Akeso's Disappointing Trial Results Send Shares Plummeting

Table of Contents

Akeso's Disappointing Clinical Trial Data

Specifics of the Trial Failure

The disappointing news stems from Akeso's Phase III clinical trial for [Specific Drug Name], a [drug class] intended to treat [specific disease]. The primary endpoint, [clearly state the primary endpoint, e.g., overall survival rate], was not met. The trial results revealed a [percentage]% efficacy rate, significantly lower than the projected [percentage]%, with a p-value of [p-value]. This failure represents a considerable setback in the drug's development, raising concerns about its future prospects.

- Reasons for Failure (as stated by Akeso): [Insert Akeso's official explanation for the trial failure if available. Otherwise, speculate based on available information, clearly stating that it is speculation.] Potential reasons could include [list potential reasons, e.g., unexpected side effects, insufficient dosage, issues with trial design, etc.].

- Unexpected Side Effects/Safety Concerns: [Detail any unexpected side effects or safety concerns that may have contributed to the trial's failure. Include specifics if available from public information]. The presence of significant side effects could lead to regulatory hurdles and delay or prevent future development.

- Potential Future Trials/Adjustments: Akeso has indicated [mention any plans for future trials, modifications to the drug, or changes in the development plan. If no information is publicly available, explain the potential next steps, like further investigation of the cause of failure, adjusting the drug formulation, or designing a new trial protocol]. This may involve further preclinical studies or a redesign of the Phase III clinical trial.

Market Reaction and Share Price Plunge

Immediate Impact on AKSO Stock

Following the announcement of the disappointing clinical trial results, Akeso's share price experienced a dramatic [percentage]% drop. Trading volume surged, indicating significant investor activity and anxiety. The company's market capitalization shrank considerably, reflecting the loss of investor confidence.

- Investor Sentiment: The immediate market reaction clearly indicates a negative investor sentiment, with widespread selling pressure driving down the share price. This reflects a significant loss of confidence in Akeso's ability to deliver on its promises.

- Proportionality of the Drop: Whether the share price drop was proportionate to the news depends on various factors, including the overall market conditions, the company's financial health, and the potential impact on the rest of Akeso's pipeline. A thorough analysis would require examining all these factors.

- Analyst Commentary/Rating Downgrades: Following the news, several analysts [mention specific analysts and firms if possible] issued negative comments and downgraded their ratings for AKSO stock, further exacerbating the sell-off. This reinforces the widespread concern about the company's prospects.

Analyzing the Long-Term Implications for Akeso

Future of the Company's Pipeline

The failure of the [Specific Drug Name] trial casts a shadow over Akeso's entire drug pipeline. While other drugs in development are distinct, the negative publicity and potential loss of investor confidence could affect funding for future research and development.

- Financial Stability: Akeso's ability to weather this setback depends on its financial reserves, its access to further funding, and its ability to secure new partnerships. The extent of the long-term damage is currently unclear.

- Strategic Direction Changes: The company may need to reassess its strategic direction, potentially focusing on its more promising drug candidates or exploring new therapeutic areas to diversify its portfolio and reduce reliance on the failed drug.

- Potential Funding Rounds/Partnerships: Akeso might seek additional funding through further investment rounds or partnerships to continue its research and development efforts. Securing such funding may be more challenging in the wake of this disappointing news.

Advice for Investors

Strategies for Navigating the Market Volatility

Navigating the market volatility following Akeso's disappointing trial results requires careful consideration and a well-defined investment strategy.

- Buy, Hold, or Sell Recommendation: [Provide a clear buy, hold, or sell recommendation. Justify your recommendation based on a comprehensive analysis of Akeso's situation, market conditions, and risk tolerance. This is not financial advice; consult a financial professional.]

- Importance of Diversification: Investors should emphasize diversification across their portfolios to mitigate risk. Over-reliance on any single stock, particularly in a volatile sector like biotech, is unwise.

- Due Diligence and Research: Before making any investment decisions, thorough due diligence and comprehensive research are essential. Understand the company's financials, its pipeline, and the risks involved before investing.

Conclusion:

Akeso's disappointing clinical trial results have undoubtedly created significant challenges, leading to a substantial share price decline. The failure of the [Specific Drug Name] trial and the market's subsequent reaction underscore the inherent risks involved in biotech investments. While the future remains uncertain, understanding the specifics of the setback, the market's reaction, and the company's long-term prospects is crucial for investors. A thorough analysis, coupled with risk management strategies, are essential for navigating this turbulent period.

Call to Action: Stay informed on the latest developments regarding Akeso's clinical trials and ongoing research to make informed decisions about your Akeso investments. Thoroughly research your options and consult with a financial advisor before making any investment decisions related to Akeso or other pharmaceutical stocks. Understanding the nuances of Akeso's situation and the wider biotech market will help navigate future volatility. Remember, informed decisions are key to successful long-term investing in the volatile world of biotech.

Featured Posts

-

Cost Cutting Measures Surge In The U S As Tariffs Remain Unclear

Apr 29, 2025

Cost Cutting Measures Surge In The U S As Tariffs Remain Unclear

Apr 29, 2025 -

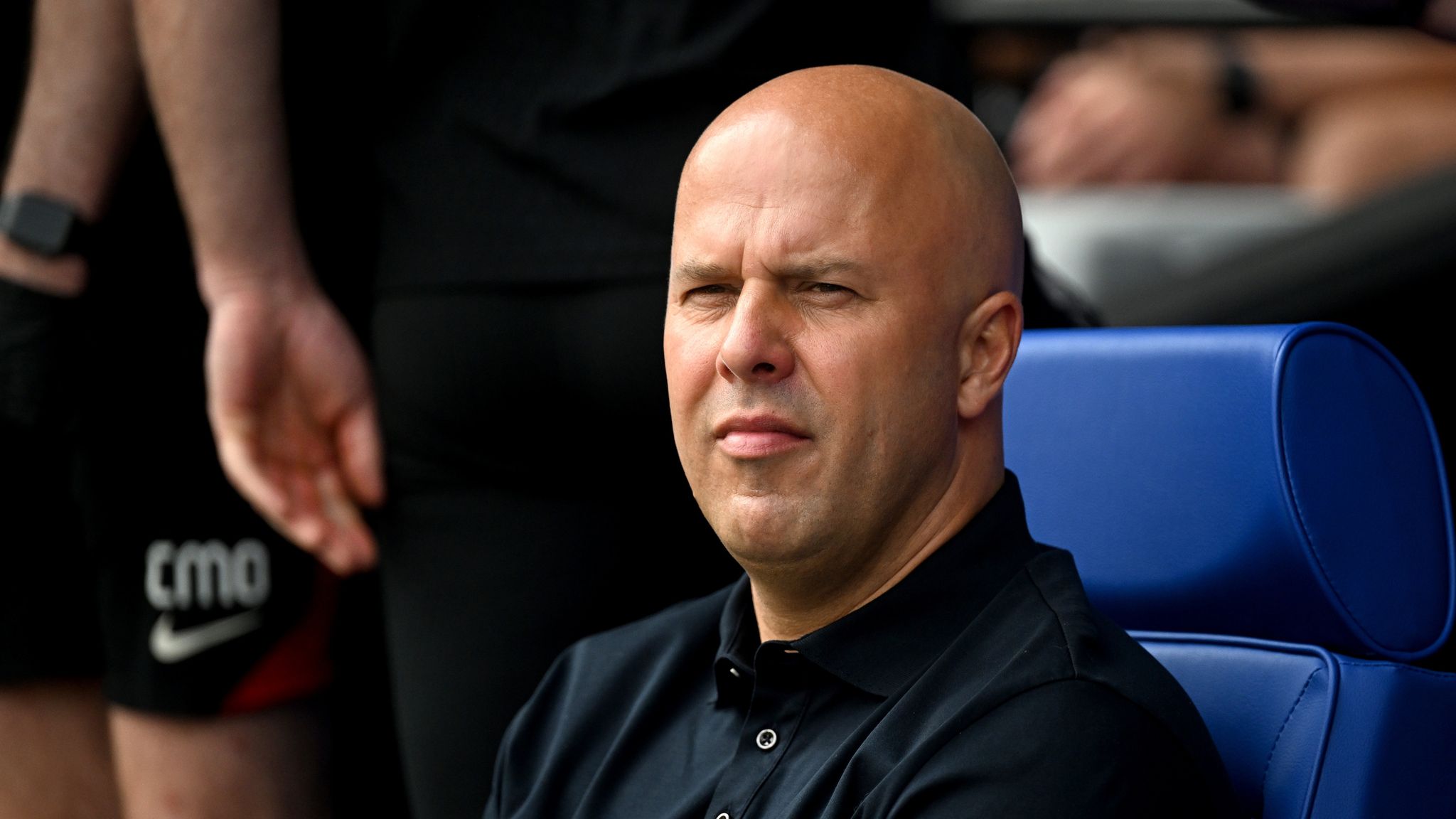

Arne Slot How Liverpool Nearly Won The Premier League

Apr 29, 2025

Arne Slot How Liverpool Nearly Won The Premier League

Apr 29, 2025 -

154 Albums And Counting Willie Nelsons Latest Release And Family Controversy

Apr 29, 2025

154 Albums And Counting Willie Nelsons Latest Release And Family Controversy

Apr 29, 2025 -

I Dont Know Why I Just Do A Deep Dive Into The Collaboration With Jeff Goldblum And Ariana Grande

Apr 29, 2025

I Dont Know Why I Just Do A Deep Dive Into The Collaboration With Jeff Goldblum And Ariana Grande

Apr 29, 2025 -

British Paralympian Vanishes In Las Vegas Police Investigation Launched

Apr 29, 2025

British Paralympian Vanishes In Las Vegas Police Investigation Launched

Apr 29, 2025