Ackman's Trade War Prediction: Time Favors US, Hurts China

Table of Contents

Ackman's Rationale: Decoupling and US Economic Resilience

Ackman's prediction hinges on several key factors, primarily focusing on the ongoing economic decoupling between the US and China and the inherent resilience of the American economy. He believes that the US, despite initial disruptions, is better positioned to weather the storm and emerge stronger in the long run. This decoupling involves a deliberate effort to reduce economic interdependence, minimizing reliance on China for manufacturing, technology, and supply chains.

The US possesses several significant strengths contributing to its resilience:

- Increased domestic manufacturing and reshoring initiatives: Companies are actively bringing manufacturing back to the US, spurred by trade tensions and a desire for greater supply chain security. This creates jobs and strengthens the domestic economy.

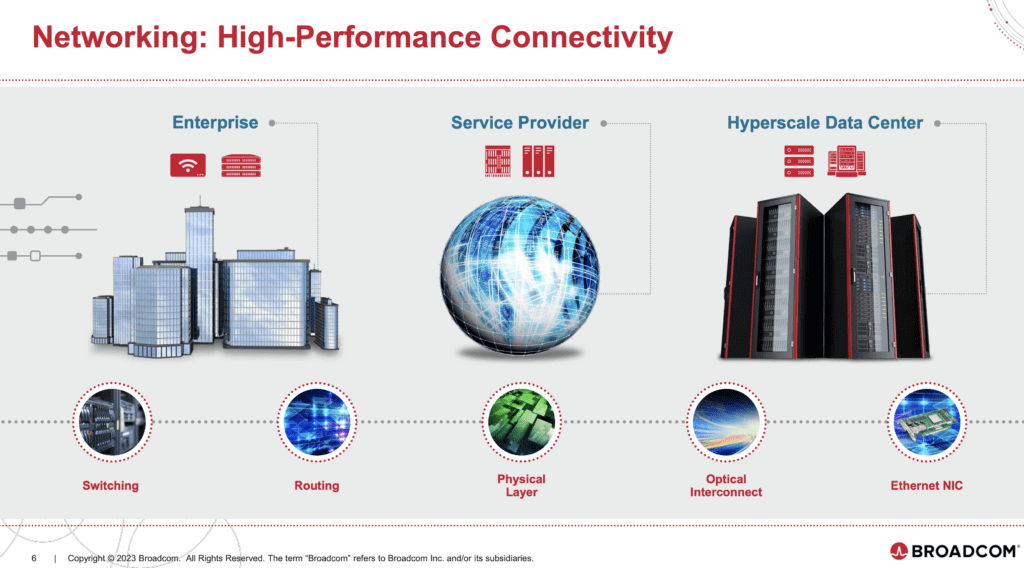

- Technological advancements and innovation within the US: The US continues to lead in technological innovation, particularly in critical sectors like AI, biotechnology, and semiconductors, offering a competitive edge in the global marketplace.

- Stronger alliances with other nations to reduce reliance on China: The US is forging stronger trade partnerships with allies to diversify its supply chains and reduce dependence on China.

- Government policies supporting US businesses: Initiatives designed to stimulate domestic manufacturing, research and development, and technological advancement provide crucial support for US-based companies.

Keywords: economic decoupling, reshoring, US manufacturing, technological innovation, economic resilience.

China's Vulnerabilities: Internal Challenges and External Pressures

While the US possesses inherent strengths, Ackman's analysis highlights significant vulnerabilities within the Chinese economy. The trade war has exacerbated pre-existing challenges, potentially leading to long-term economic instability.

Several factors contribute to China's vulnerabilities:

- Impact of tariffs and trade restrictions on Chinese exports: Tariffs and trade restrictions have directly impacted Chinese exports, hindering economic growth and impacting various sectors.

- Rising debt levels and potential financial instability: China's high levels of debt, both corporate and government, pose a significant risk to financial stability.

- Aging population and shrinking workforce: China faces a rapidly aging population and a shrinking workforce, which could significantly impact its future economic productivity.

- Increased geopolitical tensions and international scrutiny: Growing geopolitical tensions and increasing international scrutiny add to the pressure on China's economic stability.

These internal and external pressures, compounded by the trade war, form the basis of Ackman's assessment of China's comparatively weaker long-term position. Keywords: Chinese economy, economic vulnerability, debt crisis, demographic challenges, geopolitical instability.

Long-Term Implications: Investing in a Post-Trade War World

Ackman's prediction has significant implications for long-term investment strategies. Understanding the potential long-term shift in global economic power can help investors position themselves for future success.

Investors can consider several strategies based on Ackman's analysis:

- Investing in US-based companies that benefit from reshoring: Companies involved in manufacturing, technology, and related sectors stand to gain from the reshoring trend.

- Diversification of investment portfolios to mitigate risks: Diversification remains crucial to minimize exposure to potential economic downturns.

- Opportunities in emerging markets less reliant on China: Emerging markets less intertwined with China's economy may present attractive investment opportunities.

- Potential for growth in sectors less impacted by the trade war: Sectors less vulnerable to trade disruptions may offer more stable growth prospects.

Keywords: investment strategy, long-term investment, portfolio diversification, risk management, emerging markets.

Conclusion: Navigating Ackman's Trade War Prediction and Investing Wisely

Bill Ackman's prediction regarding the US-China trade war offers a compelling perspective on the long-term economic implications for both nations. While the situation remains complex and unpredictable, his analysis highlights the potential for the US to emerge stronger, leveraging its economic resilience and technological prowess. Conversely, China faces significant internal and external challenges that could hamper its long-term economic growth. Understanding Ackman's US-China trade war analysis is crucial for making informed investment decisions. By carefully assessing the long-term implications of this trade war prediction, investors can better navigate the changing global landscape and position themselves for success in a post-trade war world. Consider researching further and carefully assessing your investment strategy in light of this analysis.

Featured Posts

-

Mc Cook Jeweler Supports Nfl Players Transitions

Apr 27, 2025

Mc Cook Jeweler Supports Nfl Players Transitions

Apr 27, 2025 -

Mafs Sam Carraros Five Minute Love Triangle A Stan Series Appearance

Apr 27, 2025

Mafs Sam Carraros Five Minute Love Triangle A Stan Series Appearance

Apr 27, 2025 -

Carney Alerts Canadian Voters Trump Seeks Major Trade Concessions

Apr 27, 2025

Carney Alerts Canadian Voters Trump Seeks Major Trade Concessions

Apr 27, 2025 -

At And T Details Extreme Cost Implications Of Broadcoms V Mware Deal

Apr 27, 2025

At And T Details Extreme Cost Implications Of Broadcoms V Mware Deal

Apr 27, 2025 -

Electric Vehicle Mandates Face Renewed Pushback From Dealers

Apr 27, 2025

Electric Vehicle Mandates Face Renewed Pushback From Dealers

Apr 27, 2025

Latest Posts

-

75

Apr 28, 2025

75

Apr 28, 2025 -

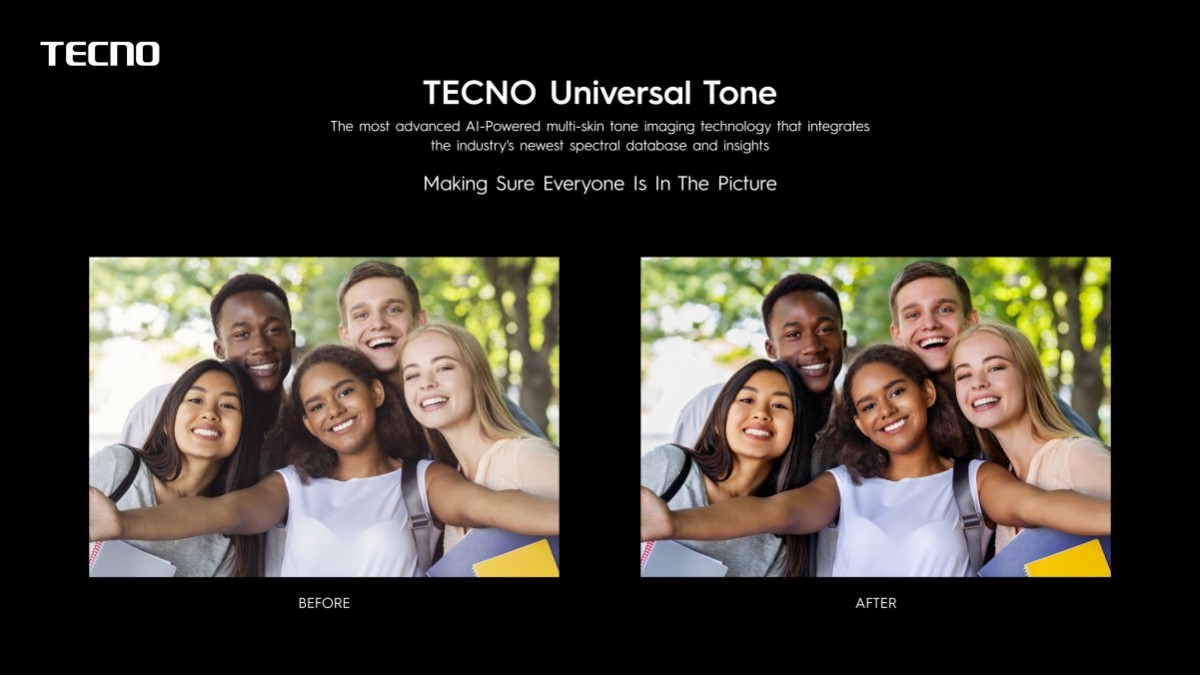

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Oppo Find X8 Ultra

Apr 28, 2025

Oppo Find X8 Ultra

Apr 28, 2025 -

Red Sox Injury Updates For Crawford Bello Abreu And Rafaela

Apr 28, 2025

Red Sox Injury Updates For Crawford Bello Abreu And Rafaela

Apr 28, 2025 -

Boston Red Sox Injury News Kutter Crawford Brayan Bello Wilyer Abreu And Ceddanne Rafaela

Apr 28, 2025

Boston Red Sox Injury News Kutter Crawford Brayan Bello Wilyer Abreu And Ceddanne Rafaela

Apr 28, 2025