power of a well-executed post-interview follow-up. Mastering these private credit interview dos and don'ts will put you on the path to success. Now go out there and ace your private credit interview!

Featured Posts

-

Tip Top One Arcachon 22e Anniversaire D Un Etablissement Emblematique

May 31, 2025

Tip Top One Arcachon 22e Anniversaire D Un Etablissement Emblematique

May 31, 2025 -

Finding The Good Life A Balanced Approach To Happiness And Success

May 31, 2025

Finding The Good Life A Balanced Approach To Happiness And Success

May 31, 2025 -

New Covid 19 Variant Fueling Case Increase Across The Nation

May 31, 2025

New Covid 19 Variant Fueling Case Increase Across The Nation

May 31, 2025 -

Sanofis Respiratory Pipeline Advances In Asthma And Copd Clinical Trials

May 31, 2025

Sanofis Respiratory Pipeline Advances In Asthma And Copd Clinical Trials

May 31, 2025 -

Banksy Auction Iconic Broken Heart Artwork

May 31, 2025

Banksy Auction Iconic Broken Heart Artwork

May 31, 2025