Addressing Investor Concerns: BofA's View On Elevated Stock Market Valuations

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's assessment of the current stock market is nuanced, neither purely optimistic nor overly pessimistic. They acknowledge the elevated valuations but also highlight underlying economic strengths and potential for future growth. Their analysis considers several key economic indicators, including inflation rates, interest rate adjustments by the Federal Reserve, and GDP growth projections.

- BofA's predicted growth trajectory for the coming quarters: BofA typically publishes quarterly reports outlining their predictions for economic growth. These projections usually incorporate factors such as consumer spending, business investment, and government spending. Their forecasts often inform their recommendations regarding specific sectors and investment strategies.

- Specific sectors BofA views as overvalued or undervalued: BofA's research frequently identifies sectors they deem overvalued (potentially susceptible to corrections) and undervalued (potentially offering higher growth opportunities). This analysis involves detailed financial modeling and assessment of industry trends.

- BofA's analysis of potential risks and opportunities: BofA identifies potential risks, such as rising inflation or geopolitical instability, alongside opportunities arising from technological advancements or emerging markets. This risk assessment is crucial for formulating robust investment strategies.

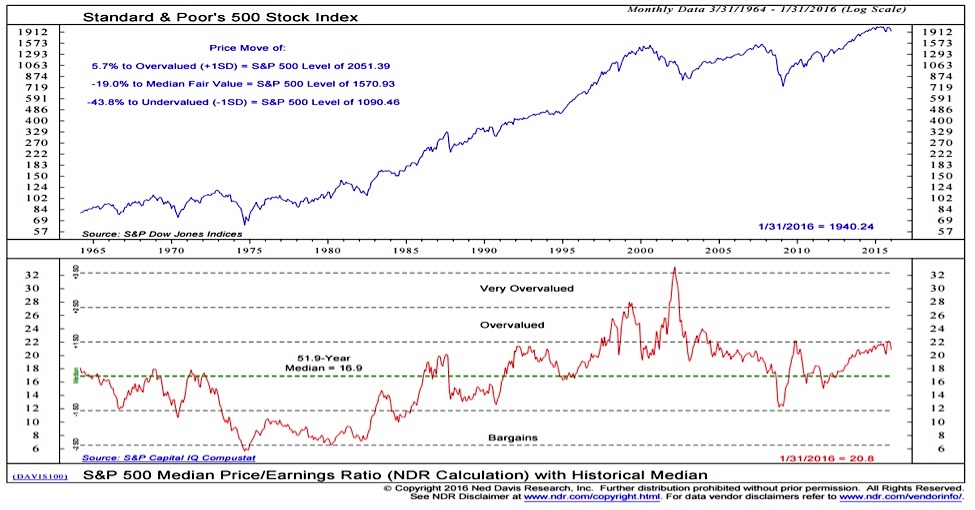

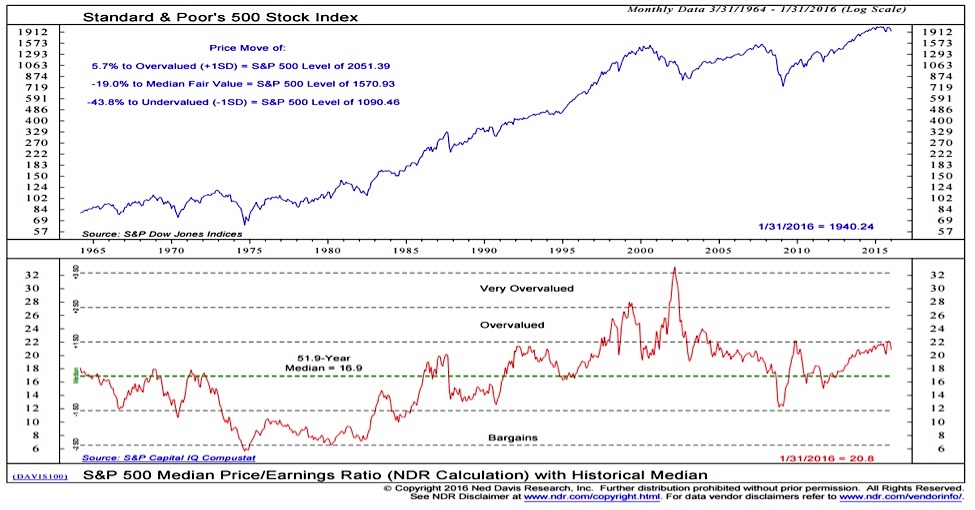

Understanding the Factors Contributing to Elevated Valuations

According to BofA's analysis, several factors contribute to the current high stock market valuations. These include macroeconomic conditions such as historically low interest rates, the impact of quantitative easing programs, and consistently strong corporate earnings reported across various sectors.

- Impact of low interest rates on stock valuations: Lower interest rates make borrowing cheaper for companies, leading to increased investments and potential for higher earnings. This, in turn, boosts stock prices as investors seek higher returns in a low-yield environment.

- Role of corporate buybacks in supporting prices: Many companies use excess cash to repurchase their own shares, reducing the number of outstanding shares and thus artificially inflating the price per share. BofA's analysis considers the extent to which this practice contributes to elevated valuations.

- Influence of investor sentiment and market psychology: Positive investor sentiment and market optimism can drive stock prices higher, even in the absence of significant improvements in underlying fundamentals. BofA's analysis considers the impact of investor behavior and market psychology on valuations.

BofA's Recommendations for Investors

BofA's advice for investors navigating these elevated valuations emphasizes a balanced and diversified approach. While acknowledging the inherent risks, they don't necessarily advocate for a complete market exit. Instead, they suggest a strategic reallocation of assets and a focus on risk management.

- Specific asset allocation recommendations: BofA may suggest adjustments to asset allocation, potentially advising a shift towards value stocks (companies trading below their intrinsic value) or an increase in bond holdings to reduce portfolio volatility.

- Advice on diversification strategies: Diversification across different asset classes (stocks, bonds, real estate, etc.) and sectors is crucial to mitigate risk. BofA’s recommendations usually highlight the importance of a well-diversified portfolio.

- Recommendations on risk management techniques: Employing risk management techniques, such as stop-loss orders or hedging strategies, is essential to protect capital during periods of market uncertainty. BofA's guidance on this front is vital for mitigating potential losses.

Addressing Specific Investor Concerns

Several anxieties are common among investors during periods of high stock market valuations. BofA addresses these concerns directly, providing insights into the likelihood and potential impact of various market events.

- BofA’s view on the likelihood of a market correction and its potential severity: Market corrections are a natural part of the market cycle. BofA analyzes various indicators to assess the probability and potential depth of a future correction.

- BofA's analysis of inflation’s impact on stock prices: High inflation erodes purchasing power and can negatively impact corporate earnings. BofA analyzes the interplay between inflation and stock prices, assessing the potential effects on different sectors.

- BofA’s assessment of geopolitical risks and their influence on the market: Geopolitical events can significantly influence market sentiment and valuations. BofA considers potential risks and their likely impact on the market.

Conclusion: Navigating Elevated Stock Market Valuations with BofA's Insights

BofA's analysis of elevated stock market valuations highlights the need for a cautious yet proactive investment approach. Their recommendations emphasize diversification, risk management, and a thorough understanding of market conditions. Remember, understanding market dynamics and employing sound investment strategies is paramount. Consulting with a qualified financial advisor for personalized guidance tailored to your risk tolerance and financial goals is strongly recommended. Learn more about BofA's perspective on managing your investments during periods of elevated stock market valuations and develop a robust investment strategy by visiting [link to relevant BofA resources].

Featured Posts

-

Hailee Steinfelds Life 20 Questions Answered

May 28, 2025

Hailee Steinfelds Life 20 Questions Answered

May 28, 2025 -

Samsung Galaxy S25 256 Go Acheter Au Meilleur Prix 775 E

May 28, 2025

Samsung Galaxy S25 256 Go Acheter Au Meilleur Prix 775 E

May 28, 2025 -

Chase Field 2025 Your Guide To Arizona Diamondbacks Games Promotions And Special Events

May 28, 2025

Chase Field 2025 Your Guide To Arizona Diamondbacks Games Promotions And Special Events

May 28, 2025 -

Manchester Uniteds Garnacho Video Shows Apparent Autograph Snub Of Young Fan

May 28, 2025

Manchester Uniteds Garnacho Video Shows Apparent Autograph Snub Of Young Fan

May 28, 2025 -

Cuaca Bandung Besok 26 3 Peringatan Hujan Di Jawa Barat

May 28, 2025

Cuaca Bandung Besok 26 3 Peringatan Hujan Di Jawa Barat

May 28, 2025

Latest Posts

-

International Companies To Present At Deutsche Bank Depositary Receipts Virtual Investor Conference May 15 2025

May 30, 2025

International Companies To Present At Deutsche Bank Depositary Receipts Virtual Investor Conference May 15 2025

May 30, 2025 -

Deutsche Bank Depositary Receipts Virtual Investor Conference Live Webcasts On May 15 2025

May 30, 2025

Deutsche Bank Depositary Receipts Virtual Investor Conference Live Webcasts On May 15 2025

May 30, 2025 -

Epiroc Aktiebolag Selects Deutsche Bank As Depositary For Its Adr Programs

May 30, 2025

Epiroc Aktiebolag Selects Deutsche Bank As Depositary For Its Adr Programs

May 30, 2025 -

Deutsche Bank Serves As Depositary Bank For Epirocs American Depositary Receipts

May 30, 2025

Deutsche Bank Serves As Depositary Bank For Epirocs American Depositary Receipts

May 30, 2025 -

Deutsche Bank Appointed Depositary Bank For Epiroc Adr Programs

May 30, 2025

Deutsche Bank Appointed Depositary Bank For Epiroc Adr Programs

May 30, 2025