Airbus Passes Tariff Costs To US Airlines

Table of Contents

The ongoing trade dispute between the US and the EU has significantly impacted the aviation industry, with Airbus recently announcing it will pass on increased tariff costs to US airlines. This move has significant implications for airfares, airline profitability, and the broader economic landscape. This article explores the details of this decision and its potential consequences, examining how US airlines are responding and the wider impact on air travel. We will delve into the specifics of the tariffs, the rationale behind Airbus's decision, and the cascading effects on passengers and the global economy.

<h2>The Impact of Tariffs on Airbus Aircraft Prices</h2>

The US has imposed substantial tariffs on Airbus aircraft imported into the country as part of a long-standing trade dispute with the EU. These tariffs, encompassing both countervailing duties (to offset government subsidies) and anti-dumping duties (to counteract allegedly unfair pricing practices), have significantly increased the cost of Airbus planes for US airlines. The exact percentage increase varies depending on the aircraft model and the specific tariff applied, but it's substantial enough to impact Airbus's bottom line and its competitiveness.

- Increased manufacturing costs for Airbus: The tariffs directly add to the cost of producing and delivering aircraft to US customers. This increased cost is not easily absorbed by Airbus.

- Reduced profit margins for Airbus: The higher costs squeeze Airbus's profit margins, potentially affecting its investment in research and development and future aircraft production.

- Impact on Airbus's competitive position in the US market: The price increase makes Airbus planes less competitive against Boeing, its main rival, which is not subject to the same tariffs in the US market.

These tariffs represent a significant barrier to entry and a blow to Airbus's market share within the United States. The ongoing dispute highlights the volatility of international trade relations and their influence on the aviation sector.

<h2>Airbus's Decision to Pass on Costs to US Airlines</h2>

Facing increased costs due to US tariffs, Airbus has opted to pass on these expenses to its US airline customers. This decision is a direct consequence of the economic pressures imposed by the trade dispute. Airbus's rationale is simple: absorb the cost and face reduced profits, or transfer the burden to its clients.

The contractual agreements between Airbus and US airlines are crucial here. While the specifics of these agreements are confidential, it’s likely that some clauses allow for price adjustments based on unforeseen circumstances, such as significant tariff increases. Negotiations between Airbus and its US airline customers likely played a significant role in determining how and to what extent the cost increase would be passed on.

- Statement from Airbus regarding the cost increase: Airbus has likely issued statements acknowledging the tariff impact and explaining its decision to adjust prices accordingly.

- Methods used to pass on the increased costs: This is likely to involve price increases on new orders, affecting airlines' capital expenditure plans and potentially delaying aircraft deliveries.

- Potential legal challenges or disputes: While unlikely, the price increase could lead to legal challenges or disputes between Airbus and US airlines who feel the cost increase is unfair or exceeds what is contractually permissible.

<h2>Consequences for US Airlines and Passengers</h2>

The increased cost of Airbus planes directly impacts US airlines' profitability and operational costs. These airlines will inevitably face a difficult decision.

- Increased operating costs for US carriers: Higher aircraft prices mean increased debt or reduced profitability. Airlines will need to find a way to offset these additional expenses.

- Potential reduction in flight routes or frequency: To maintain profitability, some airlines might be forced to reduce the number of flights or routes they offer, impacting consumers' choice and convenience.

- Impact on airline competition: The increased costs could disproportionately affect smaller US airlines, potentially impacting the overall competitive landscape.

- Analysis of consumer impact (higher airfares): The most significant consequence for passengers is the near certainty of increased airfares. Airlines will likely pass on at least a portion of the increased costs to travelers.

<h2>Wider Economic Implications</h2>

The tariff dispute between the US and the EU extends far beyond the aviation industry. It has wider economic implications, affecting jobs, investment, and trade relations.

- Impact on US manufacturing and supply chain: The tariffs can disrupt the US manufacturing and supply chain, impacting industries that supply parts and services to the aviation sector.

- Potential job losses in related industries: Reduced airline profitability and manufacturing activity could lead to job losses throughout the supply chain, potentially leading to a ripple effect throughout the US economy.

- Geopolitical implications of the trade dispute: The ongoing trade dispute highlights the complexities of international relations and the potential impact of protectionist policies on global economic growth and stability.

<h2>Conclusion</h2>

Airbus's decision to pass on tariff costs to US airlines is a significant development with wide-ranging consequences. From increased airfares for consumers to reduced profitability for airlines and broader economic effects, the impact of this trade dispute is far-reaching. The situation highlights the complexities of international trade and its impact on various sectors. The ripple effects extend beyond airline ticket prices, influencing manufacturing, employment, and geopolitical relations.

Call to Action: Stay informed about the evolving situation regarding Airbus passing tariff costs to US airlines. Continue following news and analysis to understand the long-term effects of this decision on air travel and the global aviation industry. Understanding the intricacies of these trade disputes is crucial for travelers and industry professionals alike.

Featured Posts

-

Four Inches Of Snow Or More Expected Tuesday Bitter Cold To Follow

May 03, 2025

Four Inches Of Snow Or More Expected Tuesday Bitter Cold To Follow

May 03, 2025 -

The Future Of Mobile Gaming Valorant Mobiles Potential

May 03, 2025

The Future Of Mobile Gaming Valorant Mobiles Potential

May 03, 2025 -

Nebraska Voter Id Initiative Receives National Recognition

May 03, 2025

Nebraska Voter Id Initiative Receives National Recognition

May 03, 2025 -

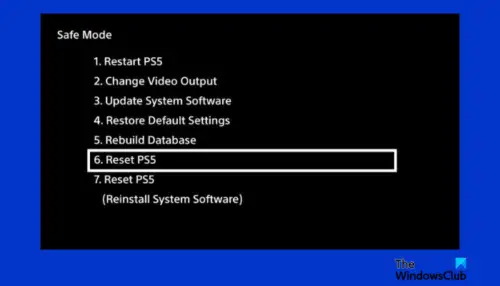

Play Station Network Sorunlarini Giderme Ve Giris Yapma

May 03, 2025

Play Station Network Sorunlarini Giderme Ve Giris Yapma

May 03, 2025 -

Dramatic Facelift Actress Sparks Debate With Altered Appearance

May 03, 2025

Dramatic Facelift Actress Sparks Debate With Altered Appearance

May 03, 2025

Latest Posts

-

Lakazet S 157 Gola Vv Frantsiya Triumf Za Lion

May 03, 2025

Lakazet S 157 Gola Vv Frantsiya Triumf Za Lion

May 03, 2025 -

157 Iyat Gol Na Lakazet Lion Na Praga Na Vtoroto Myasto

May 03, 2025

157 Iyat Gol Na Lakazet Lion Na Praga Na Vtoroto Myasto

May 03, 2025 -

Lakazet Izprevarva Papen Lion Se Priblizhava Do 2 Ro Myasto

May 03, 2025

Lakazet Izprevarva Papen Lion Se Priblizhava Do 2 Ro Myasto

May 03, 2025 -

Lakazet 157 Gola Vv Frenskoto Prvenstvo Nov Rekord

May 03, 2025

Lakazet 157 Gola Vv Frenskoto Prvenstvo Nov Rekord

May 03, 2025 -

Poleodomiki Diafthora Kai Ethniki Anagennisi O Dromos Pros Ena Dikaio Kratos

May 03, 2025

Poleodomiki Diafthora Kai Ethniki Anagennisi O Dromos Pros Ena Dikaio Kratos

May 03, 2025