Amsterdam Exchange Plunges 11% Since Wednesday: Three Days Of Losses

Table of Contents

Identifying the Triggers of the Amsterdam Exchange Decline

The 11% drop in the Amsterdam Exchange over three days didn't happen in a vacuum. Several interconnected factors likely contributed to this significant market volatility and stock market decline. Understanding these triggers is crucial for assessing the current situation and predicting potential future trends in the Amsterdam stock exchange.

-

Recent Economic Data Releases: Negative economic indicators, such as unexpectedly high inflation figures or disappointing employment data, can significantly impact investor confidence. A weaker-than-expected GDP growth forecast for the Eurozone, for example, could trigger sell-offs across the Amsterdam Exchange.

-

Geopolitical Instability and International Conflicts: Global events, such as escalating geopolitical tensions or unexpected international conflicts, can introduce considerable uncertainty into the market. These risks often lead to increased market volatility and investor apprehension, prompting them to divest from riskier assets, contributing to the stock market crash-like scenario witnessed in Amsterdam.

-

Interest Rate Changes and Their Effect on Market Valuations: Changes in interest rates by central banks, like the European Central Bank (ECB), directly impact borrowing costs and influence market valuations. A sudden increase in interest rates can make investments less attractive, leading to a decline in stock prices, as seen in the recent Amsterdam Exchange downturn. This impacts trading losses as investors readjust their strategies.

-

Inflation and Rising Energy Prices: Persistent high inflation and soaring energy prices erode purchasing power and increase business costs. This can negatively affect company profits and investor sentiment, contributing to market downturns like the one observed in the Amsterdam Exchange. This inflation directly contributes to investment losses.

-

Supply Chain Disruptions: Ongoing disruptions to global supply chains can lead to shortages and increased production costs, further impacting company profitability and investor confidence. Sectors heavily reliant on global supply chains are particularly vulnerable during such periods of market volatility.

-

Company-Specific News and Announcements: Negative news concerning specific companies listed on the Amsterdam Exchange, such as disappointing earnings reports or unexpected management changes, can trigger targeted sell-offs, contributing to the overall market decline.

Impact on Investors and the Broader Market

The sharp decline in the Amsterdam Exchange has had a significant impact on various investor groups and the broader market, highlighting the consequences of market volatility and the importance of risk management.

-

Extent of Losses: Both retail investors and institutional investors have experienced losses, with the extent varying depending on their investment strategies and risk tolerance. The magnitude of these trading losses underscores the need for careful investment planning.

-

Portfolio Diversification: Investors with well-diversified portfolios might have experienced less severe losses than those heavily invested in specific sectors or companies heavily impacted by the market downturn. This emphasizes the importance of portfolio diversification as a risk management strategy.

-

Risk Management Techniques: The current situation underlines the crucial role of risk management techniques during volatile periods. Strategies like stop-loss orders and hedging can help mitigate potential losses and reduce the impact of market fluctuations.

-

Market Corrections and Long-Term Implications: While the current decline could be seen as a market correction, its long-term implications remain uncertain. The severity and duration of the downturn will influence the recovery timeline and the overall health of the Amsterdam Exchange.

-

Trading Strategies During Downturns: Various trading strategies, such as value investing or contrarian investing, might be employed during market downturns to capitalize on potential opportunities. However, caution and careful risk assessment are paramount.

-

Impact on Hedge Funds and Other Investment Vehicles: Hedge funds and other sophisticated investment vehicles are also affected by the downturn, potentially facing significant losses and impacting their ability to meet investor obligations.

Potential Future Scenarios and Recovery Outlook for the Amsterdam Exchange

Predicting the future trajectory of the Amsterdam Exchange is challenging, but analyzing potential scenarios and considering various factors can provide some insights into the potential recovery outlook.

-

Financial Expert Forecasts: Analyzing forecasts from reputable financial experts and institutions can offer insights into the potential duration and depth of the downturn, as well as potential catalysts for a market recovery.

-

Government and Central Bank Interventions: Government policies and central bank actions aimed at stabilizing the market, such as interest rate cuts or fiscal stimulus measures, could influence the recovery trajectory.

-

Catalysts for Market Recovery: Positive economic news, improved geopolitical stability, or a resolution to supply chain issues could act as catalysts for a market recovery. Company-specific positive announcements can also contribute to a market rebound.

-

Investment Opportunities Amidst the Downturn: Market downturns often present investment opportunities for long-term investors willing to take calculated risks. Identifying undervalued assets can lead to significant gains once the market recovers.

-

Long-Term Implications of the Decline: The long-term implications of the recent decline will depend on the underlying economic conditions and the effectiveness of government and central bank interventions. The impact on economic growth, employment, and investor confidence will shape the future.

-

Future Market Trends: Current economic indicators and geopolitical factors suggest potential future market trends. Understanding these trends is crucial for developing robust investment strategies to navigate the evolving landscape of the Amsterdam Exchange.

Conclusion

The 11% plunge in the Amsterdam Exchange over the past three days highlights the inherent volatility of the stock market and the importance of market analysis. Several factors, ranging from weak economic indicators to escalating geopolitical risks, appear to have contributed to this significant decline, impacting investors across the board. Understanding these triggers and implementing effective risk management strategies is crucial for navigating such turbulent periods. The impact on investment losses and the need for robust trading strategies are evident.

Call to Action: Stay informed about the ongoing situation on the Amsterdam Exchange and consult with financial advisors to develop a robust investment strategy that addresses the current market volatility. Continuously monitor the Amsterdam Exchange's performance and adapt your investments accordingly to mitigate potential further losses and to make informed investment decisions in this dynamic environment.

Featured Posts

-

Fedor Lavrov Pavel I Trillery I Lyubov K Ostrym Oschuscheniyam

May 25, 2025

Fedor Lavrov Pavel I Trillery I Lyubov K Ostrym Oschuscheniyam

May 25, 2025 -

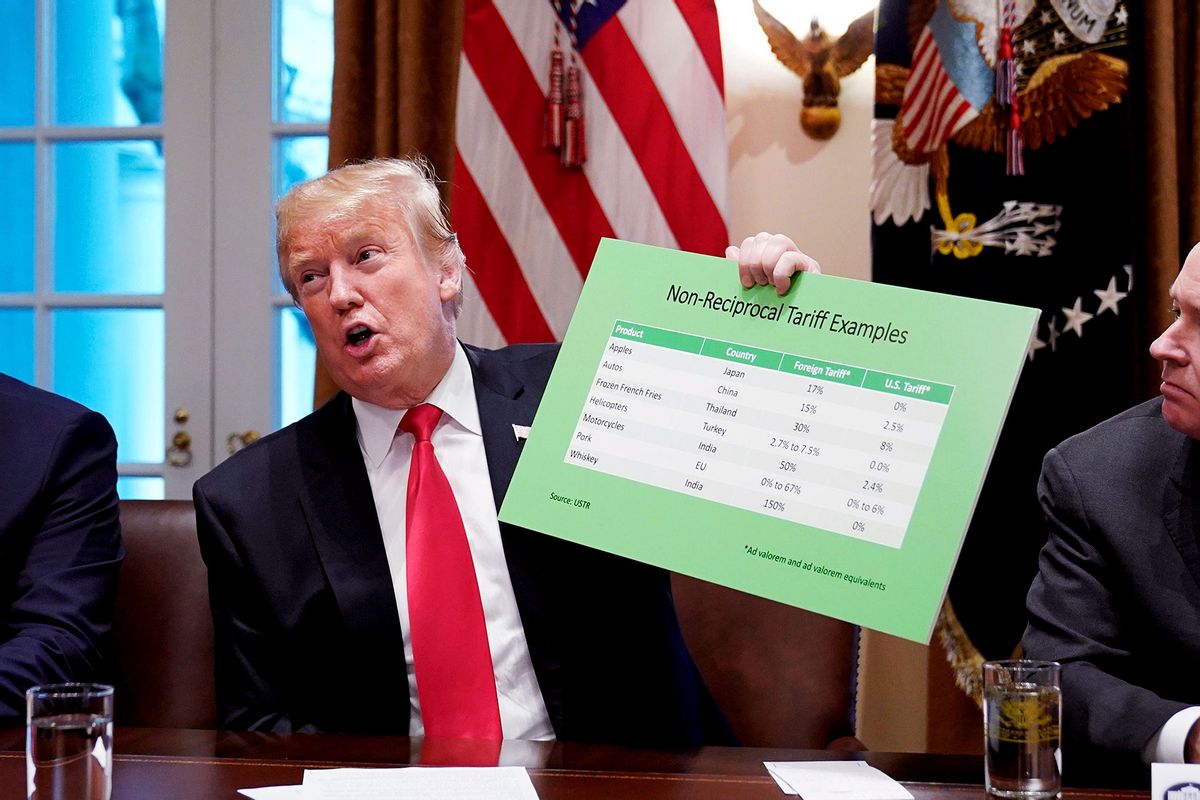

Trumps Tariff Decision 8 Jump In Euronext Amsterdam Stocks

May 25, 2025

Trumps Tariff Decision 8 Jump In Euronext Amsterdam Stocks

May 25, 2025 -

Innokentiy Smoktunovskiy Dokumentalniy Film K Ego 100 Letiyu

May 25, 2025

Innokentiy Smoktunovskiy Dokumentalniy Film K Ego 100 Letiyu

May 25, 2025 -

Bbc Radio 1 Big Weekend Confirmed Artists Including Jorja Smith Biffy Clyro And Blossoms

May 25, 2025

Bbc Radio 1 Big Weekend Confirmed Artists Including Jorja Smith Biffy Clyro And Blossoms

May 25, 2025 -

Sterke Resultaten Relx Ai Als Motor Voor Groei In 2025

May 25, 2025

Sterke Resultaten Relx Ai Als Motor Voor Groei In 2025

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025 -

Actress Mia Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 25, 2025

Actress Mia Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 25, 2025 -

Overnight Disasters 17 Celebrities Whose Careers Imploded

May 25, 2025

Overnight Disasters 17 Celebrities Whose Careers Imploded

May 25, 2025 -

From Fame To Shame 17 Celebrity Downfalls

May 25, 2025

From Fame To Shame 17 Celebrity Downfalls

May 25, 2025 -

17 Famous Faces How One Mistake Ruined Their Reputations

May 25, 2025

17 Famous Faces How One Mistake Ruined Their Reputations

May 25, 2025