Airbus Charges US Airlines For Tariffs

Table of Contents

The Source of the Tariffs and Airbus' Response

The root of this issue lies in a long-running trade dispute between the US and the EU, centered around accusations of illegal government subsidies for both Airbus and Boeing. The World Trade Organization (WTO) has issued rulings against both companies, leading to the imposition of retaliatory tariffs. The US imposed tariffs on Airbus aircraft, impacting their sales to US airlines. In response, Airbus has implemented surcharges on aircraft deliveries to American carriers, effectively passing the cost of these tariffs onto its customers.

- WTO Ruling and US Tariffs: The WTO authorized the US to impose tariffs on Airbus aircraft, citing illegal subsidies provided by European governments. These tariffs are levied as a percentage of the aircraft's value.

- Tariff Percentages and Surcharges: The specific tariff percentage imposed by the US varies depending on the aircraft model. Airbus has carefully calculated the surcharges to offset these tariffs, ensuring they accurately reflect the additional costs incurred.

- Communication to US Airlines: Airbus has directly communicated these surcharges to affected US airlines, outlining the reasons for the price increases and providing detailed explanations of the calculations.

- Legal Challenges and Appeals: Both Airbus and the EU have challenged the WTO rulings and the subsequent US tariffs, with ongoing legal battles potentially influencing the future trajectory of these surcharges.

Impact on US Airlines and the Aviation Industry

The Airbus surcharges are adding substantial costs to US airlines, impacting their financial performance and strategic planning. The effects are far-reaching, with potential consequences extending beyond individual airlines to influence the entire aviation market.

- Increased Operating Costs: The added cost of purchasing Airbus aircraft directly increases operating expenses for US airlines, potentially squeezing profit margins and affecting their ability to invest in other areas.

- Potential Airfare Increases: To offset increased costs, airlines may be compelled to raise airfares, potentially affecting passenger demand and travel patterns. The ultimate impact on ticket prices will depend on the competitive landscape and individual airline pricing strategies.

- Competitive Landscape Shift: The surcharges could advantage Boeing, the US-based aircraft manufacturer, by making Airbus aircraft comparatively more expensive. This may shift market share and influence future aircraft purchasing decisions.

- Economic Impact on the US Aviation Sector: The cumulative effect of these surcharges across multiple airlines could have a significant impact on the overall economic health of the US aviation sector.

Potential Long-Term Consequences

The Airbus tariff dispute's long-term effects are uncertain but potentially profound. It affects US-EU trade relations, the global aviation market, and the future of the industry.

- Transatlantic Aviation Market Impact: The dispute could reshape the transatlantic aviation market, potentially altering airline alliances, routes, and fleet compositions.

- Future Trade Negotiations: The outcome of future trade negotiations between the US and EU will be crucial in determining whether these tariffs are removed or remain in place. A resolution would likely lead to a reduction or removal of Airbus surcharges.

- Alternative Aircraft Suppliers: The higher cost of Airbus aircraft might push some US airlines to explore alternative aircraft manufacturers, diversifying their fleets and potentially altering the landscape of aircraft supplier dominance.

Conclusion

Airbus' decision to pass on US tariffs to US airlines is a significant development in the ongoing trade dispute between the US and EU. The financial and competitive implications are far-reaching, affecting not only individual airlines but also the broader aviation industry. The long-term consequences remain uncertain, highlighting the complex interconnectedness of global trade and its significant influence on the aviation sector. The ultimate impact will depend on the outcome of ongoing legal challenges, future trade negotiations, and the strategic responses of both Airbus and US airlines.

Call to Action: Stay informed about the latest developments in this crucial trade dispute. Follow our updates on how Airbus charges US airlines for tariffs and their impact on air travel. Learn more about the intricacies of the ongoing Airbus-Boeing trade war and its repercussions for the global aviation industry.

Featured Posts

-

Rosie Huntington Whiteleys Ethereal Lingerie A Closer Look

May 03, 2025

Rosie Huntington Whiteleys Ethereal Lingerie A Closer Look

May 03, 2025 -

Usilenie Davleniya Na Rossiyu Makron Dobilsya Podderzhki S Sh A Po Ukraine

May 03, 2025

Usilenie Davleniya Na Rossiyu Makron Dobilsya Podderzhki S Sh A Po Ukraine

May 03, 2025 -

Torgovlya Lyudmi V Sogde Obsuzhdenie Mer Protivodeystviya I Plany Na Buduschee

May 03, 2025

Torgovlya Lyudmi V Sogde Obsuzhdenie Mer Protivodeystviya I Plany Na Buduschee

May 03, 2025 -

Concerts Danse Et Cinema A La Seine Musicale Reservez Vos Places 2025 2026

May 03, 2025

Concerts Danse Et Cinema A La Seine Musicale Reservez Vos Places 2025 2026

May 03, 2025 -

Help The Nws Track Saturdays Storm Impact Report Your Damage In Tulsa

May 03, 2025

Help The Nws Track Saturdays Storm Impact Report Your Damage In Tulsa

May 03, 2025

Latest Posts

-

Anchor Brewing Companys Legacy 127 Years And Counting To Closure

May 04, 2025

Anchor Brewing Companys Legacy 127 Years And Counting To Closure

May 04, 2025 -

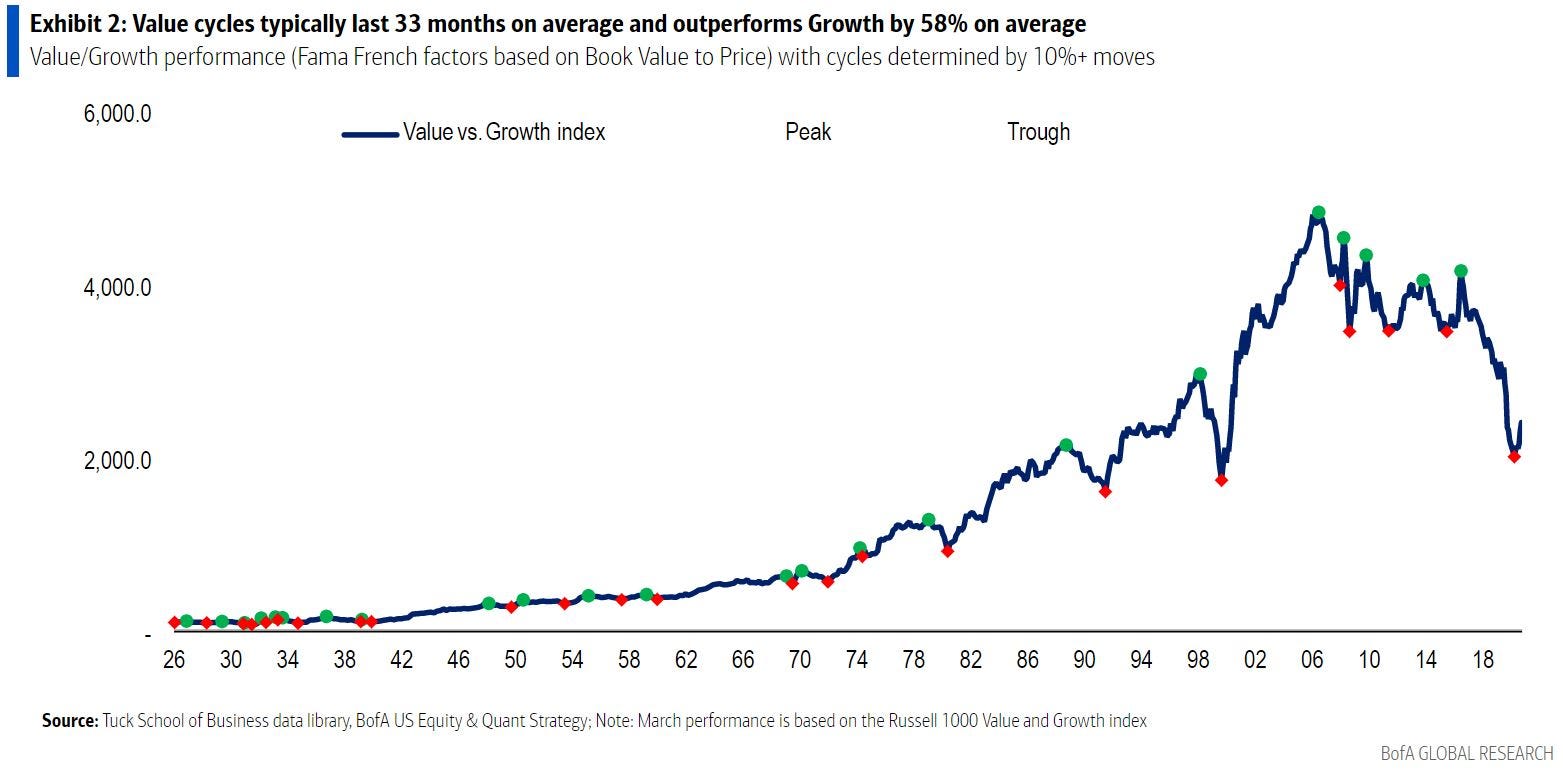

Bof As Rationale Why High Stock Market Valuations Are Not A Cause For Alarm

May 04, 2025

Bof As Rationale Why High Stock Market Valuations Are Not A Cause For Alarm

May 04, 2025 -

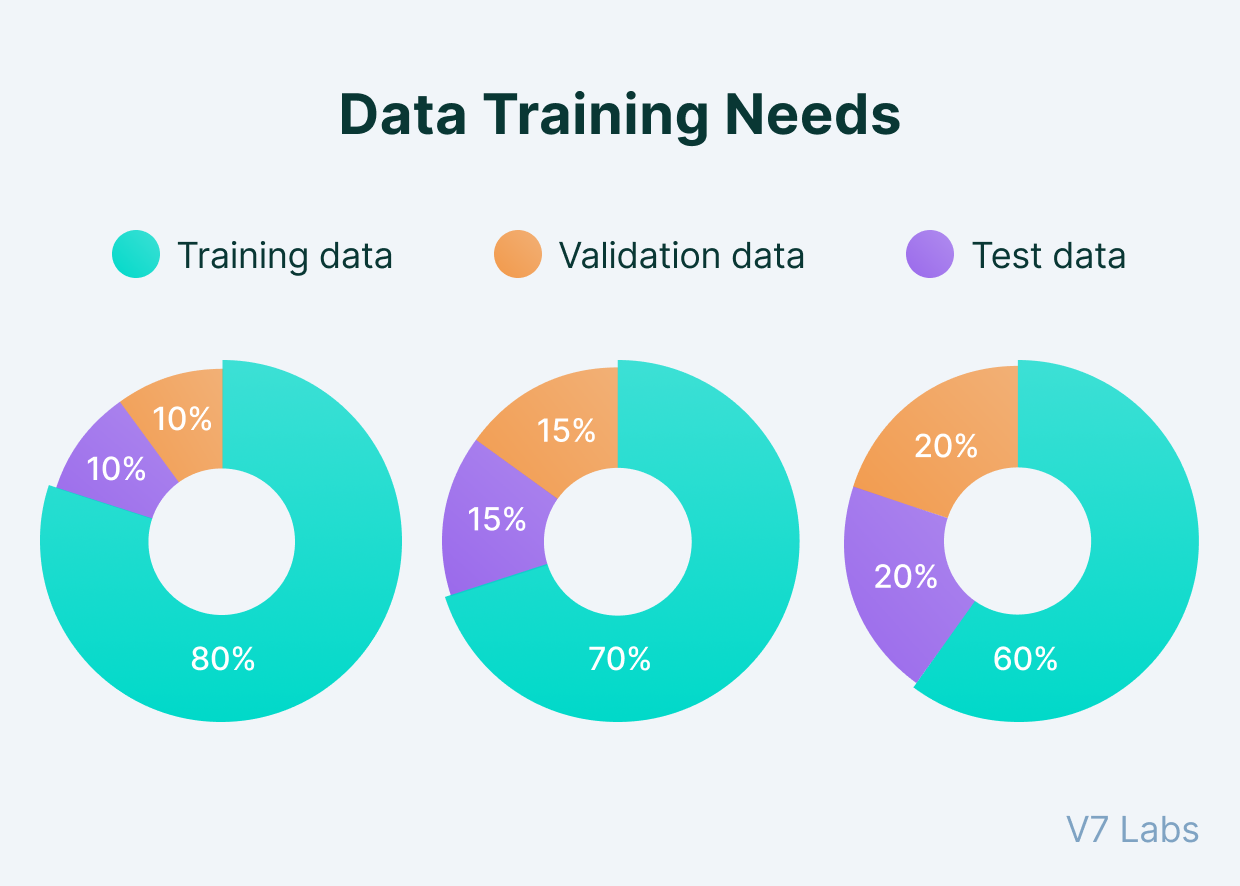

Googles Ai Search Algorithm Training Data And Opt Out Considerations

May 04, 2025

Googles Ai Search Algorithm Training Data And Opt Out Considerations

May 04, 2025 -

Middle Managements Contribution To A Thriving Company Culture And Employee Development

May 04, 2025

Middle Managements Contribution To A Thriving Company Culture And Employee Development

May 04, 2025 -

The End Of An Icon Anchor Brewing Company To Close After 127 Years

May 04, 2025

The End Of An Icon Anchor Brewing Company To Close After 127 Years

May 04, 2025