Addressing High Stock Market Valuations: BofA's View For Investors

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's overall view on the current market is cautiously optimistic, acknowledging both significant opportunities and substantial risks associated with the current high stock market valuations. They emphasize a need for careful analysis and a diversified approach. Their assessment utilizes several key metrics:

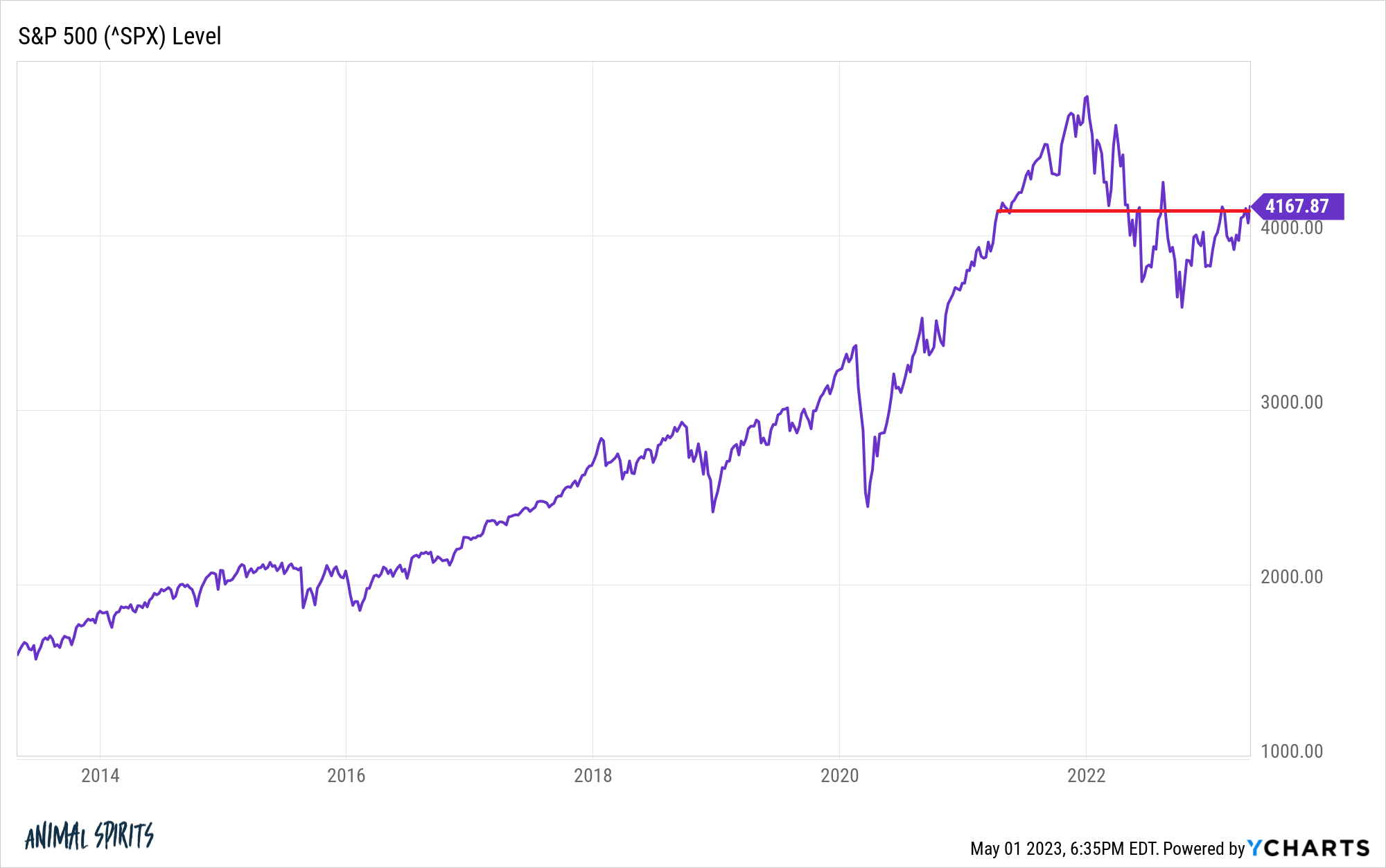

- Price-to-Earnings (P/E) ratios: BofA likely uses P/E ratios across various sectors to compare current valuations to historical averages and industry benchmarks. Elevated P/E ratios, especially when compared to historical norms, are often indicative of overvaluation.

- Shiller PE ratio (CAPE): This metric, which considers inflation-adjusted earnings over a ten-year period, provides a longer-term perspective on valuation, potentially offering insights into whether current prices are truly unsustainable.

- BofA's stance on overvaluation: While not explicitly stating a "bubble," BofA likely identifies specific sectors, such as technology or certain growth stocks, as potentially overvalued based on their analysis of these key metrics and other qualitative factors.

- Economic Indicators: BofA closely monitors inflation rates, interest rate adjustments by central banks (like the Federal Reserve), and economic growth figures (GDP) as these factors significantly impact market valuations and investor sentiment. High inflation, rising interest rates, or slowing economic growth can exert downward pressure on stock prices.

Strategies for Investors in a High-Valuation Environment

Navigating high stock market valuations requires a strategic approach. BofA likely recommends the following strategies to mitigate risks:

- Diversification: This is a cornerstone of any sound investment strategy, especially during periods of high valuations. BofA likely advocates diversifying across sectors (e.g., technology, healthcare, energy) and asset classes (stocks, bonds, real estate). This helps reduce the impact of poor performance in any single sector or asset.

- Long-Term Investment Horizon: BofA likely emphasizes the importance of a long-term perspective, advising investors to avoid short-term market fluctuations. This is crucial because even in overvalued markets, long-term growth is still possible, albeit with increased risk.

- Value Investing: In a high-growth market, BofA may suggest exploring value investing strategies, focusing on undervalued companies with strong fundamentals. This approach can offer attractive returns while minimizing the risks associated with overvalued growth stocks.

- Defensive Investment Options: Including defensive assets, such as high-quality bonds or dividend-paying stocks, can provide stability and income during periods of market uncertainty. These assets may offer relatively lower growth potential but often exhibit less volatility than growth stocks.

Understanding BofA's Market Predictions and Time Horizon

BofA’s market predictions are subject to considerable uncertainty, as are all market forecasts. They likely avoid making definitive statements about precise timing of market corrections. Instead, they might provide a range of potential outcomes and highlight key factors that could influence the market's direction:

- Market Performance Predictions: BofA might offer scenarios outlining potential market performance, perhaps indicating a possible range of returns (e.g., moderate growth, sideways movement, or a potential correction). However, they’d likely emphasize the uncertainties involved.

- Influencing Factors: Geopolitical events (e.g., wars, trade disputes), regulatory changes impacting specific sectors, and unexpected economic shocks (e.g., a major recession) all influence BofA's outlook and are cited as significant sources of uncertainty.

- Emphasis on Uncertainty: It's crucial to understand that market predictions are not guarantees. BofA likely stresses the limitations of forecasting and the importance of adapting to changing market conditions.

Alternative Asset Classes and Their Role in Portfolio Management

BofA likely encourages the consideration of alternative asset classes to further diversify portfolios and mitigate risks associated with high stock market valuations:

- Real Estate: Real estate can offer diversification benefits and potential for long-term capital appreciation, but it also has liquidity risks and is subject to local market conditions.

- Commodities: Commodities like gold and oil can act as inflation hedges and provide diversification in a portfolio, but their prices can be highly volatile.

- Bonds: Bonds can offer stability and income but may provide lower returns than stocks, especially in a rising interest rate environment.

- Optimal Allocation: BofA’s recommended allocation to alternative assets depends on the investor’s risk tolerance, investment timeline, and overall financial goals. They likely suggest a balanced approach, diversifying appropriately across assets according to individual circumstances.

Conclusion: Navigating High Stock Market Valuations: Your Next Steps

BofA's analysis highlights the need for caution and a strategic approach to investing in a market characterized by high stock market valuations. Their recommendations emphasize diversification across sectors and asset classes, adopting a long-term investment horizon, and considering alternative asset classes to mitigate risk. Remember that understanding and addressing high stock market valuations is crucial for sound investment decisions. Use BofA's insights to inform your strategy and seek professional advice to navigate the current market landscape. Continue researching BofA's analysis and other market insights to make informed decisions about your investments in this dynamic environment.

Featured Posts

-

Xrp News Sec Classification Commodity Or Security

May 01, 2025

Xrp News Sec Classification Commodity Or Security

May 01, 2025 -

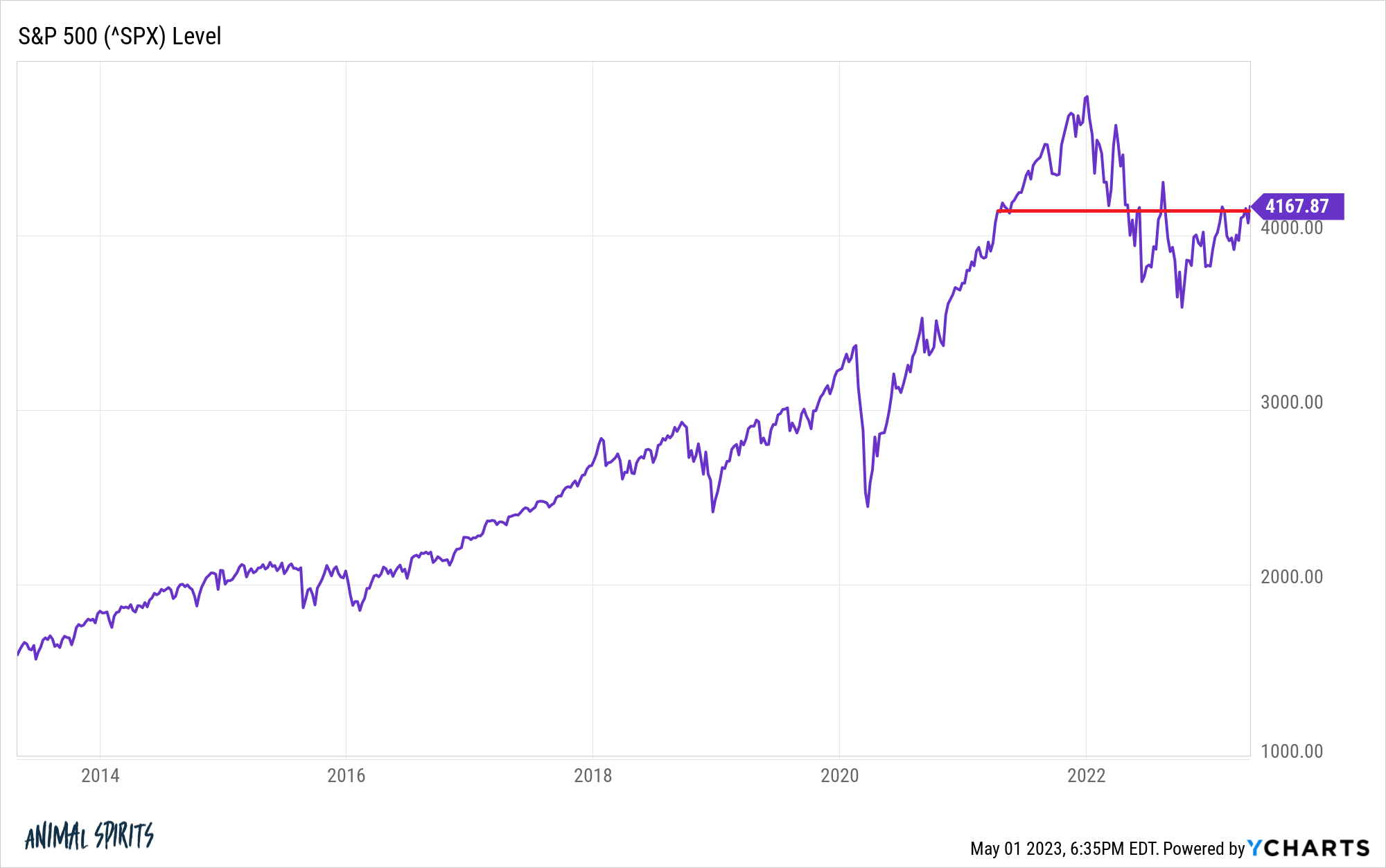

The Surge In Global Military Spending Analyzing Europes Role In The New Geopolitical Landscape

May 01, 2025

The Surge In Global Military Spending Analyzing Europes Role In The New Geopolitical Landscape

May 01, 2025 -

Resistance Grows Car Dealers Renewed Opposition To Ev Regulations

May 01, 2025

Resistance Grows Car Dealers Renewed Opposition To Ev Regulations

May 01, 2025 -

Offre Speciale Poids En Chocolat Pour Le Premier Bebe Ne Dans Cette Boulangerie Normande

May 01, 2025

Offre Speciale Poids En Chocolat Pour Le Premier Bebe Ne Dans Cette Boulangerie Normande

May 01, 2025 -

Ray Epps V Fox News A Deep Dive Into The Jan 6th Defamation Lawsuit

May 01, 2025

Ray Epps V Fox News A Deep Dive Into The Jan 6th Defamation Lawsuit

May 01, 2025

Latest Posts

-

Nghi Van Lua Dao Huong Dan Can Trong Khi Dau Tu Vao Cong Ty Co Lich Su Dang Ngo

May 01, 2025

Nghi Van Lua Dao Huong Dan Can Trong Khi Dau Tu Vao Cong Ty Co Lich Su Dang Ngo

May 01, 2025 -

Dau Tu Gop Von Nhan Biet Va Tranh Rui Ro Voi Cac Cong Ty Co Tien Su Lua Dao

May 01, 2025

Dau Tu Gop Von Nhan Biet Va Tranh Rui Ro Voi Cac Cong Ty Co Tien Su Lua Dao

May 01, 2025 -

Can Trong Khi Dau Tu Nhung Rui Ro Tiem An Khi Gop Von Vao Cong Ty Tung Bi Nghi Van Lua Dao

May 01, 2025

Can Trong Khi Dau Tu Nhung Rui Ro Tiem An Khi Gop Von Vao Cong Ty Tung Bi Nghi Van Lua Dao

May 01, 2025 -

Goi Thau Cap Nuoc Gia Dinh Thuoc Ve Tam Hop Sau Cuoc Canh Tranh Khoc Liet

May 01, 2025

Goi Thau Cap Nuoc Gia Dinh Thuoc Ve Tam Hop Sau Cuoc Canh Tranh Khoc Liet

May 01, 2025 -

Tam Hop Vuot Troi Gianh Chien Thang Goi Thau Cap Nuoc Quan Trong Cua Gia Dinh

May 01, 2025

Tam Hop Vuot Troi Gianh Chien Thang Goi Thau Cap Nuoc Quan Trong Cua Gia Dinh

May 01, 2025