Addressing Stock Market Valuation Concerns: Insights From BofA

Table of Contents

BofA's Current Market Outlook and Valuation Metrics

BofA's current market outlook often incorporates a blend of bullish and cautious perspectives, depending on the specific market sector and economic conditions. While not consistently explicitly "bullish" or "bearish", their analysis reflects a nuanced understanding of the market's complexities. Their reasoning is usually based on a thorough assessment of a range of valuation metrics, macroeconomic indicators, and geopolitical events.

BofA utilizes a variety of established valuation metrics to assess the market's health and identify potential opportunities and risks. These include:

-

Price-to-Earnings Ratio (P/E Ratio): This classic metric compares a company's stock price to its earnings per share. A high P/E ratio might suggest overvaluation, while a low P/E ratio could indicate undervaluation. However, it's crucial to compare P/E ratios within the same industry and consider a company's growth prospects. BofA often highlights discrepancies between P/E ratios across sectors in its reports.

-

Shiller PE (Cyclically Adjusted Price-to-Earnings Ratio): This metric smooths out earnings fluctuations over time, providing a more stable picture of valuation than the standard P/E ratio. BofA frequently utilizes the Shiller PE to gain a long-term perspective on market valuation.

-

Price-to-Sales Ratio (P/S Ratio): This metric compares a company's stock price to its revenue. It's particularly useful for valuing companies with negative earnings. BofA's analysis often incorporates P/S ratios, especially when evaluating high-growth technology companies.

BofA's reports frequently contain specific numerical data supporting their assessments. For example, they might point out that the Shiller PE is currently above its historical average, suggesting a potentially overvalued market, but then highlight specific sectors with more favorable valuations.

Identifying Overvalued and Undervalued Sectors According to BofA

BofA's sector analysis provides valuable insights for investors seeking to optimize their portfolios. Based on their ongoing research, BofA regularly identifies sectors they deem potentially overvalued and undervalued. This analysis is not static; it changes as market conditions evolve.

Potentially Overvalued Sectors (according to recent BofA reports – note: this information requires updating with current BofA research):

- Technology: High-growth technology stocks, particularly those with high P/E ratios and limited profitability, might be identified as overvalued during periods of economic uncertainty or rising interest rates.

- Consumer Discretionary: This sector can be highly sensitive to economic downturns and changes in consumer sentiment. High valuations in this sector might signal increased risk.

Potentially Undervalued Sectors (according to recent BofA reports – note: this information requires updating with current BofA research):

- Energy: Energy stocks could be viewed as undervalued during periods of sustained high energy prices or strategic shifts toward energy independence.

- Financials: The financial sector may appear undervalued during periods of economic recovery or low interest rate environments. However, this analysis requires a careful evaluation of bank balance sheets and regulatory environment.

Note: These are examples; specific sectors identified by BofA will vary depending on the current market conditions. Always refer to the most recent BofA reports for the most up-to-date information.

Mitigating Risk in a Potentially Overvalued Market: Strategies from BofA

Even in a potentially overvalued market, investors can employ strategies to mitigate risk and still achieve their financial goals. BofA's investment advice generally emphasizes a balanced and diversified approach.

BofA's suggested risk mitigation strategies often include:

- Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) and sectors reduces the impact of poor performance in any single area.

- Hedging: Employing hedging strategies, such as options or inverse ETFs, can help protect against potential market downturns.

- Value Investing: Focusing on fundamentally undervalued companies can reduce the reliance on market timing and overall market sentiment.

- Dollar-Cost Averaging: Investing a fixed amount of money at regular intervals, regardless of market fluctuations, can smooth out the impact of volatility.

The Impact of Macroeconomic Factors on Stock Market Valuation (BofA's Perspective)

BofA's economic analysis plays a crucial role in their stock market valuation assessments. They carefully consider the interplay of various macroeconomic factors, including:

- Inflation: High inflation erodes purchasing power and can lead to higher interest rates, potentially impacting company profitability and stock valuations.

- Interest Rates: Interest rate hikes increase borrowing costs for businesses and consumers, impacting investment and economic growth. BofA analyzes the Federal Reserve's actions and their potential consequences on the market.

- Geopolitical Events: Global events like wars, political instability, or trade disputes can significantly influence market sentiment and valuations. BofA's geopolitical risk assessment informs their market outlook.

BofA's analysts integrate these macroeconomic factors into their market models to predict potential market trends and inform their investment recommendations.

Conclusion: Making Informed Decisions about Stock Market Valuation Based on BofA's Insights

BofA's analysis of stock market valuation highlights the importance of considering both quantitative metrics (like P/E ratios and Shiller PE) and qualitative factors (such as macroeconomic conditions and geopolitical risks). While BofA's insights are valuable, remember to conduct thorough independent research and consult with a qualified financial advisor before making any investment decisions. Understanding stock market valuation concerns is crucial for long-term investment success. Stay informed about stock market valuation concerns and utilize BofA's insights to develop a robust investment strategy. Learn more about addressing your stock market valuation concerns by exploring BofA's latest reports.

Featured Posts

-

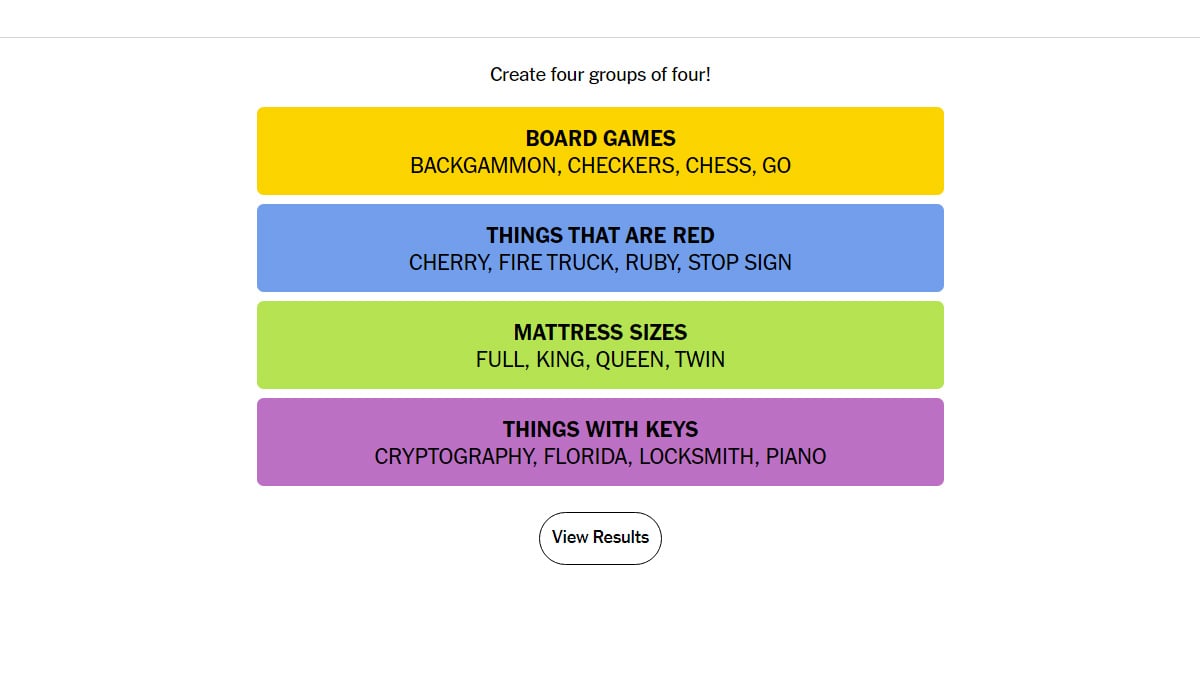

Solve Nyt Connections Puzzle 670 April 11 Hints And Answers Guide

May 19, 2025

Solve Nyt Connections Puzzle 670 April 11 Hints And Answers Guide

May 19, 2025 -

Eurovision 2025 On The Bbc What To Expect

May 19, 2025

Eurovision 2025 On The Bbc What To Expect

May 19, 2025 -

Johnny Mathis Retires 89 Year Old Singer Announces End Of Touring Amidst Memory Challenges

May 19, 2025

Johnny Mathis Retires 89 Year Old Singer Announces End Of Touring Amidst Memory Challenges

May 19, 2025 -

Chat Gpt 5 Rumors Debunked Release Date Features Price And More

May 19, 2025

Chat Gpt 5 Rumors Debunked Release Date Features Price And More

May 19, 2025 -

Legal Challenge Successful Campaigners Victory In Brockwell Park Dispute

May 19, 2025

Legal Challenge Successful Campaigners Victory In Brockwell Park Dispute

May 19, 2025