Amsterdam Exchange Plunges 7% On Opening: Trade War Concerns Weigh Heavy

Table of Contents

The Amsterdam Exchange, a significant player in European and global finance, serves as a barometer for economic health, influencing investor confidence and market sentiment worldwide. Its performance directly impacts numerous multinational corporations and smaller businesses listed on the exchange, creating ripples across various sectors. The 7% plunge underscores the serious implications of escalating trade disputes on global financial stability.

Trade War Fears as the Primary Driver

The steep decline in the Amsterdam Exchange is largely attributed to escalating trade war anxieties, primarily fueled by ongoing tensions between major global economies. The uncertainty surrounding future trade policies and the implementation of new tariffs are creating a climate of fear and instability.

-

Increased Tariffs Impacting Key Sectors: Increased tariffs imposed on goods traded between countries like the US and China are directly impacting several sectors listed on the Amsterdam Exchange. This includes significant repercussions for technology companies reliant on global supply chains, and agricultural businesses facing export restrictions.

-

Uncertainty Surrounding Future Trade Policies: The lack of clarity regarding future trade policies is a major source of concern for investors. The unpredictable nature of these policies makes it difficult for businesses to plan for the future, leading to decreased investment and reduced economic activity.

-

Investor Sentiment Shifting Towards Risk Aversion: The escalating trade war has led to a significant shift in investor sentiment, with many opting for risk-aversion strategies. This means that investors are pulling their money out of potentially volatile markets like the Amsterdam Exchange, contributing to the sharp decline.

-

Specific Companies Heavily Affected: Several companies listed on the Amsterdam Exchange with significant global trade exposure experienced dramatic losses. These include [insert example of a company and its sector, e.g., a technology firm heavily reliant on Chinese components] and [insert another example, e.g., an agricultural exporter facing US tariffs]. The impact on these key players further exacerbated the overall market downturn.

Impact on Key Sectors

The Amsterdam Exchange's plunge wasn't uniform across all sectors. Some sectors experienced significantly greater losses than others, highlighting their specific vulnerabilities to trade war uncertainties.

-

Technology Sector: The technology sector, heavily reliant on global supply chains and international trade, witnessed a particularly sharp decline, with some estimates placing the drop at over 9%. This reflects the sector's sensitivity to tariff increases and disruptions in the flow of goods and components.

-

Finance Sector: The finance sector also suffered considerable losses, falling approximately 6%, reflecting anxieties about decreased global economic activity and increased risk.

-

Energy Sector: The energy sector experienced a more moderate drop of approximately 4%, although the long-term impact of trade wars on energy prices and investments remains uncertain.

These percentage drops underscore the disproportionate impact of trade wars on sectors heavily integrated into the global economy. Companies within these sectors are now grappling with reduced profitability, supply chain disruptions, and uncertain future prospects.

Investor Reactions and Market Volatility

The 7% plunge on the Amsterdam Exchange prompted immediate and significant investor reactions, characterized by substantial selling and increased market volatility.

-

Increased Trading Volume: The trading volume surged significantly as investors reacted to the news, with many seeking to exit their positions to limit losses.

-

Market Volatility and Long-Term Implications: The sharp drop and subsequent volatility signal a significant level of uncertainty in the market. The long-term implications depend heavily on the resolution (or escalation) of trade disputes. Continued uncertainty could lead to further market declines and reduced investor confidence.

-

Shift in Investor Sentiment: The plunge has negatively impacted investor sentiment towards the Amsterdam Exchange, creating a climate of apprehension and uncertainty. The restoration of confidence will require a significant de-escalation of trade tensions and clear signals of economic stability.

Potential for Further Decline

The possibility of further declines on the Amsterdam Exchange remains a significant concern, contingent on future developments in the ongoing trade war.

-

Scenarios for Potential Further Decline: A further escalation of trade tensions, the imposition of additional tariffs, or a lack of progress in resolving existing disputes could all contribute to another market downturn.

-

Expert Opinions: Many financial analysts express caution regarding the outlook for the Amsterdam Exchange, emphasizing the need for a swift and decisive resolution to trade disputes to prevent further market instability. The uncertainty surrounding future trade policies continues to pose a significant risk.

Analyzing the Amsterdam Exchange Plunge and Future Outlook

The 7% plunge on the Amsterdam Exchange is primarily attributable to the escalating global trade war. The uncertainty surrounding future trade policies, coupled with increased tariffs, has created a climate of fear and instability, triggering significant investor sell-offs and impacting key sectors like technology, finance, and energy. Investor reactions have been characterized by increased trading volume and a shift towards risk-aversion strategies.

The outlook for the Amsterdam Exchange remains uncertain and largely dependent on the resolution of global trade disputes. Continued trade war escalation poses a significant risk of further market declines. To make informed investment decisions, it’s crucial to monitor the Amsterdam Exchange closely, track trade war developments impacting the Amsterdam Exchange, and stay informed on the Amsterdam Exchange's performance and the evolving global trade landscape.

Featured Posts

-

The China Factor Why Luxury Carmakers Face Headwinds In The Worlds Largest Market

May 25, 2025

The China Factor Why Luxury Carmakers Face Headwinds In The Worlds Largest Market

May 25, 2025 -

Moje Doswiadczenia Z Porsche Cayenne Gts Coupe Warto Kupic

May 25, 2025

Moje Doswiadczenia Z Porsche Cayenne Gts Coupe Warto Kupic

May 25, 2025 -

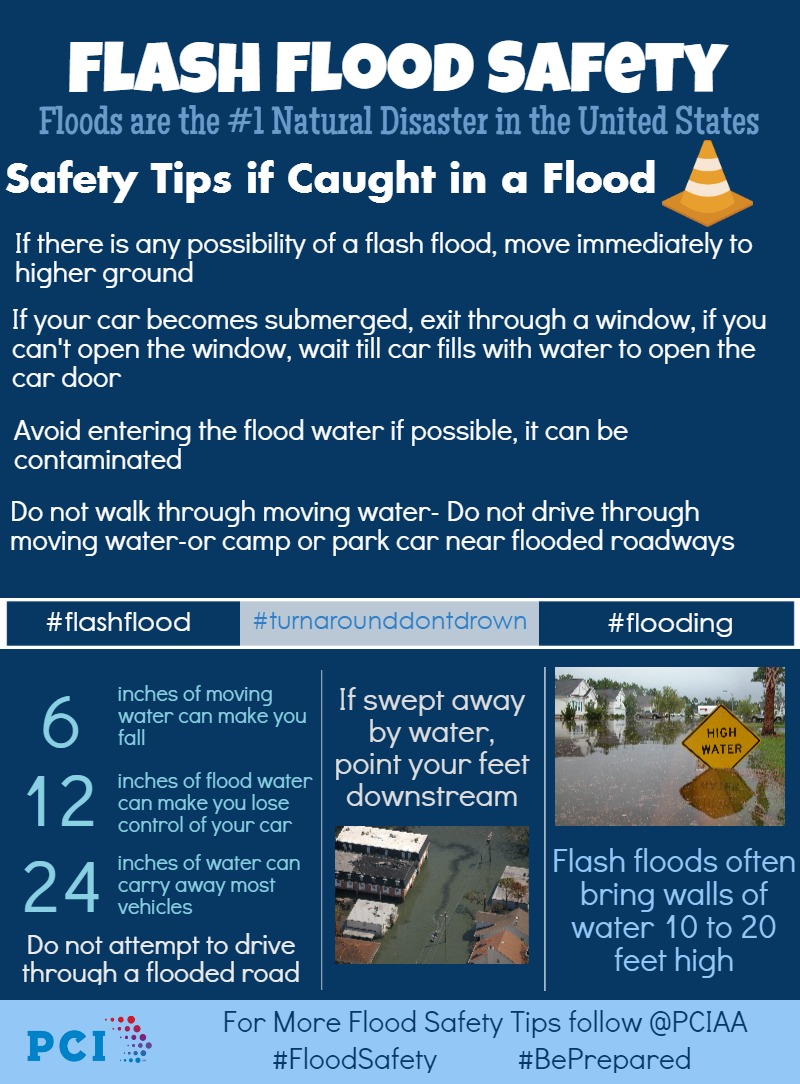

Staying Safe During Flash Floods Recognizing Warnings And Taking Action

May 25, 2025

Staying Safe During Flash Floods Recognizing Warnings And Taking Action

May 25, 2025 -

Escape To The Country Top Locations For A Tranquil Lifestyle

May 25, 2025

Escape To The Country Top Locations For A Tranquil Lifestyle

May 25, 2025 -

Auto Sector Lvmh Lead European Market Volatility After Trump Remarks

May 25, 2025

Auto Sector Lvmh Lead European Market Volatility After Trump Remarks

May 25, 2025

Latest Posts

-

Addressing The Housing Crisis Gregor Robertsons Perspective On Affordability

May 25, 2025

Addressing The Housing Crisis Gregor Robertsons Perspective On Affordability

May 25, 2025 -

Severe Weather And Flooding Miami Valley Under Flood Advisory

May 25, 2025

Severe Weather And Flooding Miami Valley Under Flood Advisory

May 25, 2025 -

Flash Flood And Tornado Situation Report April 4 2025

May 25, 2025

Flash Flood And Tornado Situation Report April 4 2025

May 25, 2025 -

How To Prepare For And Respond To Flash Flood Warnings And Alerts

May 25, 2025

How To Prepare For And Respond To Flash Flood Warnings And Alerts

May 25, 2025 -

Severe Weather Awareness Essential Flood Safety Guidelines For Day 5

May 25, 2025

Severe Weather Awareness Essential Flood Safety Guidelines For Day 5

May 25, 2025