Ambani's Reliance Earnings: Positive Outlook For Indian Equities

Table of Contents

Strong Reliance Earnings Drive Market Sentiment

Reliance Industries' latest earnings report showcased exceptional financial strength, exceeding market expectations across several key metrics. This robust performance has significantly bolstered market sentiment and instilled confidence amongst investors.

Key highlights include:

- A substantial X% increase in revenue compared to the previous quarter, driven by strong growth across its diverse portfolio.

- A Y% surge in the Jio subscriber base, solidifying its position as a leading telecom player in India.

- Impressive growth in the retail sector, fueled by successful new product launches and expansion into new markets, demonstrating the effectiveness of its omnichannel strategy.

- Significant progress in its energy transition initiatives, attracting considerable investment and positioning Reliance as a key player in the renewable energy space.

These positive results reflect the effectiveness of Reliance's diversified business model and its ability to navigate the complexities of the Indian market. This strong performance has directly translated into increased investor confidence, driving up stock prices and attracting further investments. The market's positive reaction underscores the significant influence Reliance wields on the overall health of the Indian equity market.

Impact on Key Sectors

Reliance's strong performance has created a ripple effect across several key sectors within the Indian equity market. This positive influence extends beyond Reliance itself, stimulating growth and innovation in related industries.

-

Telecom: Jio's continued growth has intensified competition, driving innovation and offering consumers more competitive pricing and advanced services. This increased competition benefits the overall telecom sector.

-

Retail: Reliance Retail's success is a significant indicator of increasing consumer spending and a shift towards organized retail in India. This growth positively impacts related industries, including logistics, manufacturing, and consumer goods.

-

Energy: Reliance's investments in renewable energy are signaling a positive shift towards sustainable practices within the energy sector. This attracts further investments in green technologies and contributes to India's broader sustainability goals. The increased focus on renewable energy is expected to further boost the sector.

The interconnectedness of these sectors means that Reliance's success acts as a catalyst for broader economic growth, further enhancing the positive outlook for Indian equities.

Long-Term Implications for Indian Equities

Reliance's positive performance holds significant long-term implications for Indian equities. The robust earnings are likely to attract substantial foreign investment, further fueling market growth and potentially leading to higher stock valuations.

The positive outlook is further supported by:

- Increased foreign investment in India due to the confidence generated by Reliance's success.

- Potential for significantly higher stock valuations across various sectors influenced by Reliance's performance.

- Increased opportunities for diversification within the Indian market, providing investors with a broader range of options.

However, potential risks and challenges remain. Geopolitical uncertainties, global economic fluctuations, and regulatory changes could impact the overall market performance. Despite these potential headwinds, the current trajectory strongly indicates a bright future for Indian equities.

Analyzing Ambani's Leadership and Strategic Decisions

Mukesh Ambani's visionary leadership and strategic decision-making have been instrumental in Reliance's remarkable success. His ability to anticipate market trends and adapt to evolving consumer needs has been crucial in driving the company's growth across various sectors.

Key strategic initiatives contributing to the positive earnings include:

- Early adoption and aggressive expansion of 4G technology through Jio.

- A strategic focus on digitalization and technological innovation across all business verticals.

- Aggressive expansion in the retail sector, leveraging technology and consumer insights.

- Early investments in renewable energy, positioning Reliance as a frontrunner in the green energy transition.

Ambani's future strategies, focusing on digital technologies, sustainable energy, and further retail expansion, promise even more significant growth and will undoubtedly continue to shape the landscape of the Indian equity market.

Conclusion: Reliance Earnings and the Future of Indian Equities

Reliance Industries' exceptional earnings have undeniably injected significant positivity into the Indian equity market. The strong performance, driven by Mukesh Ambani's strategic vision and leadership, points towards a robust and promising future for Indian equities. While risks remain, the overall outlook is undeniably positive. This makes now an opportune time to consider investment opportunities in the thriving Indian equity market. Learn more about leveraging the positive outlook of Ambani's Reliance earnings and explore investment opportunities in the thriving Indian equity market today! (Link to relevant investment resources would be inserted here).

Featured Posts

-

You Tubes Expanding Reach Attracting And Engaging Older Viewers Npr Data

Apr 29, 2025

You Tubes Expanding Reach Attracting And Engaging Older Viewers Npr Data

Apr 29, 2025 -

The Culture Departments Canoe Awakening A Community Celebration

Apr 29, 2025

The Culture Departments Canoe Awakening A Community Celebration

Apr 29, 2025 -

American Expat Life In Spain One Returned One Stayed Why

Apr 29, 2025

American Expat Life In Spain One Returned One Stayed Why

Apr 29, 2025 -

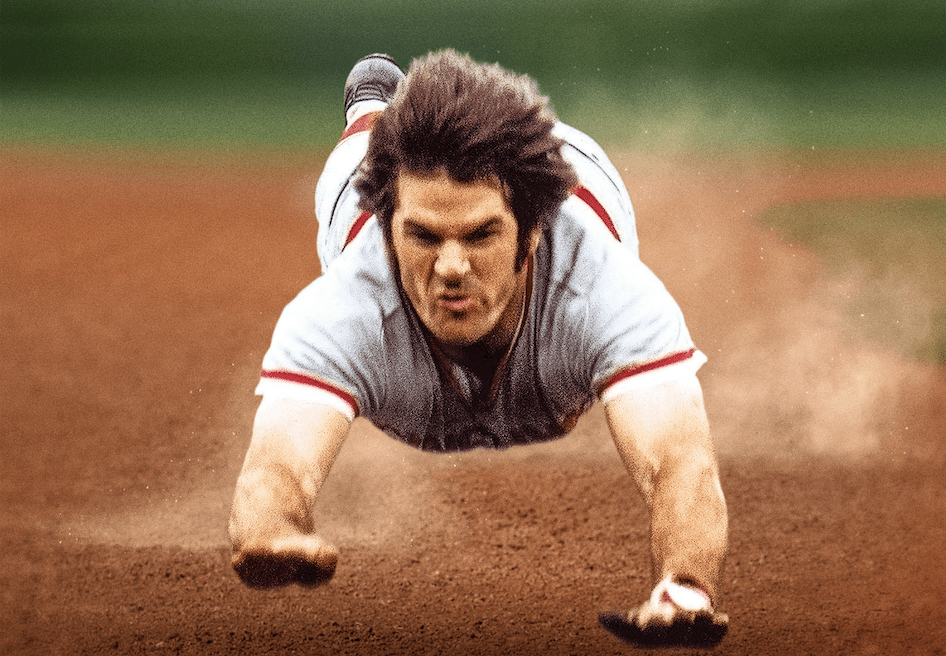

Trumps Posthumous Pardon For Pete Rose A Presidential Promise

Apr 29, 2025

Trumps Posthumous Pardon For Pete Rose A Presidential Promise

Apr 29, 2025 -

Porsche Macan Fyrsta 100 Rafutgafan Kynnt

Apr 29, 2025

Porsche Macan Fyrsta 100 Rafutgafan Kynnt

Apr 29, 2025