AEX Index Suffers Heavy Losses: More Than 4% Drop

Table of Contents

Main Points: Understanding the AEX Index Decline

2.1 Factors Contributing to the AEX Index Decline

H3: Global Market Uncertainty

The recent downturn in the AEX Index is inextricably linked to broader global market volatility. Several interconnected factors have contributed to this instability. High inflation rates across the globe, fueled by supply chain disruptions and increased energy prices, are forcing central banks to implement aggressive interest rate hikes. These hikes, while aimed at curbing inflation, also risk triggering a recession, dampening economic growth and impacting investor confidence. Furthermore, the ongoing geopolitical uncertainty, particularly the war in Ukraine, continues to create significant headwinds for global markets.

- Inflation impact on AEX: Persistent inflation erodes purchasing power and increases uncertainty, leading to risk aversion among investors.

- Interest rate hikes: Higher interest rates increase borrowing costs for businesses, potentially slowing down investment and economic activity.

- Geopolitical risks: The war in Ukraine and other geopolitical tensions create instability and uncertainty, affecting investor confidence in global markets, including the AEX.

H3: Performance of Key AEX Companies

The decline in the AEX Index is not solely a result of macro-economic factors; the underperformance of several key AEX companies significantly contributed to the overall drop. For example, ASML Holding, a major player in the semiconductor industry, experienced a [Insert Percentage]% drop, while Unilever, a multinational consumer goods company, saw a [Insert Percentage]% decline. ING Groep, a major Dutch bank, also faced significant losses. This individual stock weakness significantly impacted the overall AEX performance.

- AEX company performance: Analyzing the individual performance of major companies reveals vulnerabilities within specific sectors.

- Stock market drops: The sharp drops in these major companies underscore the broader market uncertainty.

- Individual stock losses: Investors holding shares in these companies experienced substantial losses.

H3: Sector-Specific Weakness

The AEX Index decline was not uniform across all sectors. The technology sector, particularly sensitive to interest rate hikes and global economic slowdown, experienced the most significant downturn. The energy sector also suffered, impacted by fluctuating energy prices and geopolitical instability. This sector-specific weakness highlights the vulnerability of certain industries to the current market conditions.

- AEX sector performance: A detailed sectoral analysis is crucial to understanding the specific drivers behind the overall AEX decline.

- Tech stock decline: Interest rate hikes and concerns about a potential recession disproportionately impacted technology stocks.

- Energy sector downturn: Fluctuating energy prices and geopolitical risks significantly impacted the energy sector’s performance.

H3: Impact of Investor Sentiment

Negative investor sentiment played a crucial role in exacerbating the AEX Index decline. Fear and uncertainty spurred panic selling, creating a downward spiral that amplified the initial drop. Negative news headlines and pessimistic market predictions further fueled investor anxiety, leading to a sell-off that intensified the decline.

- Investor sentiment: A shift in investor confidence from positive to negative can significantly impact market performance.

- Market panic: Panic selling can create a self-fulfilling prophecy, accelerating the market decline.

- AEX investor confidence: Restoring investor confidence is crucial for a potential market recovery.

2.2 Analysis of the AEX Index Drop and its Implications

H3: Short-Term vs. Long-Term Implications

The short-term implications of the AEX Index drop remain uncertain. While a short-term recovery is possible, the potential for further losses cannot be ruled out. The long-term outlook depends largely on how effectively global economic challenges are addressed and the overall stability of the global economy. A comprehensive analysis considering various economic indicators is needed for a clearer prediction.

- AEX Index forecast: Predicting short-term and long-term trends requires careful monitoring of key economic indicators.

- Market recovery: A recovery will likely depend on a combination of factors, including improved global economic sentiment.

- Long-term outlook: The long-term outlook remains uncertain and depends on several macroeconomic and geopolitical factors.

H3: Impact on the Dutch Economy

The decline in the AEX Index has significant implications for the Dutch economy. Reduced investor confidence can lead to decreased investment in businesses, potentially affecting job creation and economic growth. The overall health of Dutch companies listed on the AEX will heavily influence the country's economic trajectory. Monitoring the AEX closely is crucial for understanding the broader economic picture.

- AEX impact on Dutch economy: The AEX acts as a barometer for the health of the Dutch economy.

- Economic growth: A sustained decline in the AEX can negatively affect overall economic growth.

- Investor confidence: Maintaining and rebuilding investor confidence is vital for the Dutch economy.

Conclusion: Navigating the AEX Index Volatility – What to Expect Next

The sharp decline in the AEX Index reflects a confluence of global market uncertainties, weak performance of key AEX companies, sector-specific vulnerabilities, and negative investor sentiment. While the short-term outlook remains uncertain, understanding these contributing factors is crucial for navigating the volatility. Investors should remain vigilant, monitoring the AEX Index closely and staying informed about global economic developments and the performance of individual AEX companies. Conduct thorough research and consult with financial professionals before making investment decisions related to the AEX Index. Staying informed about the AEX market and its trends is essential for making sound investment decisions.

Featured Posts

-

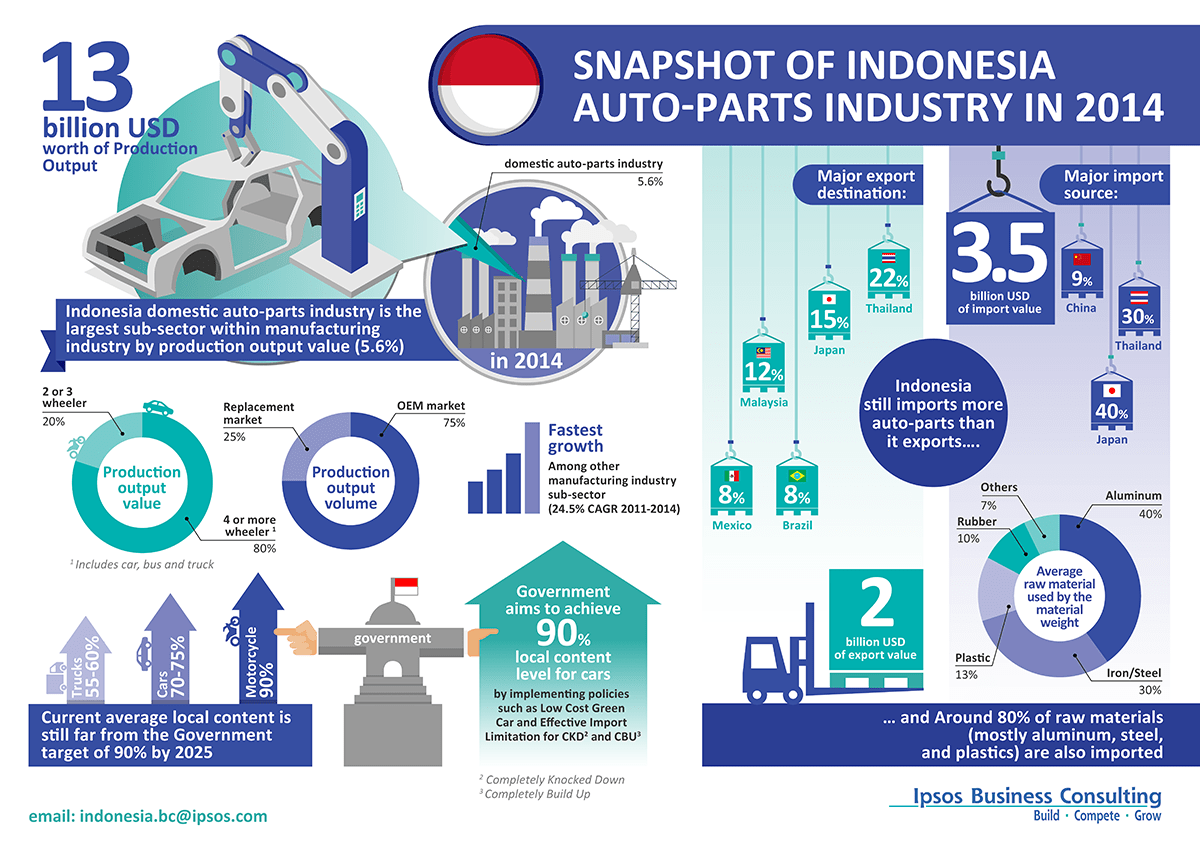

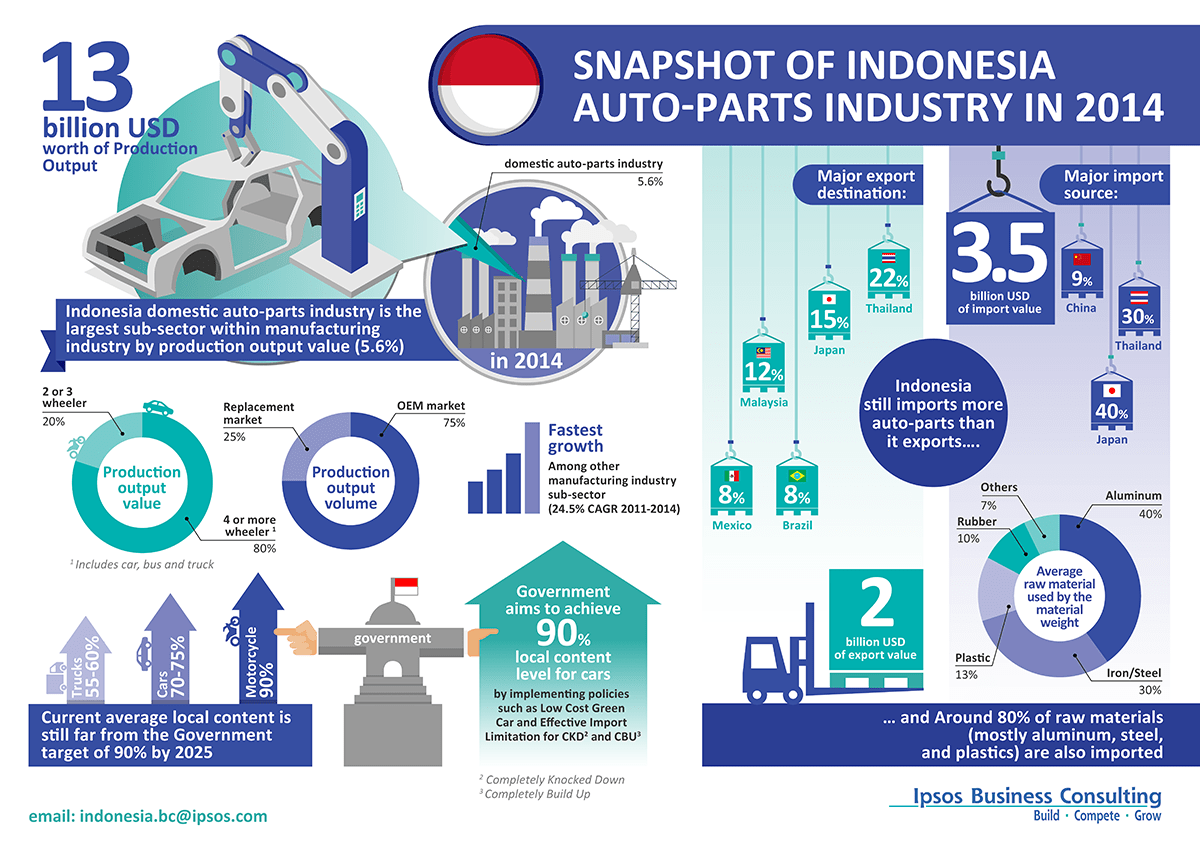

Chinas Impact How The Auto Industry Responds To Evolving Market Dynamics

May 25, 2025

Chinas Impact How The Auto Industry Responds To Evolving Market Dynamics

May 25, 2025 -

Evrovidenie 2025 Konchita Vurst Nazvala Chetyrekh Potentsialnykh Pobediteley

May 25, 2025

Evrovidenie 2025 Konchita Vurst Nazvala Chetyrekh Potentsialnykh Pobediteley

May 25, 2025 -

New Music Joy Crookes Unveils Powerful New Song I Know You D Kill

May 25, 2025

New Music Joy Crookes Unveils Powerful New Song I Know You D Kill

May 25, 2025 -

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist Key Considerations

May 25, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist Key Considerations

May 25, 2025 -

Over 1 500 To Attend Best Of Bangladesh Event In The Netherlands

May 25, 2025

Over 1 500 To Attend Best Of Bangladesh Event In The Netherlands

May 25, 2025

Latest Posts

-

New Evidence Implicates Najib Razak In French Submarine Bribery Case

May 25, 2025

New Evidence Implicates Najib Razak In French Submarine Bribery Case

May 25, 2025 -

The Problem With Thames Waters Executive Bonus Structure

May 25, 2025

The Problem With Thames Waters Executive Bonus Structure

May 25, 2025 -

Addressing Stock Market Valuation Worries Insights From Bof A

May 25, 2025

Addressing Stock Market Valuation Worries Insights From Bof A

May 25, 2025 -

Chinas Impact How The Auto Industry Responds To Evolving Market Dynamics

May 25, 2025

Chinas Impact How The Auto Industry Responds To Evolving Market Dynamics

May 25, 2025 -

The Dark Side Of Disaster Exploring The Market For Los Angeles Wildfire Bets

May 25, 2025

The Dark Side Of Disaster Exploring The Market For Los Angeles Wildfire Bets

May 25, 2025