Addressing High Stock Market Valuations: A BofA Analyst's Viewpoint For Investors

Table of Contents

Understanding Current High Stock Market Valuations

High stock market valuations are a significant concern for investors. Understanding the current state requires analyzing key metrics and the contributing factors.

Key Valuation Metrics

Several metrics help assess market valuation. Price-to-Earnings (P/E) ratios, comparing a company's stock price to its earnings per share, are widely used. A high P/E ratio suggests investors expect strong future earnings growth. Price-to-Sales (P/S) ratios, comparing stock price to revenue, provide another perspective, particularly useful for companies with low or negative earnings. Other relevant metrics include Price-to-Book (P/B) ratios and dividend yields.

- How these metrics are calculated and what they indicate: P/E ratio is calculated by dividing the market value per share by the earnings per share. A high P/E ratio might indicate investor optimism but also potential overvaluation. P/S ratio is calculated by dividing the market capitalization by the company's revenue. A high P/S ratio may suggest investors are paying a premium for future growth.

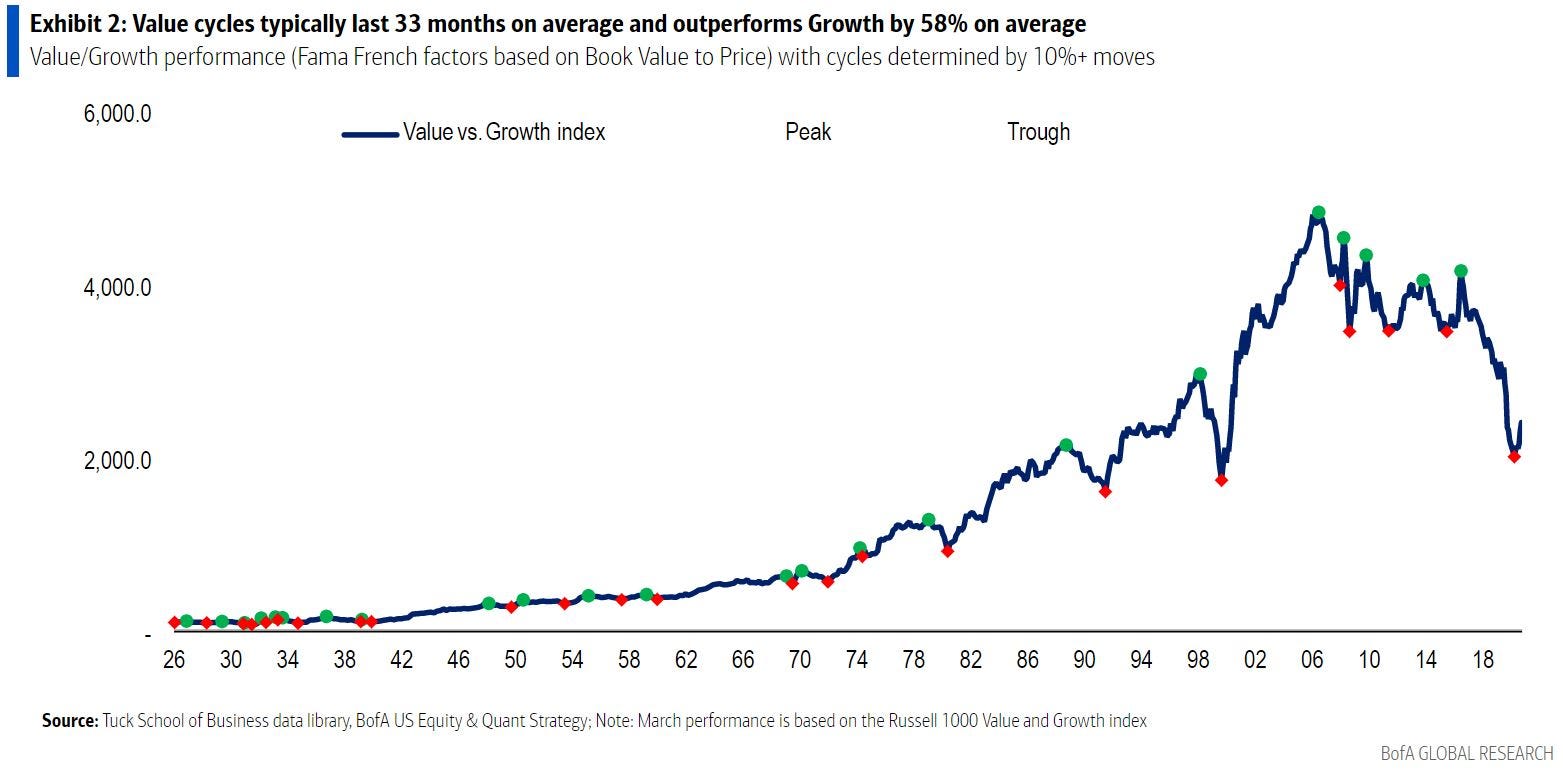

- Current market valuations compared to historical averages: Currently, many market indices show P/E ratios above historical averages, indicating potentially elevated valuations. This needs to be considered in context with economic growth and interest rates.

- Role of interest rates and economic growth: Low interest rates often fuel higher stock valuations as investors seek higher returns in the equity market. Strong economic growth further supports higher valuations, but unsustainable growth can lead to future corrections.

Factors Contributing to High Valuations

Several factors contribute to the current high stock market valuations:

- Impact of low interest rates: Low interest rates make borrowing cheaper, boosting corporate profits and encouraging investors to seek higher returns in the stock market, driving prices up.

- Role of quantitative easing and other monetary policies: Central banks' monetary policies, such as quantitative easing (QE), increase the money supply, potentially fueling asset inflation, including stocks.

- Influence of technological advancements and disruptive innovation: The rapid pace of technological innovation creates exciting growth opportunities, attracting investment and driving up valuations for technology companies and related sectors.

BofA Analyst's Perspective on Risk and Opportunity

A BofA analyst would likely highlight both the risks and opportunities presented by high stock market valuations.

Identifying Potential Risks

Investing in an overvalued market presents several risks:

- Possibility of market corrections: High valuations increase the likelihood of a market correction, where prices fall significantly, potentially leading to substantial portfolio losses.

- Increased risk of capital loss: In a high-valuation environment, the potential for capital loss is greater than in a more reasonably valued market.

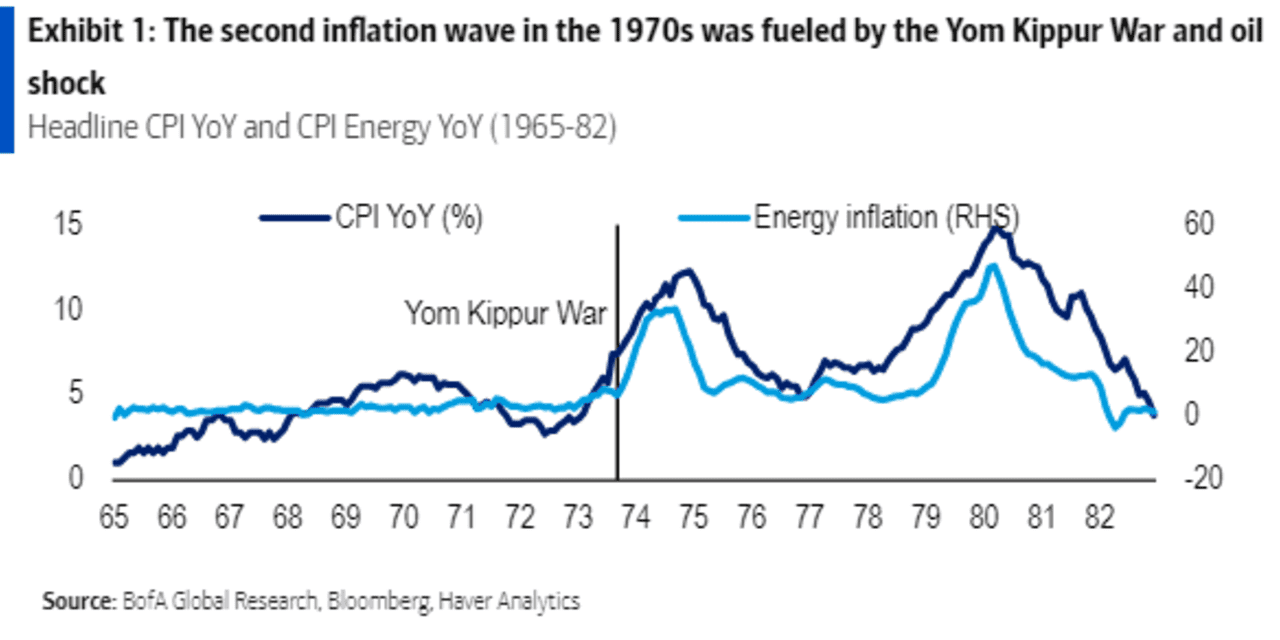

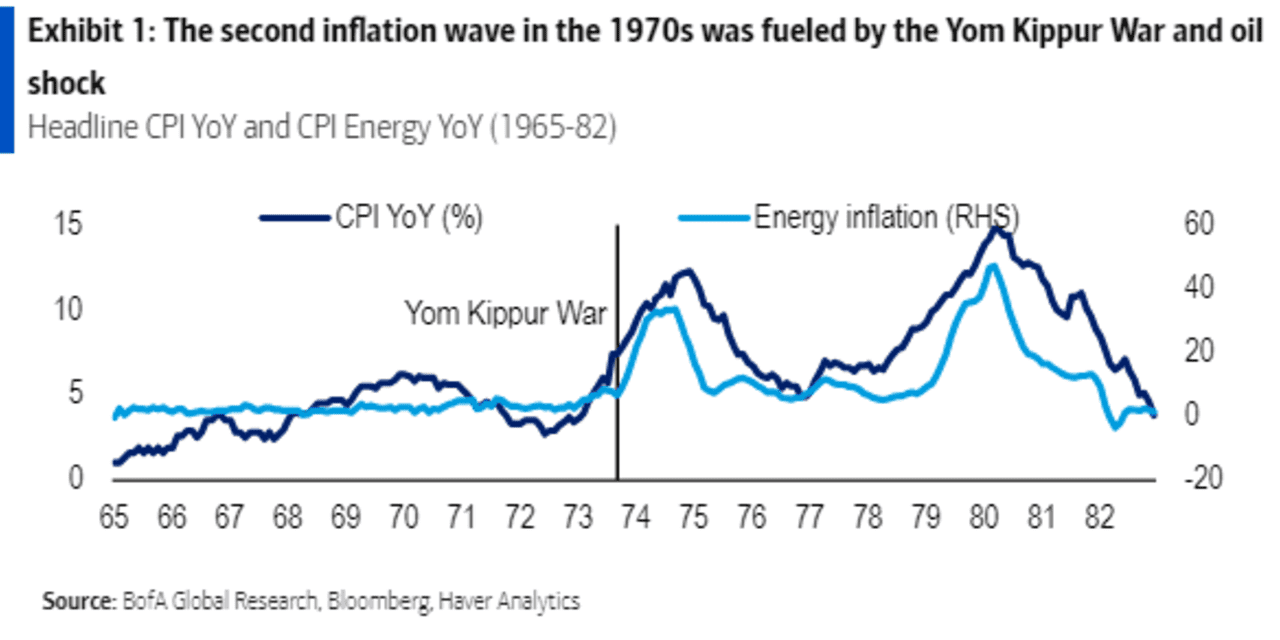

- Impact of inflation and rising interest rates: Inflation erodes purchasing power and rising interest rates increase borrowing costs for companies, potentially impacting profitability and stock prices.

Identifying Potential Opportunities

Despite the risks, opportunities still exist:

- Sector-specific opportunities: While the overall market may be overvalued, some sectors might still offer attractive opportunities based on their growth prospects and fundamentals.

- Importance of fundamental analysis and stock selection: Careful fundamental analysis, focusing on a company's financial health, competitive advantage, and future prospects, is crucial for identifying undervalued companies within an overvalued market.

- Strategies like value investing or dividend investing: Value investing focuses on finding undervalued stocks, while dividend investing provides a steady income stream, which can help mitigate some of the risks associated with high valuations.

Strategies for Navigating High Stock Market Valuations

Navigating high valuations requires careful planning and strategic approaches:

Diversification and Portfolio Management

Diversification is key to mitigating risk:

- Asset allocation strategies: Diversifying across different asset classes—stocks, bonds, real estate, alternative investments—reduces reliance on any single asset class and helps weather market volatility.

- Benefits of international diversification: Investing in international markets reduces exposure to any single country's economic or political risks.

- Role of rebalancing: Regularly rebalancing your portfolio to maintain your desired asset allocation helps control risk and take advantage of market fluctuations.

Tactical Asset Allocation

Adjusting your investment strategy based on market conditions is important:

- Potential for using market timing techniques (with caveats): While market timing is difficult, selectively adjusting allocations based on carefully considered market analysis can potentially improve returns. However, it is important to understand the limitations and risks involved.

- Role of risk tolerance: Your risk tolerance should dictate your investment strategy. More risk-averse investors may opt for a more conservative approach, while those with higher risk tolerance might consider more aggressive strategies.

- Importance of long-term investing strategies: Maintaining a long-term investment horizon helps weather short-term market fluctuations and benefit from long-term growth.

Conclusion

This article has examined the current landscape of high stock market valuations, offering insights from a BofA analyst's perspective. Understanding the factors contributing to these valuations, along with identifying potential risks and opportunities, is crucial for effective investment decision-making. By diversifying your portfolio, employing sound risk management strategies, and remaining disciplined in your approach, you can navigate the challenges presented by high stock market valuations. Remember to conduct thorough research and consider consulting a financial advisor before making any investment decisions related to addressing high stock market valuations.

Featured Posts

-

Wrqt Syasat Aqtsadyt Jdydt Mn Amant Alastthmar Baljbht Alwtnyt

May 03, 2025

Wrqt Syasat Aqtsadyt Jdydt Mn Amant Alastthmar Baljbht Alwtnyt

May 03, 2025 -

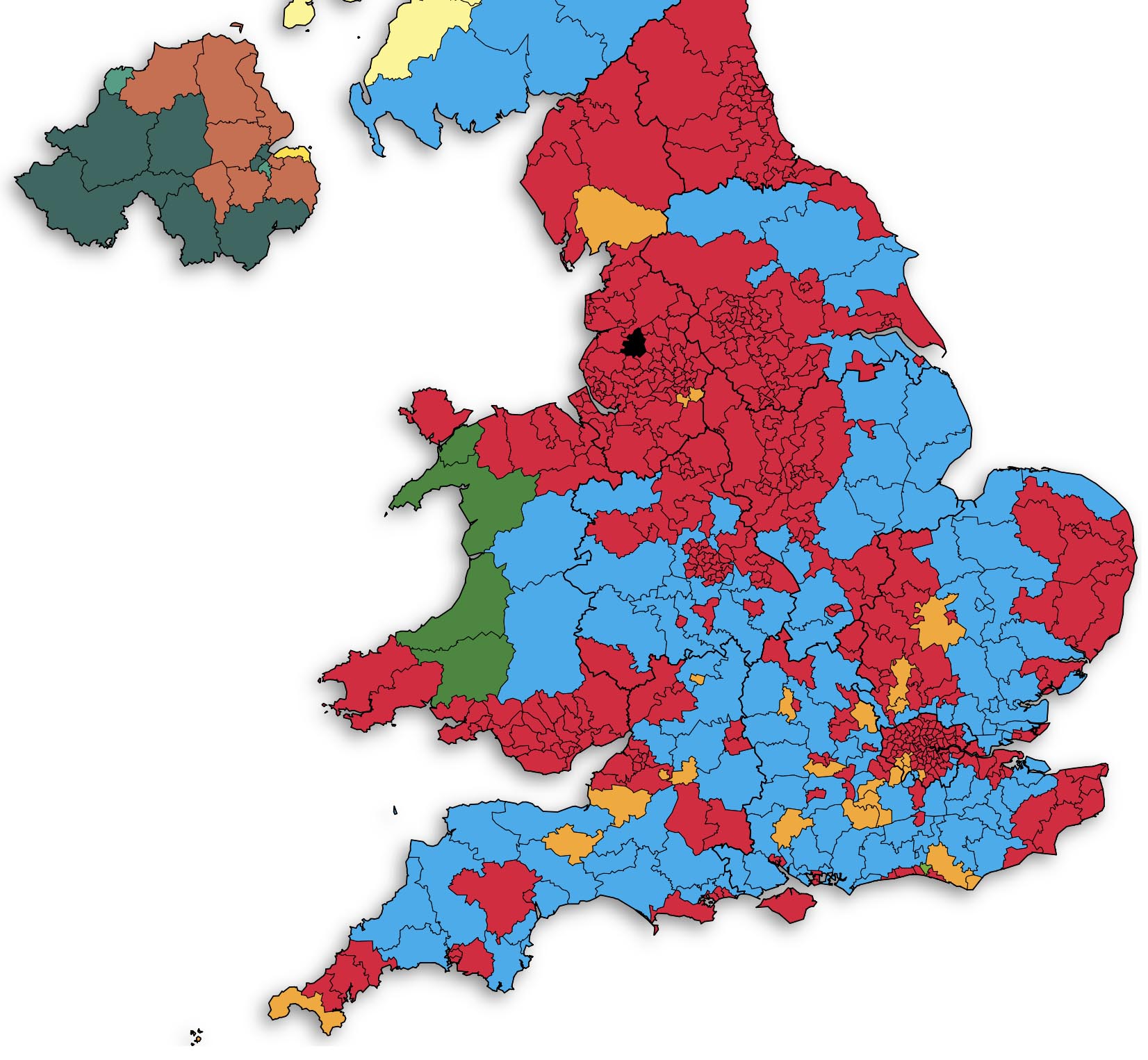

Scottish Election 2024 Farages Reform Uk And The Snp Conundrum

May 03, 2025

Scottish Election 2024 Farages Reform Uk And The Snp Conundrum

May 03, 2025 -

Googles Future Uncertain Pichais Concerns Over Doj Antitrust Plan And Search Impact

May 03, 2025

Googles Future Uncertain Pichais Concerns Over Doj Antitrust Plan And Search Impact

May 03, 2025 -

Reform Partys Local Election Performance A Key Indicator For Farage

May 03, 2025

Reform Partys Local Election Performance A Key Indicator For Farage

May 03, 2025 -

The Countrys Top Emerging Business Hubs A Geographic Analysis

May 03, 2025

The Countrys Top Emerging Business Hubs A Geographic Analysis

May 03, 2025

Latest Posts

-

Anchor Brewing Companys Legacy 127 Years And Counting To Closure

May 04, 2025

Anchor Brewing Companys Legacy 127 Years And Counting To Closure

May 04, 2025 -

Bof As Rationale Why High Stock Market Valuations Are Not A Cause For Alarm

May 04, 2025

Bof As Rationale Why High Stock Market Valuations Are Not A Cause For Alarm

May 04, 2025 -

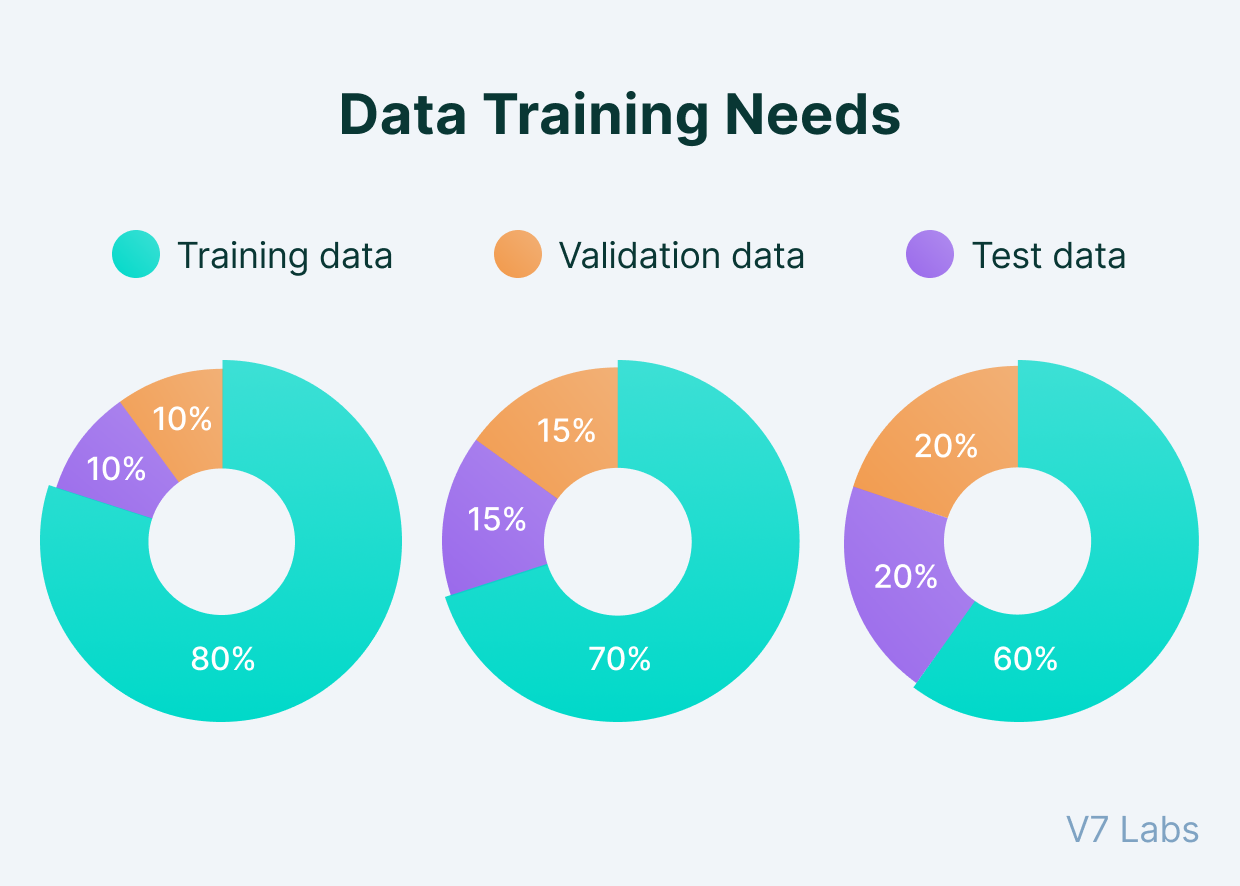

Googles Ai Search Algorithm Training Data And Opt Out Considerations

May 04, 2025

Googles Ai Search Algorithm Training Data And Opt Out Considerations

May 04, 2025 -

Middle Managements Contribution To A Thriving Company Culture And Employee Development

May 04, 2025

Middle Managements Contribution To A Thriving Company Culture And Employee Development

May 04, 2025 -

The End Of An Icon Anchor Brewing Company To Close After 127 Years

May 04, 2025

The End Of An Icon Anchor Brewing Company To Close After 127 Years

May 04, 2025