Amsterdam Exchange Suffers 11% Drop Since Wednesday

Table of Contents

Potential Causes of the Amsterdam Exchange Drop

Several intertwined economic factors likely contributed to the sharp decline in the Amsterdam Exchange. Understanding these underlying causes is crucial for assessing the situation and predicting future market behavior.

-

Increased Inflation and Recession Fears: Persistent high inflation across Europe continues to erode consumer spending power, dampening economic growth. Coupled with rising interest rates aimed at curbing inflation, fears of a looming recession are casting a long shadow over investor confidence. This uncertainty is a key driver of the recent stock market crash.

-

Geopolitical Instability: Ongoing geopolitical tensions, particularly the war in Ukraine and its impact on energy prices and supply chains, add significant uncertainty to the global economic outlook. This instability contributes significantly to market volatility and investor apprehension.

-

Specific Company Performance: While the overall market suffered, the underperformance of specific large-cap companies listed on the Amsterdam Exchange likely exacerbated the decline. Negative earnings reports or disappointing future guidance from key players can trigger significant sell-offs, impacting the overall market index.

-

Negative Impact of a Specific Sector: Certain sectors, such as technology or energy, may have been disproportionately affected by specific market trends. For example, rising interest rates can significantly impact the valuations of technology companies, while fluctuating energy prices affect energy sector performance.

Impact on Key Sectors and Companies

The 11% drop hasn't affected all sectors equally. The technology sector, particularly companies heavily reliant on venture capital funding, experienced significant losses due to rising interest rates and concerns over future growth.

-

Technology Sector: Several tech companies listed on the Amsterdam Exchange saw double-digit percentage drops in their share prices. This reflects broader concerns about the tech sector's valuation in a rising interest rate environment.

-

Energy Sector: The energy sector, while initially benefiting from high energy prices, is also vulnerable to geopolitical uncertainty and potential regulatory changes. Fluctuating oil and gas prices have created volatility within this sector.

-

Financial Sector: Banks and financial institutions, while generally considered more stable, are not immune to the broader market downturn. Concerns about potential loan defaults in a weakening economic climate can also impact their stock prices.

The specific companies most affected will vary, but thorough research into individual company performance reports will reveal the extent of the impact. This necessitates careful analysis of individual company reports and overall sector performance in relation to the broader Amsterdam stock market.

Investor Sentiment and Market Reaction

The 11% drop has understandably created a climate of fear and uncertainty amongst investors. Panic selling, driven by fear of further losses, has contributed to the sharp decline.

-

Increased Market Volatility: The Amsterdam stock market has experienced significantly increased volatility since Wednesday's drop, with sharp intraday swings reflecting the heightened uncertainty.

-

High Trading Volume: Trading volume has surged, indicating intense activity as investors react to the situation – both buying and selling in a highly volatile environment.

-

Government/Regulatory Response: While no immediate drastic government interventions have been announced, authorities are likely closely monitoring the situation and may consider measures to stabilize the market if the decline continues or worsens.

Predictions and Future Outlook for the Amsterdam Exchange

Predicting the future performance of the Amsterdam Exchange is inherently challenging, given the complex interplay of global and local economic factors.

-

Potential for Recovery: A potential scenario involves a gradual recovery, as investor confidence slowly returns and underlying economic fundamentals improve.

-

Continued Decline: However, a continued decline remains a possibility if recession fears intensify, geopolitical tensions escalate, or further negative news emerges from key companies or sectors.

-

Market Stabilization: A more likely scenario in the short term might be a period of market stabilization, with fluctuations around current levels as investors digest the latest information and assess the situation. Economic forecasts and expert opinions will play a crucial role in shaping market sentiment and influencing future investor decisions.

Conclusion: Understanding the Amsterdam Exchange's 11% Drop and What's Next

The 11% drop in the Amsterdam Exchange since Wednesday is a significant event with multiple contributing factors, including inflation, recession fears, geopolitical instability, and company-specific performance issues. This decline has significantly impacted investor confidence and created considerable market volatility. The future outlook remains uncertain, with possibilities ranging from a gradual recovery to a continued decline, or a period of stabilization. Stay informed about the latest developments in the Amsterdam stock market performance and consult a financial advisor to manage your investment portfolio effectively. Understanding the dynamics of the Amsterdam Exchange and staying updated on market news is crucial for making informed investment decisions.

Featured Posts

-

Koezuti Porsche F1 Motorral Felszerelve

May 24, 2025

Koezuti Porsche F1 Motorral Felszerelve

May 24, 2025 -

Trumps Cuts To Museums A Look At The Lasting Consequences For Cultural Preservation

May 24, 2025

Trumps Cuts To Museums A Look At The Lasting Consequences For Cultural Preservation

May 24, 2025 -

Stock Market Plunge In Amsterdam 7 Drop Highlights Trade War Risks

May 24, 2025

Stock Market Plunge In Amsterdam 7 Drop Highlights Trade War Risks

May 24, 2025 -

Legendas F1 Technologia Porsche Koezuti Autoban

May 24, 2025

Legendas F1 Technologia Porsche Koezuti Autoban

May 24, 2025 -

Serious M6 Crash Causes Major Traffic Disruption

May 24, 2025

Serious M6 Crash Causes Major Traffic Disruption

May 24, 2025

Latest Posts

-

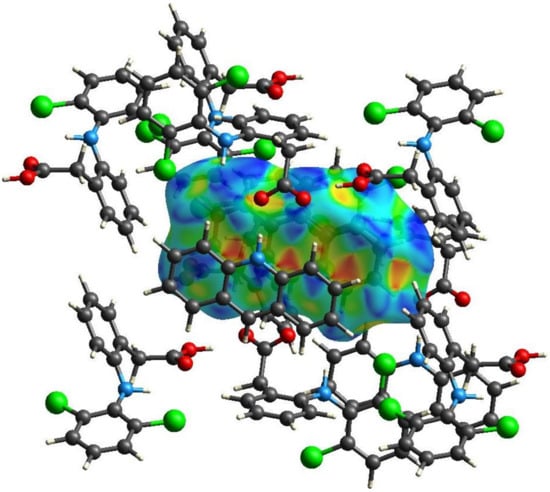

The Role Of Orbital Space Crystals In Advanced Pharmaceuticals

May 24, 2025

The Role Of Orbital Space Crystals In Advanced Pharmaceuticals

May 24, 2025 -

Improving Drug Development Through Orbital Space Crystal Research

May 24, 2025

Improving Drug Development Through Orbital Space Crystal Research

May 24, 2025 -

Space Crystals And The Future Of Pharmaceutical Innovation

May 24, 2025

Space Crystals And The Future Of Pharmaceutical Innovation

May 24, 2025 -

The Future Of Ai Open Ai And Jony Ives Collaboration

May 24, 2025

The Future Of Ai Open Ai And Jony Ives Collaboration

May 24, 2025 -

Harnessing Space Crystals For Enhanced Drug Development

May 24, 2025

Harnessing Space Crystals For Enhanced Drug Development

May 24, 2025