Addressing Investor Concerns: BofA On High Stock Market Valuations

Table of Contents

BofA's Assessment of Current Market Valuations

BofA's assessment of current market valuations is nuanced, acknowledging both the robust economic fundamentals supporting the market and the inherent risks associated with elevated price levels. While they don't necessarily declare a market bubble, they do highlight the need for caution and strategic portfolio management.

-

Valuation Metrics: BofA employs a range of valuation metrics to gauge market health, including the widely followed Price-to-Earnings (P/E) ratio and the cyclically adjusted price-to-earnings ratio (Shiller PE ratio). These metrics compare current stock prices to historical earnings, providing a context for assessing whether current prices are justified relative to past performance. High P/E ratios, for example, often suggest that the market may be overvalued.

-

Sectoral Analysis: BofA's analysis often dissects the market into specific sectors, identifying those that appear particularly overvalued or undervalued based on their fundamental strength and future growth prospects. Sectors exhibiting rapid growth and high valuations warrant closer scrutiny, while undervalued sectors may present attractive opportunities.

-

Reasoning: BofA's reasoning usually considers a combination of factors, including corporate earnings growth, interest rate expectations, inflation levels, and geopolitical risks. A strong economic outlook, supported by healthy corporate earnings, might justify higher valuations. However, the potential for rising interest rates or unexpected economic shocks could quickly change this assessment.

Identifying Key Risks and Opportunities

While the market presents opportunities, BofA emphasizes several key risks associated with high stock market valuations.

-

Rising Interest Rates: Increased interest rates can significantly impact stock valuations. Higher rates make borrowing more expensive for companies, reducing their profitability and potentially lowering investor demand for stocks. BofA likely models various interest rate scenarios to assess the potential impact on market valuations.

-

Geopolitical Risks and Economic Uncertainties: Global events, such as geopolitical tensions or unexpected economic downturns, can introduce significant volatility into the market, potentially leading to corrections even in the absence of an underlying market bubble. BofA carefully assesses these external factors when evaluating market risk.

-

Investment Opportunities: Despite the overall high valuations, BofA may identify specific sectors or investment strategies that still present attractive opportunities. This could involve focusing on companies with strong fundamentals and sustainable growth potential, even within sectors that appear broadly overvalued. Value investing strategies, focusing on undervalued companies, might also be highlighted.

BofA's Recommended Investment Strategies

BofA's recommendations usually emphasize a proactive and strategic approach to portfolio management in the face of high valuations.

-

Diversification: Diversifying your portfolio across different asset classes is a cornerstone of BofA's recommended strategies. This could involve allocating assets to stocks, bonds, real estate, or alternative investments to mitigate risk and potentially enhance returns.

-

Asset Allocation: The specific allocation across different asset classes depends on individual risk tolerance and investment goals. BofA's advice generally balances higher-growth potential assets with more conservative options.

-

Rationale: The rationale behind BofA's recommended approach is risk mitigation. By diversifying and carefully selecting investments, investors can aim to protect their capital while still participating in market growth.

Considering Risk Tolerance and Investment Goals

Before implementing any investment strategy, it's crucial to align it with your personal risk tolerance and financial goals.

-

Long-Term Perspective: A long-term investment horizon is essential to weather short-term market fluctuations. High valuations don't automatically signal an immediate crash; understanding the long-term growth prospects of your investments is vital.

-

Personalized Advice: Seeking personalized financial advice from a qualified professional is highly recommended. A financial advisor can help you assess your risk tolerance, develop a tailored investment strategy, and monitor your portfolio's performance.

-

Risk Tolerance Assessment: Numerous online resources and questionnaires can help you determine your personal risk tolerance. Understanding your comfort level with risk is crucial for making sound investment decisions.

Conclusion

BofA's analysis of high stock market valuations underscores the need for a cautious yet opportunistic approach to investing. While the market presents opportunities, understanding the associated risks—particularly those stemming from rising interest rates and geopolitical uncertainties—is crucial for informed decision-making. BofA's recommended strategies emphasize diversification and aligning investments with individual risk tolerance and long-term goals. To navigate this complex market landscape effectively, conducting further research on BofA's detailed analysis and consulting with a financial advisor to develop a personalized investment strategy tailored to your specific needs and risk tolerance in the context of these high stock market valuations is highly recommended. [Link to relevant BofA resources, if available].

Featured Posts

-

Nintendos Action Leads To Ryujinx Emulator Development Cease

Apr 29, 2025

Nintendos Action Leads To Ryujinx Emulator Development Cease

Apr 29, 2025 -

Chargers To Kick Off 2025 Season In Brazil Justin Herberts Role

Apr 29, 2025

Chargers To Kick Off 2025 Season In Brazil Justin Herberts Role

Apr 29, 2025 -

Exclusive Riviera Blue Porsche 911 S T Now Available

Apr 29, 2025

Exclusive Riviera Blue Porsche 911 S T Now Available

Apr 29, 2025 -

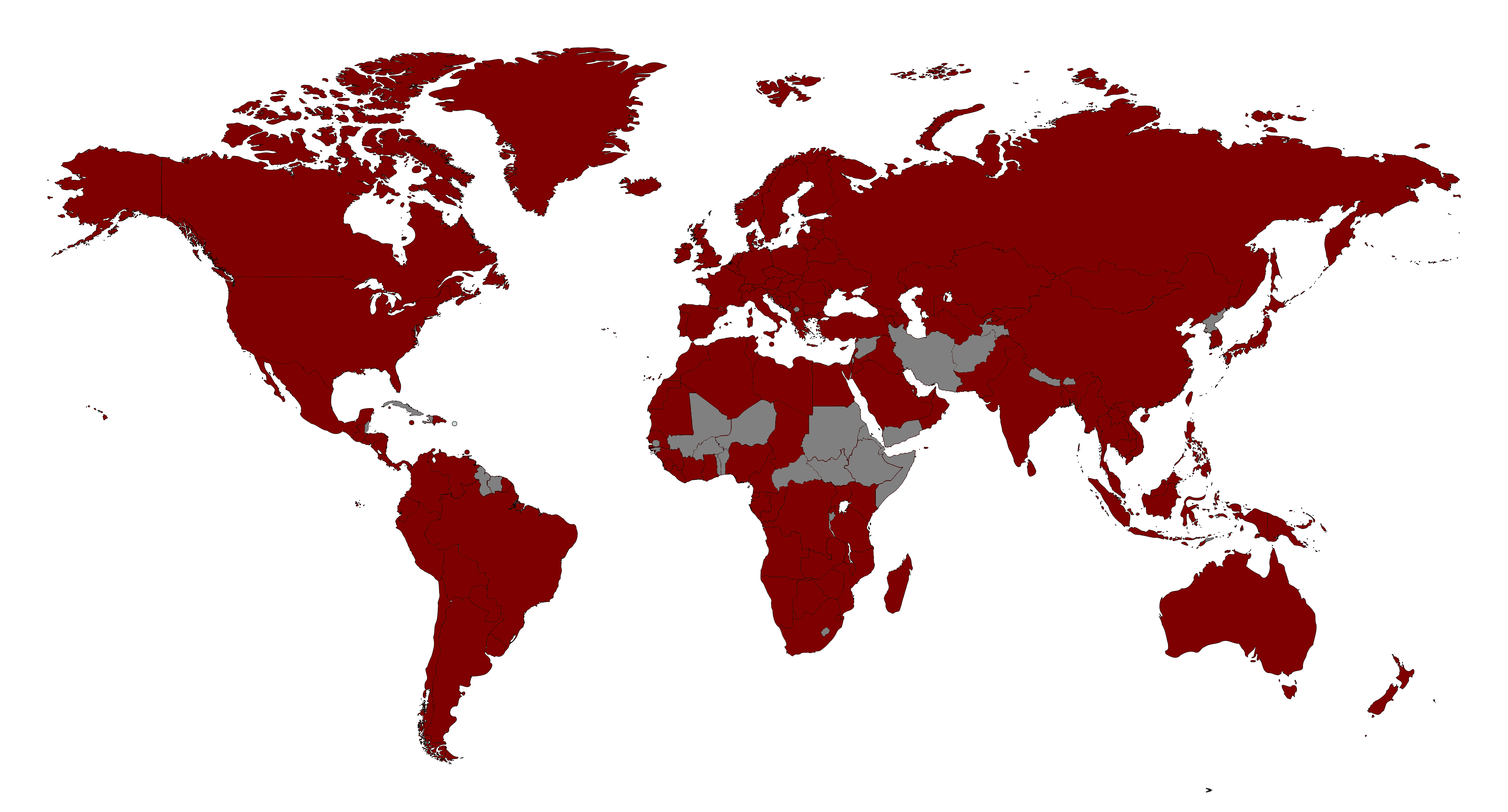

Pw C Global Retreat A Dozen Countries Exit Amidst Scandal Concerns

Apr 29, 2025

Pw C Global Retreat A Dozen Countries Exit Amidst Scandal Concerns

Apr 29, 2025 -

Brazil Bound Justin Herbert And The Chargers 2025 Season Debut

Apr 29, 2025

Brazil Bound Justin Herbert And The Chargers 2025 Season Debut

Apr 29, 2025