Activision Blizzard Acquisition: FTC's Appeal Against Court Decision

Table of Contents

The FTC's Arguments Against the Acquisition

The FTC's opposition to the Activision Blizzard acquisition rests on several key pillars, primarily focusing on competitive concerns and the potential for anti-competitive practices.

Concerns Regarding Competition

The FTC's primary argument centers on the potential for reduced competition within the gaming market, largely focusing on the immensely popular Call of Duty franchise. The commission fears that Microsoft's ownership of Activision Blizzard could significantly alter the competitive landscape.

- Loss of exclusivity deals for Call of Duty on competing platforms (PlayStation, Nintendo): The FTC worries that Microsoft might make Call of Duty exclusive to Xbox, or offer significantly worse terms to competitors, harming PlayStation and Nintendo players. This could lead to a decline in competition and ultimately impact consumer choice.

- Potential for Microsoft to leverage its ownership of Activision Blizzard to stifle innovation and harm competitors: The FTC suggests that Microsoft could use its newly acquired market power to hinder the development and success of rival gaming studios and platforms. This could manifest in various ways, such as preferential treatment for Microsoft's own studios and services.

- Market dominance concerns within the gaming subscription services sector (Game Pass): The integration of Activision Blizzard's titles into Xbox Game Pass could further solidify Microsoft's dominance in the subscription gaming market, potentially driving out competitors and limiting consumer choice. The FTC is particularly concerned about the potential for this to stifle innovation in the subscription model.

Antitrust Concerns and Market Power

Beyond Call of Duty, the FTC's broader concern is that the Activision Blizzard acquisition would grant Microsoft excessive market power, leading to negative consequences for consumers.

- Analysis of Microsoft's market share in gaming consoles, PC gaming, and cloud gaming: The FTC's arguments are based on a detailed analysis of Microsoft's existing market share across various gaming platforms. The acquisition, they argue, would significantly increase this market share, leading to anti-competitive practices.

- Discussion of potential anti-competitive practices resulting from the combined entity: This includes potential price increases for games, reduced innovation in game development, and a decrease in the quality and variety of games available to consumers.

- Examination of precedents set in other significant antitrust cases: The FTC has referenced past antitrust cases to support their arguments, emphasizing the importance of preventing monopolies and maintaining a competitive market.

Microsoft's Defense and the Court's Initial Ruling

Microsoft has vigorously defended the acquisition, presenting counterarguments and emphasizing the potential benefits for gamers.

Microsoft's Counterarguments

Microsoft has countered the FTC’s claims by highlighting the benefits of the merger, emphasizing its commitment to continued support of other platforms.

- Commitment to continued Call of Duty releases on PlayStation: A key part of Microsoft’s defense is its pledge to keep releasing Call of Duty titles on PlayStation for years to come, ensuring that PlayStation players are not disadvantaged.

- Plans to expand Game Pass's library and reach a wider audience: Microsoft argues that the inclusion of Activision Blizzard games in Game Pass will benefit consumers by providing greater access to a wider library of high-quality titles at a lower cost.

- Arguments refuting the FTC’s assertion of significant market power: Microsoft contends that the gaming market remains highly competitive, with significant players beyond itself, thus negating the FTC's claims of potential market dominance.

The Judge's Decision

The initial court ruling sided with Microsoft, concluding that the FTC had not presented sufficient evidence to demonstrate that the acquisition would substantially lessen competition.

- Summary of the judge's reasoning and key findings: The judge found that the FTC's arguments, particularly concerning Call of Duty, were not strong enough to justify blocking the merger.

- Analysis of the legal precedents cited in the decision: The judge's decision relied on several legal precedents related to antitrust law and mergers and acquisitions.

- Discussion of the implications of the ruling for future merger challenges: This ruling has set a precedent, potentially impacting how future merger challenges are assessed by courts.

The FTC's Appeal and its Potential Outcomes

Despite the initial court ruling, the FTC has filed an appeal, arguing that the court’s decision was flawed.

Grounds for the Appeal

The FTC's appeal centers on their belief that the initial ruling overlooked crucial evidence and misinterpreted market dynamics.

- Detailed explanation of the specific points of contention in the appeal: The FTC likely highlights the aspects of the initial ruling they believe to be incorrect or misrepresented.

- Discussion of the legal strategy employed by the FTC: The FTC’s legal strategy in the appeal focuses on strengthening their evidence and refuting Microsoft's arguments.

- Assessment of the likelihood of success for the FTC’s appeal: Predicting the success of the appeal is difficult, dependent on the court’s assessment of the evidence presented.

Implications for the Gaming Industry

The outcome of the FTC's appeal carries significant weight for the future of the gaming industry.

- Potential consequences of a successful FTC appeal (blocked acquisition): A successful appeal could result in the acquisition being blocked, significantly altering Microsoft's gaming strategy and potentially impacting Activision Blizzard's future.

- Potential consequences of a failed FTC appeal (precedent for future mergers): Conversely, if the appeal fails, it could set a precedent for future large-scale mergers in the tech industry.

- Broader implications for the regulatory scrutiny of large tech mergers: The outcome will impact how regulators approach future mergers and acquisitions within the tech sector, potentially leading to tighter scrutiny and more stringent regulatory frameworks.

Conclusion

The FTC's appeal against the court's decision on the Activision Blizzard acquisition is a critical event for the gaming industry. The arguments surrounding competition, market power, and the future of gaming illustrate the complexities of regulating mega-mergers in the dynamic tech landscape. The outcome will undoubtedly establish a significant precedent for future antitrust cases involving large tech companies. To remain informed about this significant development and its far-reaching consequences, stay updated on the ongoing Activision Blizzard Acquisition case. Further research into antitrust laws and their application to the tech industry is highly recommended for a deeper understanding of this pivotal event.

Featured Posts

-

Rybakina Match Za 4 Milliarda Pryamaya Translyatsiya S Eks Tretey Raketkoy Mira

May 23, 2025

Rybakina Match Za 4 Milliarda Pryamaya Translyatsiya S Eks Tretey Raketkoy Mira

May 23, 2025 -

Effective Negotiation Strategies For Best And Final Job Offers

May 23, 2025

Effective Negotiation Strategies For Best And Final Job Offers

May 23, 2025 -

The Exclusive Story Behind Sam Altman And Jony Ives Collaboration

May 23, 2025

The Exclusive Story Behind Sam Altman And Jony Ives Collaboration

May 23, 2025 -

A Photographic Retrospective James Wiltshires 10th Anniversary At The Border Mail

May 23, 2025

A Photographic Retrospective James Wiltshires 10th Anniversary At The Border Mail

May 23, 2025 -

Former Man United Boss Ten Hag A Leverkusen Candidate

May 23, 2025

Former Man United Boss Ten Hag A Leverkusen Candidate

May 23, 2025

Latest Posts

-

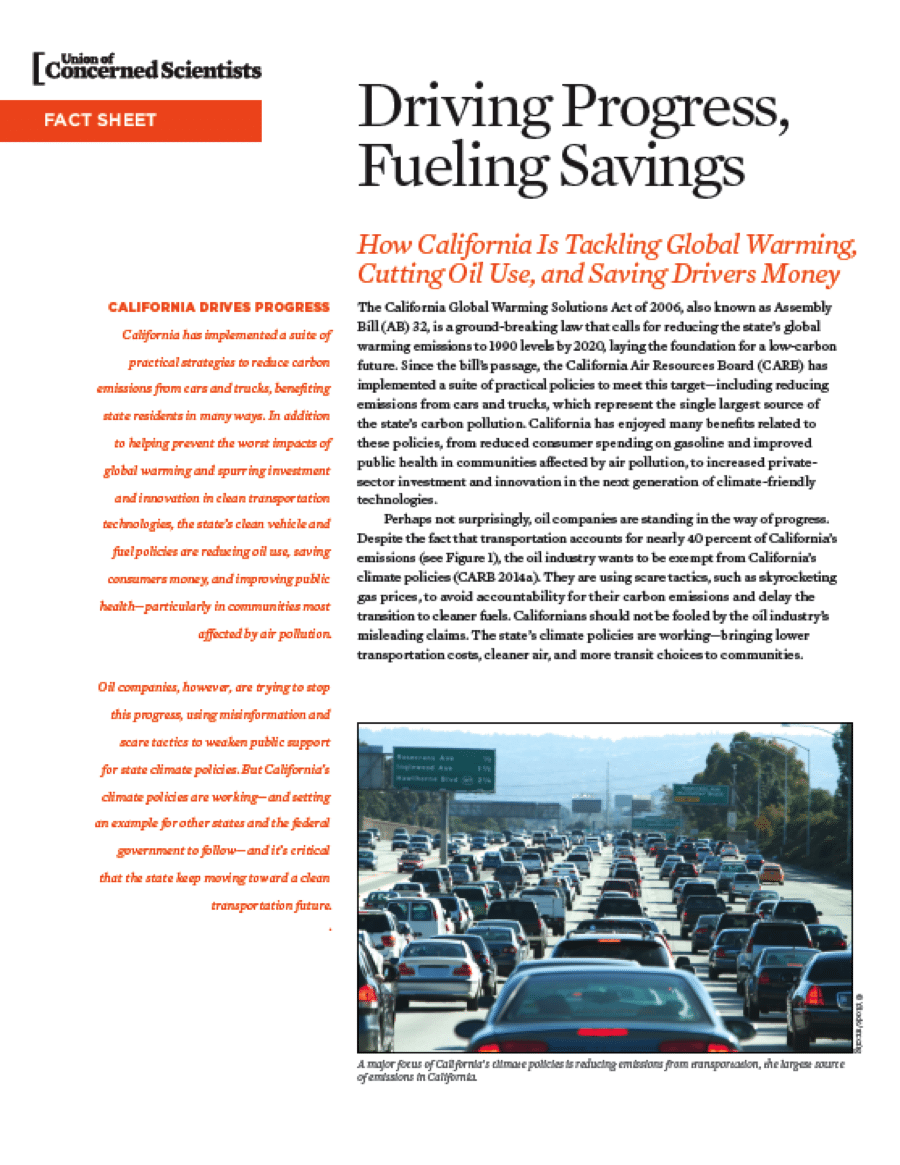

Memorial Day Weekend Fueling Savings With Low Gas Prices

May 23, 2025

Memorial Day Weekend Fueling Savings With Low Gas Prices

May 23, 2025 -

Gas Prices Plunge Memorial Day Weekend Savings

May 23, 2025

Gas Prices Plunge Memorial Day Weekend Savings

May 23, 2025 -

Are Memorial Day Gas Prices The Lowest Ever

May 23, 2025

Are Memorial Day Gas Prices The Lowest Ever

May 23, 2025 -

This Memorial Day Weekend Could See The Cheapest Gas In Years

May 23, 2025

This Memorial Day Weekend Could See The Cheapest Gas In Years

May 23, 2025 -

Memorial Day Gas Prices A Decade Low Forecast

May 23, 2025

Memorial Day Gas Prices A Decade Low Forecast

May 23, 2025